Open Interest Chart

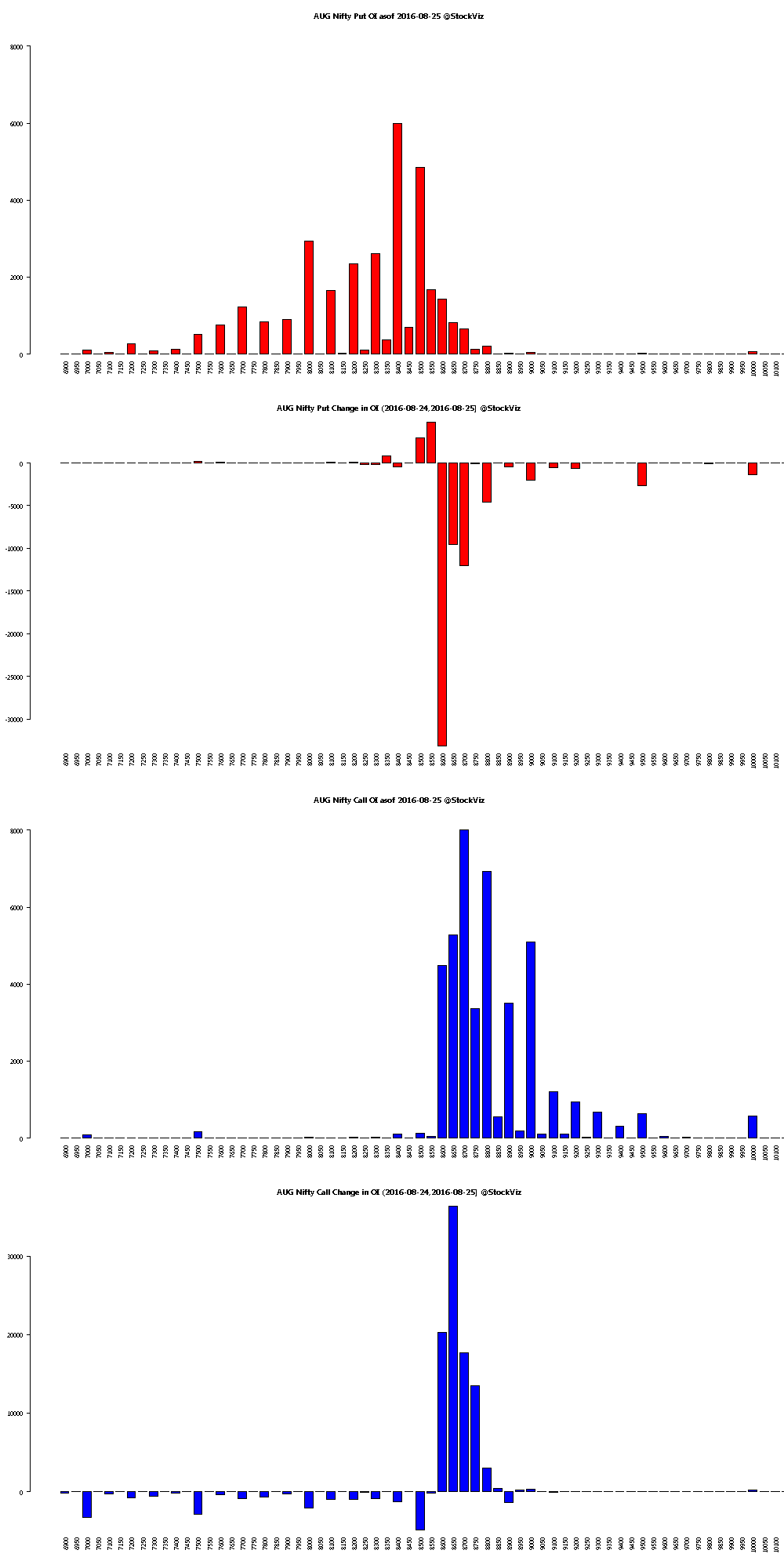

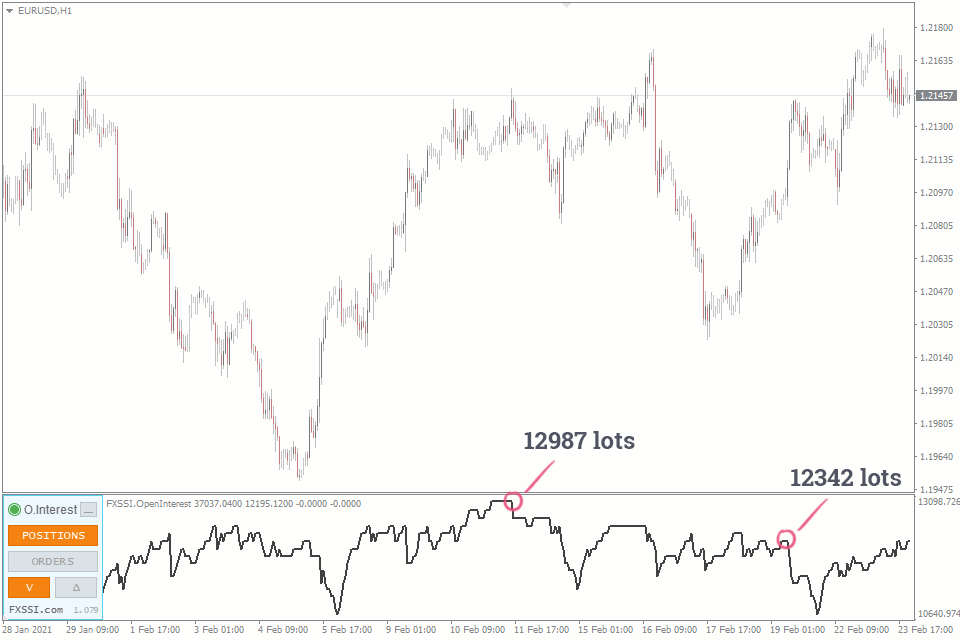

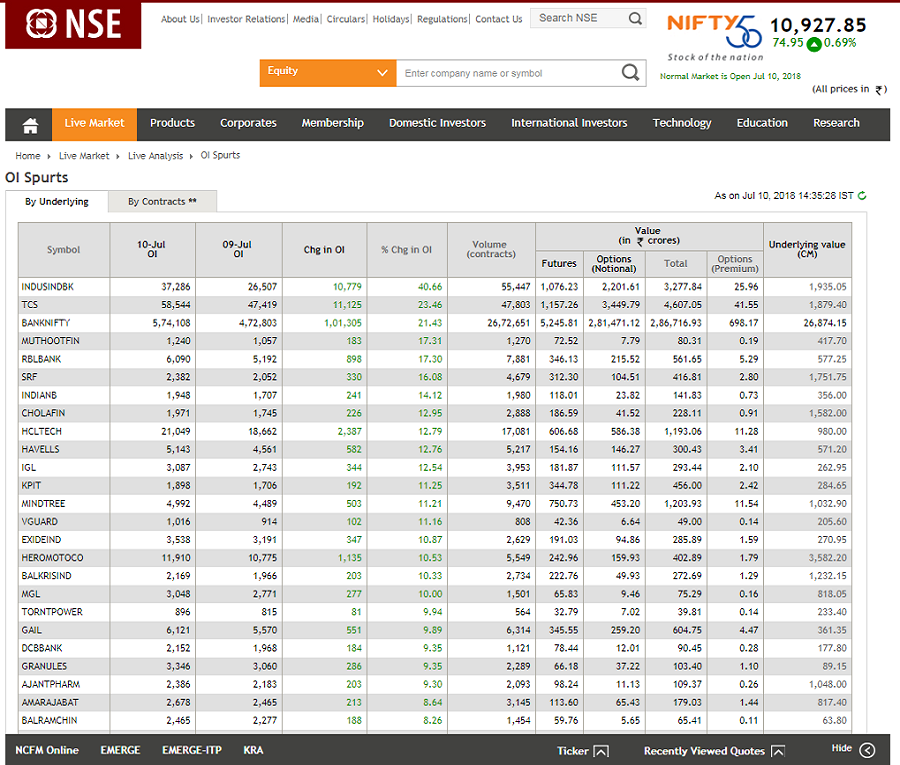

Open Interest Chart - Web track intraday and weekly rolling contract statistics (such as volatility, risk reversal prices, open interest, put/call ratios, and more), and compare them to the prior week. It also includes tools such as an oi distribution profile, large oi increase/decrease coloring, a stats screener, and much more. Web open interest is the total number of outstanding derivative contracts for an asset—such as options or futures—that have not been settled. The daily volume and open interest report is released at the end of each trading day and is a preliminary report. Cme group releases official data in the daily bulletin the following morning. Open interest measures the number of outstanding contracts in the derivatives market. Open interest increased by 98.9k contracts two weeks ago, which was its second fastest increase on record, prompting me to suggest a cycle low for volatility. Our charts are designed to help traders like you identify trends, analyze data, and make informed decisions about your options trading strategies. Essential for traders focused on active and pending trade analysis. Commitment of traders (cot) charts are updated each friday at 3pm ct. Thursday, 30 may 2024 (final) download data. Trade directly with your broker. On the chart, open interest data is available as the open interest indicator: Web the commitment of traders (cot) reports provide a breakdown of each tuesday’s open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the. Explore options trading effectively with stolo’s multistrike oi analysis on the oi chart tool. Web get the market direction from the live chart of nifty open interest (oi) & observe the change over time between any two points of put and call. Web open interest is the number of trades not settled at a given moment for a specific asset.. Web open interest is the total number of outstanding derivative contracts for an asset—such as options or futures—that have not been settled. Web daily volume and open interest activity chart. Open interest increased by 98.9k contracts two weeks ago, which was its second fastest increase on record, prompting me to suggest a cycle low for volatility. Web price vs strikewise. Web view live btcusdt open interest chart to track latest price changes. Web option chain (equity derivatives) futures contracts. Thursday, 30 may 2024 (final) download data. View trending market activity for volume and open interest across trading days. Open interest increased by 98.9k contracts two weeks ago, which was its second fastest increase on record, prompting me to suggest a. Trade ideas, forecasts and market news are at your disposal as well. Web get the market direction from the live chart of nifty open interest (oi) & observe the change over time between any two points of put and call. It is important to understand that since this is the number of open positions, the value can both increase and. Open interest keeps track of every open position in. Daraus können sie erkennen, um welchen kurs bulle und bär zum verfallstag kämpfen. Essential for traders focused on active and pending trade analysis. Also, view the latest live chart data, historical oi data, & futures oi, at upstox.com. Web bitcoin aggregated open interest chart, statistics, markets and more. Daraus können sie erkennen, um welchen kurs bulle und bär zum verfallstag kämpfen. Open interest keeps track of every open position in. Web bitcoin aggregated open interest chart, statistics, markets and more. Web view live btcusdt open interest chart to track latest price changes. Web the commitment of traders (cot) reports provide a breakdown of each tuesday’s open interest for. Web track intraday and weekly rolling contract statistics (such as volatility, risk reversal prices, open interest, put/call ratios, and more), and compare them to the prior week. Web open interest is the total number of outstanding derivative contracts that have not been settled. Web the options change in open interest page shows equity options with the largest increase and decrease. Web open interest is the total number of outstanding derivative contracts for an asset—such as options or futures—that have not been settled. Volume and open interest reports for cme group futures and options contain monthly and weekly data available free of charge. On the chart, open interest data is available as the open interest indicator: Trade ideas, forecasts and market. The daily volume and open interest report is released at the end of each trading day and is a preliminary report. It also includes tools such as an oi distribution profile, large oi increase/decrease coloring, a stats screener, and much more. You can select and have the script plot the following: With student loans, that extra on the top isn't. You can select and have the script plot the following: Thursday, 30 may 2024 (final) download data. Just ask and chatgpt can help with writing, learning, brainstorming and more. Web track intraday and weekly rolling contract statistics (such as volatility, risk reversal prices, open interest, put/call ratios, and more), and compare them to the prior week. Web daily volume and open interest activity chart. Web open interest is the number of trades not settled at a given moment for a specific asset. Web price vs strikewise oi. Web the options change in open interest page shows equity options with the largest increase and decrease in open interest from the previous trading session. It is important to understand that since this is the number of open positions, the value can both increase and decrease during the day. Explore options trading effectively with stolo’s multistrike oi analysis on the oi chart tool. Use precise options activity and its connection with stock prices provided by strikewise oi to make knowledgeable trading choices. Also, view the latest live chart data, historical oi data, & futures oi, at upstox.com. If 6000pe has the highest open interest, traders perceive it as important support for the current expiry. Open interest measures the number of outstanding contracts in the derivatives market. It also includes tools such as an oi distribution profile, large oi increase/decrease coloring, a stats screener, and much more. With student loans, that extra on the top isn't so little right now, as it is.

Open Interest. How to use it in trading?

Introducing Intraday OI Charts Sensibull Blog

Nifty open interest chart live tf futures trading hours

Open Interest Indicator (MT4/MT5) amount of Traders in Market

Nifty open interest chart live tf futures trading hours

Open Interest analysis using technical analysis charts and indicators

Open Interest Analysis Excel for Options Trading Tuitions

Open Interest Analysis helps to identify stock market trends

Open Interest on Chart futures io

Charting Platform with Open Interest Indicator ? SOLVED Stocks On Fire

Open Interest Keeps Track Of Every Open Position In.

Historical Bitcoin Open Interest Chart.

It’s An Important Indicator Of Market Liquidity And Investor Sentiment.

Cme Group Releases Official Data In The Daily Bulletin The Following Morning.

Related Post: