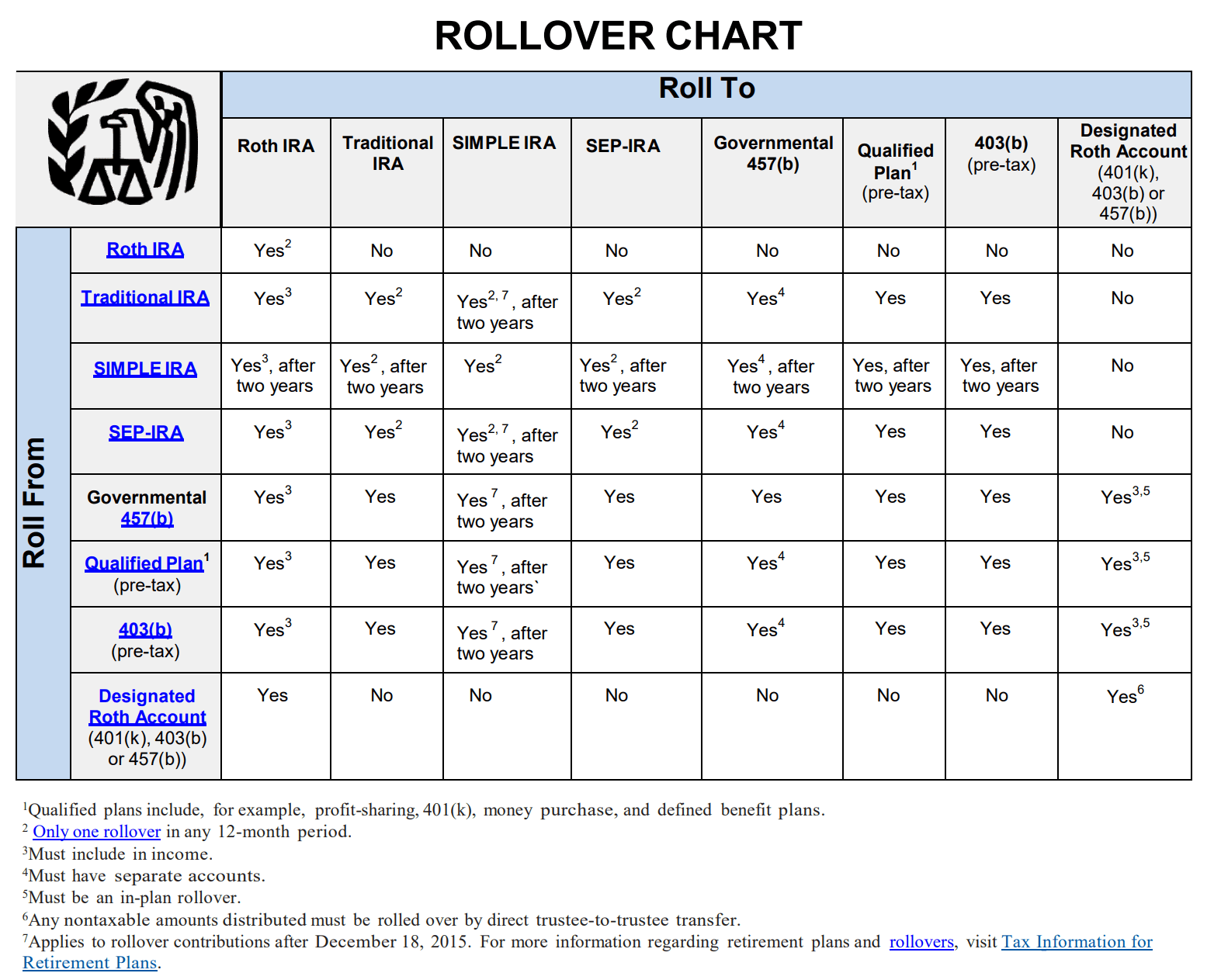

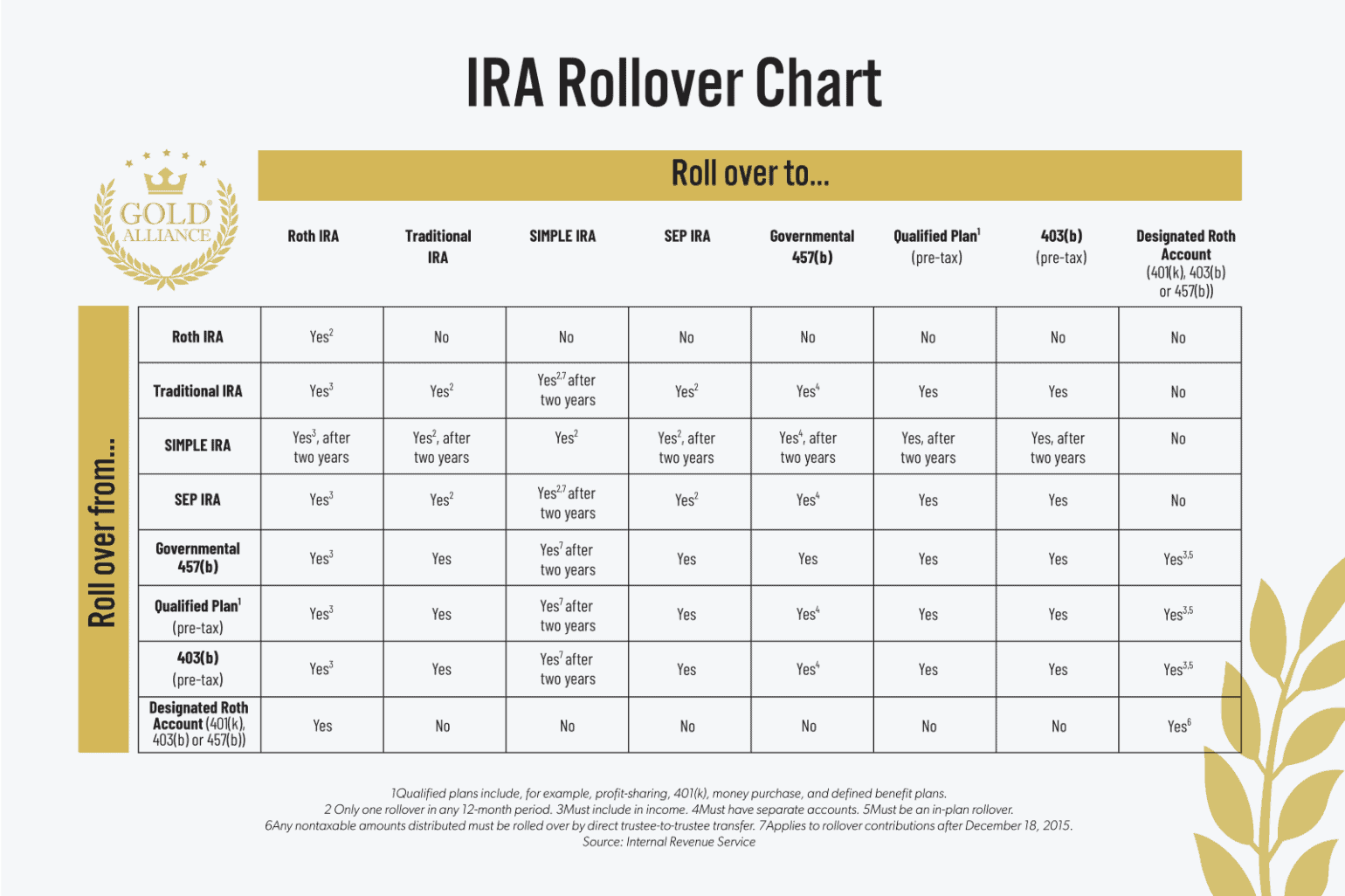

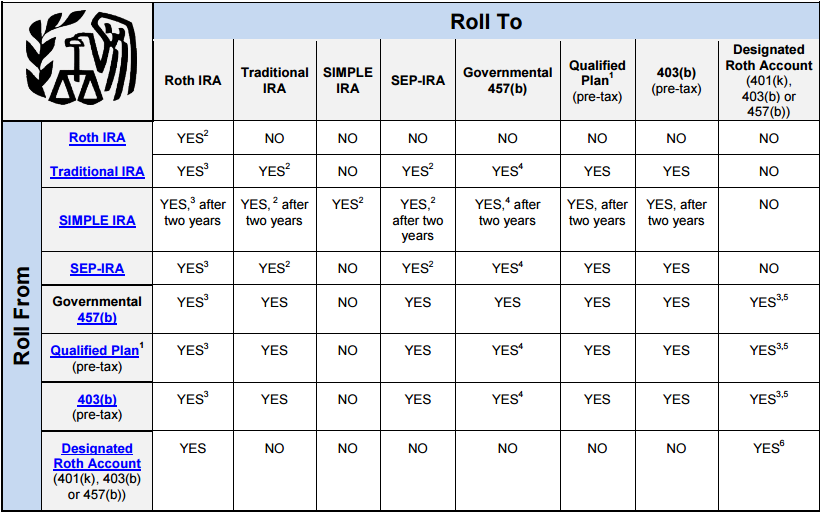

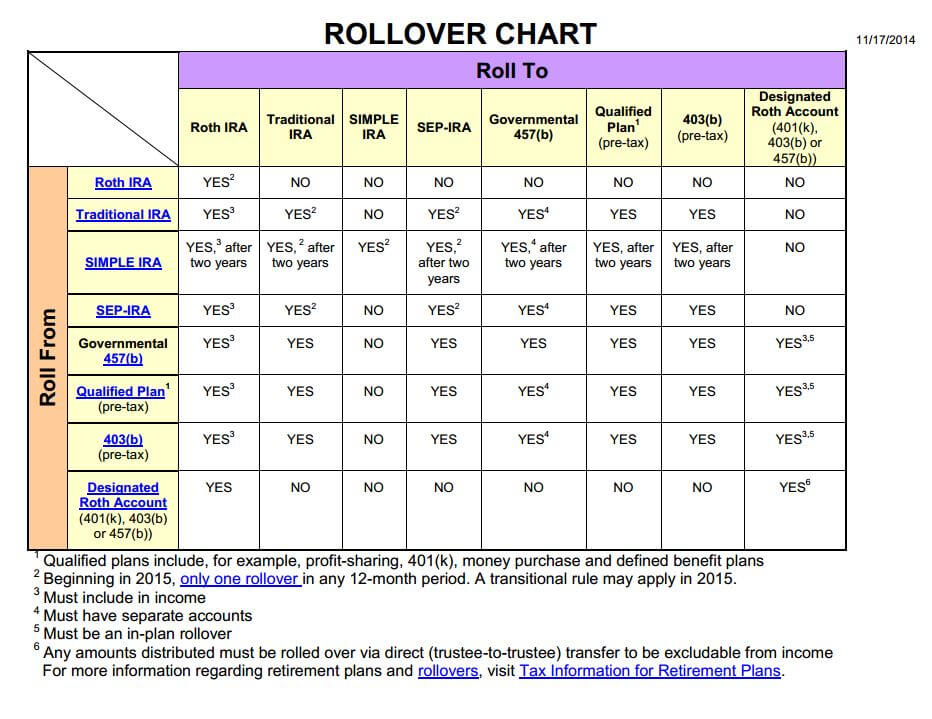

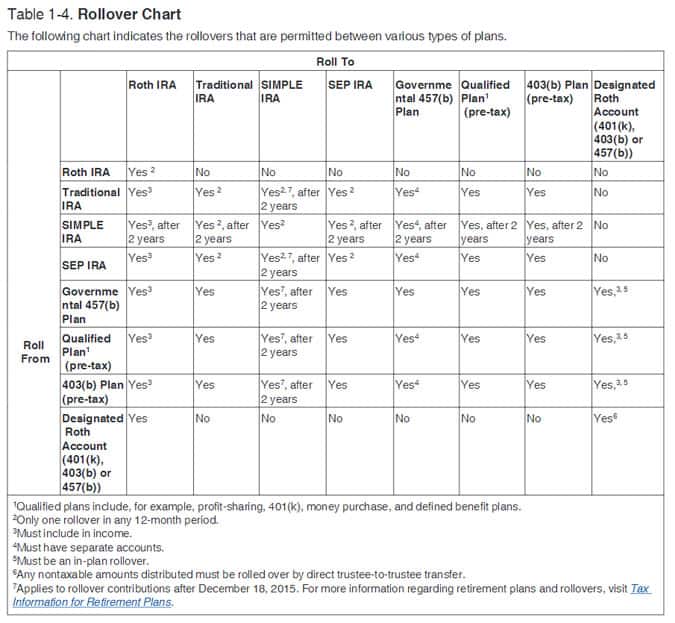

Rollover Chart Irs

Rollover Chart Irs - Web retirement plan rollover chart. This chart is intended for informational purposes only and is not legal, tax, or investment advice. Which brokerages to open your account at. Updated on june 30, 2022. It is possible to pay the taxes due from the traditional ira. Many people roll their 401 (k) into an individual retirement. A rollover is the process of moving retirement plan or ira assets to another qualified plan or ira. This chart is for informational purposes only and is not legal, tax and investment advice. Web here’s a recent and handy rollover chart by the internal revenue service updated for new rules that may be helpful. You may want to note the differences between. This chart is for informational purposes only and is not legal, tax and investment advice. Always check with a tax advisor before rolling funds between plans. One of the most common reasons for rolling over a retirement account is to move it out of a former employer’s plan. Definition of eligible rollover distributions. A rollover occurs when you withdraw cash. Updated on june 30, 2022. One of the most common reasons for rolling over a retirement account is to move it out of a former employer’s plan. A rollover is the process of moving retirement plan or ira assets to another qualified plan or ira. How to decide which rollover is right for you. You must pay taxes whenever you. Web the irs provides a handy chart detailing which types of accounts are eligible for rollovers (left column) and what types of accounts you can roll them into (top row). Web ira rollover chart. A rollover occurs when you withdraw cash or other assets from one eligible retirement plan and contribute all or part of it, within 60 days, to. Many people roll their 401 (k) into an individual retirement. Web here’s a recent and handy rollover chart by the internal revenue service updated for new rules that may be helpful. Web updated february 13, 2024. You must pay taxes whenever you convert from a traditional ira to a roth ira in the conversion year. 413, rollovers from retirement plans. A rollover is the process of moving retirement plan or ira assets to another qualified plan or ira. You can roll over eligible rollover distributions from these plans to a roth ira or to a designated roth account in the same plan (if the plan allows rollovers to designated roth accounts). However, qualified plans are not required by law to. This chart is intended for informational purposes only and is not legal, tax, or investment advice. Definition of eligible rollover distributions. In that case, a 401 (k) is rolled into an ira at another brokerage of your. A rollover occurs when you withdraw cash or other assets from one eligible retirement plan and contribute all or part of it, within. You must pay taxes whenever you convert from a traditional ira to a roth ira in the conversion year. You may want to note the differences between. Web the rules for allowable rollovers are detailed in a rollover chart provided by the irs. In that case, a 401 (k) is rolled into an ira at another brokerage of your. Always. Web having enough cash to convert. Web here’s a recent and handy rollover chart by the internal revenue service updated for new rules that may be helpful. How do eligible rollover distributions work? A rollover occurs when you withdraw cash or other assets from one eligible retirement plan and contribute all or part of it, within 60 days, to another. You must pay taxes whenever you convert from a traditional ira to a roth ira in the conversion year. Web the irs provides a handy chart detailing which types of accounts are eligible for rollovers (left column) and what types of accounts you can roll them into (top row). Web updated may 03, 2024. Web the rules for allowable rollovers. Rolling over your 401 (k) plan to an ira when you switch jobs can provide you with more. How do eligible rollover distributions work? The chart below shows what the internal revenue service deems as permissible when rolling funds over from one type of retirement account to another. It is possible to pay the taxes due from the traditional ira.. Web the irs provides a handy chart detailing which types of accounts are eligible for rollovers (left column) and what types of accounts you can roll them into (top row). Web updated may 03, 2024. A rollover occurs when you withdraw cash or other assets from one eligible retirement plan and contribute all or part of it, within 60 days, to another eligible retirement plan. Web retirement plan rollover chart. Web your guide to 401 (k) and ira rollovers. Web ira rollover chart. A rollover is the process of moving retirement plan or ira assets to another qualified plan or ira. However, qualified plans are not required by law to have a provision to accept rollovers,” kaplan explains. In that case, a 401 (k) is rolled into an ira at another brokerage of your. One of the most common reasons for rolling over a retirement account is to move it out of a former employer’s plan. What is an eligible rollover distribution? Web having enough cash to convert. Savings can also be converted into a roth ira or recharacterized from it. Updated on june 30, 2022. This rollover transaction isn't taxable, unless the rollover is to a roth ira or a designated roth account. Restrictions to be aware of when rolling over.

Learn the Rules of IRA Rollover & Transfer of Funds

IRA Rollover Chart Where Can You Roll Over Your Retirement Account

IRS issues updated Rollover Chart The Retirement Plan Blog

IRS Rollover Chart

Follow the Rules When Rolling Over Your EmployerSponsored Retirement

IRA Rollover Chart Rules Regarding Rollovers and Conversions AAII

Learn the Rules of IRA Rollover & Transfer of Funds

irsrolloverchart Snider Advisors

Ira Types Chart

PDF PDF Télécharger Download

Web Updated February 13, 2024.

Individual Retirement Arrangements (Iras) Types Of Retirement Plans.

Web A Rollover Involves Transferring The Assets From Your 401 (K) To A Roth Or Traditional Ira.

Web Are You Eligible To Receive A Distribution From Your 401 (K), 403 (B) Or Governmental 457 (B) Retirement Plan?

Related Post: