Ohio Strs Retirement Chart

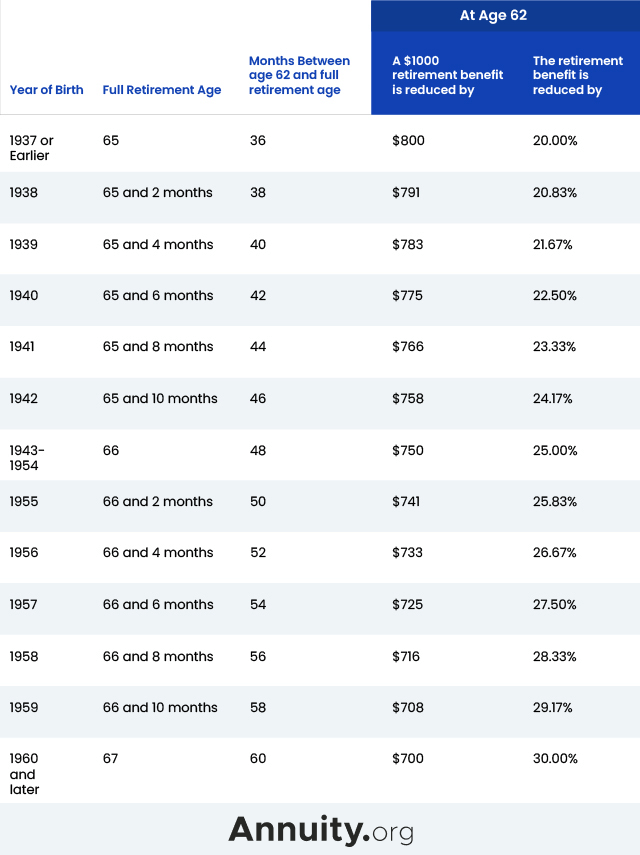

Ohio Strs Retirement Chart - This improvement of the retirement eligibility requirements means that thousands of members will be eligible for an unreduced benefit at an earlier age. The updated online version of the form will be available in october. 14% employer contribution rate (2018): The state teachers retirement board eliminated the age 60 requirement that was set to take effect in 2026. The calculator reflects the updated retirement eligibility requirements and plans of payment for defined benefit, defined contribution and combined plans. Web you can compare this plan with your other strs ohio retirement plan options in the retirement plan comparison chart. 14% participation in social security: View and print your selections and make changes before submitting your application. To estimate benefit amounts under other plans of payment, please use the benefit estimate calculator available in your. This benefit calculation table and estimate worksheet for retirement aug. The updated online version of the form will be available in october. The state teachers retirement board eliminated the age 60 requirement that was set to take effect in 2026. On august 1, 2023 through july 1, 2026 eligibility will be 35 years of service at any age. Web credit in other ohio retirement systems, if applicable. Web the strs. Web the ohio retirement for teachers association and strs watchdogs began pressing the board to restore the cola. Web the strs ohio website at www.strsoh.org. This improvement of the retirement eligibility requirements means that thousands of members will be eligible for an unreduced benefit at an earlier age. Re teachers can't turn $90 billion nest egg over to strs corporate. Web credit in other ohio retirement systems, if applicable. Web for strs ohio members preparing for retirement, estimating the amount of the service retirement benefit is an important step in evaluating retirement income. Web the ohio retirement for teachers association and strs watchdogs began pressing the board to restore the cola. Web the ohio retirement for teachers association raised over. That uses the member’s age, years of service and final average salary. The strs ohio combined plan includes features of the defined benefit and defined contribution plans, so you have benefits while teaching and two elements to your retirement benefit. Web compare the features, benefits and eligibility of the defined benefit, defined contribution and combined plans offered by strs ohio.. These calculators can help members determine their estimated retirement benefit amount. As an strs ohio member enrolled in the defined benefit plan, you qualify for lifetime benefits after meeting one of the eligibility requirements indicated in. Your last day of paid school employment, and 14% employer contribution rate (2018): Web predators out for strs. That uses the member’s age, years of service and final average salary. Web for strs ohio members preparing for retirement, estimating the amount of the service retirement benefit is an important step in evaluating retirement income. The state teachers retirement board eliminated the age 60 requirement that was set to take effect in 2026. Your last day of paid school. View and print your selections and make changes before submitting your application. This improvement of the retirement eligibility requirements means that thousands of members will be eligible for an unreduced benefit at an earlier age. The state teachers retirement board eliminated the age 60 requirement that was set to take effect in 2026. Web you can compare this plan with. Web the ohio retirement for teachers association raised over $60,000 for steen’s legal defense fund. The calculator reflects the updated retirement eligibility requirements and plans of payment for defined benefit, defined contribution and combined plans. State teachers retirement system of ohio. Web the strs ohio website at www.strsoh.org. Web under current law, in addition to being eligible to retire at. The state teachers retirement board eliminated the age 60 requirement that was set to take effect in 2026. Web under current law, in addition to being eligible to retire at age 65 with at least five years of service, strs members are eligible to retire with 34 years of service at any age. Your last day of paid school employment,. To view your annual statement, log into the personal account information area and select “my documents” under useful links on the home page. Web service credit helps determine your eligibility for retirement and the amount of your monthly retirement benefit. Web the ohio retirement for teachers association and strs watchdogs began pressing the board to restore the cola. The anonymous. These calculators can help members determine their estimated retirement benefit amount. To estimate benefit amounts under other plans of payment, please use the benefit estimate calculator available in your. That uses the member’s age, years of service and final average salary. Web compare the features, benefits and eligibility of the defined benefit, defined contribution and combined plans offered by strs ohio. On august 1, 2023 through july 1, 2026 eligibility will be 35 years of service at any age. Retirement income is based on a calculation that uses the member’s age, years of service and final average salary. Web predators out for strs. 14% participation in social security: 14% employer contribution rate (2018): Web receive your first partial benefit payment on your retirement date if you submit your application at least 30 days before your retirement date. Re teachers can't turn $90 billion nest egg over to strs corporate raiders, may 24: Effective date of retirement your earliest effective date of retirement is the first day of the month following the later of: The calculator reflects the updated retirement eligibility requirements and plans of payment for defined benefit, defined contribution and combined plans. Web learn how to use the service retirement calculator in your online personal account to get an estimate of your retirement benefit amount. As a member of sers, you have been funding your own retirement through employee contributions, employer contributions, and investment returns on. Those members who receive a paper statement will not be able to view it online until late september.

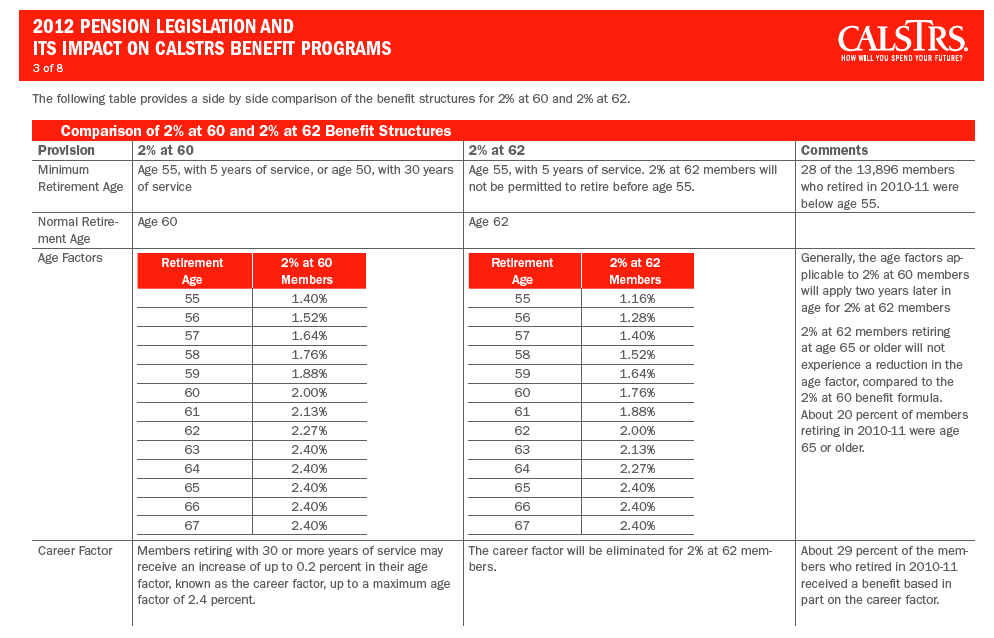

More Info. on STRS Rates The AFT Guild

STRS Ohio News for Benefit Recipients Newsletter — STRS Ohio News

Kathie Bracy's Blog STRS Flashback 2 years ago how many STRS

Service Retirement and Plans of Payment (Defined Benefit Plan) Brochure

JGR Financial Solutions STRS Ohio

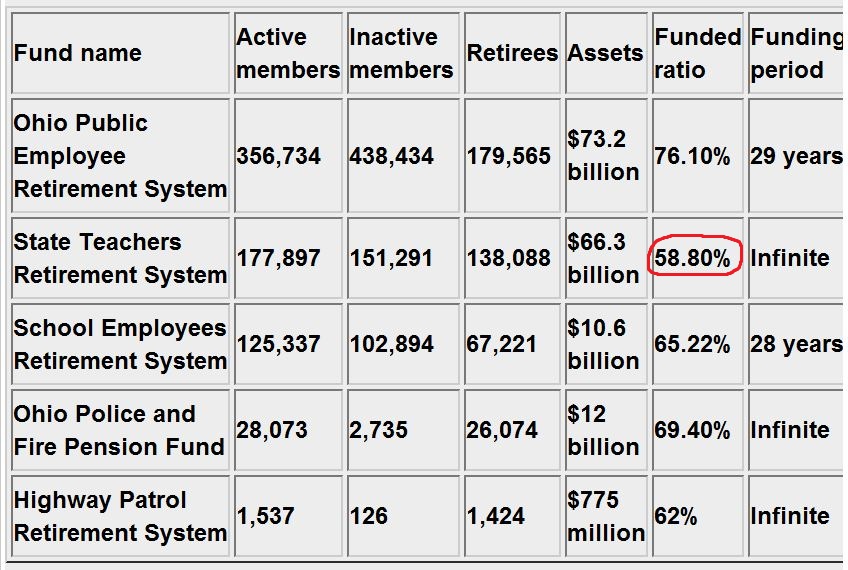

Sers Ohio Retirement Chart

Kathie Bracy's Blog Bob Buerkle An open letter to all STRS members

Strs Retirement Chart 2024 Adrian Eulalie

STRS Ohio Retirement Estimate Overview YouTube

Kathie Bracy's Blog STRS Retiree Buying Power STRS Ohio Pension

This Benefit Calculation Table And Estimate Worksheet For Retirement Aug.

Web The Ohio Retirement For Teachers Association Raised Over $60,000 For Steen’s Legal Defense Fund.

Web Wade Steen, A Trustee Of The State Teachers Retirement System Of Ohio, Speaks To Reporters During A Wednesday, May 15, 2024, Meeting Of The Pension Fund's Board At Strs Headquarters In Columbus, Ohio.

Web You Can Compare This Plan With Your Other Strs Ohio Retirement Plan Options In The Retirement Plan Comparison Chart.

Related Post: