The Chart Describes A Tax System

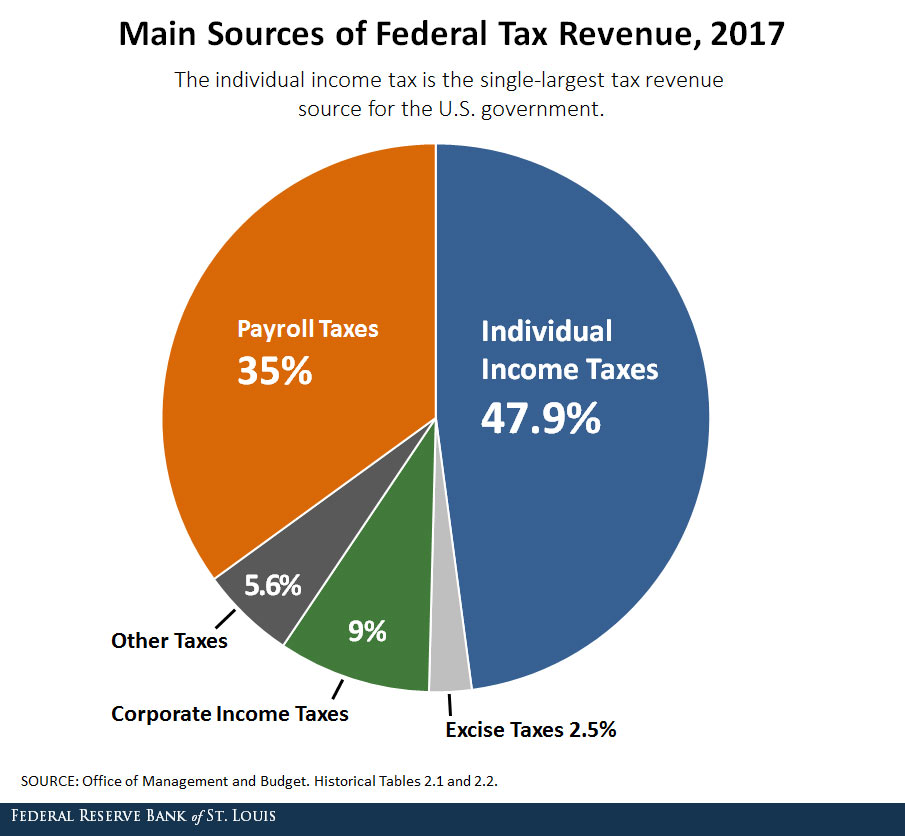

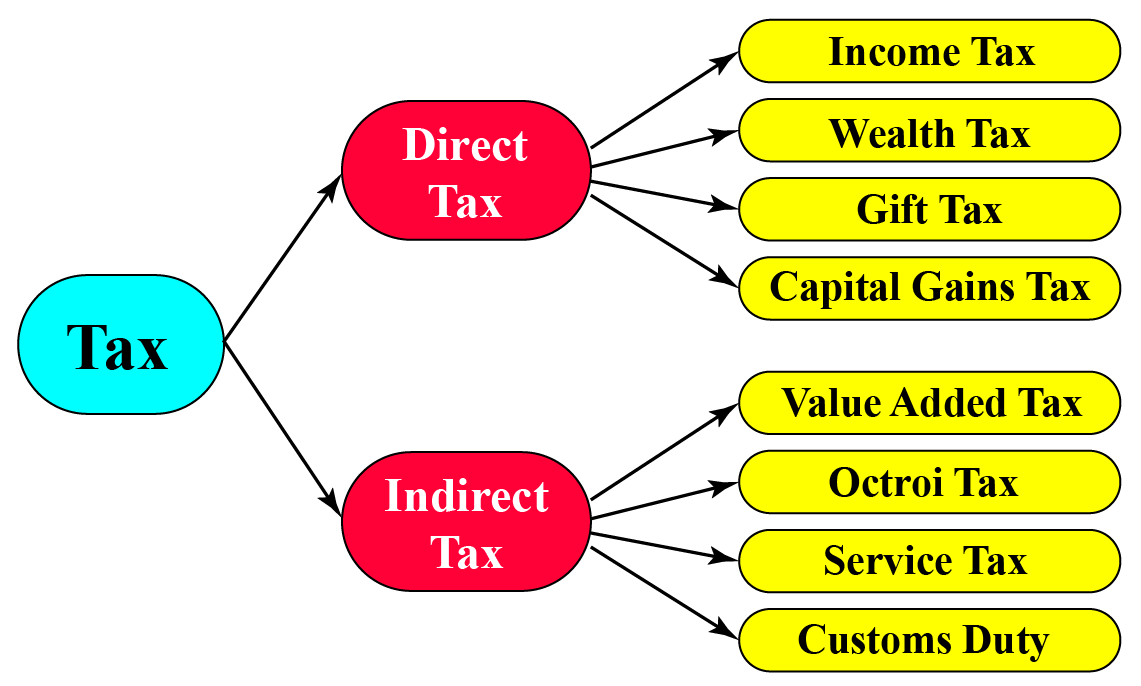

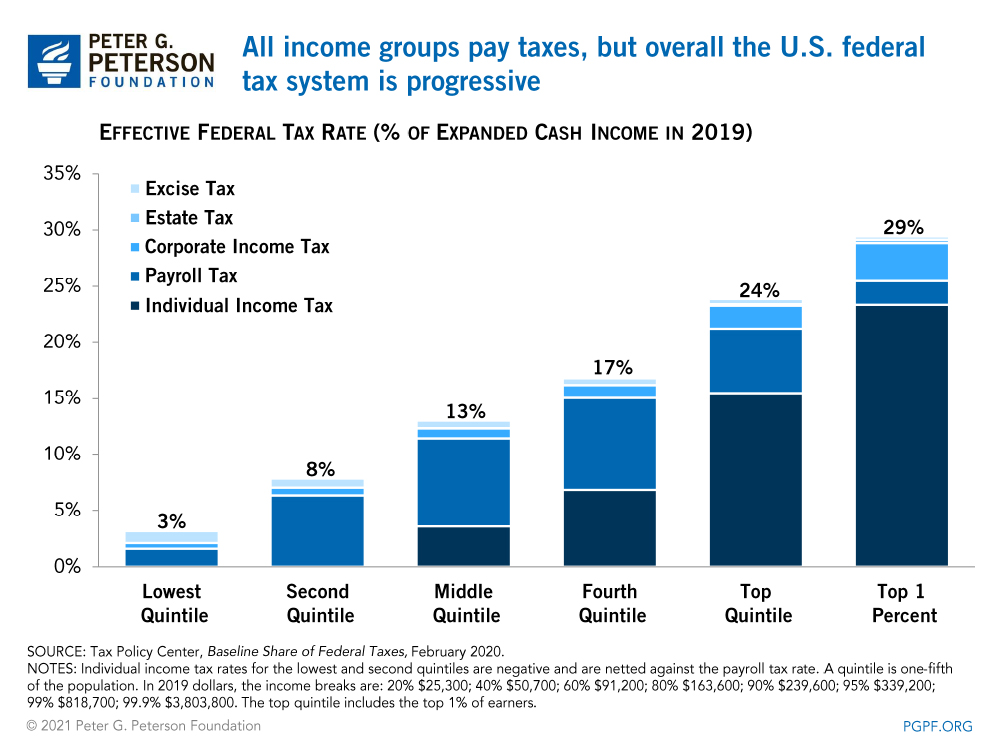

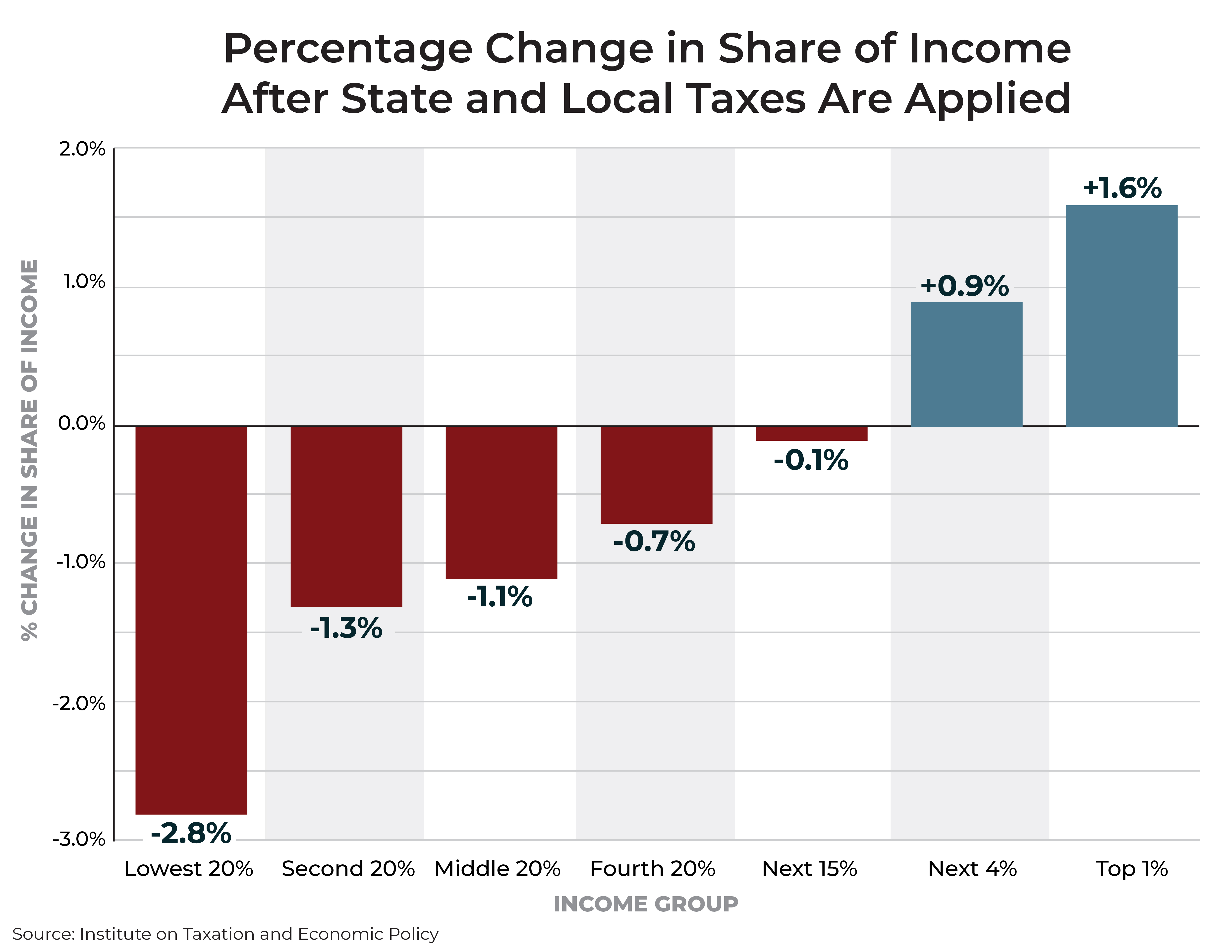

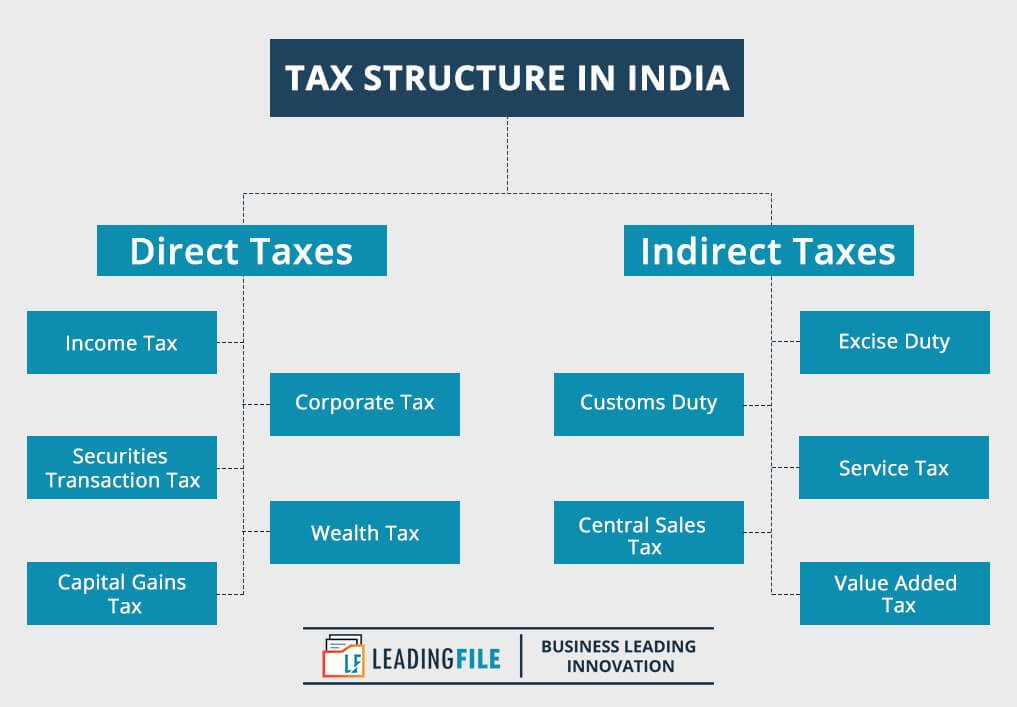

The Chart Describes A Tax System - In 2016, the bottom 50. Check out the infographic below for an overview of the. Web a tax system that is progressive applies higher tax rates to higher levels of income. The federal government finances its operations with taxes, fees, and other receipts collected from many different. Web overview of the federal tax system in 2022. In the united states, the federal individual income tax has rates that range from 10 percent to. The report also provides selected statistics on the tax system as a. Web the chart below illustrates how progressive the income tax system is today, as well as which income groups generate the most revenue. Web it is an income tax system that levies the same percentage tax to everyone regardless of income. Web study with quizlet and memorize flashcards containing terms like when the tax rate decreases as income increases, the system is:, if income distribution is made more. Web the marginal tax rate is the tax rate that applies to an additional dollar of income earned. Tax complexity key elements of the u.s. Web tax policy center briefing book 1/3 why are taxes so complicated? Web how does the tax system work? The federal income tax is. Web namely, the three types are (1) proportional taxes, (2) regressive taxes, and (3) progressive taxes. Web study with quizlet and memorize flashcards containing terms like when the tax rate decreases as income increases, the system is:, if income distribution is made more. What is the standard deduction? Tax complexity key elements of the u.s. Web the chart shows sources. Web the marginal tax rate is the tax rate that applies to an additional dollar of income earned. Check out the video below for more information. Why are taxes so complicated?. Web it is an income tax system that levies the same percentage tax to everyone regardless of income. Web the chart below illustrates how progressive the income tax system. Web a tax system that is progressive applies higher tax rates to higher levels of income. Web how does the tax system work? Web overview of the federal tax system in 2022. This report describes the federal tax structure and system in effect for 2022. What are itemized deductions and who claims them? The report also provides selected. What are itemized deductions and who claims them? Tax incidence analysis seeks to determine who ultimately bears the burden of a tax. Web the chart shows sources of revenue for federal, state, and local governments in the united states. Web the marginal tax rate is the tax rate that applies to an additional dollar of. In the united states, the federal individual income tax has rates that range from 10 percent to. Web overview of the federal tax system in 2022. This report describes the federal tax structure and system in effect for 2020. Tax incidence analysis seeks to determine who ultimately bears the burden of a tax. Suppose there is a cut in the. Web study with quizlet and memorize flashcards containing terms like when the tax rate decreases as income increases, the system is:, if income distribution is made more. It is usually segmented into tax brackets that progress to successively higher rates. Web the chart shows sources of revenue for federal, state, and local governments in the united states. Web we can. Why are taxes so complicated?. This report describes the federal tax structure and system in effect for 2022. Web overview of the federal tax system in 2022. Web the united states government operates a complicated tax system — one in which the president, a billionaire, can pay $750 in federal income taxes two years in a. Suppose there is a. The federal income tax is. Check out the infographic below for an overview of the. Web a progressive tax is a tax system that increases rates as the taxable income goes up. Tax complexity key elements of the u.s. Web it is an income tax system that levies the same percentage tax to everyone regardless of income. The federal government finances its operations with taxes, fees, and other receipts collected from many different. Web study with quizlet and memorize flashcards containing terms like when the tax rate decreases as income increases, the system is:, if income distribution is made more. Web this report describes the federal tax structure, provides some statistics on the tax system as a. The report also provides selected statistics on the tax system as a. Web the united states government operates a complicated tax system — one in which the president, a billionaire, can pay $750 in federal income taxes two years in a. Web we can use this simple model of the tax system to see how a change in the income tax rate affects both individuals and the economy as a whole. Why are taxes so complicated?. What are itemized deductions and who claims them? Web the chart below illustrates how progressive the income tax system is today, as well as which income groups generate the most revenue. This report describes the federal tax structure and system in effect for 2022. Web before we can begin to assess the value of specific proposals, it helps to look at the big picture of how the system works. Web study with quizlet and memorize flashcards containing terms like when the tax rate decreases as income increases, the system is:, if income distribution is made more. Suppose there is a cut in the tax. Web it is an income tax system that levies the same percentage tax to everyone regardless of income. This report describes the federal tax structure and system in effect for 2019. The report also provides selected statistics on the tax system as a. Web tax policy center briefing book 1/3 why are taxes so complicated? In the united states, the federal individual income tax has rates that range from 10 percent to. Tax complexity key elements of the u.s.

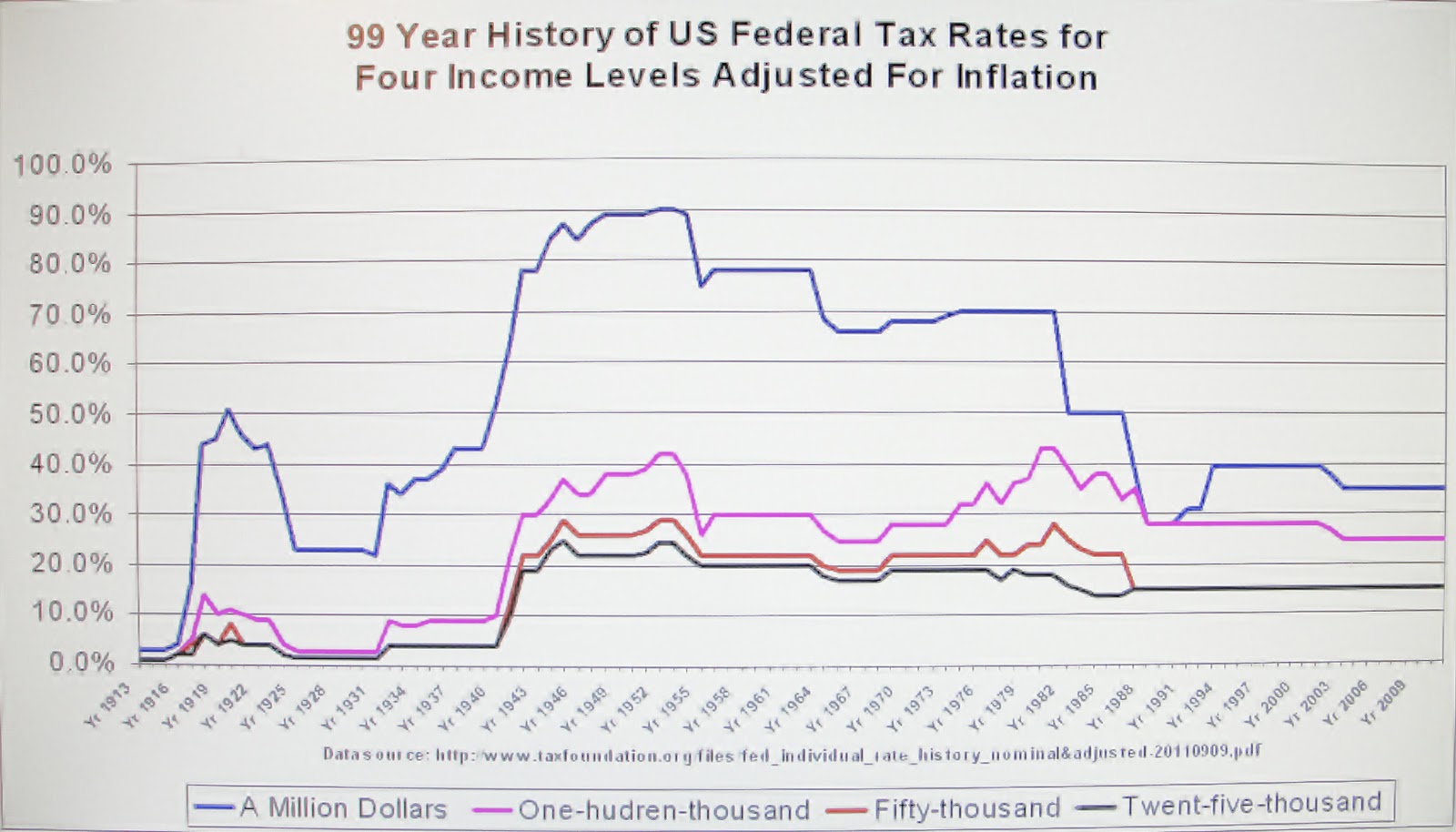

DataDriven Viewpoints A 99 YEAR HISTORY OF TAX RATES IN AMERICA

Hich Best Describes a Negative Tax

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/3601618/ctj_taxshares.0.png)

11 charts that explain taxes in America Vox

The Purpose and History of Taxes St. Louis Fed

How to calculate taxes and discounts Basic Concept, Formulas and

Budget Basics Who Pays Taxes?

Tax SystemNational Taxation Bureau of the Central Area

Tax Day 2016 Charts to Explain our Tax System Committee for a

How State Tax Systems Worsen the Economic Divide in Charts ITEP

Basic Of GST Clear All Your GST Doubts GST Information Explained

The Federal Government Finances Its Operations With Taxes, Fees, And Other Receipts Collected From Many Different.

It Must Have Seen Dramatic Changes.

It Is Usually Segmented Into Tax Brackets That Progress To Successively Higher Rates.

Tax Incidence Analysis Seeks To Determine Who Ultimately Bears The Burden Of A Tax.

Related Post: