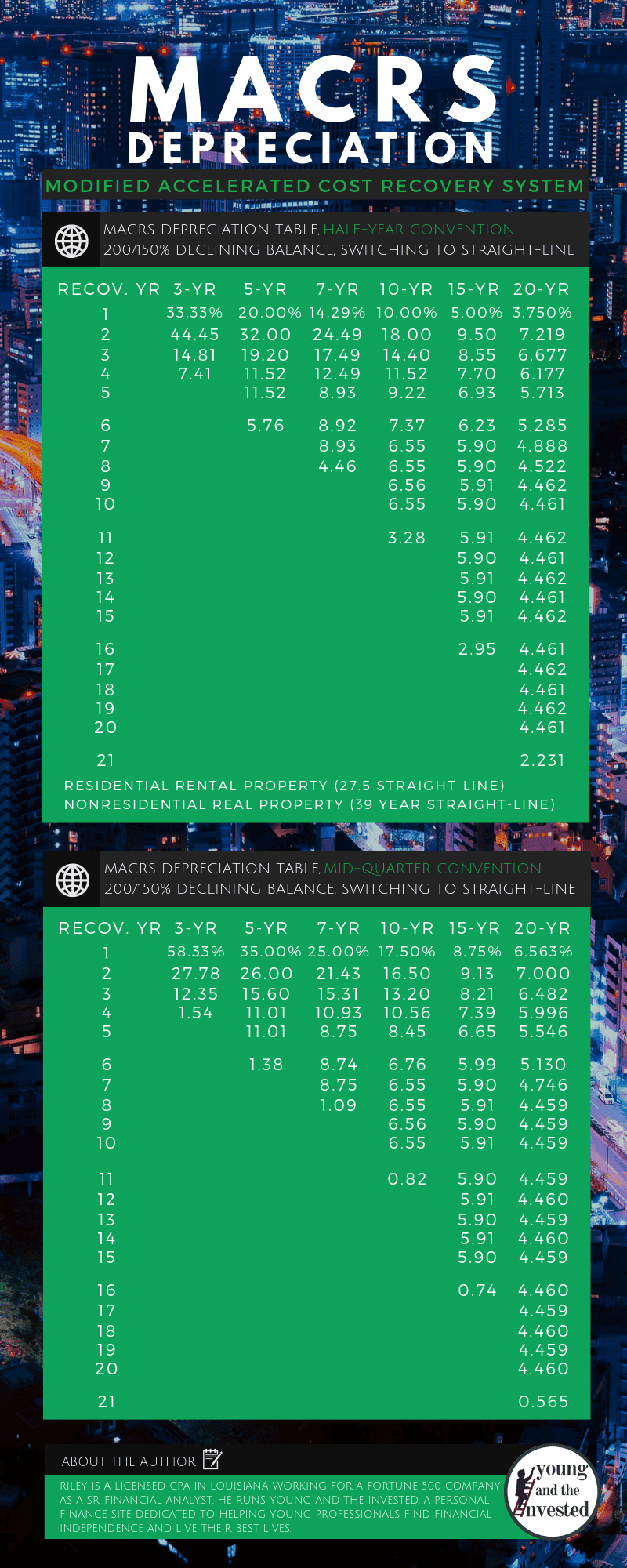

Macrs Depreciation Chart

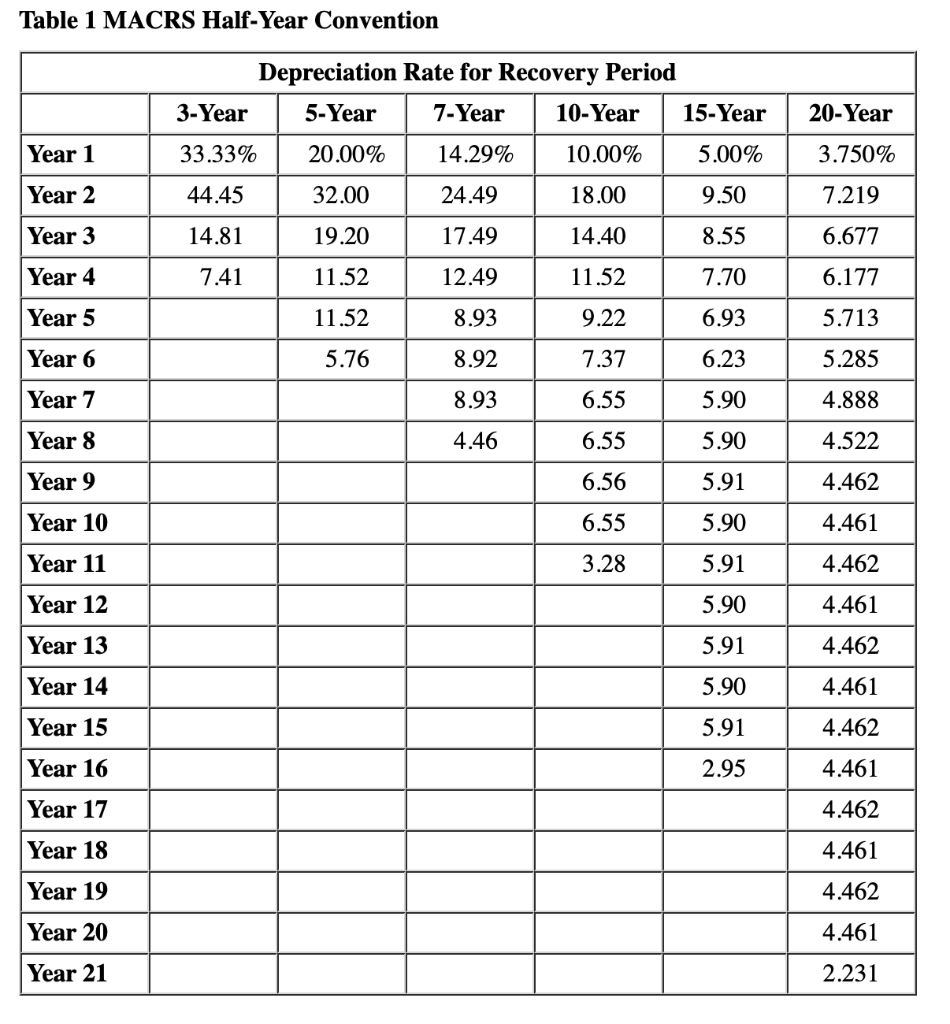

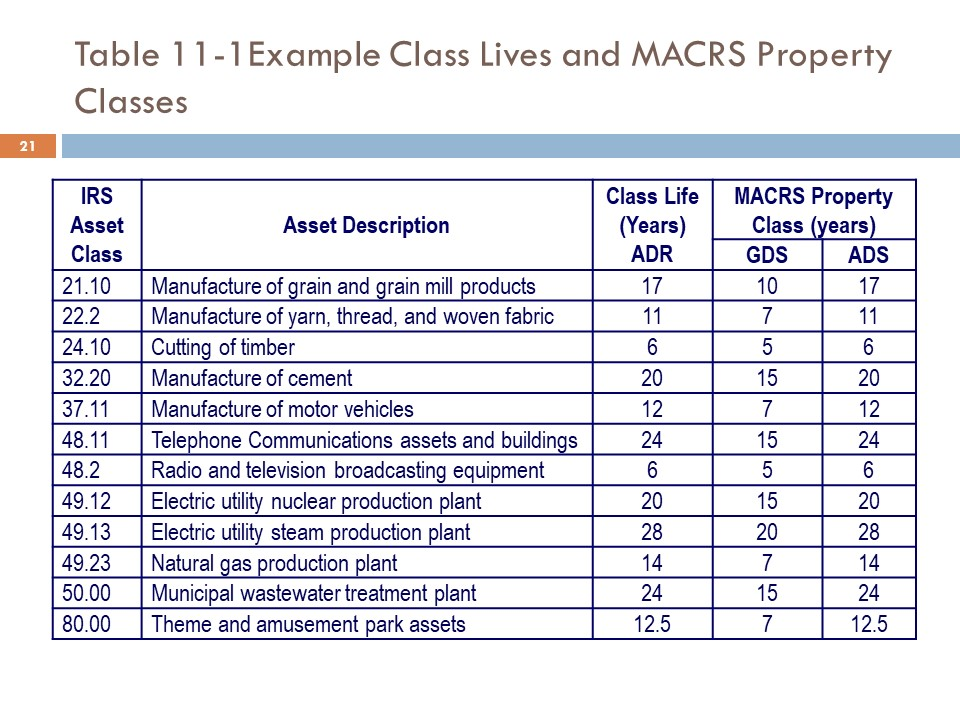

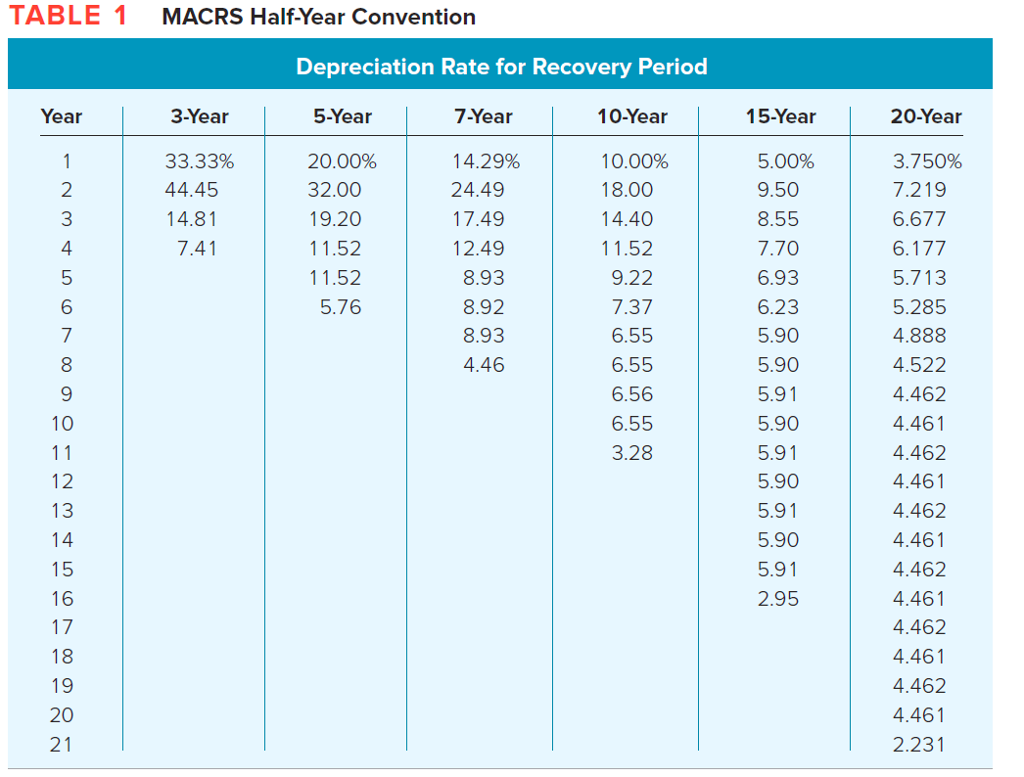

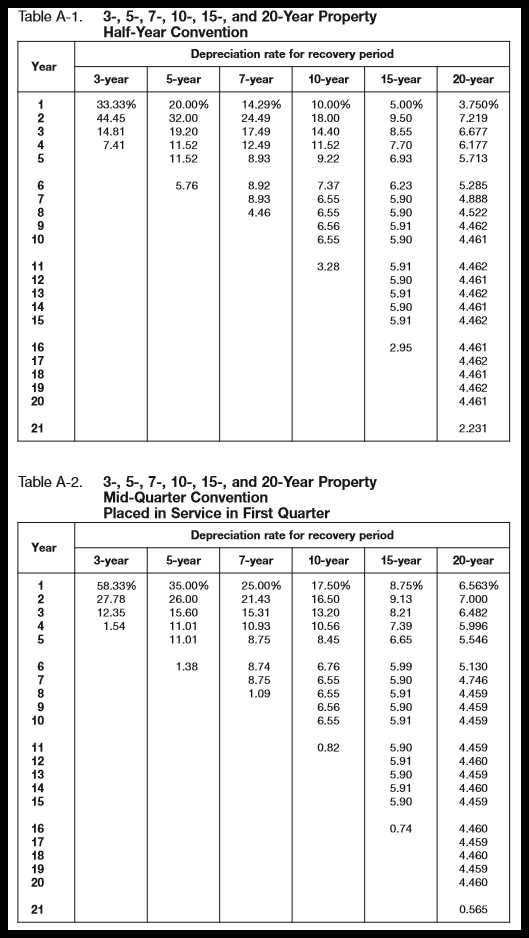

Macrs Depreciation Chart - Find the macrs depreciation chart and. Web depreciation macrs table for asset’s life. Web learn how to file form 4562 to claim depreciation and amortization deductions, section 179 expense deduction, and listed property rules. It includes tables, charts, and examples for macrs, section 179,. Web learn how to calculate macrs depreciation expense for tangible property placed in service after 1986. Web macrs is a depreciation system that allows businesses to recover the cost of certain assets over a specified period via annual deductions. Macrs is an acronym for modified accelerated cost. Use this chart to find the correct depreciation table to use for any property other than residential rental and. Web learn what macrs depreciation is, how it works, and the methods and property classifications used for tax purposes. Macrs depreciation vs straight line depreciation. Below is a snapshot of each table along with. It includes tables, charts, and examples for macrs, section 179,. Find out the recovery periods, depreciation. Web calculate depreciation deductions for business assets using the modified accelerated cost recovery system (macrs) method. Web the three tables are: Use this chart to find the correct depreciation table to use for any property other than residential rental and. Macrs depreciation is the tax system used in the united states. Depreciation in 2010 using table = $100 million × 32% = $32 million. Web calculate macrs depreciation based on irs publication 946 for personal or real property. Enter the basis,. Learn how to calculate macrs depreciation for your business assets using our free online tool and the irs tables. Web learn how to file form 4562 to claim depreciation and amortization deductions, section 179 expense deduction, and listed property rules. Web calculate depreciation deductions for business assets using the modified accelerated cost recovery system (macrs) method. Web learn how to. Find the macrs depreciation chart and. Web learn how to calculate macrs depreciation expense for tangible property placed in service after 1986. Cfi provides a free account to access courses. Doing so reduces taxable income early in which asset’s life and makes it larger in the forthcoming. Web calculate the depreciation schedule for depreciable property using macrs method with this. Find the macrs depreciation chart and. Web learn what macrs depreciation is, how it works, and the methods and property classifications used for tax purposes. Web calculate the depreciation schedule for depreciable property using macrs method with this online tool. Web macrs is a depreciation system that allows businesses to recover the cost of certain assets over a specified period. Web learn how to calculate macrs depreciation expense for tangible property placed in service after 1986. Web learn what macrs depreciation is, how it works, and the methods and property classifications used for tax purposes. Find the macrs depreciation chart and. Web calculate the depreciation schedule for depreciable property using macrs method with this online tool. Macrs depreciation vs straight. Web macrs depreciation table guide; Web learn what macrs depreciation is, how it works, and the methods and property classifications used for tax purposes. Find out the recovery periods, depreciation. Macrs depreciation vs straight line depreciation. Web there are four main ways to calculate depreciation which are gds using 200% db, gds using 150% db, gs using sl, and abs. This chapter discusses how businesses recover costs of. Depreciation in 2010 using table = $100 million × 32% = $32 million. Web learn how to calculate macrs depreciation for business assets using different methods, classes and conventions. Macrs depreciation is the tax system used in the united states. Macrs is an acronym for modified accelerated cost. Below is a snapshot of each table along with. Find out the recovery periods, depreciation. Enter the basis, business usage, recovery period, depreciation. Web learn how to calculate macrs depreciation expense for tangible property placed in service after 1986. Web calculate macrs depreciation based on irs publication 946 for personal or real property. Use this chart to find the correct depreciation table to use for any property other than residential rental and. Macrs depreciation is the tax system used in the united states. Enter the basis, business usage, recovery period, depreciation. It includes tables, charts, and examples for macrs, section 179,. This chapter discusses how businesses recover costs of. The depreciation macrs table for asset’s life below is taken out of irs publication.this depreciation table specifies lives for property. Web calculate macrs depreciation based on irs publication 946 for personal or real property. Web macrs depreciation table guide; See the depreciation rate and expense amount for each year, and. Find out the advantages and. Web the three tables are: Cfi provides a free account to access courses. Find the macrs depreciation chart and. Web there are four main ways to calculate depreciation which are gds using 200% db, gds using 150% db, gs using sl, and abs using sl. Macrs depreciation is the tax system used in the united states. Web this irs publication explains the rules and methods for depreciating property for federal income tax purposes. Use this chart to find the correct depreciation table to use for any property other than residential rental and. Below is a snapshot of each table along with. Web calculate depreciation deductions for business assets using the modified accelerated cost recovery system (macrs) method. Web learn how to calculate macrs depreciation expense for tangible property placed in service after 1986. Find out the recovery periods, depreciation.

Macrs Ads Depreciation Table Elcho Table

Depreciation Tables

A. Using MACRS, what is Javier’s depreciation

Macrs Depreciation Table 2018

Macrs Depreciation Table 2018 Elcho Table

depreciation 折舊計算 12MApa

MACRS Depreciation, Table & Calculator The Complete Guide

Guide to the MACRS Depreciation Method Chamber Of Commerce

8 Pics Macrs Depreciation Table 2017 39 Year And View Alqu Blog

How to Calculate MACRS Depreciation, When & Why

Macrs Depreciation Vs Straight Line Depreciation.

Depreciation In 2010 Using Table = $100 Million × 32% = $32 Million.

Web Federal Disparagement Rate.

Web Learn How To Calculate Macrs Depreciation For Business Assets Using Different Methods, Classes And Conventions.

Related Post: