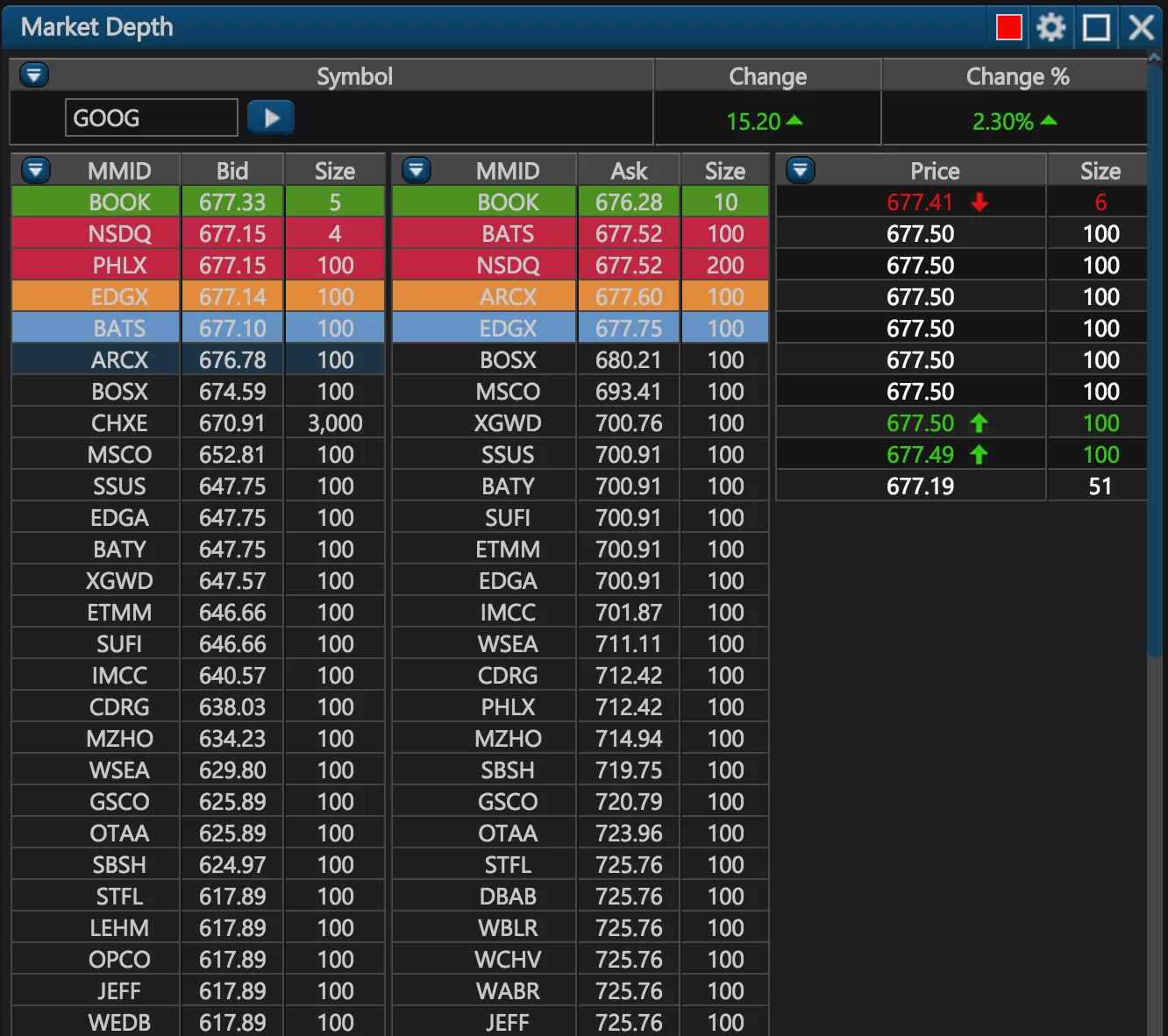

Market Depth Chart

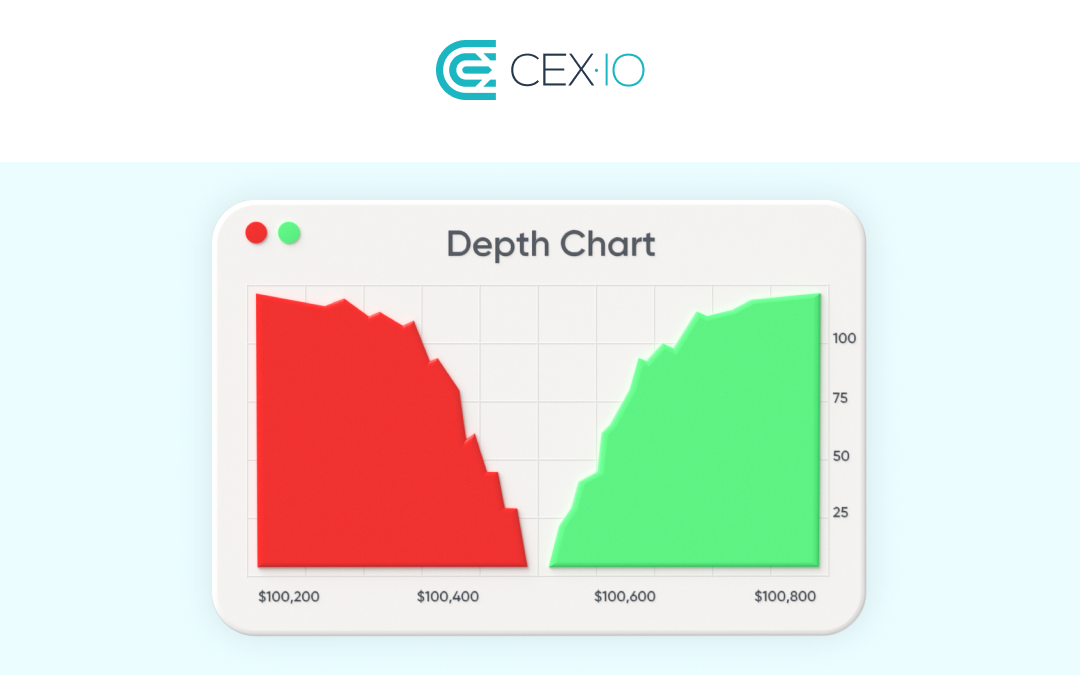

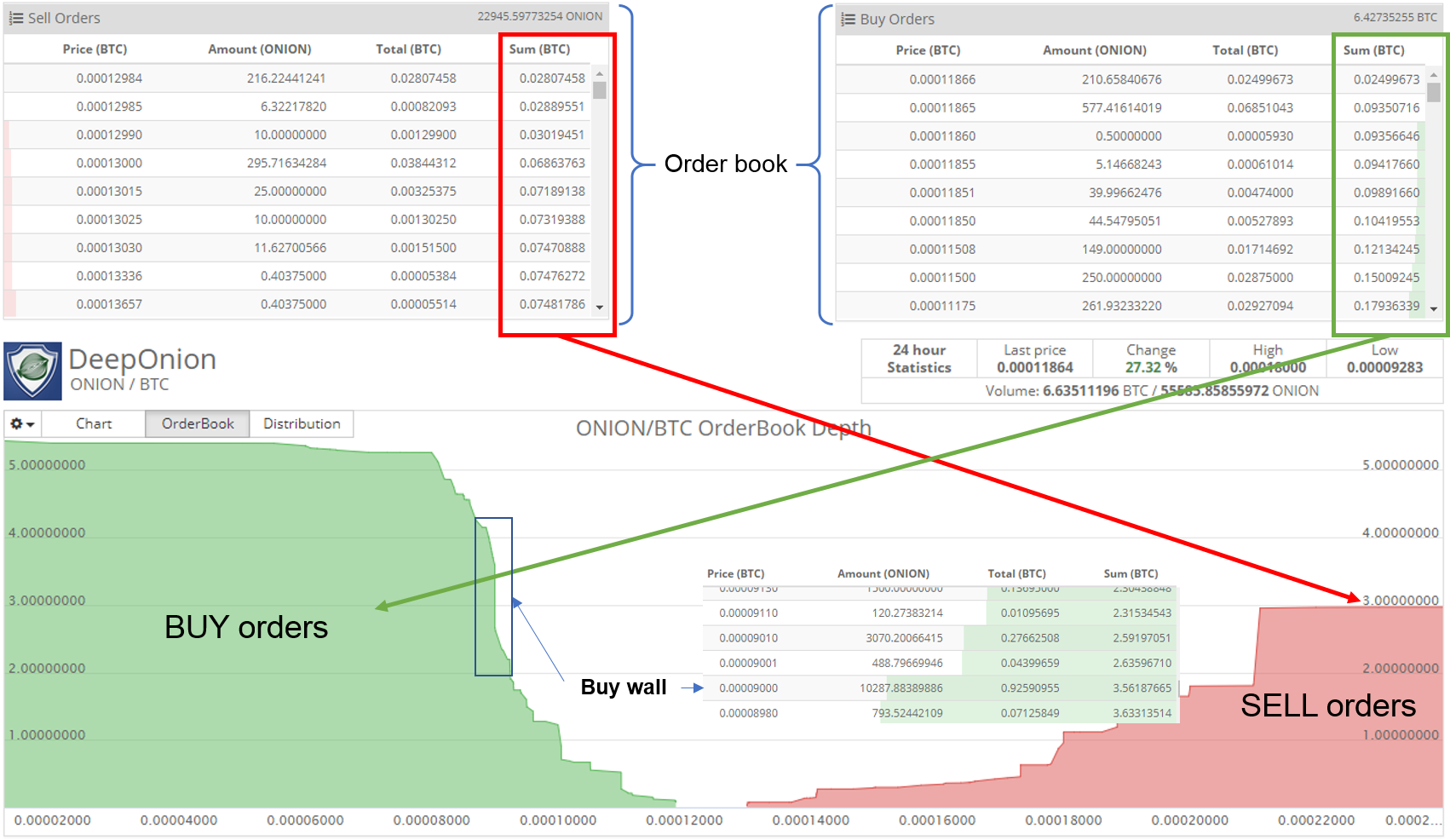

Market Depth Chart - Each price level takes on a different color depending on the volume of corresponding dom level. Each price level takes on a different color depending on the volume of corresponding dom level. See volume at different prices to analyze how supply and demand are interacting and where prices may go. Only the utilities sector was positive in april. Web a depth chart illustrates the supply and demand sides to show how much of an asset you can sell at a particular market price. This widget also displays the buy and sell walls, which can be a helpful determinant in your trading decision. Just ask and chatgpt can help with writing, learning, brainstorming and more. Web market depth refers to the market liquidity for a security based on the number of standing orders to buy (bids) and sell (offers) at various price levels. It is usually displayed in a format known as the “depth chart,” which shows the number of buy orders (bids) and sell orders (asks) at different price points. This refers to the minimum price increment at which trades may be made on the market. Web the market depth chart gives you an idea of the trading volume on a selected market. See volume at different prices to analyze how supply and demand are interacting and where prices may go. Each price level takes on a different color depending on the volume of corresponding dom level. Web the market depth chart allows us to study. Web let’s start by quickly defining the purpose of a market depth chart and then we’ll look at the steps for how to build one in tableau. In other words, it helps traders to determine where the actual orders in the market are being made. Hovering over the chart will show you: Web market depth data is a visual representation. To view the market depth, follow these steps: Buy orders are shown in green color and sell orders are red. Web the market depth map helps traders identify potential levels of support and resistance by analyzing the volumes of limit order book (dom). Web market depth refers to the market liquidity for a security based on the number of standing. Emerging markets was the only index on our chart (below) to post a positive gain in april. (1) bid/ask window, (2) size of orders, and (3) depth. This kind of chart illustrates both sides of supply and demand. Web market depth charts display bid (buy) and ask (sell) data for a particular asset at different prices. Web big time price. Web the market depth chart, also known as the order book, provides a visual representation of the current buy and sell orders for a particular security or asset at varying price levels. It is a graphical representation of orders for a specific asset at various prices. Each price level takes on a different color depending on the volume of corresponding. The major stock markets in the united states went through a process of decimalisation in april 2001. To view the market depth, follow these steps: The dom lays out all of the market participants in both limit order (resting orders waiting to participate in the market) and market orders. Web big time price today: Web the market depth map helps. Web the market depth chart gives you an idea of the trading volume on a selected market. Web a depth chart is a visual representation of buy and sell orders for a particular asset at varied prices. The depth chart is split between buy and sell walls, which represent the demand and supply changes and patterns. It is usually displayed. Web market depth data is a visual representation of the buy and sell orders in a particular market at various price levels. Just ask and chatgpt can help with writing, learning, brainstorming and more. Web market depth refers to the market liquidity for a security based on the number of standing orders to buy (bids) and sell (offers) at various. Web a market depth chart, also known as a level 2 market data chart, represents the supply and demand for a particular asset at different price levels. Web the market depth chart gives you an idea of the trading volume on a selected market. A depth chart helps traders understand a trading pair’s overall supply and demand. It is a. Multicharts’ dom displays ten price levels each way and allows entry and exit automation directly in the dom window. Web the order book, or depth of market (dom), is a panel through which you can see how many orders are to buy and sell an asset at different prices. Web the dom is a chart interface that allows traders to. Web market depth refers to the market liquidity for a security based on the number of standing orders to buy (bids) and sell (offers) at various price levels. This refers to the minimum price increment at which trades may be made on the market. Let's assume that the asset price is now $1. This visualization of supply and demand turns order book data into a chart that’s both easy and fast to read. Web the market depth chart is a graphical representation of the order book, depicting the pending buying and selling orders on a specific asset. Then, the order book will show how many orders there are for prices of $0.90, $1.10, and so on. It is a graphical representation of orders for a specific asset at various prices. Web the market depth map helps traders identify potential levels of support and resistance by analyzing the volumes of limit order book (dom). Web market depth map helps traders identify potential levels of support and resistance by analyzing the volumes of limit order book (dom). Web a depth chart is a visual representation of buy and sell orders for a particular asset at varied prices. A depth chart helps traders understand a trading pair’s overall supply and demand. Web let’s start by quickly defining the purpose of a market depth chart and then we’ll look at the steps for how to build one in tableau. Web [1] [2] factors influencing market depth. To view the market depth, follow these steps: See volume at different prices to analyze how supply and demand are interacting and where prices may go. Each price level takes on a different color depending on the volume of corresponding dom level.

Market Depth Chart Updates

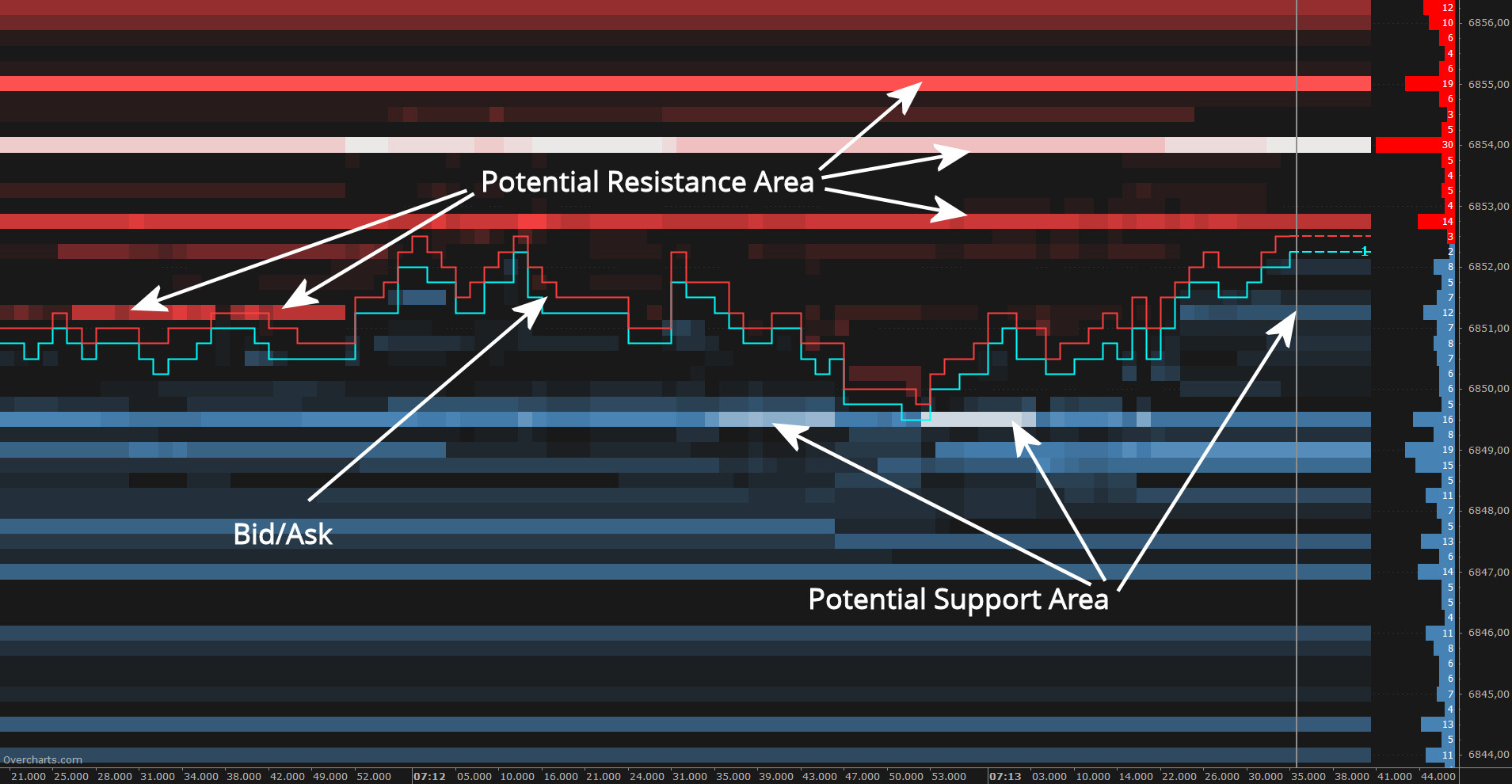

Market Depth Map Overcharts

how to use market depth in forex My Forex Help

What Is Market Depth Chart and How to Read It? CEX.IO University

How to read the order book and market depth charts by benezim Medium

Market depth chart indicator

Market depth chart indicator

Market depth chart indicator

Understand the Market Depth Charts in Trading Hacker Noon

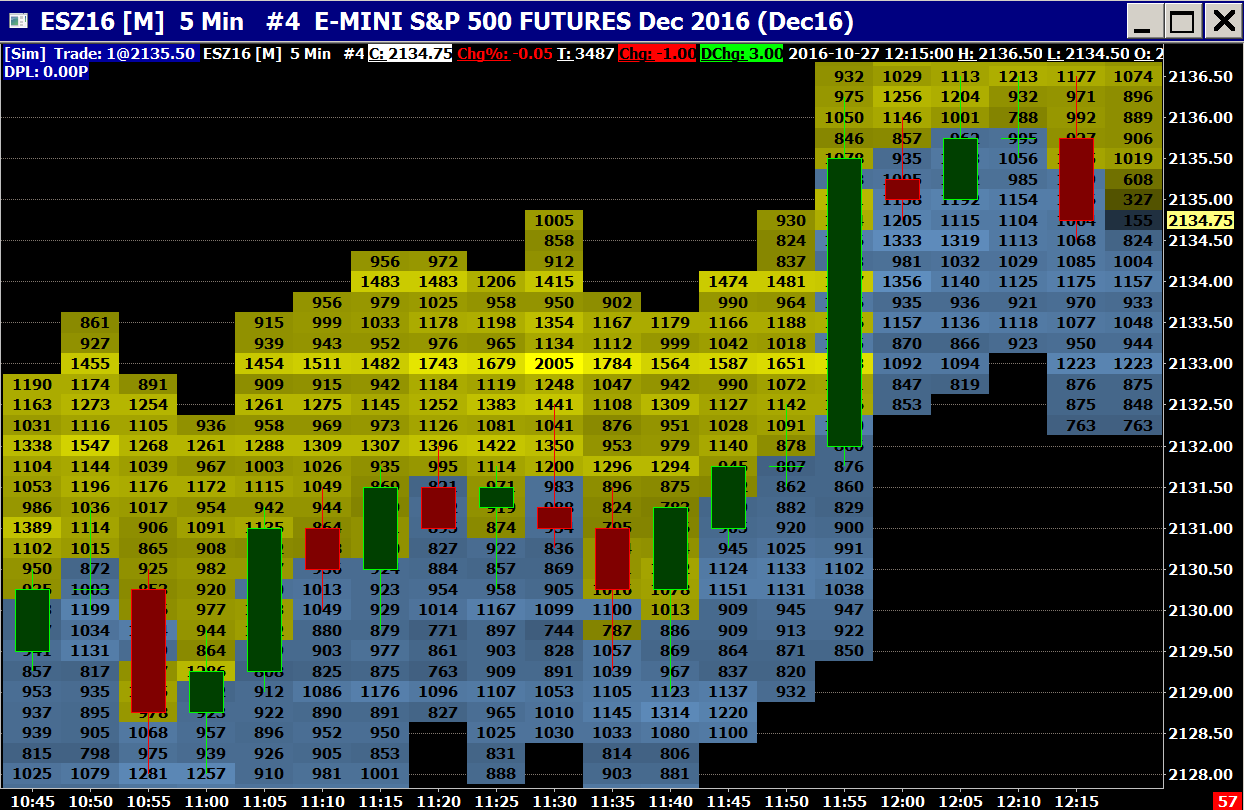

Understanding Market Depth Charts and Order Books NinjaTrader

Only The Utilities Sector Was Positive In April.

Emerging Markets Was The Only Index On Our Chart (Below) To Post A Positive Gain In April.

Web To Read A Level 2 Depth Chart, You Need To Understand The L2 Data Window Structure.

It Is Comprised Of Three Key Components:

Related Post: