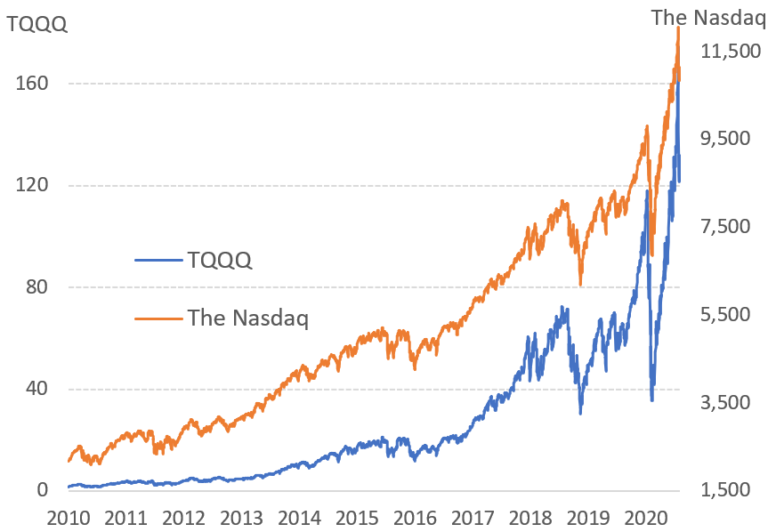

Tqqq Vs Qqq Chart

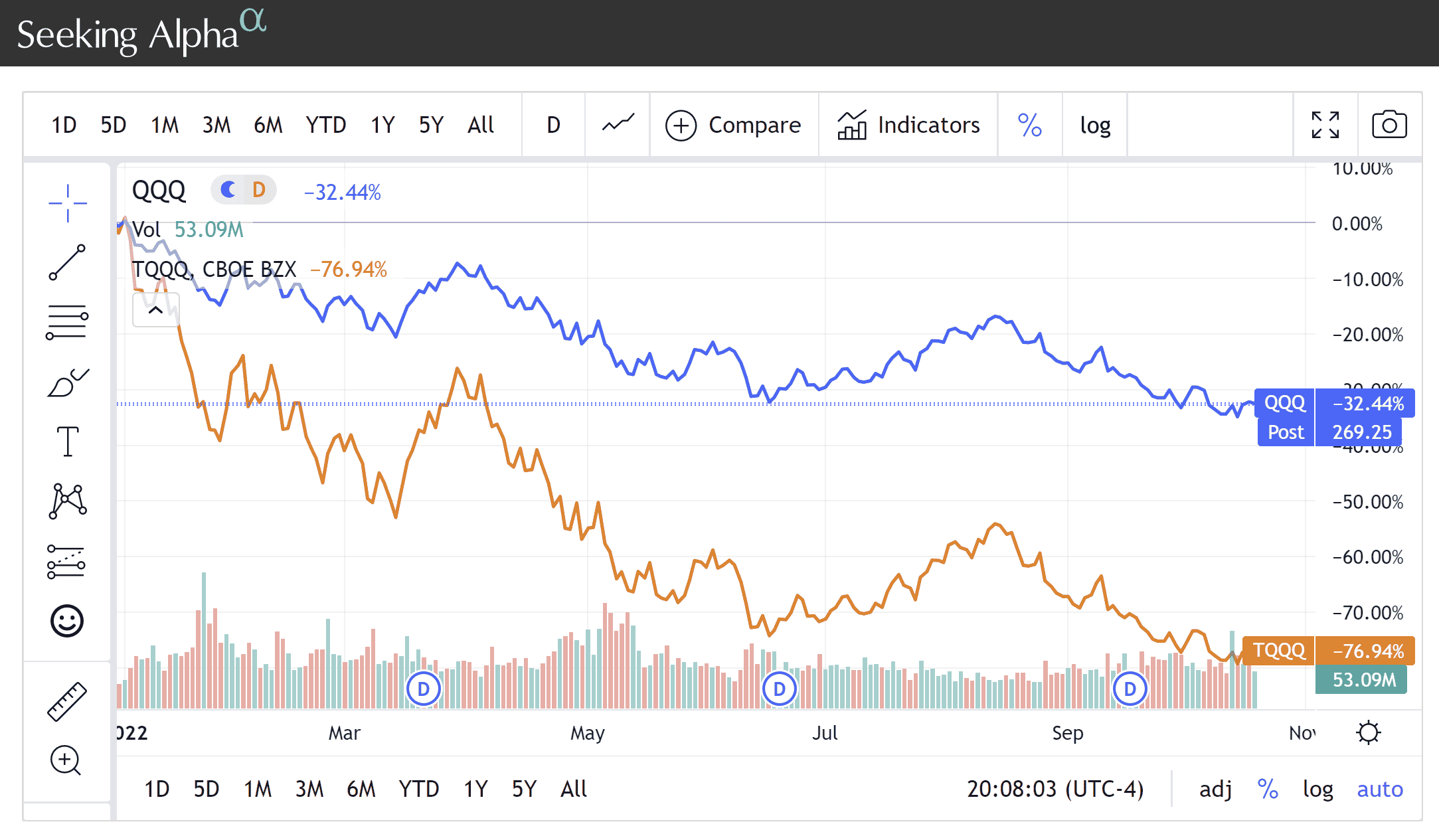

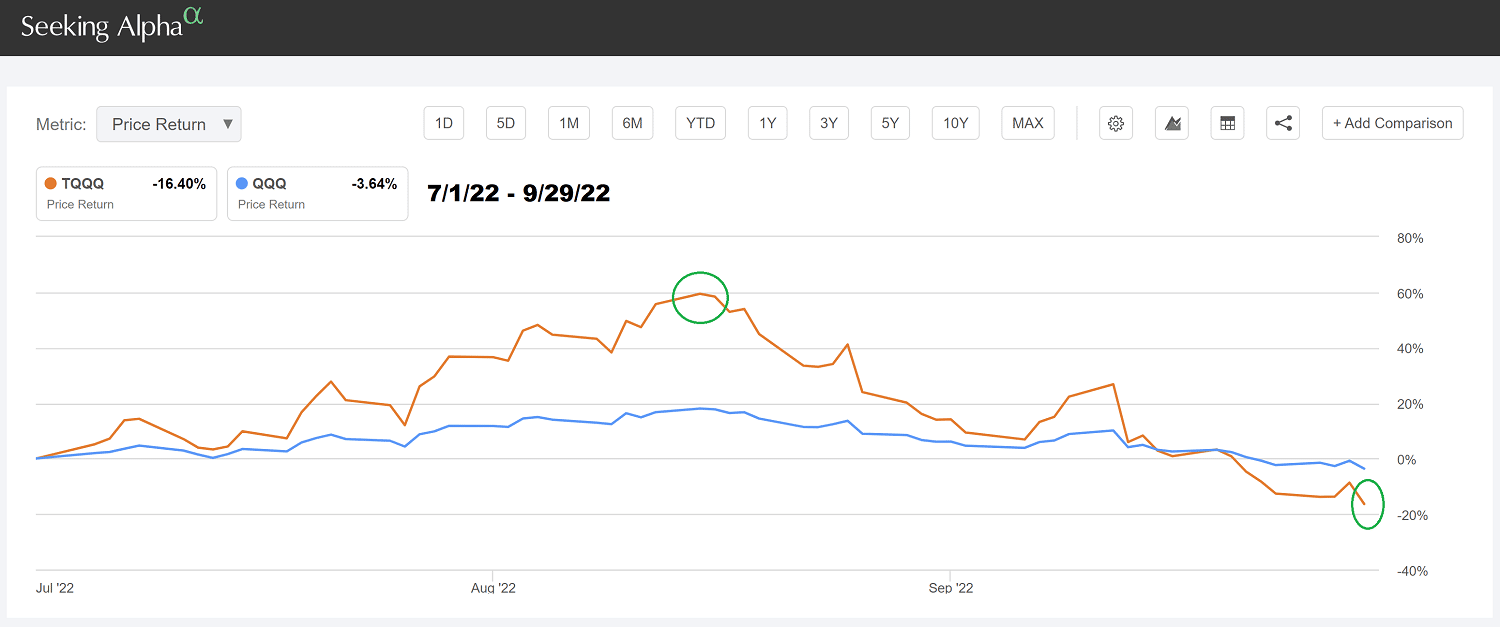

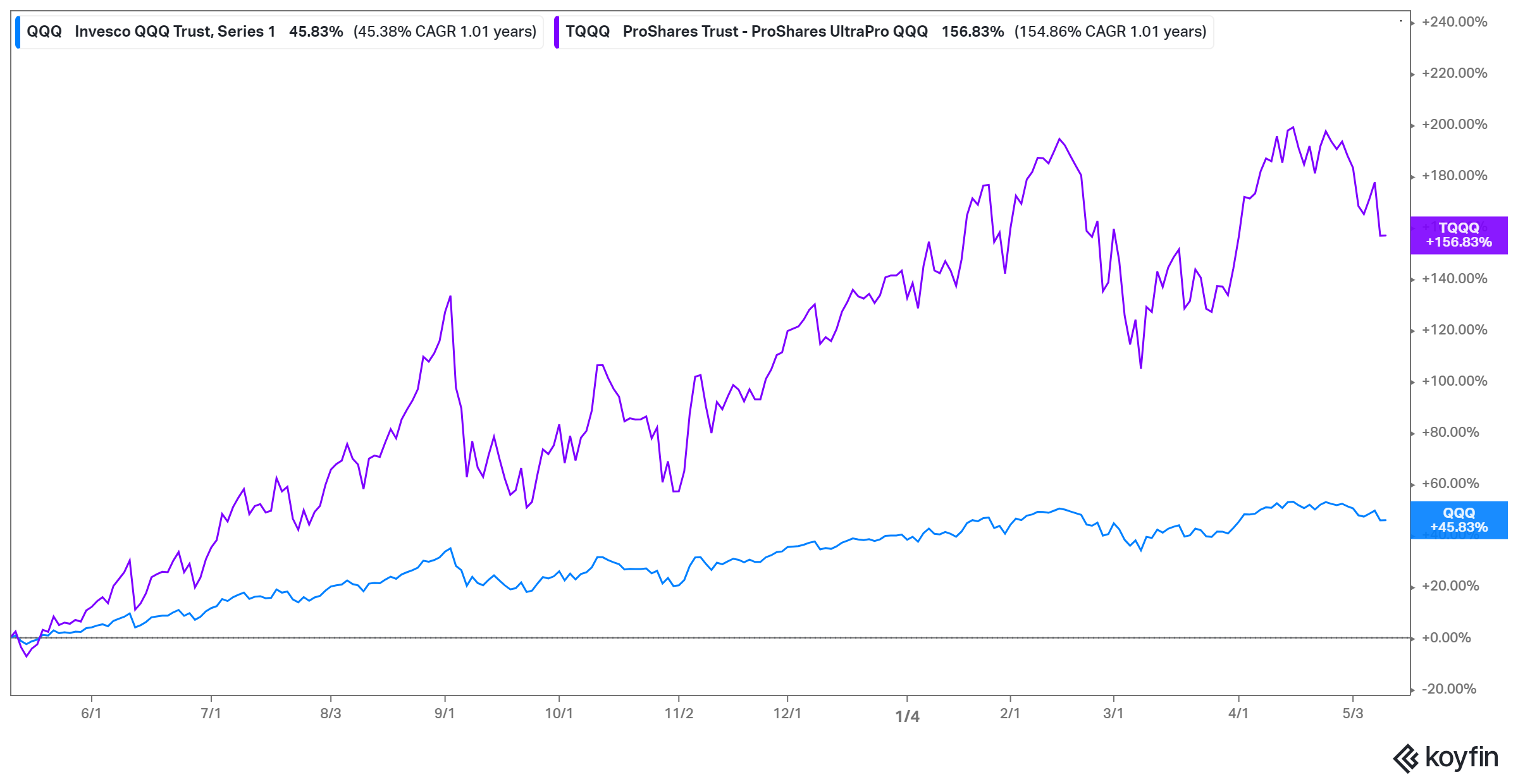

Tqqq Vs Qqq Chart - Chart is updated nightly to reflect the more recent of the previous day's market closing price or the closing price on the day the fund was last traded. Web compare etfs qqq and tqqq on performance, aum, flows, holdings, costs and esg ratings. But the best choice for you will ultimately depend on a myriad of factors. 65.40 +0.05 (+0.08%) after hours: Daily return during q2 2024. 61.4 61.5 61.6 61.7 61.8 61.9 62 62.1 62.2. 6:00 am 8:00 am 10:00 am 12:00 pm 2:00 pm 4:00 pm 6:00 pm. As you can see, tqqq’s returns have ranged between 249% and 565% of qqq's return. Fund flows (1y) −5.77 b usd. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that help make better etf investing decisions. But the best choice for you will ultimately depend on a myriad of factors. Fund flows (1y) −5.77 b usd. All etfs by morningstar ratings. Web tqqq stock price chart. The chart below displays the growth of a $10,000 investment in both assets, with all. Web compare etfs qqq and tqqq on performance, aum, flows, holdings, costs and esg ratings. The chart below displays the growth of a $10,000 investment in both assets, with all. 61.4 61.5 61.6 61.7 61.8 61.9 62 62.1 62.2. Daily return during q2 2024. The bid & ask refers. Web compare etfs qqq and tqqq on performance, aum, flows, holdings, costs and esg ratings. 07:00 08:00 09:00 10:00 11:00 12:00 13:00 58 59 60 61 62 63 zoom 1d 1w 1m 3m 6m ytd 1y 3y 5y 10y 15y 20y may 31, 2024 → may 31, 2024. 65.40 +0.05 (+0.08%) after hours: Over the past 10 years, qqq has. Learn the advantages and disadvantag… Bid price and ask price. Assets under management (aum) 22.00 b usd. Fund flows (1y) −5.77 b usd. The bid & ask refers. These numbers are adjusted for stock splits and include dividends. Web over the past 10 years, tqqq has outperformed qqq with an annualized return of 36.70%, while qqq has yielded a comparatively lower 18.35% annualized return. May 24 at 7:59 pm edt. Fund flows (1y) −5.77 b usd. 6:00 am 8:00 am 10:00 am 12:00 pm 2:00 pm 4:00 pm. 07:00 08:00 09:00 10:00 11:00 12:00 13:00 58 59 60 61 62 63 zoom 1d 1w 1m 3m 6m ytd 1y 3y 5y 10y 15y 20y may 31, 2024 → may 31, 2024. Chart is updated nightly to reflect the more recent of the previous day's market closing price or the closing price on the day the fund was last. Fund flows (1y) −5.77 b usd. May 24 at 4:00 pm edt. Over the past 10 years, qqq has had annualized average returns of 18.31% , compared to 36.60% for tqqq. Learn the advantages and disadvantag… The bid & ask refers. Bid price and ask price. Chart is updated nightly to reflect the more recent of the previous day's market closing price or the closing price on the day the fund was last traded. Web 65.35 +1.78 (+2.80%) at close: Web compare etfs qqq and tqqq on performance, aum, flows, holdings, costs and esg ratings. Learn the advantages and disadvantag… Daily return during q2 2024. Web compare etfs qqq and tqqq on performance, aum, flows, holdings, costs and esg ratings. Web tqqq stock price chart. As you can see, tqqq’s returns have ranged between 249% and 565% of qqq's return. May 24 at 7:59 pm edt. 61.4 61.5 61.6 61.7 61.8 61.9 62 62.1 62.2. Bid price and ask price. Web tqqq stock price chart. These numbers are adjusted for stock splits and include dividends. As you can see, tqqq’s returns have ranged between 249% and 565% of qqq's return. Bid price and ask price. Over the past 10 years, qqq has had annualized average returns of 18.31% , compared to 36.60% for tqqq. Web in the past year, qqq returned a total of 29.88%, which is significantly lower than tqqq's 79.16% return. Web over the past 10 years, tqqq has outperformed qqq with an annualized return of 36.70%, while qqq has yielded a comparatively lower 18.35% annualized return. Chart is updated nightly to reflect the more recent of the previous day's market closing price or the closing price on the day the fund was last traded. The bid & ask refers. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that help make better etf investing decisions. All etfs by morningstar ratings. As you can see, tqqq’s returns have ranged between 249% and 565% of qqq's return. Fund flows (1y) −5.77 b usd. May 24 at 4:00 pm edt. 61.4 61.5 61.6 61.7 61.8 61.9 62 62.1 62.2. Web 65.35 +1.78 (+2.80%) at close: 1 day −0.11% 5 days −2.68% 1 month 19.90% 6 months 43.78% year to date 26.71% 1 year 79.99% 5 years 402.05% all time 15268.36% key stats. But the best choice for you will ultimately depend on a myriad of factors. These numbers are adjusted for stock splits and include dividends.

ProShares UltraPro QQQ ETF (TQQQ) TQQQ CHART

The Powerful Secret to TQQQ Investing Wall Strategies

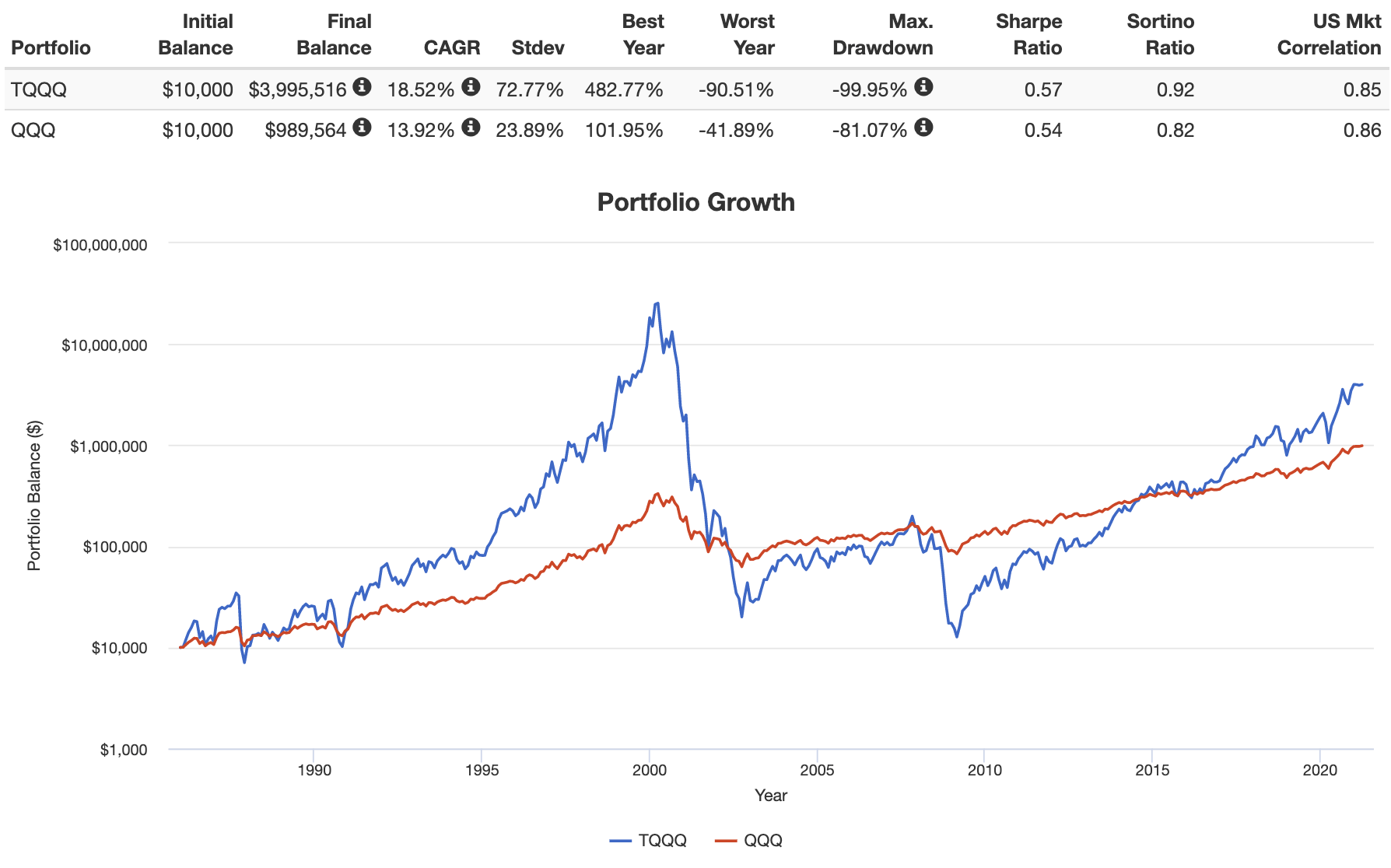

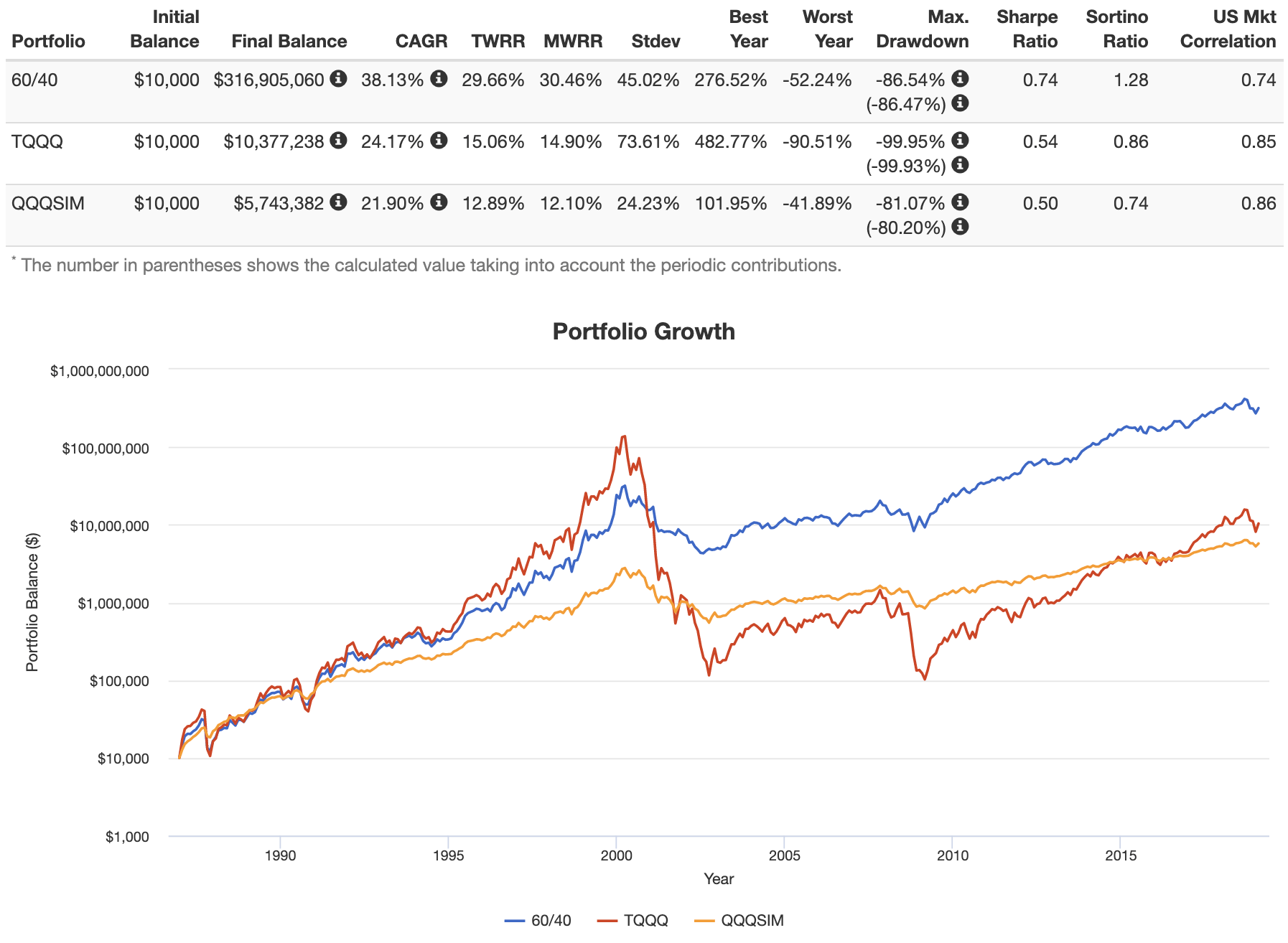

TQQQ ETF Is It A Good Investment for a Long Term Hold Strategy?

TQQQ ETF Is It A Good Investment for a Long Term Hold Strategy?

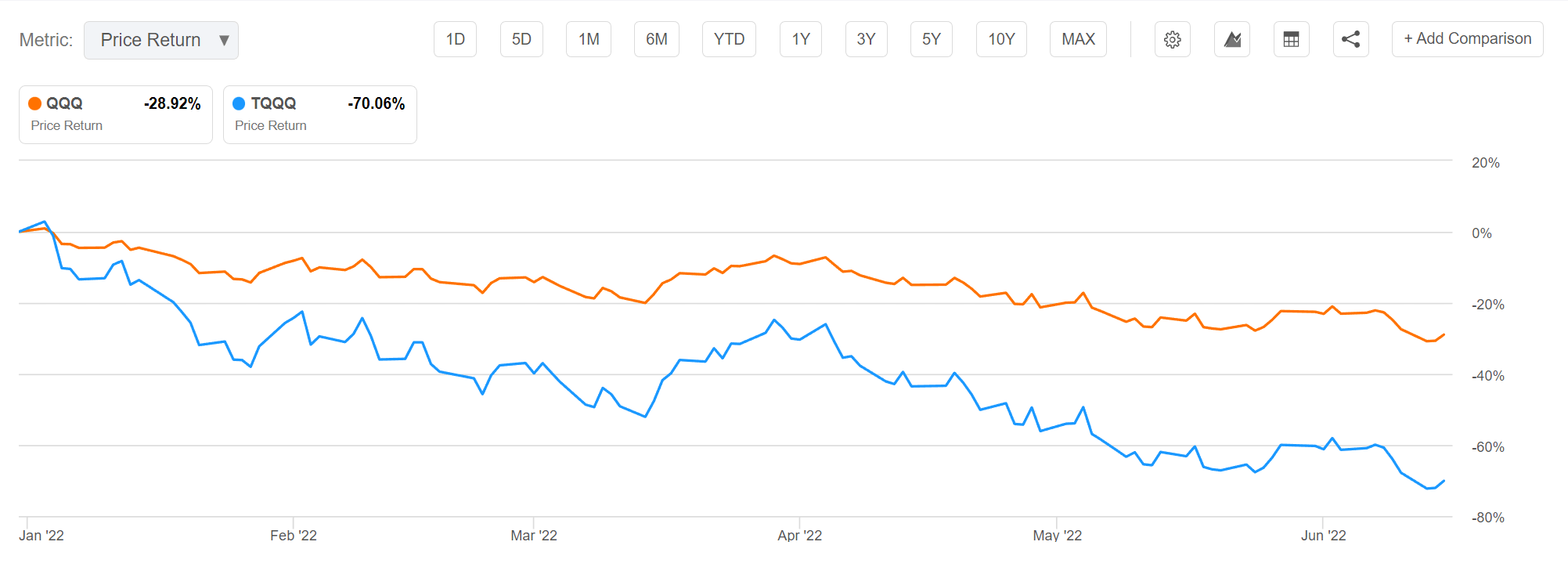

TQQQ ETF A Tool For Swing Traders Seeking Alpha

Is TQQQ Stock Worth a Long Term Hold?

Is TQQQ Stock Worth a Long Term Hold?

ARKK vs TQQQ vs QQQ for AMEXARKK by wendigooor — TradingView

Is TQQQ or QQQ ETF a Better Investment for You?

ETF Battles QQQ vs. VGT (12/20) ETF Portfolio Management

Web Below I’ve Compiled Charts Of The Qqq And Tqqq Over 12 Month, Five Year And 10 Year Timeframes.

Web Compare Etfs Qqq And Tqqq On Performance, Aum, Flows, Holdings, Costs And Esg Ratings.

6:00 Am 8:00 Am 10:00 Am 12:00 Pm 2:00 Pm 4:00 Pm 6:00 Pm.

65.40 +0.05 (+0.08%) After Hours:

Related Post: