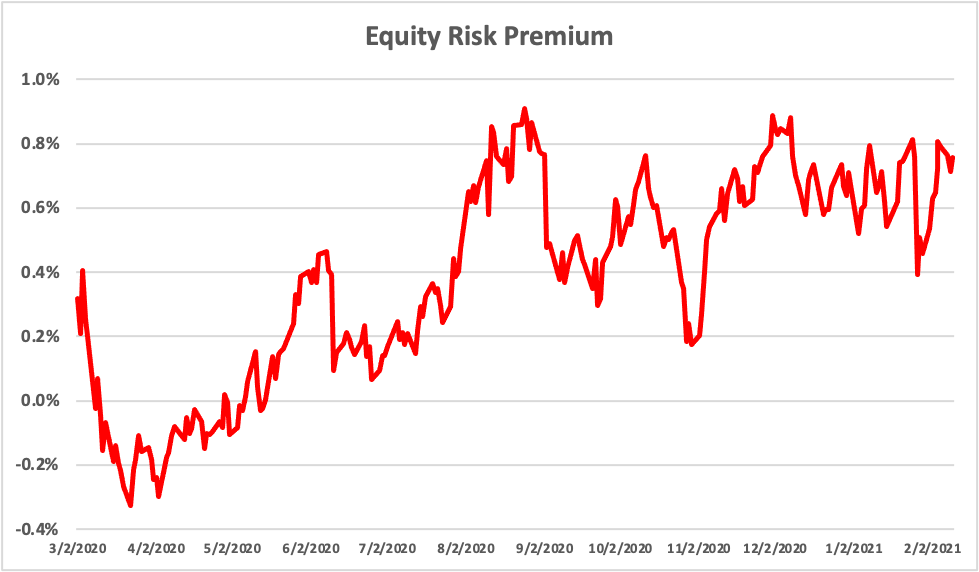

Sp 500 Equity Risk Premium Chart

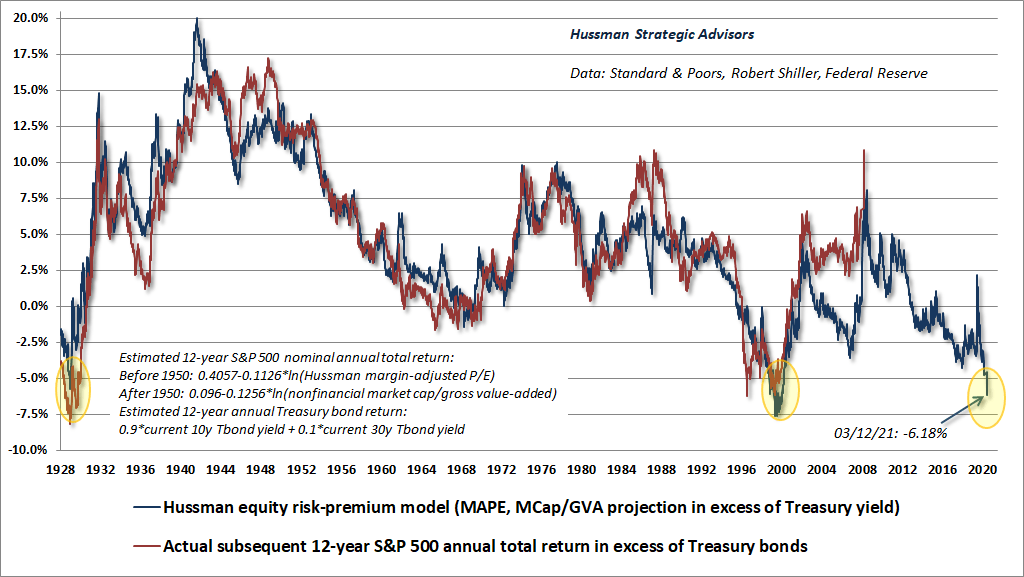

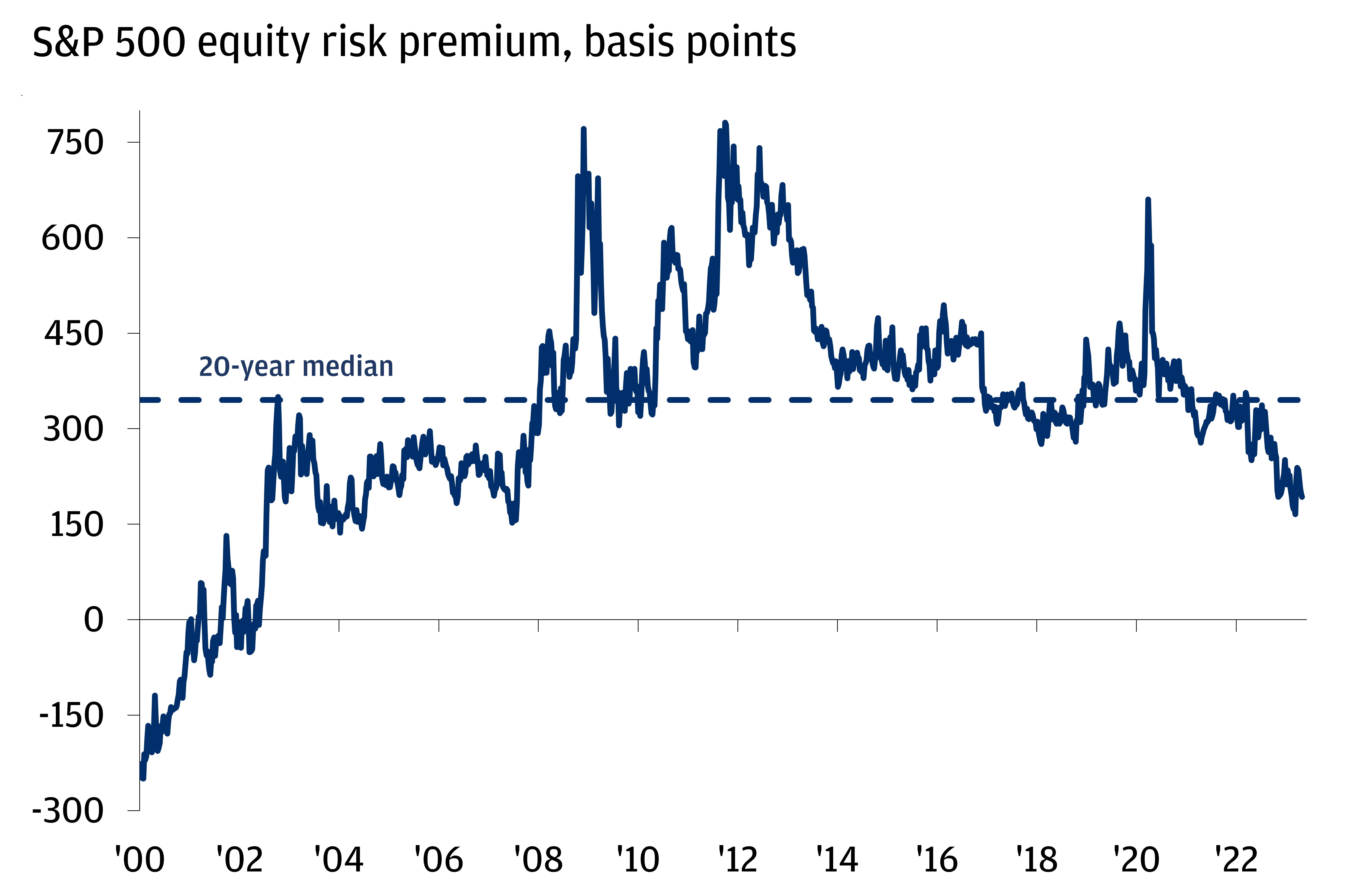

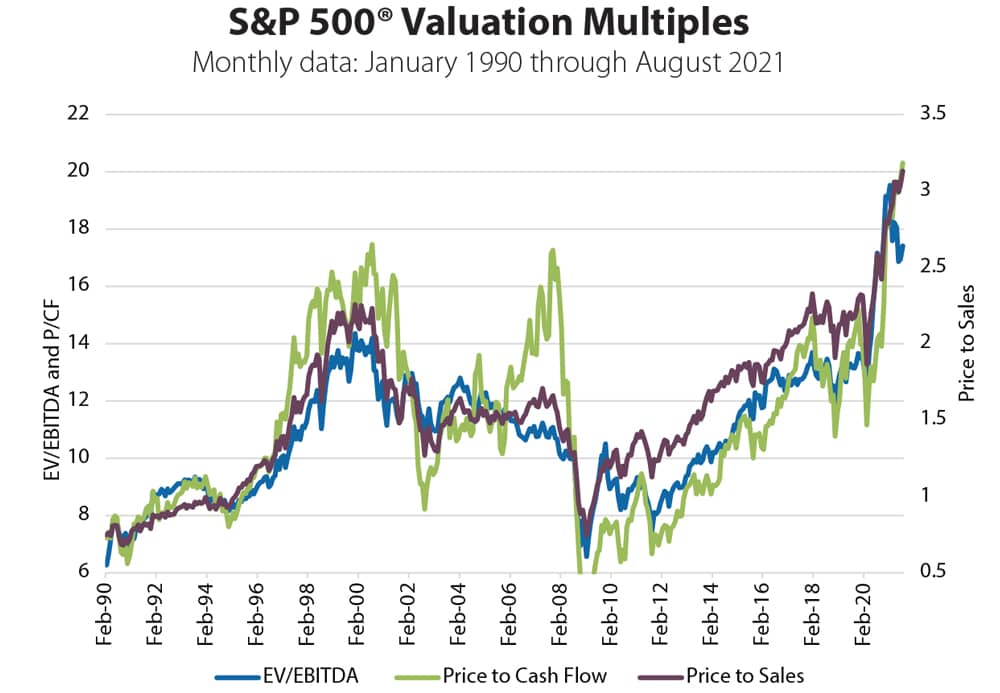

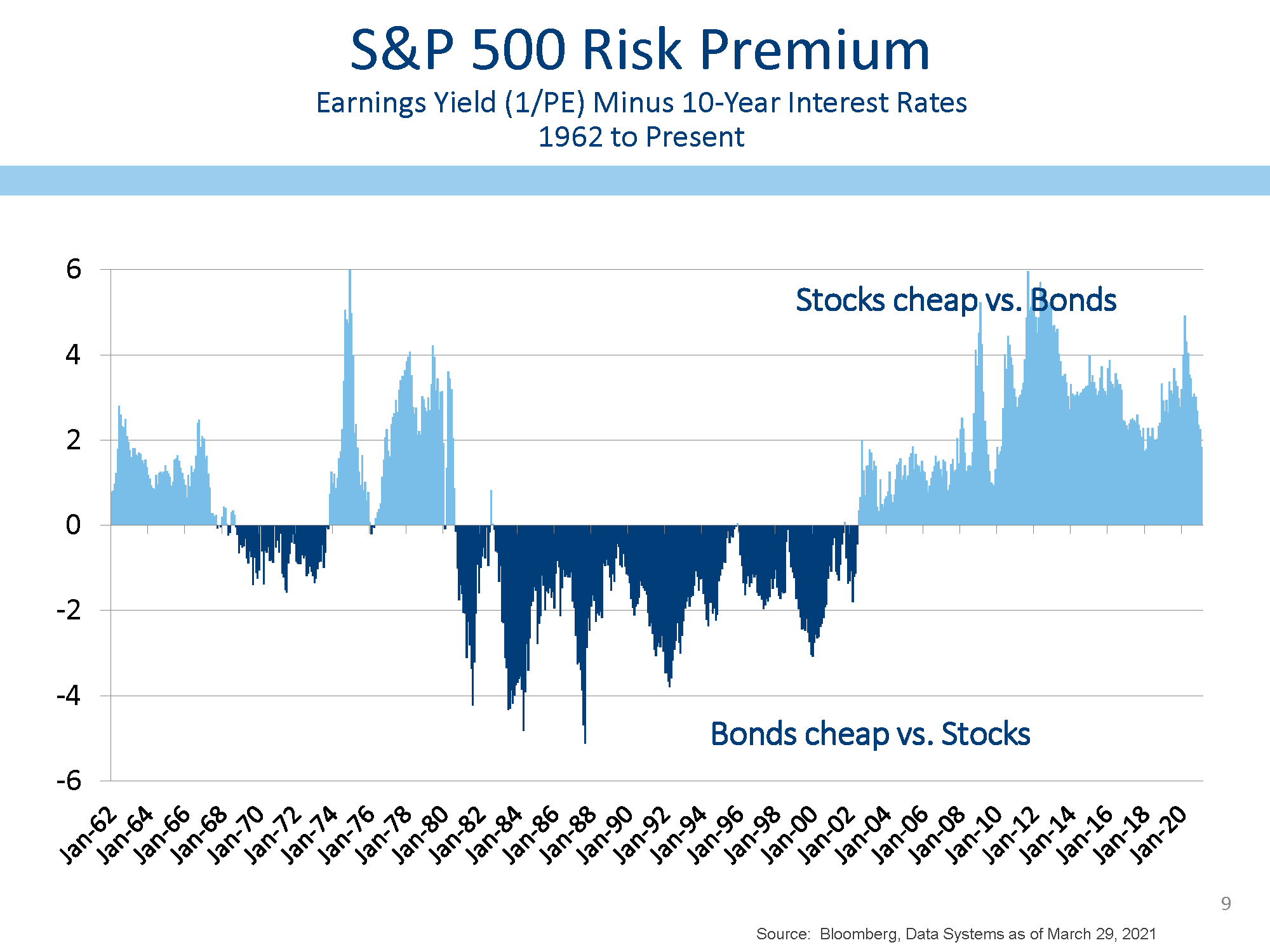

Sp 500 Equity Risk Premium Chart - Web s&p us equity risk premium index total return charts including level and total return charts. Web the updated chart shows the impact of changes in the equity risk premium on the valuation of the s&p 500. Web at 3,950, the s&p 500 appears to be nearly 16% overvalued based on historical equity risk premium. Web s&p us equity risk premium index er kurs heute: Stocks over long term government bonds. S&p 500 sectors forward metrics & fundamentals. Treasury bond futures excess return index. Viele chartindikatoren für die beste analyse! S&p 400 sectors forward metrics & fundamentals. Download as an excel file instead: Web the current earnings yield on the s&p 500 is about 4.5%. Standard & poor’s, bloomberg finance, l.p., as of may 30, 2024. For those that don't know, equity risk premium is the premium. Web the index measures the spread of returns of u.s. The index ended an exciting day of trading on friday, 31 may 2024 at. This suggests that investors demand a slightly lower return for investments in that country, in. S&p 500 nrri & neri. Web the current earnings yield on the s&p 500 is about 4.5%. Web the average market risk premium in the united states increased slightly to 5.7 percent in 2023. Web the current negative equity risk premium suggests markets may not. For those that don't know, equity risk premium is the premium. Web at 3,950, the s&p 500 appears to be nearly 16% overvalued based on historical equity risk premium. Web find the latest information on s&p us equity risk premium inde (^spuserpt) including data, charts, related news and more from yahoo finance The erp is essential for the calculation of. The erp is essential for the calculation of discount rates and derived from the capm. View daily, weekly or monthly format back to when s&p us equity risk premium inde stock was issued. Constituents include the s&p 500® futures excess return index and the s&p u.s. On the other hand, if the premium were to drop to 3.50% the valuation. Web a primary influence on the s&p 500 is the equity risk premium. Web at 3,950, the s&p 500 appears to be nearly 16% overvalued based on historical equity risk premium. The equity risk premium is the extra percentage of incremental risk that investors demand to divest from corporate bonds and invest in the stock market. View daily, weekly or. Stocks over long term government bonds. S&p 500 would drop 18.2% to 3,900. S&p 500 forward revenues, earnings & margins. Web the index measures the spread of returns of u.s. Treasury bond futures excess return index. The index ended an exciting day of trading on friday, 31 may 2024 at. Web the index measures the spread of returns of u.s. On the other hand, if the premium were to drop to 3.50% the valuation jumps to 5,997. For those that don't know, equity risk premium is the premium. S&p 500 nrri & neri. On the other hand, if the premium were to drop to 3.50% the valuation jumps to 5,997. View daily, weekly or monthly format back to when s&p us equity risk premium inde stock was issued. S&p 400 sectors forward metrics & fundamentals. Web discover historical prices for ^spuserpp stock on yahoo finance. Web technical stocks chart with latest price quote. The erp is essential for the calculation of discount rates and derived from the capm. Web s&p 500 earnings yield & equity risk premium (w/us 10 year & 3 month treasury yield) more. Web at 3,950, the s&p 500 appears to be nearly 16% overvalued based on historical equity risk premium. Starting in 2008, i have written annual update papers. S&p 500 sectors forward metrics & fundamentals. Web the index measures the spread of returns of u.s. Web s&p us equity risk premium index total return charts including level and total return charts. The erp is essential for the calculation of discount rates and derived from the capm. S&p 500 would drop 18.2% to 3,900. Web the current negative equity risk premium suggests markets may not be sufficiently compensating investors for today’s market and economic risks. Treasury bond futures excess return index. View daily, weekly or monthly format back to when s&p us equity risk premium inde stock was issued. Web the average market risk premium in the united states increased slightly to 5.7 percent in 2023. Web the index measures the spread of returns of u.s. Web at 3,950, the s&p 500 appears to be nearly 16% overvalued based on historical equity risk premium. Web the updated chart shows the impact of changes in the equity risk premium on the valuation of the s&p 500. Historical implied equity risk premiums for the us. Web s&p 500 earnings yield & equity risk premium (w/us 10 year & 3 month treasury yield) more. S&p 500 nrri & neri. S&p 400 sectors forward metrics & fundamentals. For those that don't know, equity risk premium is the premium. The erp is essential for the calculation of discount rates and derived from the capm. This suggests that investors demand a slightly lower return for investments in that country, in. Dazu alle wichtigen infos zur performance, volatilität & news zum s&p us equity risk premium index er index. Standard & poor’s, bloomberg finance, l.p., as of may 30, 2024.

聯準會升息對科技股估值的影響 美股 鉅亨號 Anue鉅亨

Conseq CHART OF THE WEEK Global equity risk premium indicates solid

Chart Of The Week Equity Risk Premium EM Is Cheap Again

Counting The Chickens Twice Seeking Alpha

S&p 500 Equity Risk Premium Chart

The path forward Breakout or breakdown? J.P. Private Bank

U.S. Equity Risk Insights Touchstone Investments

S&P 500 Risk Premium L&S Advisors

S&p 500 Equity Risk Premium Chart

S&P 500 & Corp. Profits Notes From the Rabbit Hole

Viele Chartindikatoren Für Die Beste Analyse!

Starting In 2008, I Have Written Annual Update Papers On Equity Risk Premiums, In Two Installments.

Download As An Excel File Instead:

This Yield Is Based On Trailing S&P Earnings And Is Calculated By Dividing S&P 500 Earnings Over The Index Value, Which Is The Reciprocal Of The More Commonly Referenced Price.

Related Post: