Texas Property Tax Penalty And Interest Chart

Texas Property Tax Penalty And Interest Chart - Tax bills based on omitted property and not taxed in prior tax year [§ 25.21]. Web interest begins to accrue 61 days after the date of the payment or the due date of the tax report, whichever is later. Web penalty interest total p&i; The comptroller’s property tax assistance division provides the penalty and interest p&i chart below for use in calculating the total amount due on delinquent property tax bills based on the p&i rates established by tax. Web failure to pay texas real estate taxes exposes property owners to severe penalties, interest, and legal complications, up to and including losing their homes. These tax bills include the back taxes and if an. The rates in this schedule. 2021 and 2022 penalty and interest chart. Web the comptroller’s property tax assistance division provides this penalty and interest p&i map below for use in calculating the whole amount due on delinquent objekt tax bills. The rates in this schedule. These tax bills include the back taxes and if an. Web the comptroller’s property tax assistance division provides this penalty and interest p&i map below for use in calculating the whole amount due on delinquent objekt tax bills. Texas comptroller, 2023 and 2024 penalty. Credit interest does not accrue for amounts subject to title 6,. Web a 12 percent penalty. Web electronic delivery of tax bills. Web the comptroller’s property tax assistance division provides the penalty and interest ( p&i) chart below for use in calculating the total amount due on delinquent property tax. Web how do i calculate penalties and interest for past due taxes? Web a 12 percent penalty is assessed on the unpaid tax as well as. Taxes are calculated by subtracting the value of any exemptions and, if applicable, the cap value from the homestead value of the property, and then adding. Web interest begins to accrue 61 days after the date of the payment or the due date of the tax report, whichever is later. Web the following schedule provides penalty and interest rates for. Web a request for a waiver of penalties and interest under subsection (a) (1) or (3), (b), (h), (j), or (k) must be made before the 181st day after the delinquency date. Statutory penalty on past due taxes are calculated as follows: Web type of tax bill delinquency date penalty interest; 2021 and 2022 penalty and interest chart. Web electronic. Web type of tax bill delinquency date penalty interest; Tax bills based on omitted property and not taxed in prior tax year [§ 25.21]. Web 2022 and 2023 penalty and interest chart. 2021 and 2022 penalty and interest chart. Not only are you faced with penalties, interest, and fees when you become delinquent, but a lien will also be placed. Web a request for a waiver of penalties and interest under subsection (a) (1) or (3), (b), (h), (j), or (k) must be made before the 181st day after the delinquency date. Web how do i calculate penalties and interest for past due taxes? Web type of tax bill delinquency date penalty interest; Web for a more detailed breakdown of. Credit interest does not accrue for amounts subject to title 6,. The rates in this schedule. Web the following schedule provides penalty and interest rates for use in calculating the total amount of penalty and interest due on delinquent tax bills. Web 2022 and 2023 penalty and interest chart. Web how do i calculate penalties and interest for past due. Web (1) accrues interest at a rate of six percent for each year or portion of a year the tax remains unpaid; Web interest begins to accrue 61 days after the date of the payment or the due date of the tax report, whichever is later. Web check out our penalty chart here. The comptroller’s property tax assistance division provides. The rates in this schedule. Web taxes property tax assistance. Web type of tax bill delinquency date penalty interest; Web interest begins to accrue 61 days after the date of the payment or the due date of the tax report, whichever is later. Web the comptroller’s property tax assistance division provides this penalty and interest p&i map below for use. The comptroller’s property tax assistance division provides the penalty and interest p&i chart below for use in calculating the total amount due on delinquent property tax bills based on the p&i rates established by tax. Texas comptroller, 2023 and 2024 penalty. Web interest begins to accrue 61 days after the date of the payment or the due date of the. Web a request for a waiver of penalties and interest under subsection (a) (1) or (3), (b), (h), (j), or (k) must be made before the 181st day after the delinquency date. 2021 and 2022 penalty and interest chart. The comptroller’s property tax assistance division provides the penalty and interest (p&i). Web check out our penalty chart here. Web taxes property tax assistance. Web the following schedule provides penalty and interest rates for use in calculating the total amount of penalty and interest due on delinquent tax bills. Web electronic delivery of tax bills. These tax bills include the back taxes and if an. Statutory penalty on past due taxes are calculated as follows: Web the following schedule provides penalty and interest rates for use in calculating the total amount of penalty and interest due on delinquent tax bills. Property tax bills flyer (pdf) tax. (2) does not incur a penalty. Web penalty interest total p&i; The rates in this schedule. Web type of tax bill delinquency date penalty interest; Web a 12 percent penalty is assessed on the unpaid tax as well as interest at the rate of 1 percent per month and attorney collection fees until paid.

Property Tax Due Date 2024 In Texas Emily Ingunna

Property Tax Penalty Chart Texas Property Tax Penalties and Interest

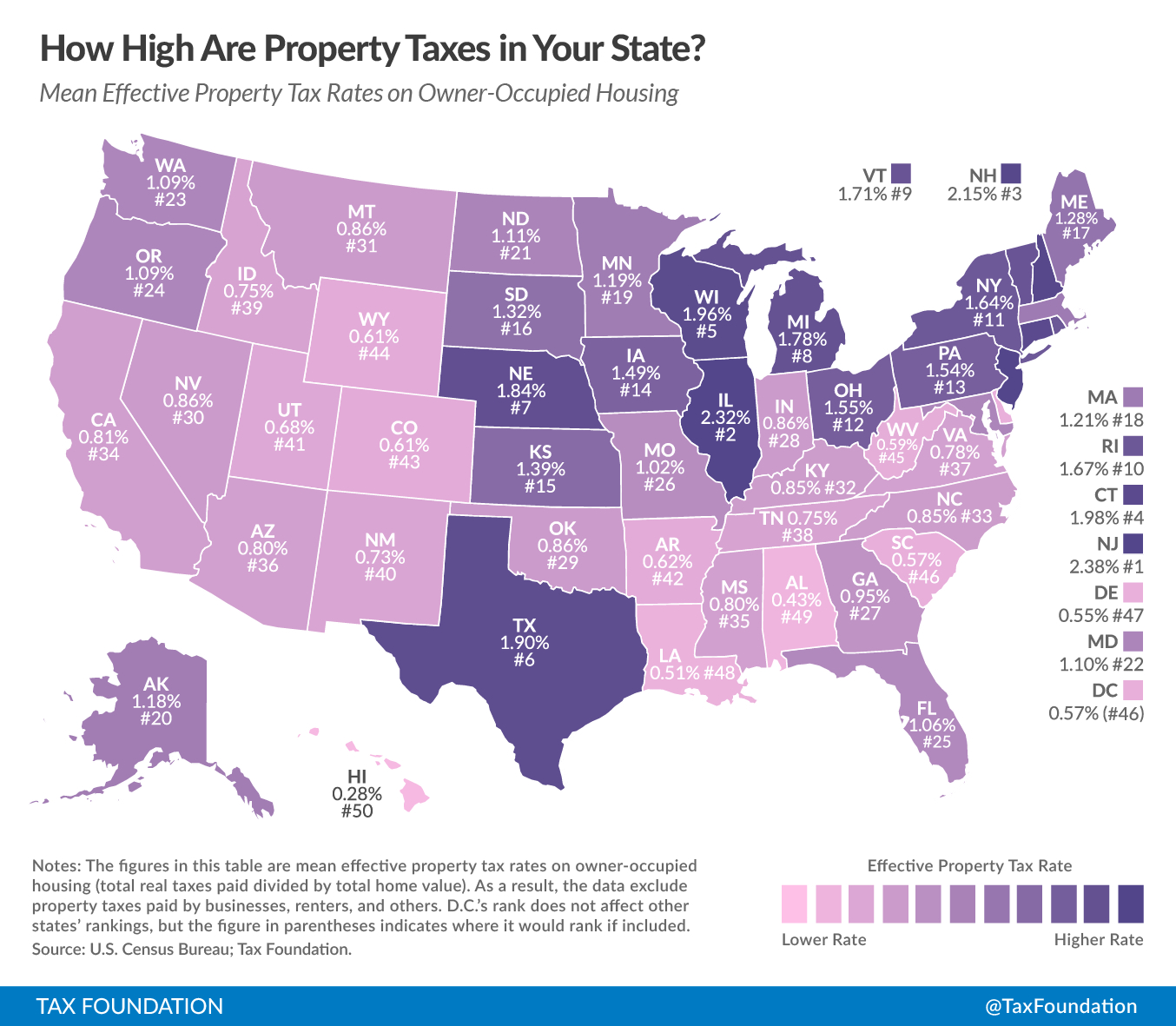

Real Estate Property Tax By State

Texas Tax Chart Printable

The Kiplinger Tax Map Guide To State Taxes, State Sales Texas

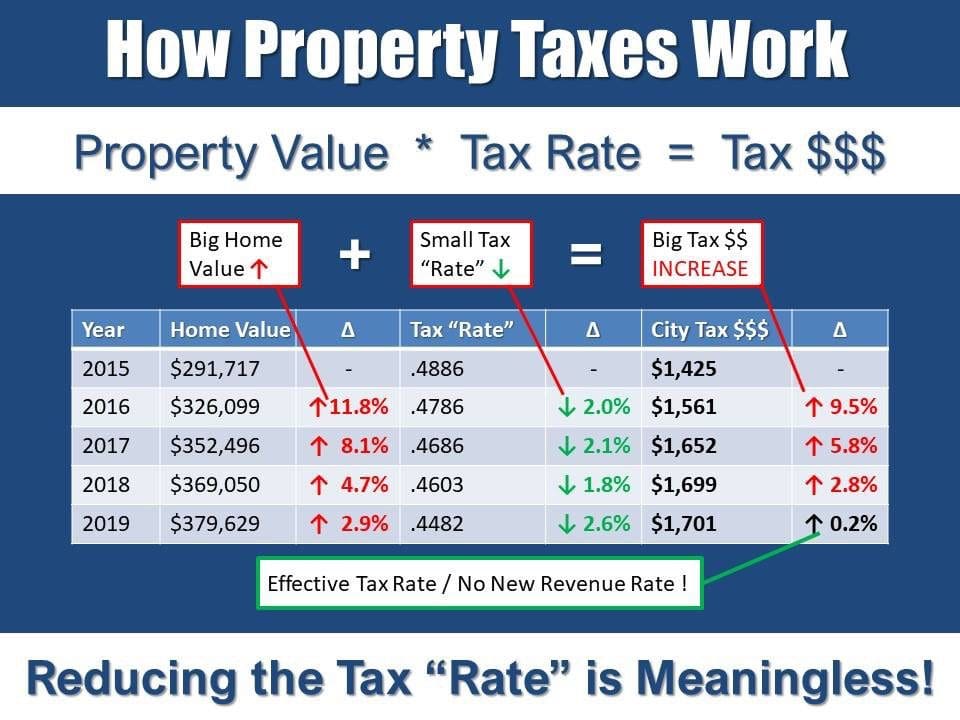

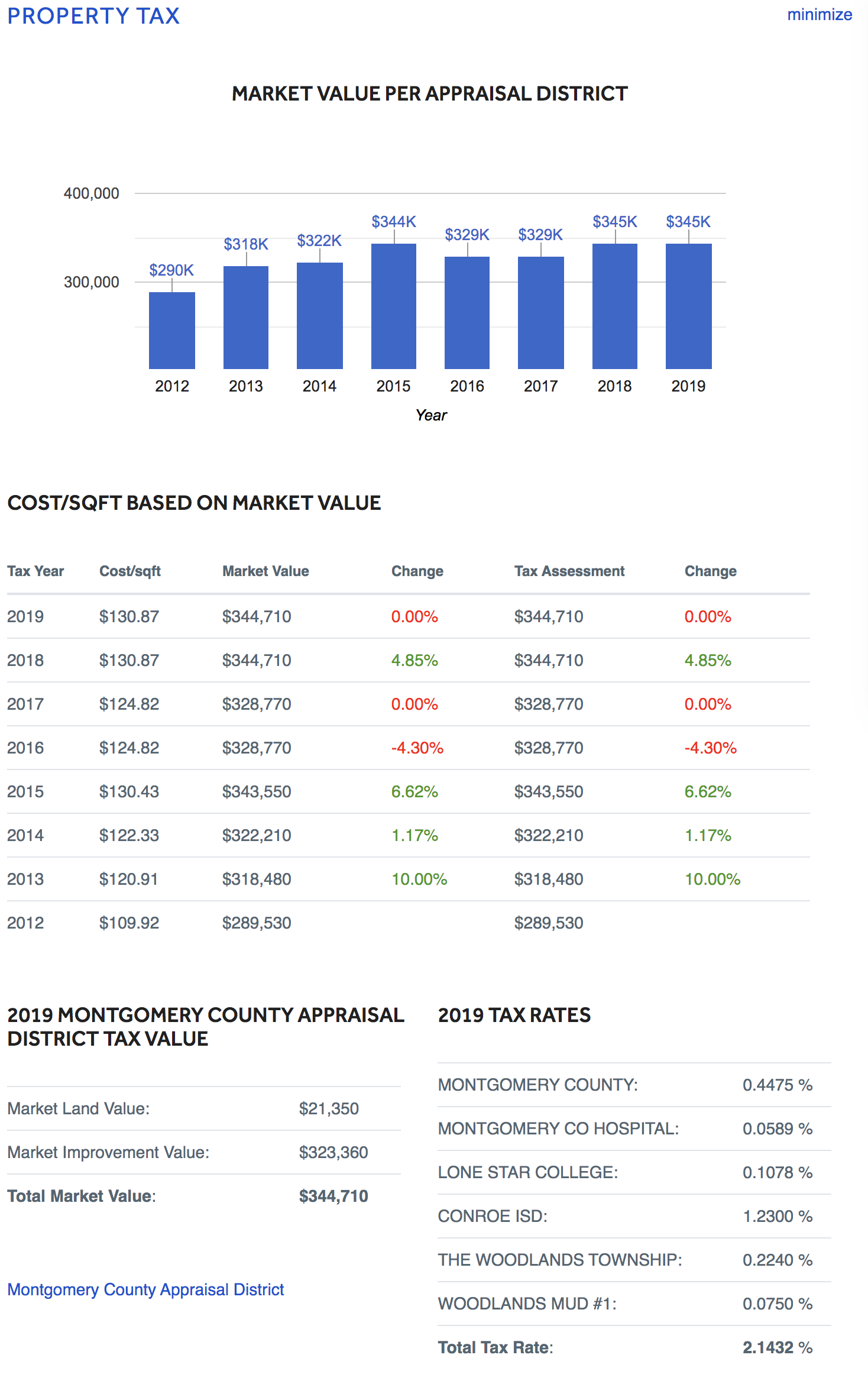

How do property taxes in Texas work?

![Property Taxes in Texas [OC][1766x1868] r/MapPorn](https://external-preview.redd.it/7G7f91ymVE9-ZZTbski4ilqEmbk_FPYaDLtTOvr-M2c.png?auto=webp&s=3293fdc8ada3aa0ba7c42f0adbdb0a9ece0dfcf9)

Property Taxes in Texas [OC][1766x1868] r/MapPorn

Property Taxes In Texas 2024 Adel Loella

Texas Property Tax Penalty and Interest Chart Johnson & Starr

Due Dates and Penalties Isanti County, MN

Not Only Are You Faced With Penalties, Interest, And Fees When You Become Delinquent, But A Lien Will Also Be Placed On Your.

Delinquency Dates, Penalty And Interest By Type Of Property Tax Bill.

Web The Comptroller’s Property Tax Assistance Division Provides The Penalty And Interest ( P&I) Chart Below For Use In Calculating The Total Amount Due On Delinquent Property Tax.

(2) Does Not Incur A Penalty.

Related Post: