Ohio Teacher Retirement Chart

Ohio Teacher Retirement Chart - Web 1 employers contribute to strs ohio plans based on teacher payroll. The calculator has been updated to reflect the change in retirement eligibility requirements for defined benefit plan participants that eliminates the age 60. Web the online statement is organized just like the printed statement and provides an itemized history of earnings, deposits, projected retirement benefits and retirement credit for each school year. For more information about strs ohio’s services, select one of. Web prior to 2012, teachers could retire at any age after 30 years of service and receive a pension equal to 66% of the average of their five highest years’ salary, according to strs. Web to retrieve a copy of this letter, log into esers: Web the headquarters of the state teachers retirement system of ohio is pictured on wednesday, may 15, 2024, in columbus, ohio. Web retirement plan comparison chart. Service retirement and plans of payment brochure or visit the strs ohio website at. The 11.09% contribution is subject to change by the retirement board. The strs ohio combined plan includes features of the defined benefit and defined contribution plans, so you have benefits while teaching and two elements to your retirement benefit. As a participant in the combined plan, a portion of your retirement income comes from the performance of the investment choices you selected for the defined contribution portion of your account during. Web school employees retirement system of ohio 300 e. Web orta advocates for the pensions and benefits of ohio's active and retired educators; The strs ohio combined plan includes features of the defined benefit and defined contribution plans, so you have benefits while teaching and two elements to your retirement benefit. The 11.09% contribution is subject to change by the. Web the headquarters of the state teachers retirement system of ohio is pictured on wednesday, may 15, 2024, in columbus, ohio. Web to retrieve a copy of this letter, log into esers: Web log in to your account. Web prior to 2012, teachers could retire at any age after 30 years of service and receive a pension equal to 66%. As a participant in the combined plan, a portion of your retirement income comes from the performance of the investment choices you selected for the defined contribution portion of your account during your teaching. A portion of employer contributions is set aside to pay for the existing unfunded liability of the retirement system. Web how does it work? The strs. The strs ohio combined plan includes features of the defined benefit and defined contribution plans, so you have benefits while teaching and two elements to your retirement benefit. Web log in to your account. See the charts on pages 9 and 10 that give a percentage figure to apply to your final average salary to find your pension amount on. Web 1 employers contribute to strs ohio plans based on teacher payroll. Web to retrieve a copy of this letter, log into esers: Web prior to 2012, teachers could retire at any age after 30 years of service and receive a pension equal to 66% of the average of their five highest years’ salary, according to strs. Web strs logo. However, some members may have the option of an alternative retirement plan (arp). See the charts on pages 9 and 10 that give a percentage figure to apply to your final average salary to find your pension amount on an annual basis. Strs ohio defined benefit plan; Select “calculators” from the top menu. Web 1 employers contribute to strs ohio. Web strs logo with text labelling the logo specific to state teachers retirement system of ohio. Web the online statement is organized just like the printed statement and provides an itemized history of earnings, deposits, projected retirement benefits and retirement credit for each school year. Web retirement plan comparison chart. For more information about strs ohio’s services, select one of.. Web to retrieve a copy of this letter, log into esers: Web the early retirement reduction chart is reflected in the shaded areas of the benefit calculation tables, beginning on page 30 of the service retirement and plans of payment brochure. The 11.09% contribution is subject to change by the retirement board. A portion of employer contributions is set aside. Strs ohio defined contribution plan; We rely on membership dues to continue our. Go to the foundation deduction notice application found under ‘financial information’ click on the 2025 link to download the…. For more information about strs ohio’s services, select one of. Select “calculators” from the top menu. However, some members may have the option of an alternative retirement plan (arp). Web the online statement is organized just like the printed statement and provides an itemized history of earnings, deposits, projected retirement benefits and retirement credit for each school year. As a participant in the combined plan, a portion of your retirement income comes from the performance of the investment choices you selected for the defined contribution portion of your account during your teaching. Strs ohio defined contribution plan; A portion of employer contributions is set aside to pay for the existing unfunded liability of the retirement system. Web educators are covered by the state teachers retirement system (strs), which is similar to opers in that it also offers defined benefit, defined contribution, and combined plans. This is a comprehensive plan that provides. Web 1 employers contribute to strs ohio plans based on teacher payroll. Select “calculators” from the top menu. Web orta advocates for the pensions and benefits of ohio's active and retired educators; Web log in to your account. Demands accountability from the state teachers retirement system of ohio; Web strs logo with text labelling the logo specific to state teachers retirement system of ohio. The 11.09% contribution is subject to change by the retirement board. Strs ohio’s primary purpose is to provide a monthly benefit in retirement for ohio’s public educators. Click on “service retirement.” your benefit estimate will be saved to the “documents” area of your online account.

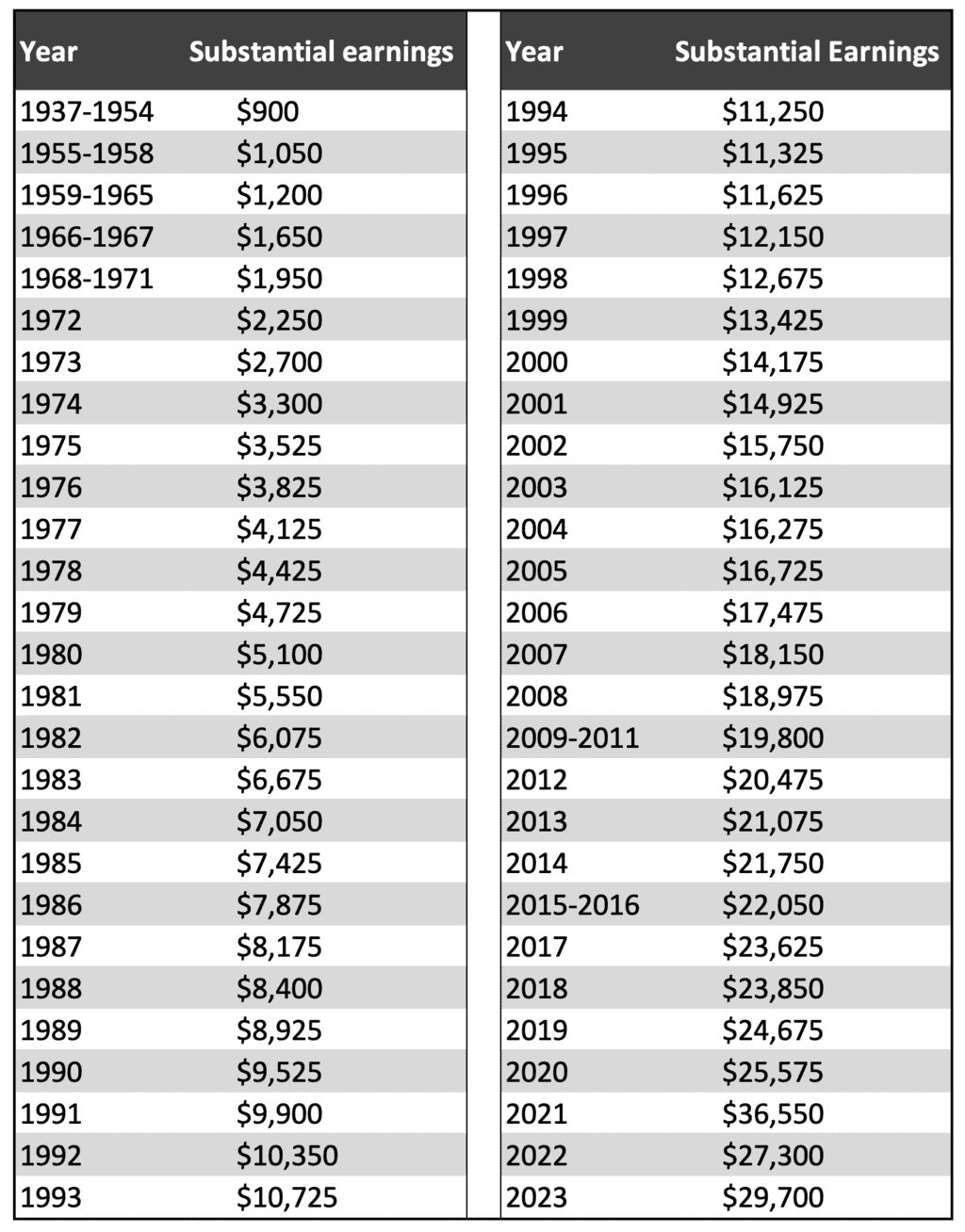

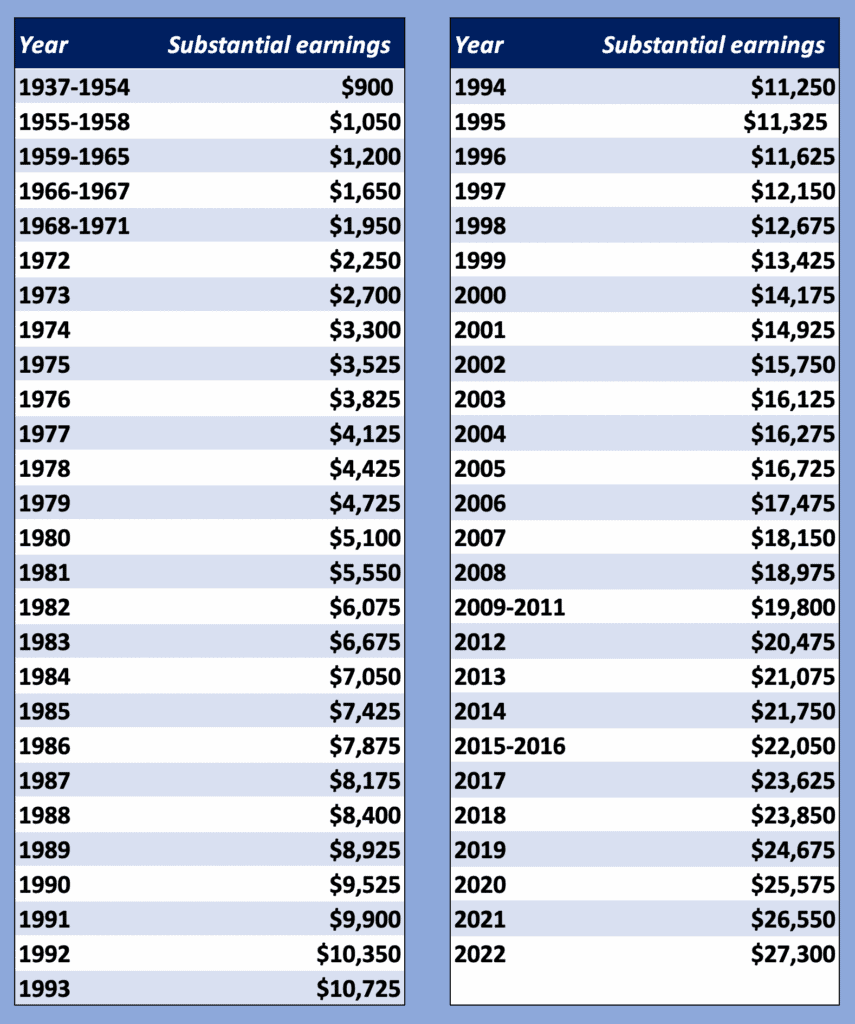

Teacher’s Retirement and Social Security Social Security Intelligence

Ohio Teacher Retirement Chart

Sers Ohio Retirement Chart

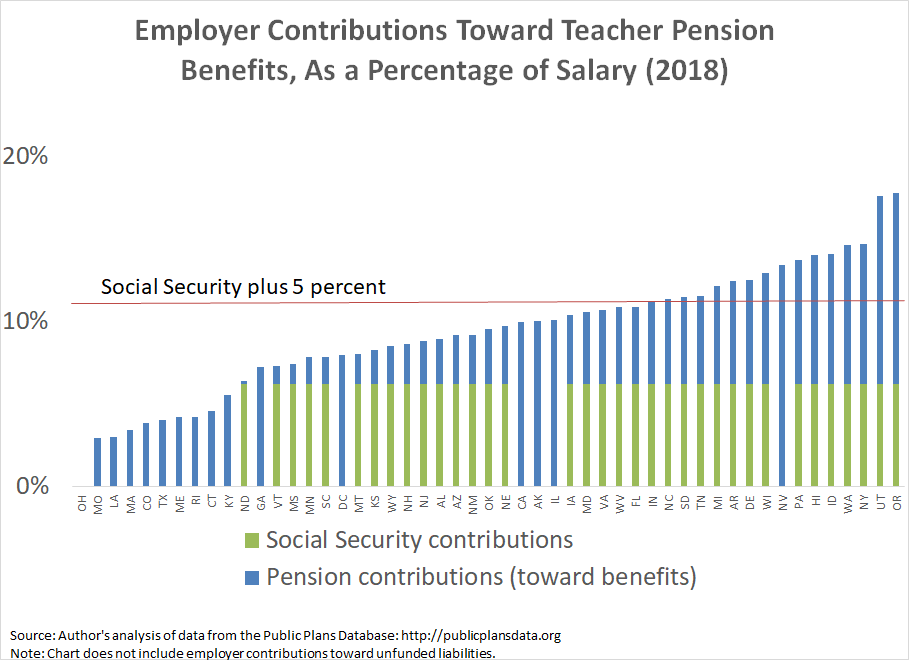

Default Settings How Ohio can nudge teachers toward a more secure

State Teachers Retirement System of Ohio What are supplemental

Retirement Benefits May 2012

Ohio teacher retirement chart JuraRuadhan

Tsp retirement calculator NickosZishan

Which States Have the Best (and Worst) Teacher Retirement Plans

Here's What Retirement Looks Like In America In Six Charts

Web As A New Member Of The State Teachers Retirement System Of Ohio (Strs Ohio), You Have 180 Days From Your First Day Of Paid Service To Choose One Of The Three Retirement Plans:

Web The Early Retirement Reduction Chart Is Reflected In The Shaded Areas Of The Benefit Calculation Tables, Beginning On Page 30 Of The Service Retirement And Plans Of Payment Brochure.

Strs Ohio Defined Benefit Plan;

Web Prior To 2012, Teachers Could Retire At Any Age After 30 Years Of Service And Receive A Pension Equal To 66% Of The Average Of Their Five Highest Years’ Salary, According To Strs.

Related Post: