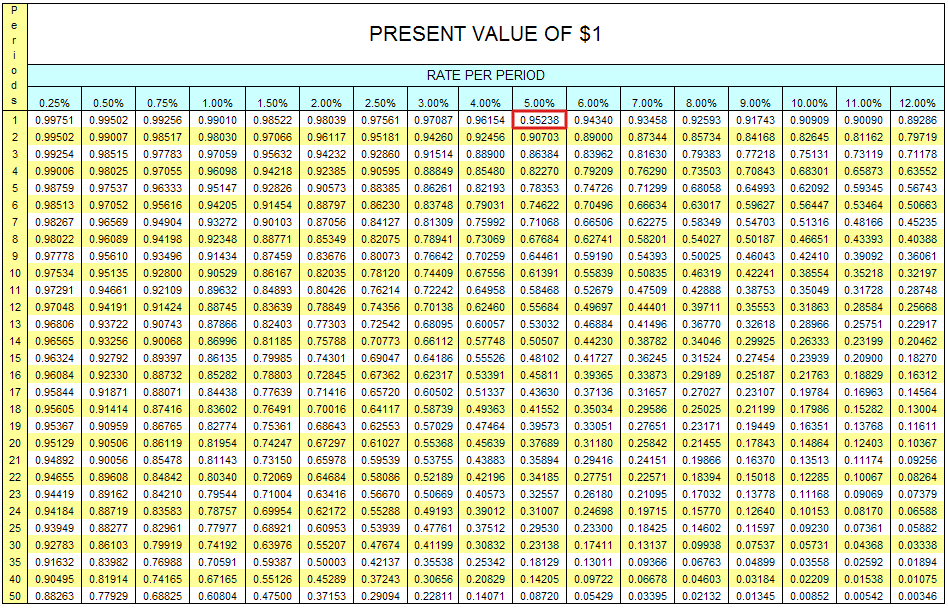

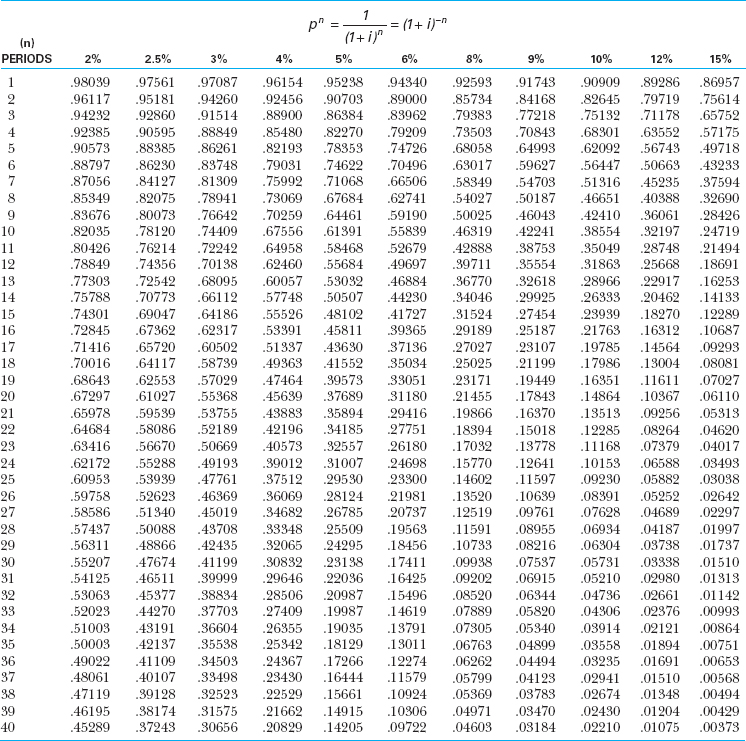

Present Value Chart 1

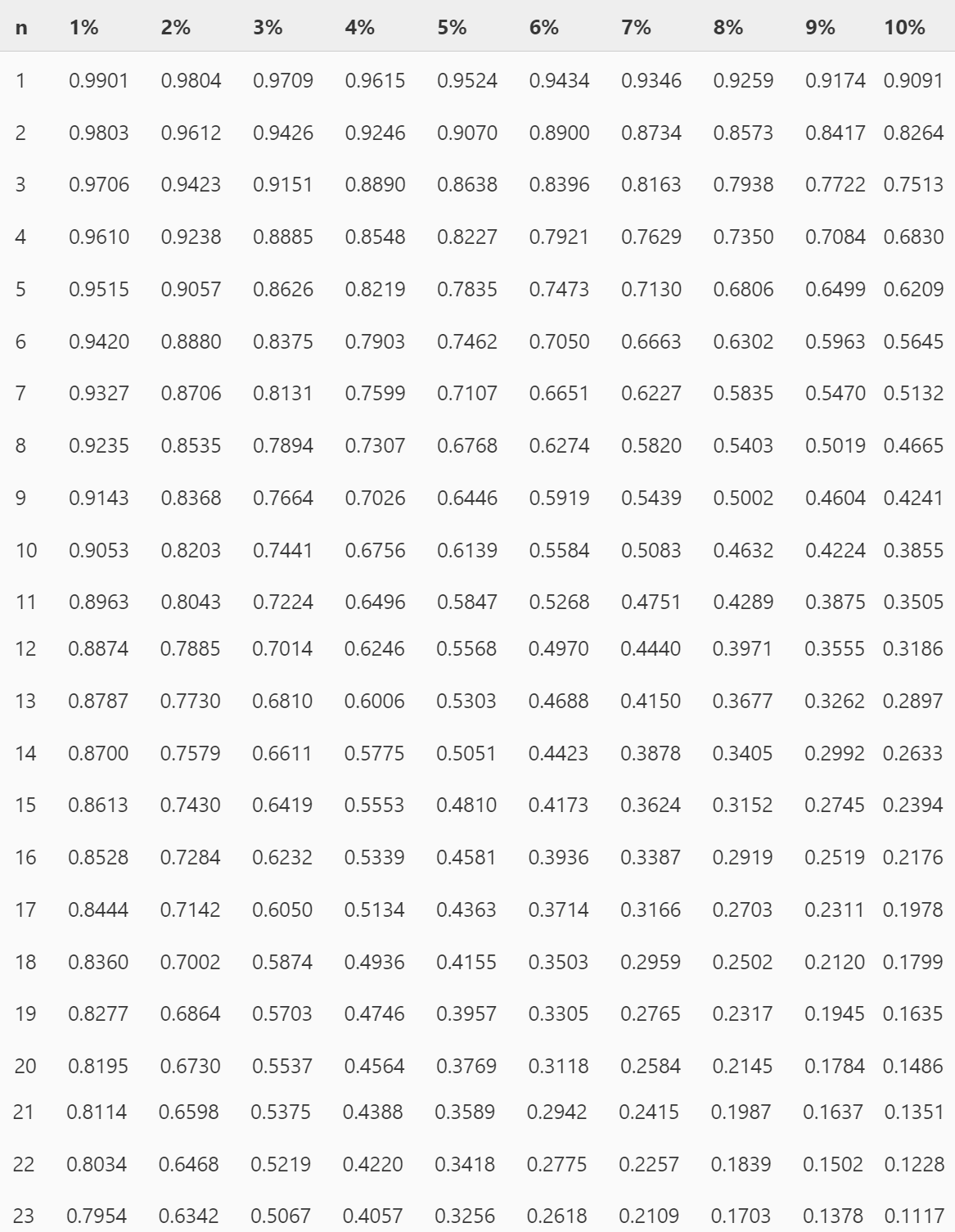

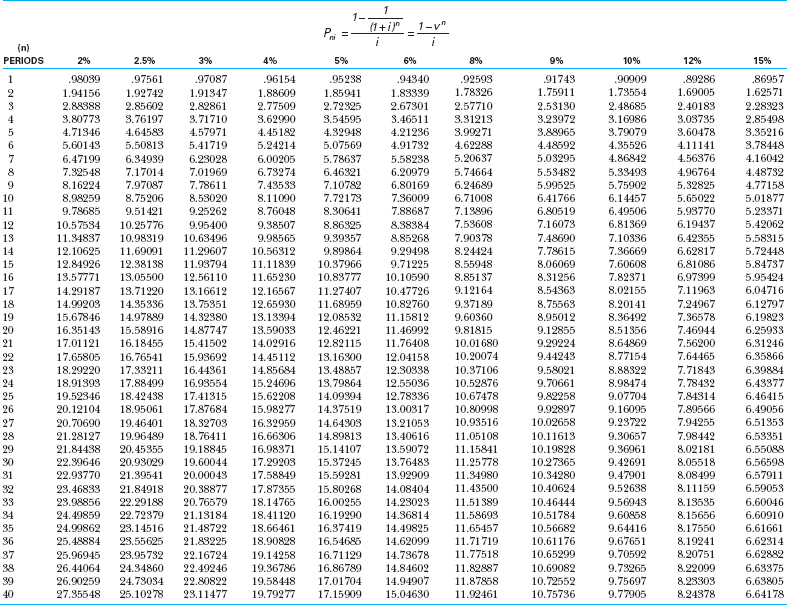

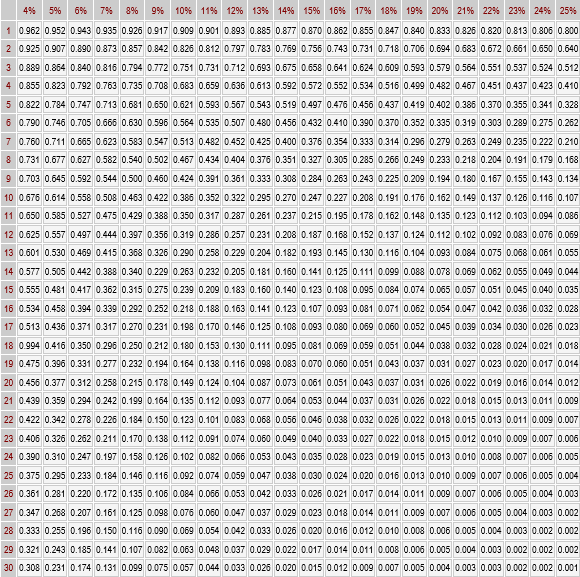

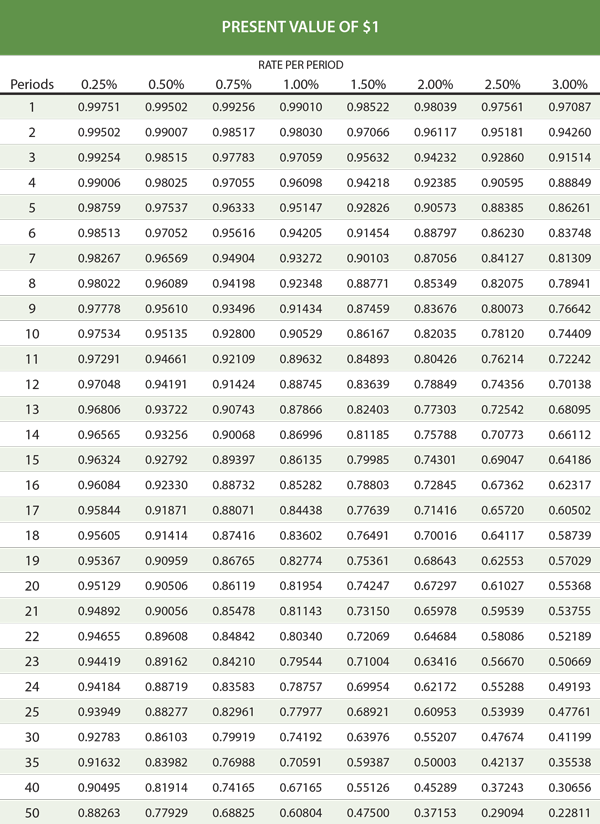

Present Value Chart 1 - Web pv = fv / (1 + r) where: Web a present value (pv) chart is a graphical representation used in finance to illustrate the present value of future cash flows or investments over time. Web pv = $570 / (1+0. Web the present value formula is pv=fv/(1+i) n, where you divide the future value fv by a factor of 1 + i for each period between present and future dates. Web updated november 27, 2023. A present value table is a tool that helps analysts calculate the pv of an amount of money by multiplying it by a coefficient found on the table. Web the formula for calculating the present value of an ordinary annuity is: Web present value (pv) = $10,000 ÷ (1 + 12%)^(2 × 1) = $7,972 thus, the $10,000 cash flow in two years is worth $7,972 on the present date, with the downward. Web what is a present value of 1 table? What is $570 in 3 years worth now, at an interest rate of. Where fv is the future value, r is the required rate of return, and n is the number of time periods. 15 = $495.65 (to nearest cent) or what if you don't get the money for 3 years example: Web the present value formula is pv=fv/(1+i) n, where you divide the future value fv by a factor of 1 +. Web updated january 9, 2021. 15 = $495.65 (to nearest cent) or what if you don't get the money for 3 years example: Web table 2 present value of $1. Where fv is the future value, r is the required rate of return, and n is the number of time periods. Web the present value formula is pv=fv/(1+i) n, where. P = the present value of the annuity stream to be. 15) 1 = $570 / 1. Web in an effort to help you find trades that could improve your fantasy team, we present the dynasty trade value chart.you can use this chart to compare players and. Web pv = $570 / (1+0. Web the present value formula is pv=fv/(1+i). Web what is a present value of 1 table? P = the present value of the annuity stream to be. Web present value (pv) = $10,000 ÷ (1 + 12%)^(2 × 1) = $7,972 thus, the $10,000 cash flow in two years is worth $7,972 on the present date, with the downward. Web updated january 9, 2021. Web the formula. Present value, or pv, is defined as the. Web the present value formula pv = fv/ (1+i)^n states that present value is equal to the future value divided by the sum of 1 plus interest rate per period raised to. Web pv = fv / (1 + r) where: Web present value tables present value of one dollar period 1%. Web the formula for calculating the present value of an ordinary annuity is: Web pv = fv / (1 + r) where: 15 = $495.65 (to nearest cent) or what if you don't get the money for 3 years example: In other words, it is a table. Web a present value (pv) chart is a graphical representation used in finance. What is $570 in 3 years worth now, at an interest rate of. A present value of 1 table states the discount rates that are used for various combinations of and time periods. Present value, or pv, is defined as the. Web the present value formula pv = fv/ (1+i)^n states that present value is equal to the future value. Present value (pv) is the current value of an expected future stream of cash flow. Thanks to this formula, you can estimate the present value of an income. Web the present value formula pv = fv/ (1+i)^n states that present value is equal to the future value divided by the sum of 1 plus interest rate per period raised to.. Web the present value formula pv = fv/ (1+i)^n states that present value is equal to the future value divided by the sum of 1 plus interest rate per period raised to. Web a present value (pv) chart is a graphical representation used in finance to illustrate the present value of future cash flows or investments over time. What is. Present value helps compare money received today to money received in the future. Web in an effort to help you find trades that could improve your fantasy team, we present the dynasty trade value chart.you can use this chart to compare players and. P = the present value of the annuity stream to be. The video explains the concept of. Web table 2 present value of $1. Web updated november 27, 2023. 15 = $495.65 (to nearest cent) or what if you don't get the money for 3 years example: Web the formula for this is: Web updated january 9, 2021. Web the present value formula pv = fv/ (1+i)^n states that present value is equal to the future value divided by the sum of 1 plus interest rate per period raised to. A present value of 1 table states the discount rates that are used for various combinations of and time periods. N/i 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 20.0% 1. Web present value (pv) = $10,000 ÷ (1 + 12%)^(2 × 1) = $7,972 thus, the $10,000 cash flow in two years is worth $7,972 on the present date, with the downward. Web in an effort to help you find trades that could improve your fantasy team, we present the dynasty trade value chart.you can use this chart to compare players and. Period $0 $250 $500 $750 $1k $1.25k 0 5 10 accumulated deposits accumulated interest. Present value (pv) is the current value of an expected future stream of cash flow. A present value table is a tool that helps analysts calculate the pv of an amount of money by multiplying it by a coefficient found on the table. Present value = fv/ (1 + r)n. What is $570 in 3 years worth now, at an interest rate of. In other words, it is a table.

Present Value of 1 Table PVIF Printable and Excel Template

Present Value Of 1 Annuity Table Pdf Tutor Suhu

Present Value Tables PDF

Present value of 1 table Accounting for Management

Present Value of 1

What is a Present Value Table? Definition Meaning Example

Present Value Tables Double Entry Bookkeeping

Present Value Of 1 Annuity Table Pdf Tutor Suhu

Present Value Chart PDF Present Value Mathematical Finance

Present Value Table.pdf Present Value Mathematical Finance

The Video Explains The Concept Of Present Value In Finance.

Web The Present Value Formula Is Pv=Fv/(1+I) N, Where You Divide The Future Value Fv By A Factor Of 1 + I For Each Period Between Present And Future Dates.

Web The Formula For Calculating The Present Value Of An Ordinary Annuity Is:

Web Present Value Tables Present Value Of One Dollar Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 2 0.980.

Related Post: