State Irc Conformity Chart

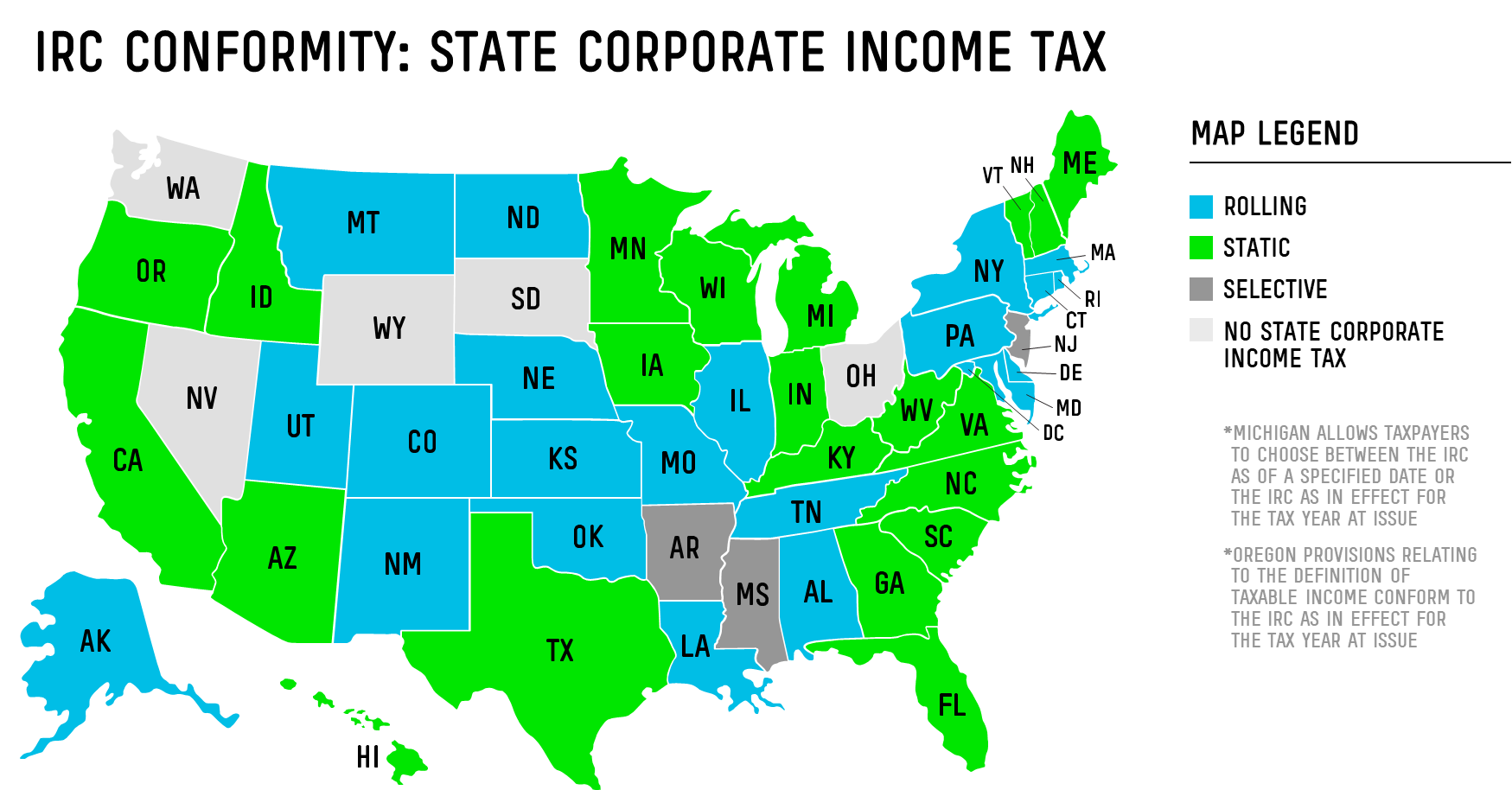

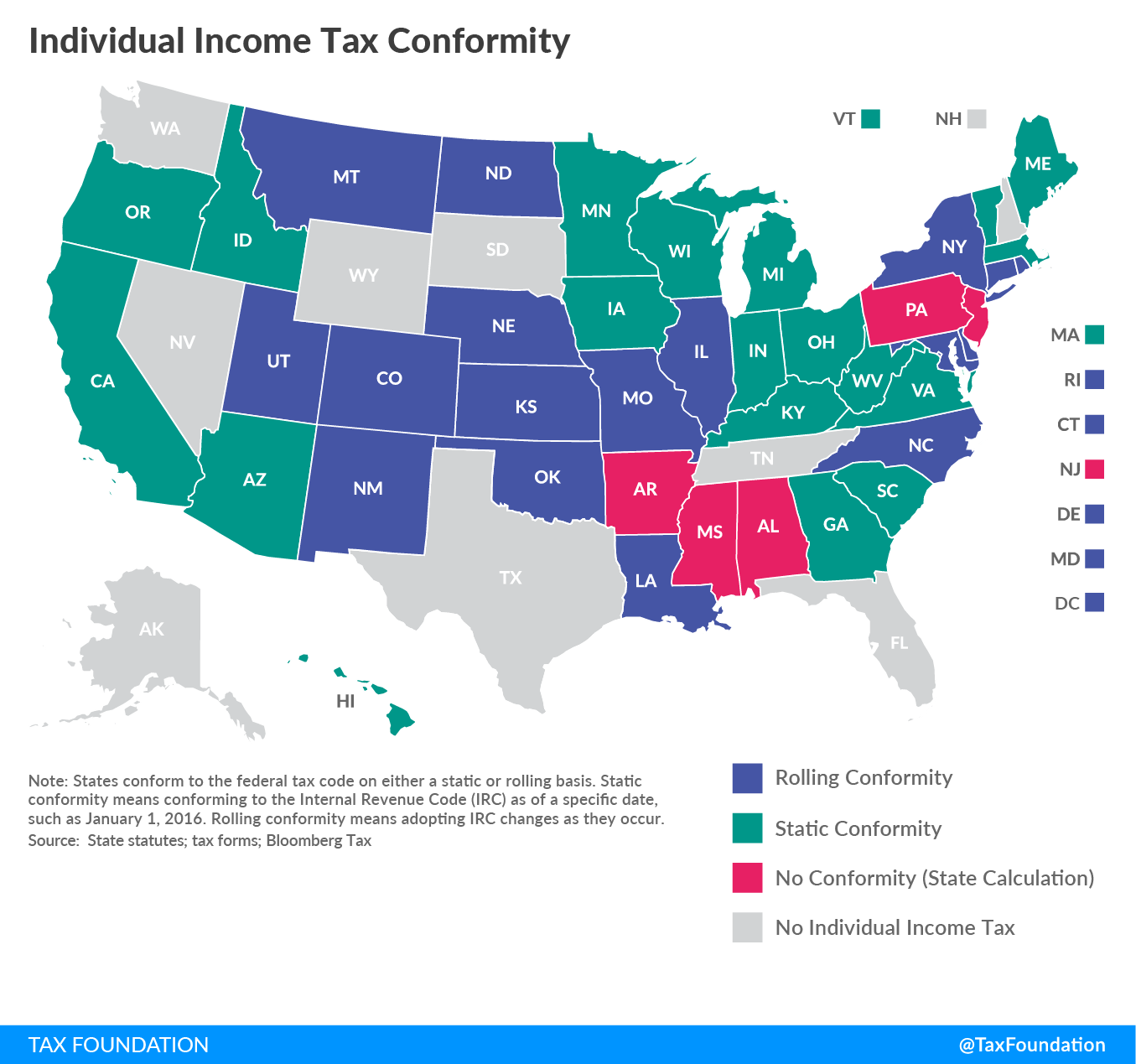

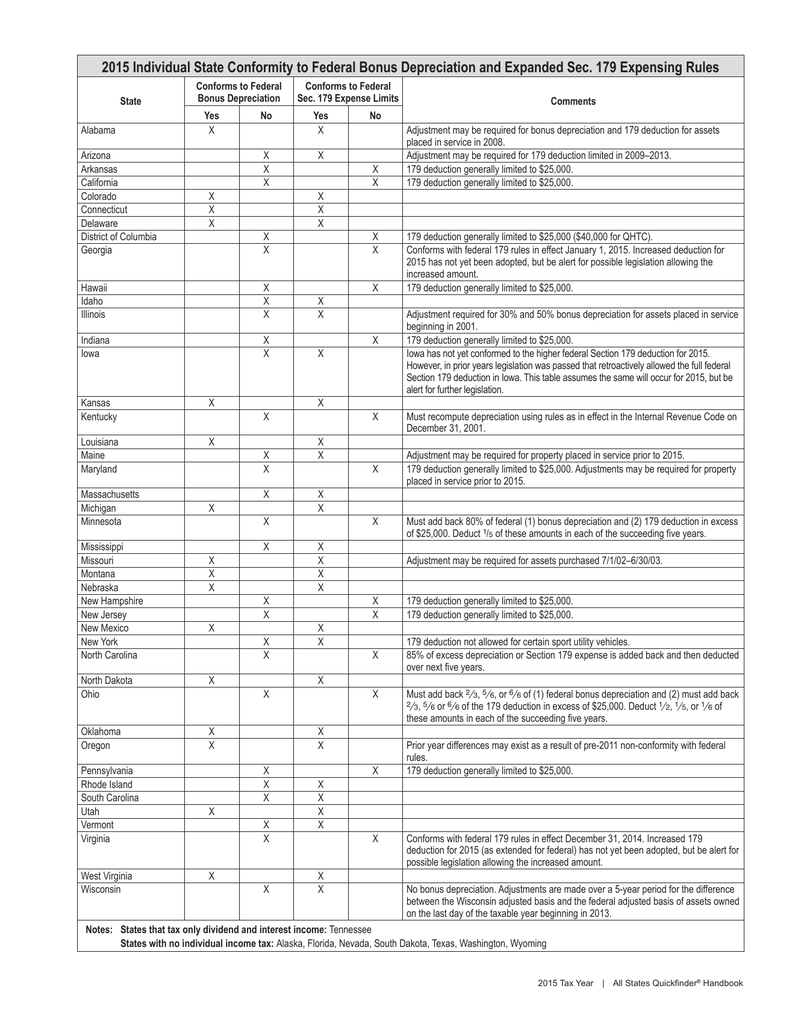

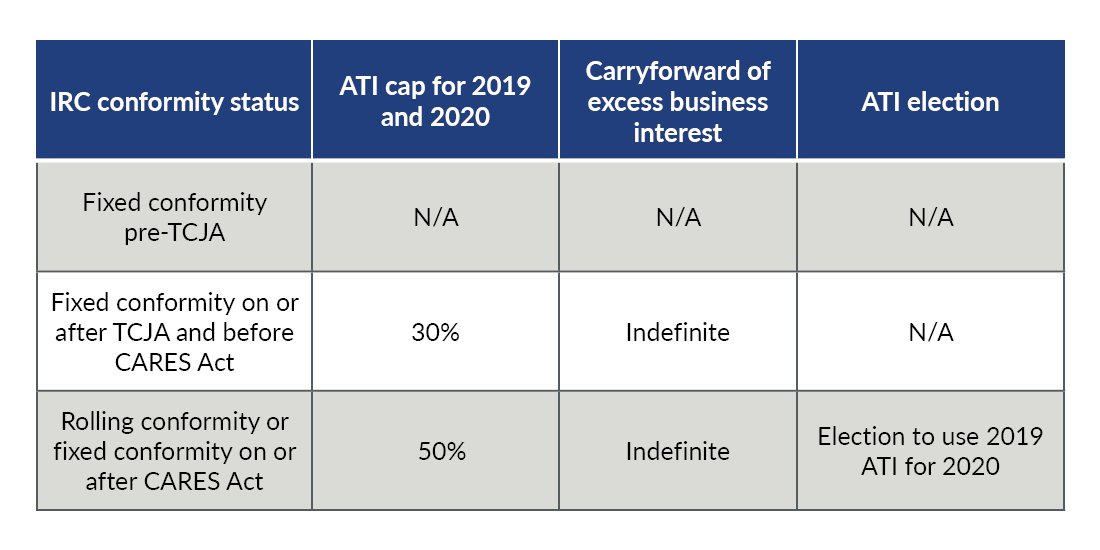

State Irc Conformity Chart - Conformity chart, which includes each state’s conformity status, key differences between state and federal bonus depreciation rules, state. Web with an eye to the fluid dynamics of what federal tax reform might entail, this article reviews state conformity to federal income tax provisions in various settings — focusing on how. To the extent there are legislative changes after. Web a state's conformity to the internal revenue code (irc) is an important policy choice that affects state corporate income tax regimes using a measure of income. The state conforms to the irc as of a specific date that is after the enactment of the opportunity zones legislation. New law updates state conformity to irc and decouples from tcja changes to irc §174. Web those differences generally fall into three categories: Web these maps track specific state corporate tax law conformity to the recent federal changes made to irc § 163(j) interest expense limitation, 80% cap rules, and qualified. Web download the full state i.r.c. Web a survey of the federal provisions to which states conform, what each state can expect from federal tax changes, and what options are available to them. Conformity to the irc and associated amendments. (2) conformity to the internal revenue code; Web this chart summarizes which version of the federal internal revenue code each state follows in defining taxable wages for withholding purposes. The state conforms to the irc as of a specific date that is after the enactment of the opportunity zones legislation. Web a state's. Web a survey of the federal provisions to which states conform, what each state can expect from federal tax changes, and what options are available to them. Web these maps track specific state corporate tax law conformity to the recent federal changes made to irc § 163(j) interest expense limitation, 80% cap rules, and qualified. Web this chart summarizes which. Of the more than 40 states plus the district. Web download the full state i.r.c. States that explicitly adopt the code as of a fixed date will conform to the code as of that date. Conformity to the irc and associated amendments. Web department of revenue posted two charts reflecting newly enacted legislation that generally updates minnesota’s definition of the. On march 23, 2022, arizona enacted sb 1264, which advances the state’s internal revenue code (irc). The chart below provides a basic irc conformity overview. And (3) modifications under state law. Conformity chart, which includes each state’s conformity status, key differences between state and federal bonus depreciation rules, state. (2) conformity to the internal revenue code; Web this chart summarizes which version of the federal internal revenue code each state follows in defining taxable wages for withholding purposes. Conformity to the irc and associated amendments. The state conforms to the irc as of a specific date that is after the enactment of the opportunity zones legislation. Web with an eye to the fluid dynamics of what. Web this chart summarizes which version of the federal internal revenue code each state follows in defining taxable wages for withholding purposes. The chart below provides a basic irc conformity overview. The state conforms to the irc as of a specific date that is after the enactment of the opportunity zones legislation. And (3) modifications under state law. Web read. Effective immediately, and applicable for. Conformity to the irc and associated amendments. States that explicitly adopt the code as of a fixed date will conform to the code as of that date. Web this paper provides a snapshot of how states currently conform to internal revenue code (irc) income tax provisions in general, as well as to the irc’s treatment. The chart below provides a basic irc conformity overview. The state conforms to the irc as of a specific date that is after the enactment of the opportunity zones legislation. Web those differences generally fall into three categories: Web these maps track specific state corporate tax law conformity to the recent federal changes made to irc § 163(j) interest expense. On march 23, 2022, arizona enacted sb 1264, which advances the state’s internal revenue code (irc). Web department of revenue posted two charts reflecting newly enacted legislation that generally updates minnesota’s definition of the internal revenue code (irc) to the irc. Web these maps track specific state corporate tax law conformity to the recent federal changes made to irc §. Web this chart summarizes which version of the federal internal revenue code each state follows in defining taxable wages for withholding purposes. States that explicitly adopt the code as of a fixed date will conform to the code as of that date. Web those differences generally fall into three categories: Web a state's conformity to the internal revenue code (irc). Conformity chart, which includes each state’s conformity status, key differences between state and federal bonus depreciation rules, state. The chart below provides a basic irc conformity overview. Web read a kpmg report* that explores which states likely conform to the amendments to section 174, which states likely decouple from those changes, and the. On march 23, 2022, arizona enacted sb 1264, which advances the state’s internal revenue code (irc). Web this paper provides a snapshot of how states currently conform to internal revenue code (irc) income tax provisions in general, as well as to the irc’s treatment of nols,. (2) conformity to the internal revenue code; To the extent there are legislative changes after. New law updates state conformity to irc and decouples from tcja changes to irc §174. Web this chart summarizes which version of the federal internal revenue code each state follows in defining taxable wages for withholding purposes. Web department of revenue posted two charts reflecting newly enacted legislation that generally updates minnesota’s definition of the internal revenue code (irc) to the irc. Web those differences generally fall into three categories: Conformity to the irc and associated amendments. Web a state's conformity to the internal revenue code (irc) is an important policy choice that affects state corporate income tax regimes using a measure of income. The state conforms to the irc as of a specific date that is after the enactment of the opportunity zones legislation. States that explicitly adopt the code as of a fixed date will conform to the code as of that date. Of the more than 40 states plus the district.

The State of Federal Conformity Tax Foundation of Hawaii

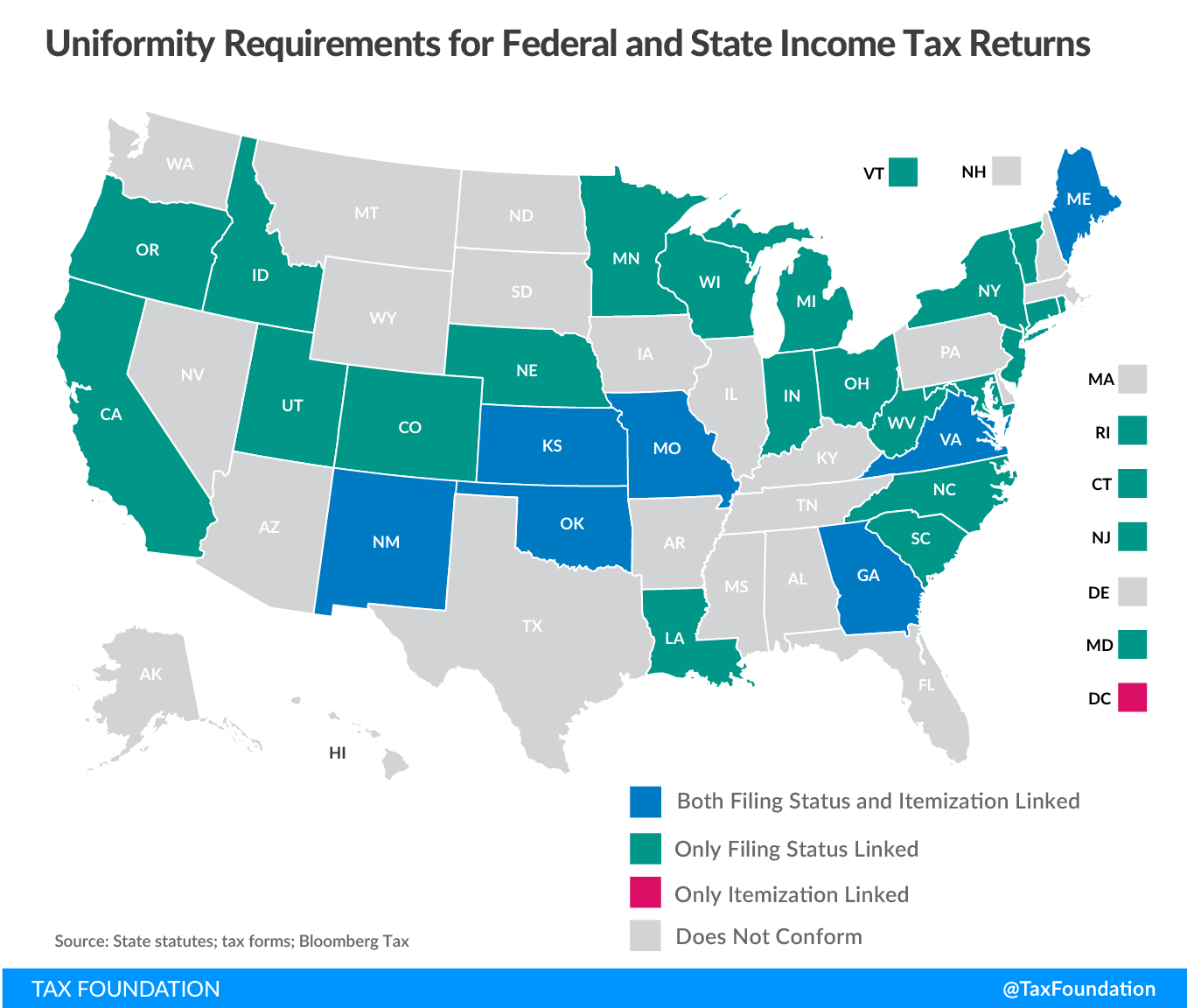

Federal Tax Reform & the States Conformity & Revenue Tax Foundation

2015 Individual State Conformity to Federal Bonus Depreciation and

How do federal tax changes affect your state taxes?

State and local tax implications of the CARES Act and other COVID19

State Tax Conformity a Year After Federal Tax Reform

State Tax Conformity a Year After Federal Tax Reform

State Tax Conformity a Year After Federal Tax Reform

GILTI and Other Conformity Issues Still Loom for States in 2020 The

State Conformity to Federal PandemicRelated Tax Provisions in CARES

And (3) Modifications Under State Law.

Web These Maps Track Specific State Corporate Tax Law Conformity To The Recent Federal Changes Made To Irc § 163(J) Interest Expense Limitation, 80% Cap Rules, And Qualified.

Web Download The Full State I.r.c.

Web This Paper Provides A Snapshot Of How States Currently Conform To Internal Revenue Code (Irc) Income Tax Provisions In General, As Well As To The Irc’s Treatment.

Related Post: