Payroll Chart Of Accounts

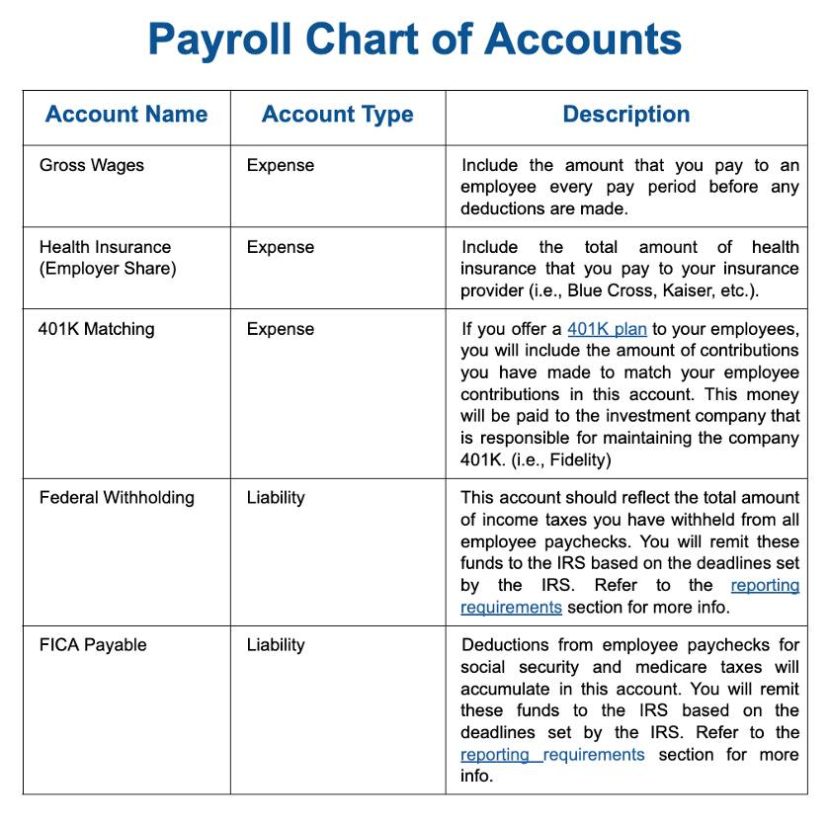

Payroll Chart Of Accounts - Payroll is the most complex accounting process you must complete. The four primary account types, or general ledgers in a standard chart of accounts are: Before you can record payroll, you will need to set up payroll accounts on your chart of accounts list. When you first start handling the accounting and bookkeeping tasks for your ecommerce business, you’ll likely be overwhelmed. Web payroll accounting refers to the process of recording, organizing, and managing an organization's employee expenses information. Web a chart of accounts is a simple tool to set up and organize the general ledger and accounting system of a business. Bookkeeping services for small business, the chart of accounts is a listing of all accounts tracked by your business in your accounting software general ledger. Please include this bulletin number in the email subject line. Hello, i'm setting up a new chart of accounts, and i'm seeking a sample payroll accounts with numbering. It includes all the financial aspects related to employee compensation, such. Questions may be directed to the payroll system support group at [email protected]. As we discussed in our article: Web here’s what an average payroll chart of accounts list contains: Please include this bulletin number in the email subject line. Zoho books is an efficient invoicing and payroll software that offers automated billing, detailed financial tracking, and easy compliance management. Web a chart of accounts is a simple tool to set up and organize the general ledger and accounting system of a business. Web payroll chart of accounts. You also need to account for payroll expenses in your books. Please include this bulletin number in the email subject line. Web how to do payroll in quickbooks in 6 steps. Web the chart of accounts, or coa, is a list of the account numbers and names relevant to your company. Is quickbooks payroll right for you? To understand how payroll ends up in general ledger, you need to review the accounting cycle. Typically, a chart of accounts will have four categories. Web mapping payroll items to general ledger accounts allows. Zoho books is an efficient invoicing and payroll software that offers automated billing, detailed financial tracking, and easy compliance management. Web a chart of accounts is a business’s list of financial accounts, reflecting the structure of the company’s balance sheet and income statement. Learn more about how to configure chart of accounts for payroll in quickbooks payroll powered by employment. Recording payroll on your books involves making sure that amounts are accurately posted to payroll accounts. Web here’s what an average payroll chart of accounts list contains: Learn more about how to configure chart of accounts for payroll in quickbooks payroll powered by employment hero. Hello, i'm setting up a new chart of accounts, and i'm seeking a sample payroll. Web the chart below explains 5 types of accounting payroll expenses: How do you get the payroll process right? “the labor in cost of goods sold looks crazy. To understand how payroll ends up in general ledger, you need to review the accounting cycle. If you have tipped employees, make sure you’re using a template designed for that type of. When to use a quickbooks alternative. It requires you to classify different payroll expenses that you incur as you calculate net pay from gross pay (like wages, unemployment taxes, and benefit payments) according to the appropriate expense (and. To understand how payroll ends up in general ledger, you need to review the accounting cycle. Firstly you’ll want to go to. Onpay is best for small businesses. Creating a financial roadmap with a chart of accounts. Web a chart of accounts (coa) is a structured list of an organization’s financial accounts used to categorize and record financial transactions. If you have tipped employees, make sure you’re using a template designed for that type of workforce. Web payroll accounting is the process. Recording these costs can give small business. Why is the chart of accounts important? Is quickbooks payroll right for you? Before you can record payroll, you will need to set up payroll accounts on your chart of accounts list. Quickbooks payroll is best for its accounting integration. To ensure your accounting books are accurate, learn how to record payroll transactions. Web payroll chart of accounts. Web a chart of accounts is a simple tool to set up and organize the general ledger and accounting system of a business. A chart of accounts is a list of general ledger accounts that businesses of all sizes and structures use. Firstly you’ll want to go to the chart of accounts page for payroll. Hi, i've just started using qb payroll in this financial year so very new to it all. Web a chart of accounts is a simple tool to set up and organize the general ledger and accounting system of a business. I know we didn’t pay that much in shop labor this month. Web payroll accounting refers to the process of recording, organizing, and managing an organization's employee expenses information. Web amanda cameron | dec 17, 2020. Onpay is best for small businesses. Hello, i'm setting up a new chart of accounts, and i'm seeking a sample payroll accounts with numbering. Web the chart below explains 5 types of accounting payroll expenses: After all, there are a lot of. Web a chart of accounts is a business’s list of financial accounts, reflecting the structure of the company’s balance sheet and income statement. You also need to account for payroll expenses in your books. Once you hire more than a handful of employees, it’s best to. This is where payroll accounting comes into play. Solved•by quickbooks•26•updated january 17, 2024. Payroll is the most complex accounting process you must complete.

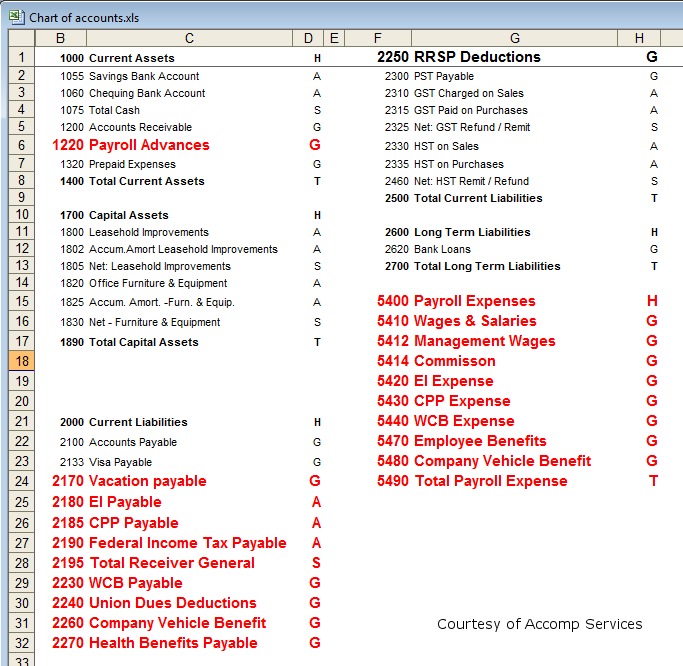

Sample Chart Of Accounts Excel

Chart Of Accounts For Payroll In Quickbooks

The Chart of Accounts List Builds Your QuickBooks Online Company

Free Payroll Templates Tips & What To Include

Sample chart of accounts quickbooks

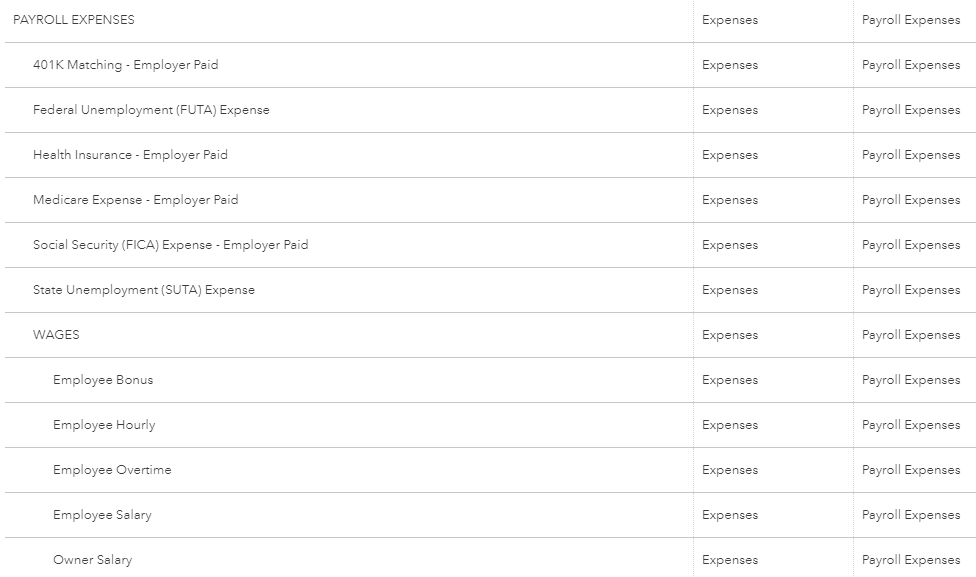

Chart Of Accounts Payroll

Chart of Accounts Payroll Tax Taxes

ChartofAccountsTemplate.xlsx Payroll Tax Expense

Chart Of Accounts For Payroll

Small Business Payroll Software Simply Accounting Tutorial

Your Accounting Transactions Are Posted To General Ledger, But Is The Information Accurate?

Please Include This Bulletin Number In The Email Subject Line.

It Requires You To Classify Different Payroll Expenses That You Incur As You Calculate Net Pay From Gross Pay (Like Wages, Unemployment Taxes, And Benefit Payments) According To The Appropriate Expense (And.

Quickbooks Payroll Is Best For Its Accounting Integration.

Related Post: