Triple Bottom Chart Pattern

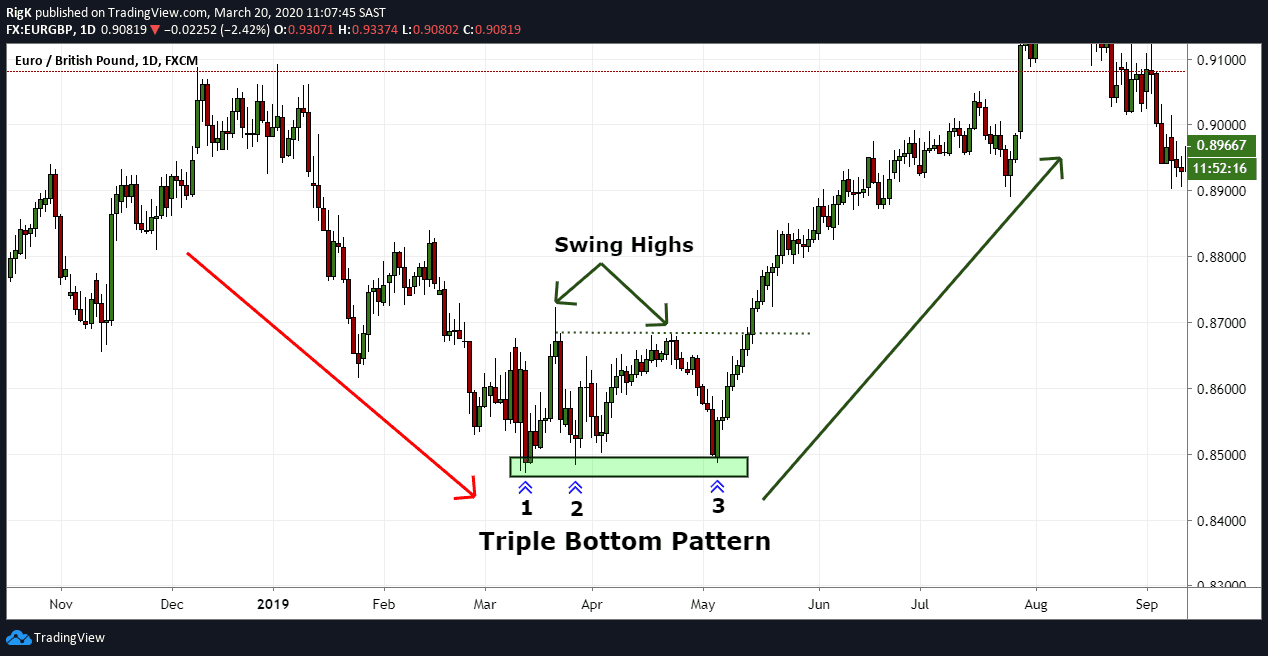

Triple Bottom Chart Pattern - Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. The chart example above shows a triple bottom formation that turned the eur/gbp forex pair to the upside after a downtrend. The triple bottom chart pattern is formed after a prolonged downtrend where bears are in control of the market. Web the triple bottom reversal is a bullish reversal pattern typically found on bar charts, line charts and candlestick charts. Web triple bottom patterns consist of several candlesticks that form three valleys or support levels that are either equal or near equal height. Each successive attempt is typically accompanied by declining volume. Triple bottom entry & exit points. 74% the above numbers are based on more than 2,500 perfect trades. Web a triple bottom is a bullish reversal chart pattern found at the end of a bearish trend and signals a shift in momentum. A triple bottom is generally seen as three. This is a sign of a tendency towards a reversal. It’s characterized by three equal lows bouncing off support followed by the price action breaching resistance. Web a triple bottom pattern is a visual pattern that shows the buyers (bulls) taking control of the price action from the sellers (bears). The triple bottom chart pattern is formed after a prolonged. But this is not the only factor that makes a bullish case for the stock. Web the triple bottom price pattern is characterized by three unsuccessful attempts to push price through an area of support. This candlestick pattern suggests an impending change in the trend direction after the sellers failed to break the support in three consecutive attempts. This pattern. The chart example above shows a triple bottom formation that turned the eur/gbp forex pair to the upside after a downtrend. Web the triple trough or triple bottom is a bullish pattern in the shape of a wv. Web triple bottom chart pattern. Each successive attempt is typically accompanied by declining volume. 65% percentage meeting price target: Identifying the triple bottom pattern. Triple bottom entry & exit points. Web the triple bottom is a bullish reversal pattern that occurs at the end of a downtrend. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. On the fundamental side, strong agreement among. Much like its twin, the triple top pattern, it is considered one of the most reliable and accurate chart patterns and is fairly easy to identify on trading charts. It’s characterized by three equal lows bouncing off support followed by the price action breaching resistance. Web the triple bottom pattern offers a second chance for traders who missed the double. Web the triple bottom is a bullish reversal pattern that occurs at the end of a downtrend. See the glossary for definitions. Triple bottom entry & exit points. Web the triple bottom pattern is a bullish reversal chart pattern in technical analysis that indicates a shift from a downtrend to an uptrend. A triple bottom is a visual pattern that. Web the triple bottom chart pattern is a technical analysis trading strategy in which the trader attempts to identify a reversal point in the market. Increased trading volume towards the end of the chart indicates heightened market activity, often preceding significant price. A triple bottom is generally seen as three. See the glossary for definitions. Web the triple bottom is. Each successive attempt is typically accompanied by declining volume. Web triple bottom patterns consist of several candlesticks that form three valleys or support levels that are either equal or near equal height. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Triple bottom entry. Much like its twin, the triple top pattern, it is considered one of the most reliable and accurate chart patterns and is fairly easy to identify on trading charts. As the name suggests, it creates a distinct triple bottom visual on the chart. There are three equal lows followed by a break above resistance. Web the triple bottom is a. Much like its twin, the triple top pattern, it is considered one of the most reliable and accurate chart patterns and is fairly easy to identify on trading charts. There are three equal lows followed by a break above resistance. Web the triple bottom is a bullish reversal pattern that occurs at the end of a downtrend. Web triple bottom. Web a triple bottom pattern is a visual pattern that shows the buyers (bulls) taking control of the price action from the sellers (bears). Web the triple bottom is a bullish reversal pattern that occurs at the end of a downtrend. Web triple bottom chart pattern. Traders look for three consecutive low points separated by intervening peaks,. The pattern appears on a price chart as three equal low levels followed by an uptrend that breaks through the. As the name suggests, it creates a distinct triple bottom visual on the chart. It consists of a neckline and three distinct bottoms, forming during market indecision and taking time to develop. A triple bottom is a visual pattern that shows the buyers (bulls) taking control of the price action from the sellers (bears). Overall performance rank (1 is best): This is a sign of a tendency towards a reversal. The chart example above shows a triple bottom formation that turned the eur/gbp forex pair to the upside after a downtrend. Web a triple bottom is a chart pattern used for technical analysis, which shows the buyers are taking control of the price action from the sellers. Bottom patterns (bottom 2 and bottom 3) indicate strong support levels where buyers have stepped in multiple times, further signaling a potential upward movement. It involves monitoring price action to find a distinct pattern before the price launches higher. It appears rarely, but it always warrants consideration, as it is a strong signal for a significant uptrend in price. This pattern is characterized by three consecutive swing lows that occur nearly at the same price level followed by a breakout of the resistance level.

Triple Bottom Pattern Explanation and Examples

Triple Bottom Pattern A Reversal Chart Pattern InvestoPower

How To Trade Triple Bottom Chart Pattern TradingAxe

Chart Pattern Triple Bottom — TradingView

How To Trade Triple Bottom Chart Pattern TradingAxe

The Triple Bottom Trading Chart Pattern in 2021 Trading charts

Triple Bottom Pattern A Reversal Chart Pattern InvestoPower

The Triple Bottom Candlestick Pattern ThinkMarkets AU

The Triple Bottom Pattern is a bullish chart pattern. It occurs

Triple Bottom Chart Pattern Trading charts, Stock trading strategies

Web The Triple Bottom Reversal Is A Bullish Reversal Pattern Typically Found On Bar Charts, Line Charts And Candlestick Charts.

Buyers Enter The Market And Absorb The Selling Pressure When The Price Drops To The Support.

Web What Are Triple Bottom Chart Patterns?

65% Percentage Meeting Price Target:

Related Post: