State Nol Carryforward Chart

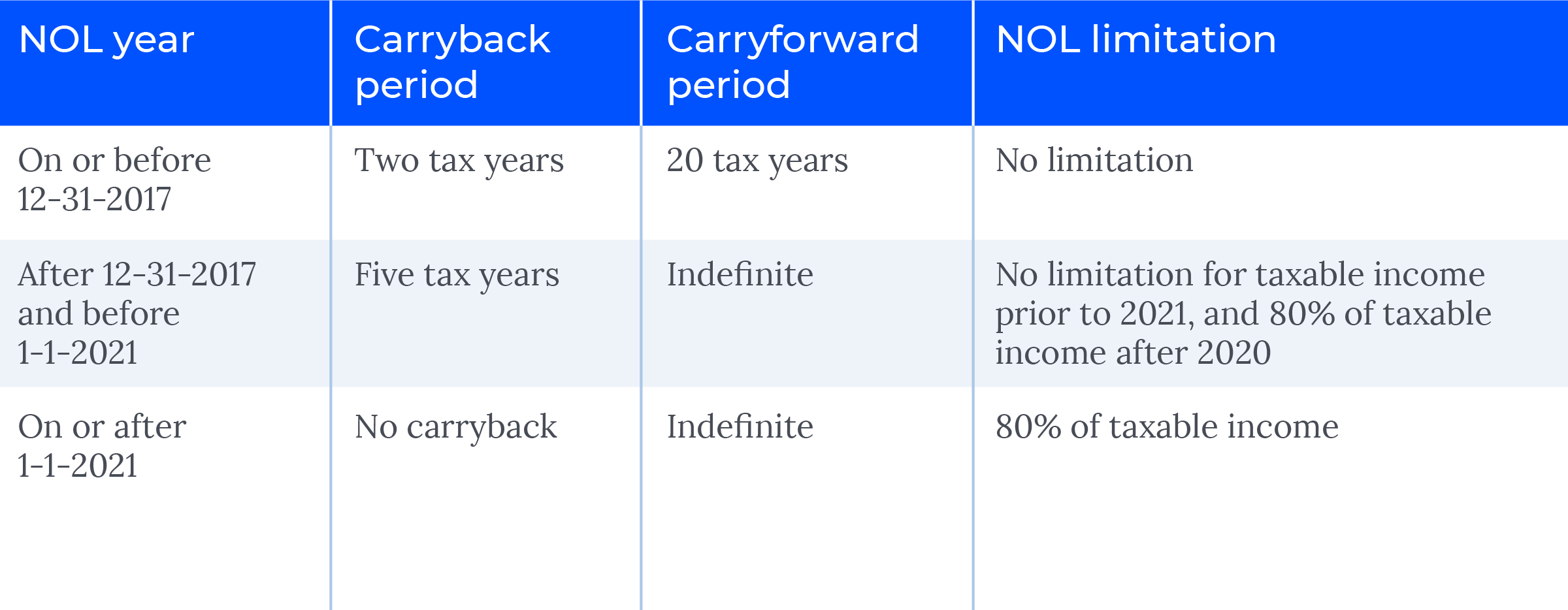

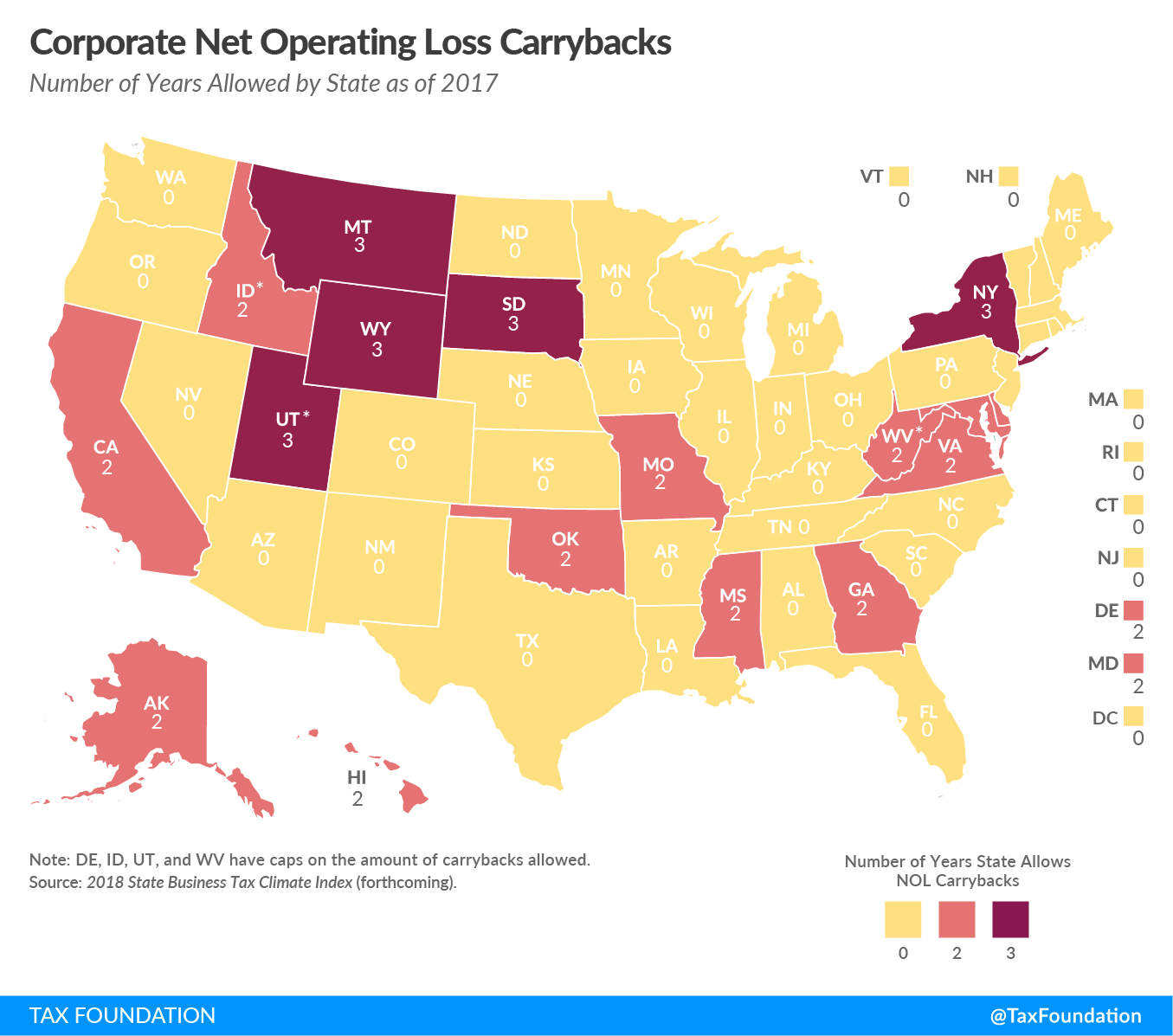

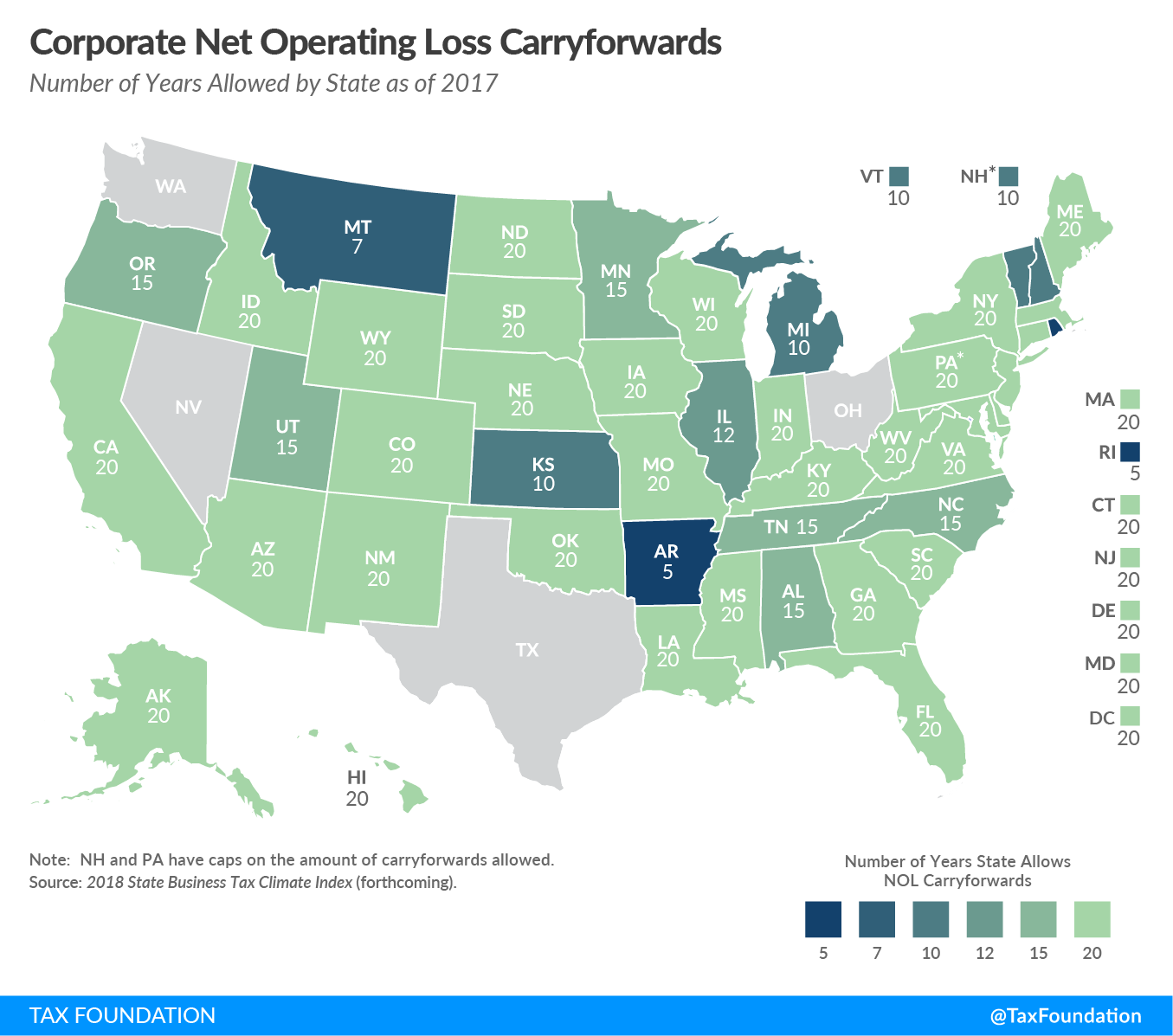

State Nol Carryforward Chart - For most taxpayers, nols arising in tax years ending after 2020 can only be carried. Web the first map below shows the number of nol carryforward years allowed by states. Web as the combined group sustained an nol, each member computes its share of the nol as follows: December 11, 20152 min read by: Offer the full 20 years of carryforwards. 2013 through 2018, nol can be carried back to each of the past 2 years. Most taxpayers no longer have the option to carryback a net operating loss (nol). For losses incurred in tax years: Web specifically, the legislation limits c corporations to a deduction of $100,000 of nol carryforwards for each tax year ending on or after dec. Web the federal government allows nol provisions to be carried forward indefinitely, and to reduce tax liability by up to 80 percent in any given year. Web specifically, the legislation limits c corporations to a deduction of $100,000 of nol carryforwards for each tax year ending on or after dec. Web irc § 172 (b) (1) (a) allows taxpayers to carry nols back two and forward 20 years, unless a taxpayer elects to waive the carryback period, in which case nols will only be carried. 2019. Web below are two maps taken from data in our 2015 state business tax climate index, one showing the number of nol carryforward years allowed by each state’s. Web specifically, the legislation limits c corporations to a deduction of $100,000 of nol carryforwards for each tax year ending on or after dec. Web the federal government allows nol provisions to. Web as the combined group sustained an nol, each member computes its share of the nol as follows: Web many conformed with the federal tax code regarding nols (internal revenue code § 172), which generally stated that an nol could be carried forward to offset any taxable. The second map shows nol carryback years. Web specifically, the legislation limits c. Web the first map shows the number of nol carryforward years allowed by each state?s corporate income tax code. Web irc § 172 (b) (1) (a) allows taxpayers to carry nols back two and forward 20 years, unless a taxpayer elects to waive the carryback period, in which case nols will only be carried. Web in california, the standard rule. Carryback your nol deduction to the past 2 tax years by filing your amended return s and carryforward any excess. For most taxpayers, nols arising in tax years ending after 2020 can only be carried. For losses incurred in tax years: 2013 through 2018, nol can be carried back to each of the past 2 years. Web the federal government. For losses incurred in tax years: 2013 through 2018, nol can be carried back to each of the past 2 years. Web in california, the standard rule for nol carryovers is that they can be carried forward for 10 years 2 following the loss year for losses generated in 2000 through 2007. Web specifically, the legislation limits c corporations to. Web the first map below shows the number of nol carryforward years allowed by states. 172 (b) (1) (a) allows taxpayers to carry nols back 2 and forward 20 years, unless a taxpayer elects to waive the carryback period, in which case nols will only be carried. Web the federal government allows nol provisions to be carried forward indefinitely, and. Web the federal government allows nol provisions to be carried forward indefinitely, and to reduce tax liability by up to 80 percent in any given year. For losses incurred in tax years: Most taxpayers no longer have the option to carryback a net operating loss (nol). Web specifically, the legislation limits c corporations to a deduction of $100,000 of nol. Web if you carry forward your nol to a tax year after the nol year, list your nol deduction as a negative figure on schedule 1 (form 1040), line 8a, for 2023, for the year to which the. Web a net operating loss (nol) occurs when a company’s allowable deductions exceed its taxable income within a tax period. Web the. Web for tax years before 2018, taxpayers could generally carry nols back 2 years and then forward 20 years. Web if you carry forward your nol to a tax year after the nol year, list your nol deduction as a negative figure on schedule 1 (form 1040), line 8a, for 2023, for the year to which the. 172 (b) (1). If taxpayers l, m, n, and o file a combined report in 2016, the nol. Carryback your nol deduction to the past 2 tax years by filing your amended return s and carryforward any excess. 31, 2021, and prior to dec. Offer the full 20 years of carryforwards. Most taxpayers no longer have the option to carryback a net operating loss (nol). December 11, 20152 min read by: Web the first map below shows the number of nol carryforward years allowed by states. Web below are two maps taken from data in our 2015 state business tax climate index, one showing the number of nol carryforward years allowed by each state’s. Web if you carry forward your nol to a tax year after the nol year, list your nol deduction as a negative figure on schedule 1 (form 1040), line 8a, for 2023, for the year to which the. Web as the combined group sustained an nol, each member computes its share of the nol as follows: 172 (b) (1) (a) allows taxpayers to carry nols back 2 and forward 20 years, unless a taxpayer elects to waive the carryback period, in which case nols will only be carried. Web irc § 172 (b) (1) (a) allows taxpayers to carry nols back two and forward 20 years, unless a taxpayer elects to waive the carryback period, in which case nols will only be carried. 2013 through 2018, nol can be carried back to each of the past 2 years. 2019 and after, nol can no longer be carried back to the past 2 years. Web in california, the standard rule for nol carryovers is that they can be carried forward for 10 years 2 following the loss year for losses generated in 2000 through 2007. For most taxpayers, nols arising in tax years ending after 2020 can only be carried.

Tax relief options for real estate brokers Wipfli

Net Operating Loss Carryforward & Carryback Provisions by State

Nol Carryforward Worksheet 2021

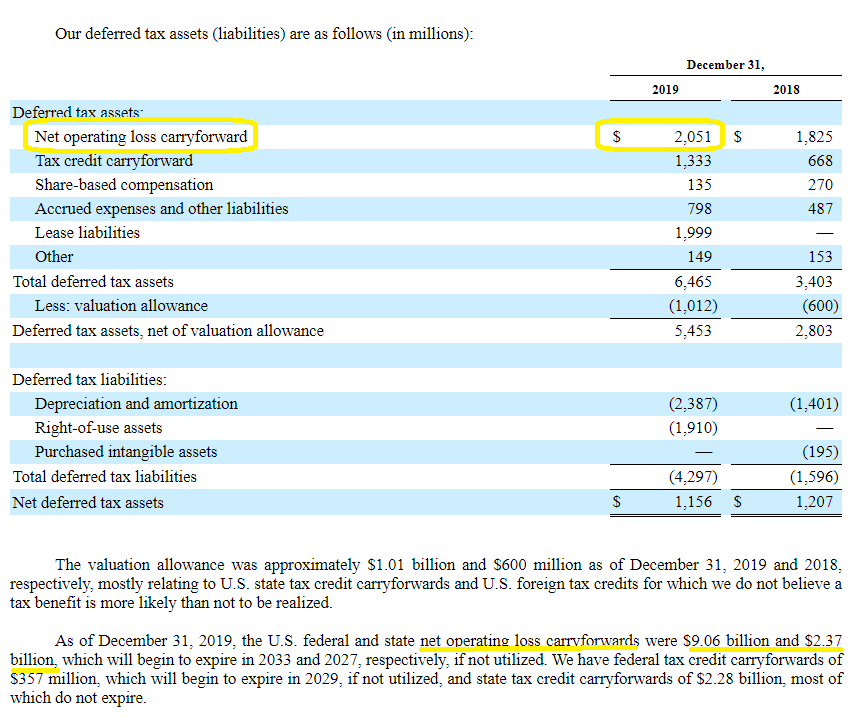

(NOL) Net Operating Loss Carryforward Explained Losses Assets

(NOL) Net Operating Loss Carryforward Explained Losses Assets

Net Operating Loss (NOL) Formula + Calculator

Corporate Net Operating Loss Carryforward and Carryback Provisions by

What Are Net Operating Loss Carrybacks? Tax Foundation

Corporate Net Operating Loss Carryforward and Carryback Provisions by State

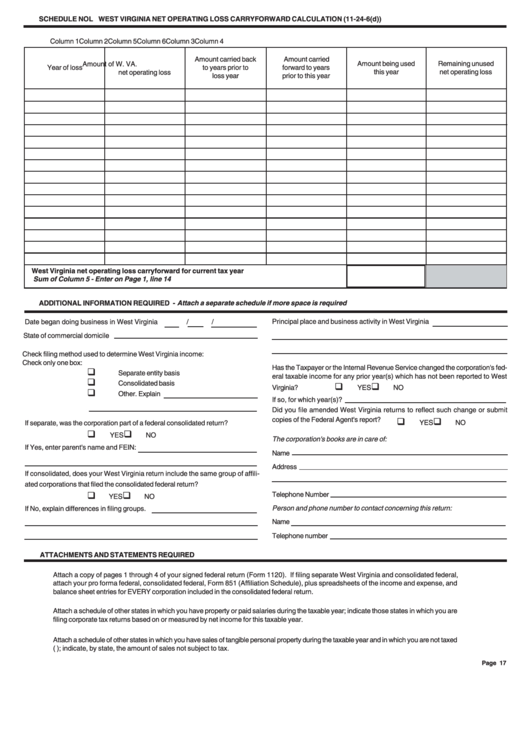

Schedule Nol West Virginia Net Operating Loss Carryforward

The Nol Can Generally Be Used To Offset A.

Web The Federal Government Allows Nol Provisions To Be Carried Forward Indefinitely, And To Reduce Tax Liability By Up To 80 Percent In Any Given Year.

The Second Map Shows Nol Carryback Years.

For Losses Incurred In Tax Years:

Related Post: