Sample Non Profit Chart Of Accounts

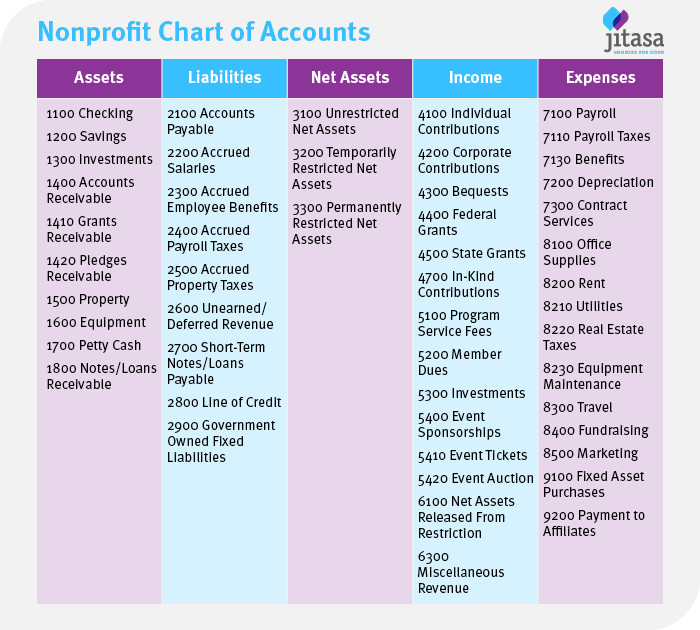

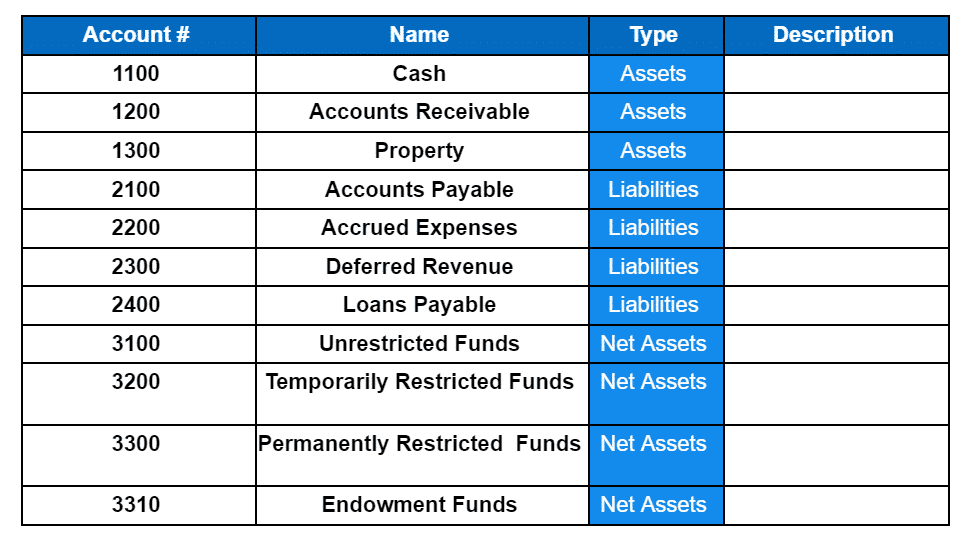

Sample Non Profit Chart Of Accounts - This is because they reinvest all funds back into their organization and mission. The financial statement in which the account appears. Nonprofit chart of accounts example; Web the nonprofit chart of accounts is a crucial tool, offering a structured method to keep track of financial transactions, including payroll taxes, ensuring efficient financial management, regulatory adherence, and accurate reporting. What is a chart of accounts anyway? Your coa should align with the specific needs of the organization and reflect its unique financial activities. Any assets owned by your nonprofit (like bank accounts, investments, property, and equipment) should be numbered in the 1000 range. A coa categorizes an expense. Liabilities (like loans, mortgages, and accounts payable) should be in the 2000 range. It’s part of your accounting architecture. Web in a nonprofit’s chart of accounts, each account is identified in four ways: Your chart of accounts should reflect what your organization has and does. Web examples of a nonprofit chart of accounts. Web nonprofit chart of accounts examples. Web in this guide, we’ll cover the basics of the nonprofit chart of accounts, including: Learn everything in our blog with free samples! When you’ve created your nonprofit chart of accounts, it will look like a long ledger, organized by activities. Web the nonprofit chart of accounts template is available for download in pdf format by following the link below. Non profit chart of accounts guide and key. Web a chart of accounts is a. When accounts are created in an accounting system, they are organized using names and numbers. Notes and major health warnings. Your coa should align with the specific needs of the organization and reflect its unique financial activities. “nonprofits view their accounting processes through an accountability lens rather than one based solely on profitability and revenue generation…. Let’s dive in with. Purpose of the nonprofit chart of accounts; Web best online brokers. Liabilities (like loans, mortgages, and accounts payable) should be in the 2000 range. It’s part of your accounting architecture. Can't i get that to be what's in qbo plus when i set company type to nonprofit organization (form 990)? Analyze your organization’s needs and objectives. Any assets owned by your nonprofit (like bank accounts, investments, property, and equipment) should be numbered in the 1000 range. This is because they reinvest all funds back into their organization and mission. Web for example, if you are fundraising on your birthday, use a photo of yourself holding up a sign for the. Your chart of accounts reflects your unique organization. The account numbers, account number ranges, account names, breakdowns of each account category… A nonprofit chart of accounts (coa) is a guide that helps nonprofits classify and track expenses and revenue. Your coa should align with the specific needs of the organization and reflect its unique financial activities. Web discover how to. What is the chart of accounts for nonprofits. Web best online brokers. Account numbers are, for the most part, up to you and how you would like to organize them. Charts of accounts are like snowflakes. These line items pertain to your financial position (or statement of financial position) and to your financial activities (or statement of activities). It’s part of your accounting architecture. What is the chart of accounts for nonprofits. Every organization's chart of accounts looks different. Web sample nonprofit chart of accounts: Users use this non profit accounting template at their own risk. But the first two, number and name, determine the overall structure and organization of accounts and subaccounts. When you’ve created your nonprofit chart of accounts, it will look like a long ledger, organized by activities. Every organization's chart of accounts looks different. What is the chart of accounts for nonprofits. Any assets owned by your nonprofit (like bank accounts, investments,. Every nonprofit organization has a unique coa that depends on your specific programs, revenue sources, and activities. Nonprofit chart of accounts download link. Account numbers are, for the most part, up to you and how you would like to organize them. Can't i get that to be what's in qbo plus when i set company type to nonprofit organization (form. A coa categorizes an expense. A nonprofit chart of accounts (coa) is a guide that helps nonprofits classify and track expenses and revenue. When accounts are created in an accounting system, they are organized using names and numbers. But the first two, number and name, determine the overall structure and organization of accounts and subaccounts. Web examples of a nonprofit chart of accounts. Learn everything in our blog with free samples! Notes and major health warnings. It’s part of your accounting architecture. Non profit chart of accounts guide and key. Nonprofit chart of accounts download link. Let’s dive in with an overview of what your nonprofit’s coa is and how it’s. Liabilities (like loans, mortgages, and accounts payable) should be in the 2000 range. Web the chart of accounts (or coa) is a numbered list that categorizes your financial activity into different accounts and subaccounts. Web steps for nonprofits to implement a chart of accounts. Your coa should align with the specific needs of the organization and reflect its unique financial activities. If you don’t want to use a photo, you can use the nonprofit’s logo.Chart Of Accounts Example For Non Profit

Sample Nonprofit Chart Of Accounts Quickbooks

Grow Your Nonprofit Organization With A Good Chart of Accounts Help

Nonprofit Chart of Accounts Template Double Entry Bookkeeping

Sample Nonprofit Chart of Accounts (PTAs, Scouts, HOAs, Sports, Social

sample nonprofit chart of accounts

Example Of Chart Of Accounts For Nonprofit

Chart Of Accounts Example For Non Profit

Nonprofit Chart of Accounts How to Get Started + Example

The Newbie’s Information to Nonprofit Chart of Accounts Heart Sleeve

This Is Because They Reinvest All Funds Back Into Their Organization And Mission.

The Name Of The Account In The General Ledger.

The Account Numbers, Account Number Ranges, Account Names, Breakdowns Of Each Account Category…

Account Numbers Are, For The Most Part, Up To You And How You Would Like To Organize Them.

Related Post: