Quickbooks Chart Of Accounts For Nonprofits

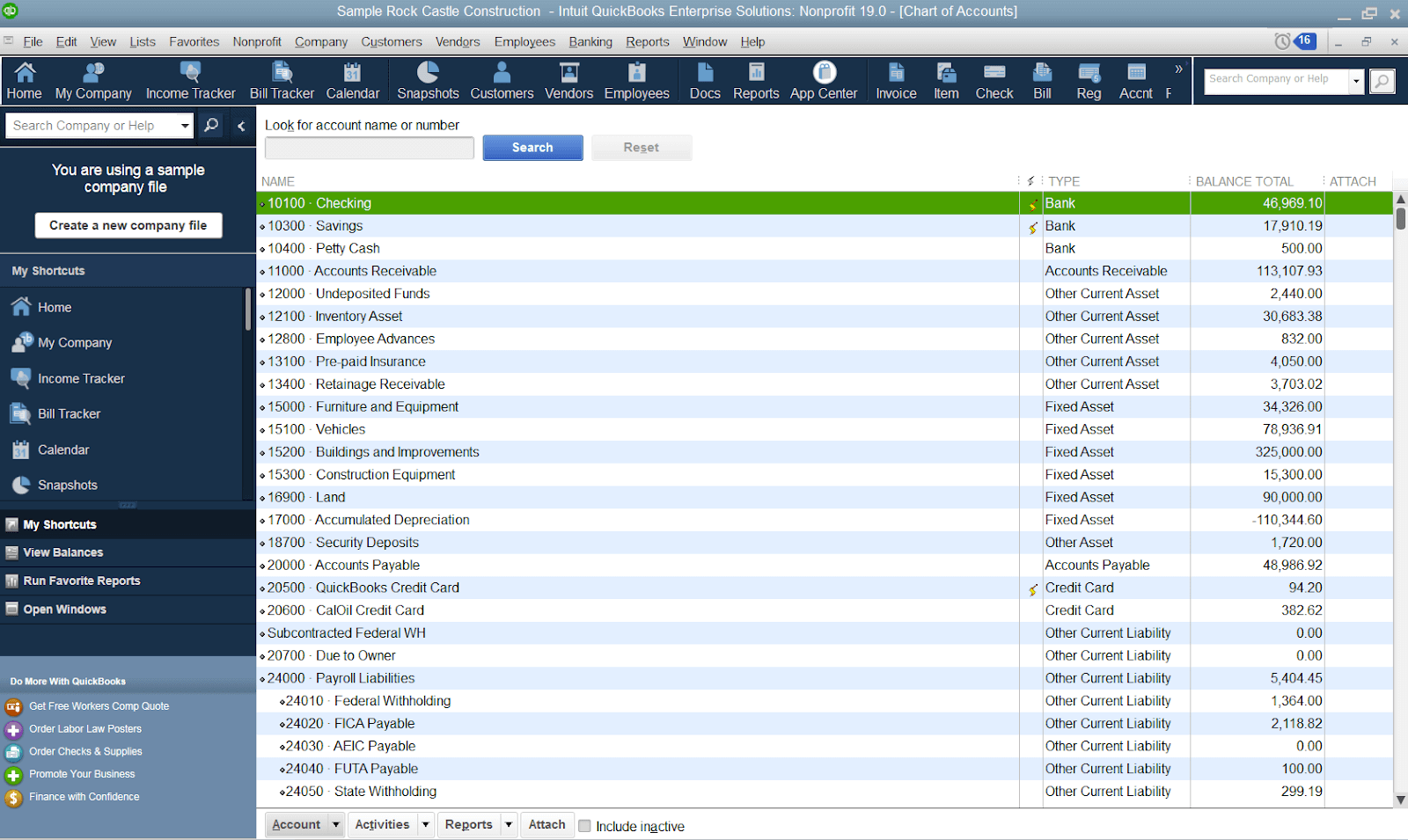

Quickbooks Chart Of Accounts For Nonprofits - What is the nonprofit's mission? Analyze your organization’s needs and objectives. As with the label, you can go to the account settings to do so. The chart of accounts helps you do just that. By correctly and consistently appending each transaction with each of these database flags, quickbooks can easily and quickly find the information you ask it for. Number, name, category type, and a short description. To begin to record a donation, you must create an invoice for the product or service so that you can record the income. Web in both quickbooks desktop and quickbooks online, the chart of accounts drives the appearance of the balance sheet and profit and loss reports. Web the chart of accounts (or coa) is a numbered list that categorizes your financial activity into different accounts and subaccounts. It functions as a directory of these records, making it the backbone of all accounting procedures at your nonprofit. Instead, it breaks these accounts into categories like assets, liabilities, income, expenses, and equity. Typically, your nonprofit’s coa will be divided into the following five categories: Wherever you are starting, this post and the following one will give you a framework approach to making sure you have the key accounts your organization needs. Your coa should align with the specific. By intuit• updated 2 months ago. It functions as a directory of these records, making it the backbone of all accounting procedures at your nonprofit. Instead, it breaks these accounts into categories like assets, liabilities, income, expenses, and equity. What is the nonprofit's mission? This list does not include all financial transactions. What programs do we offer? As with the label, you can go to the account settings to do so. Create an account for charitable contributions. Select a quickbooks version that suits your nonprofit’s size and requirements. What is the nonprofit's mission? Forvis is a trademark of forvis, llp, registered with the u.s. Quickbooks integrates with many other programs, including apps commonly used by nonprofits, such as kindful donor management software and. Web at a minimum, the following should be included in the questionnaire: Wherever you are starting, this post and the following one will give you a framework approach to making. A nonprofit exists to perform specific services and programs, as stated in their mission. It functions as a directory of these records, making it the backbone of all accounting procedures at your nonprofit. Web the main problem is quickbooks does not have a segmented nonprofit chart of accounts that allows you to segregate your activity by fund, functional area, programs,. It functions as a directory of these records, making it the backbone of all accounting procedures at your nonprofit. By correctly and consistently appending each transaction with each of these database flags, quickbooks can easily and quickly find the information you ask it for. The chart of accounts helps you do just that. Web discover how to build your chart. The chart of accounts helps you do just that. By intuit• updated 2 months ago. Web at a minimum, the following should be included in the questionnaire: For example, a nonprofit that relies heavily on grant funding may need to create specific accounts to track grant income and expenses. Quickbooks offers various options, including quickbooks online and quickbooks desktop, with. Web how to use quickbooks at your nonprofit. Quickbooks integrates with many other programs, including apps commonly used by nonprofits, such as kindful donor management software and. Every nonprofit organization has a unique coa that depends on your specific programs, revenue sources, and activities. Web so you have quickbooks online set up for your nonprofit, but what about your chart. There are 5 sections you need to add as a nonprofit.if you're. About the chart of account names, you may want to edit them to your preference. Can i change the status. Web a chart of accounts (coa) is a list of financial accounts that helps nonprofits keep track of their transactions. But in general, your coa should follow some. Web quickbooks enterprise nonprofit caters to larger organizations, offering specialized features like donation and church management and a customized nonprofit chart of accounts. Web so you have quickbooks online set up for your nonprofit, but what about your chart of accounts? There are 5 sections you need to add as a nonprofit.if you're. Each time you add or remove an. Wherever you are starting, this post and the following one will give you a framework approach to making sure you have the key accounts your organization needs. Analyze your organization’s needs and objectives. It includes recording revenues and expenditures, tracking expenses, preparing financial statements and analysis reports, budgeting, and ensuring compliance with relevant laws and regulations. Web at a minimum, the following should be included in the questionnaire: For example, a nonprofit that relies heavily on grant funding may need to create specific accounts to track grant income and expenses. What is a chart of accounts? A nonprofit exists to perform specific services and programs, as stated in their mission. Instead, it breaks these accounts into categories like assets, liabilities, income, expenses, and equity. Web track funds you receive from donors in quickbooks online. Web so you have quickbooks online set up for your nonprofit, but what about your chart of accounts? There are 5 sections you need to add as a nonprofit.if you're. But in general, your coa should follow some standard guidelines and numbering conventions. Web chart of accounts considerations for nonprofits using quickbooks online. Web the key to using quickbooks online for nonprofits is to set up the chart of accounts, locations, and classes such that the numbers on your reports can be directly transferred to your form 990 without further manipulation. A customized coa helps in accurately tracking these funds and ensuring they are used appropriately. What programs do we offer?

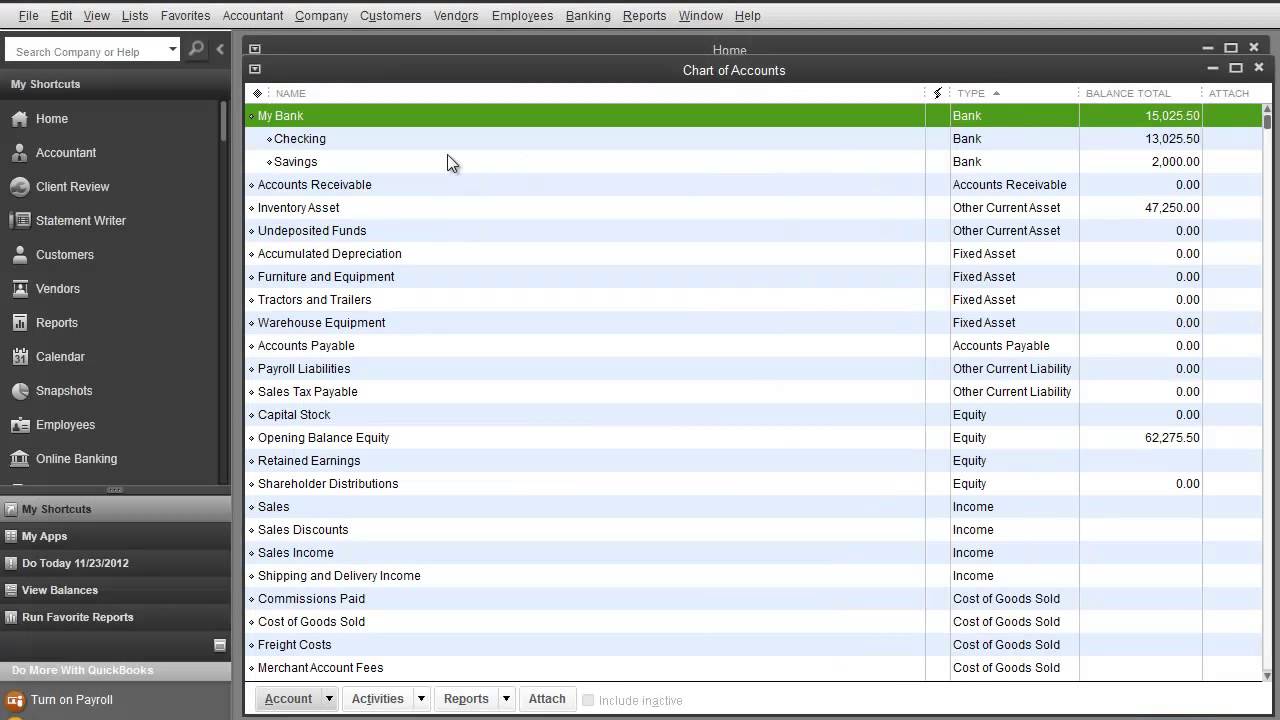

Quickbooks Lessons Charts of Accounts Setup (www.QuickbooksTutorial

![QuickBooks Premier NonProfit Edition 2007 [OLDER VERSION]](https://i2.wp.com/g-ecx.images-amazon.com/images/G/01/software/detail-page/qbpremnp2007-4-lg.jpg)

QuickBooks Premier NonProfit Edition 2007 [OLDER VERSION]

Quickbooks Nonprofit Chart Of Accounts

Quickbooks Nonprofit Chart Of Accounts

Nonprofit Chart of Accounts Template Double Entry Bookkeeping

QuickBooks for Nonprofits Setting Up the Chart of Accounts Chart of

QB Online Chart of Accounts for Nonprofit establishing funds

Chart Of Accounts For Nonprofit Quickbooks

Nonprofit Accounting Software > QuickBooks® Enterprise Industry Solutions

Sample Nonprofit Chart Of Accounts Quickbooks

Web Nonprofit Accounting Is The Practice Of Tracking And Accounting For Funds Received Or Disbursed By A Nonprofit Organization.

Web The Chart Of Accounts, Customer/Jobs Utility, And Classes Utility Are Simply Database Flags That Are Appended To Each Transaction.

Select A Quickbooks Version That Suits Your Nonprofit’s Size And Requirements.

Number, Name, Category Type, And A Short Description.

Related Post: