Pmi Coverage Chart

Pmi Coverage Chart - Pmi is the most commonly used form of credit enhancement. Web private mortgage insurance, or pmi, is a type of coverage you buy if you get a conventional mortgage — one that isn't federally guaranteed — and put down less than 20% to purchase a home or. My home in your inbox. Web for property types, transaction types and ineligible home possible mortgages, refer to guide chapter 4501. Web welcome to an improved seller/servicer guide. The table below details the standard coverage requirements. Web borrowers can choose the initial premium rate, which is a percentage of the loan amount. Find out when you have to pay pmi and learn how to calculate the cost. Review the requirements and guidelines for mi companies to obtain. Private mortgage insurance (pmi) is an insurance policy that you pay when you take out a mortgage loan without committing to at least the 20% down payment most lenders require. Find out when you have to pay pmi and learn how to calculate the cost. Web borrowers can choose the initial premium rate, which is a percentage of the loan amount. What is private mortgage insurance (pmi)? If choosing custom mi, in addition to all other applicable credit fees in price, the credit fee in price in exhibit 19 applies,. Private mortgage insurance (pmi) is an insurance policy that you pay when you take out a mortgage loan without committing to at least the 20% down payment most lenders require. Generally, all companies that sell mortgage insurance price their policies this way. This loan uses a monthly premium mi plan requiring two months to be escrowed at closing that will. Standard coverage for the transaction type (noted with ^) and minimum coverage (noted with *) with corresponding llpas. Web private mortgage insurance (pmi) can be a tricky subject, so we broke down what pmi insurance is, how much it costs and whether it’s the right option for you. Generally, all companies that sell mortgage insurance price their policies this way.. There may be more coverage offerings. The table below highlights their standard coverage requirements, as well as coverage requirements for homeready®, home possible® and charter minimum coverages. Standard coverage for the transaction type (noted with ^) and minimum coverage (noted with *) with corresponding llpas. Find out when you have to pay pmi and learn how to calculate the cost.. Web borrowers can choose the initial premium rate, which is a percentage of the loan amount. Web private mortgage insurance, or pmi, is a type of coverage you buy if you get a conventional mortgage — one that isn't federally guaranteed — and put down less than 20% to purchase a home or. If choosing custom mi, in addition to. * census.gov, all others nar. This is an additional insurance policy that will protect your lender if you are unable to pay your mortgage. However, lenders typically charge an adjusting pmi rate. Web identify the applicable coverage line. Be sure to consult your automated underwriting system response and program descriptions. The program's reduced mortgage insurance coverage. Web depending on the loan, fannie mae, freddie mac and investors require different levels of coverage for mortgage insurance (mi). The table below details the standard coverage requirements. Web private mortgage insurance (mi) helps make homeownership possible for families who may have challenges securing a higher down payment and because of that, freddie mac. Web here is a chart of estimated monthly pmi costs based on a rate of 0.55%. Introduction to private mortgage insurance. Private mortgage insurance (pmi) is an insurance policy that you pay when you take out a mortgage loan without committing to at least the 20% down payment most lenders require. The program's reduced mortgage insurance coverage. Web use nerdwallet's. Be sure to consult your automated underwriting system response and program descriptions. Generally, all companies that sell mortgage insurance price their policies this way. Search the web for fannie mae's mortgage insurance coverage requirements to identify how much coverage is required for your loan. Find out when you have to pay pmi and learn how to calculate the cost. Web. This loan uses a monthly premium mi plan requiring two months to be escrowed at closing that will be included in the. What is private mortgage insurance (pmi)? Web here is a chart of estimated monthly pmi costs based on a rate of 0.55%. Please take a few minutes to watch a short training video. If you pay less than. However, lenders typically charge an adjusting pmi rate. Web here is a chart of estimated monthly pmi costs based on a rate of 0.55%. Freddie mac’s charter* requires credit enhancement for any loans greater than 80% ltv. Offered through participating lenders, home possible is available to borrowers who meet the program’s income requirements. The table below details the standard coverage requirements. Private mortgage insurance (pmi) is an insurance policy that you pay when you take out a mortgage loan without committing to at least the 20% down payment most lenders require. Web private mortgage insurance (pmi) can be a tricky subject, so we broke down what pmi insurance is, how much it costs and whether it’s the right option for you. Web borrowers can choose the initial premium rate, which is a percentage of the loan amount. Standard coverage for the transaction type (noted with ^) and minimum coverage (noted with *) with corresponding llpas. Web identify the applicable coverage line. Introduction to private mortgage insurance. Please take a few minutes to watch a short training video. If you pay less than a 20% down payment on your home, you will have to pay pmi. What is private mortgage insurance (pmi)? Review the requirements and guidelines for mi companies to obtain. There may be more coverage offerings.

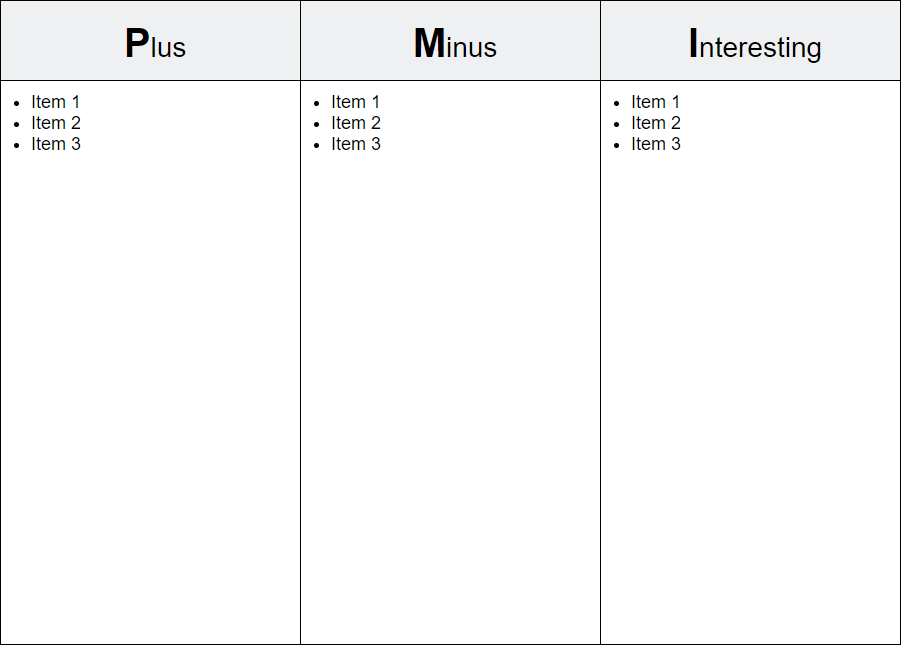

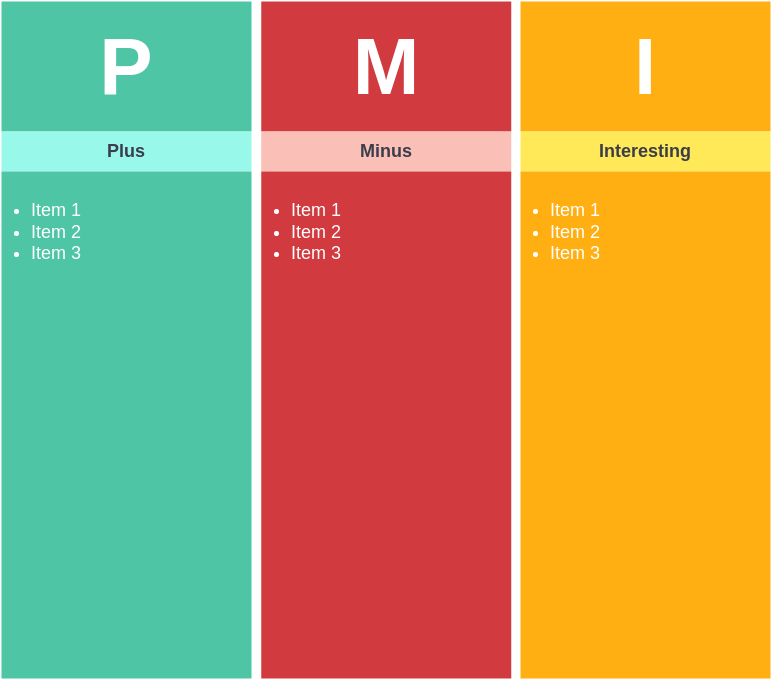

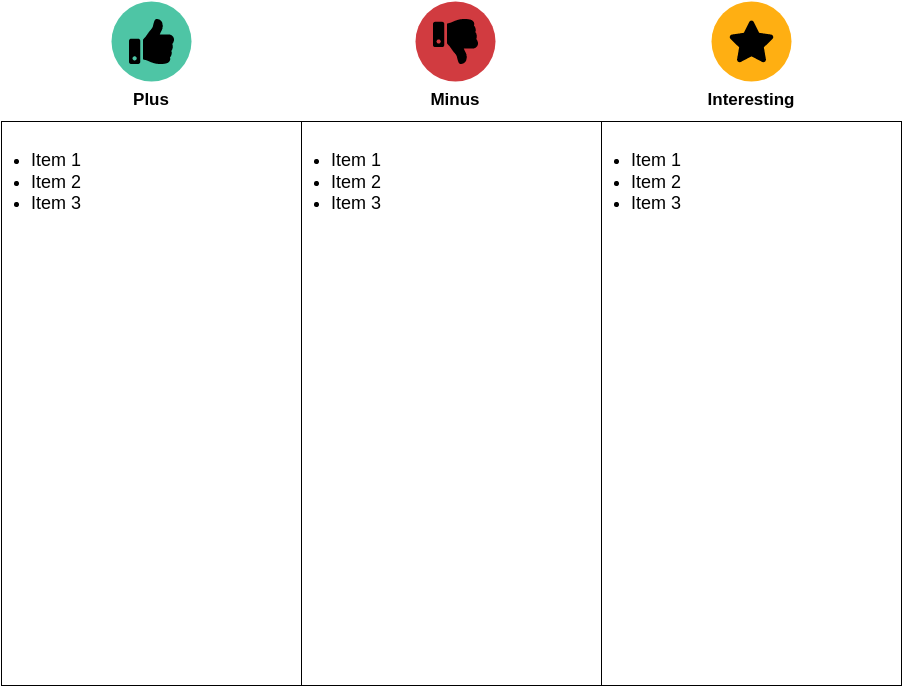

Thinking Skill What is PMI Chart?

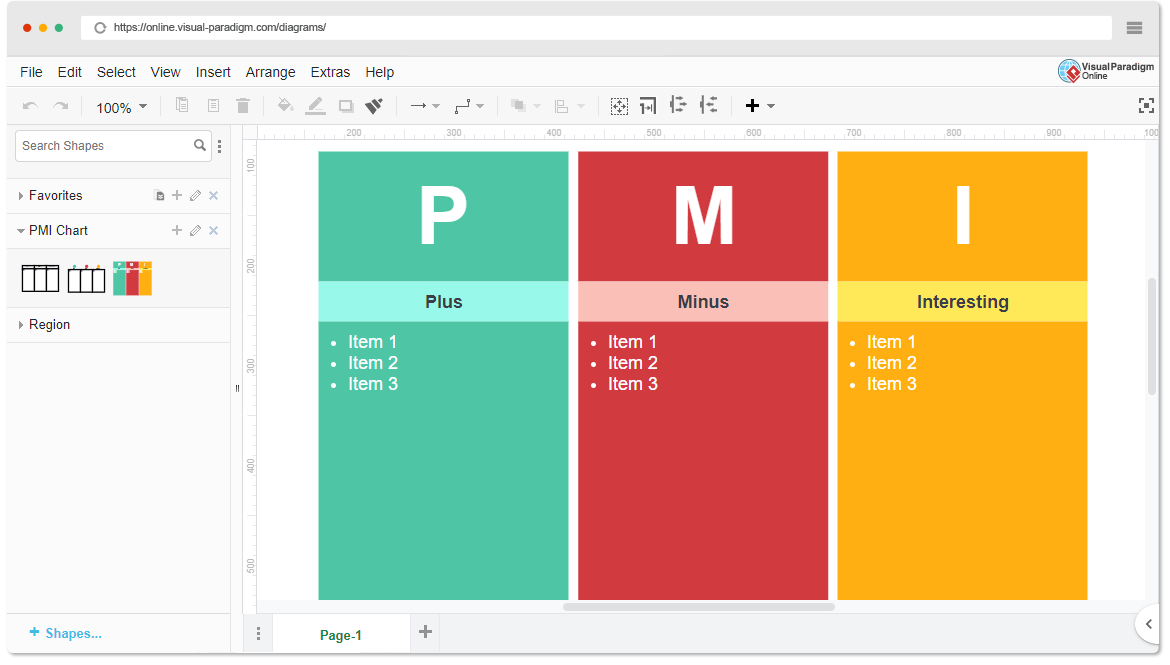

Online PMI Chart Templates

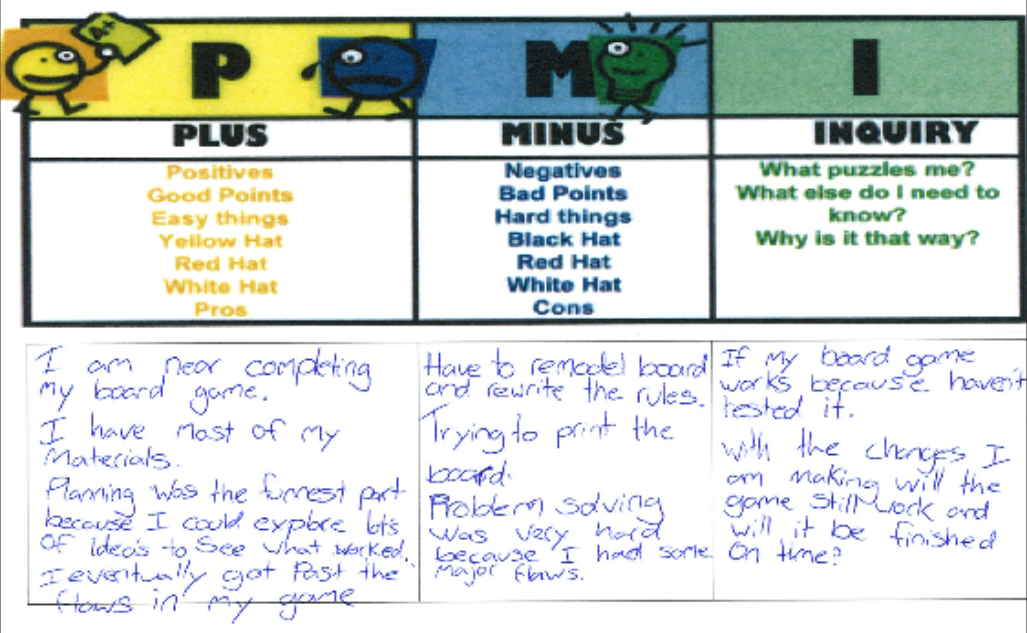

PMI Chart Examples PMI CHART

PMI chart template Tankekart

PMI Chart Examples PMI CHART

A Complete Guide to the PMI PMBOK Method Smartsheet

Online PMI Chart Templates

Pmi Chart Template

PMI Chart Examples PMI CHART

PMI Explained

Web Private Mortgage Insurance, Or Pmi, Is A Type Of Coverage You Buy If You Get A Conventional Mortgage — One That Isn't Federally Guaranteed — And Put Down Less Than 20% To Purchase A Home Or.

Pmi Is The Most Commonly Used Form Of Credit Enhancement.

Web Depending On The Loan, Fannie Mae, Freddie Mac And Investors Require Different Levels Of Coverage For Mortgage Insurance (Mi).

Web Welcome To An Improved Seller/Servicer Guide.

Related Post: