Look At The Below Yield Curve Inversion Chart

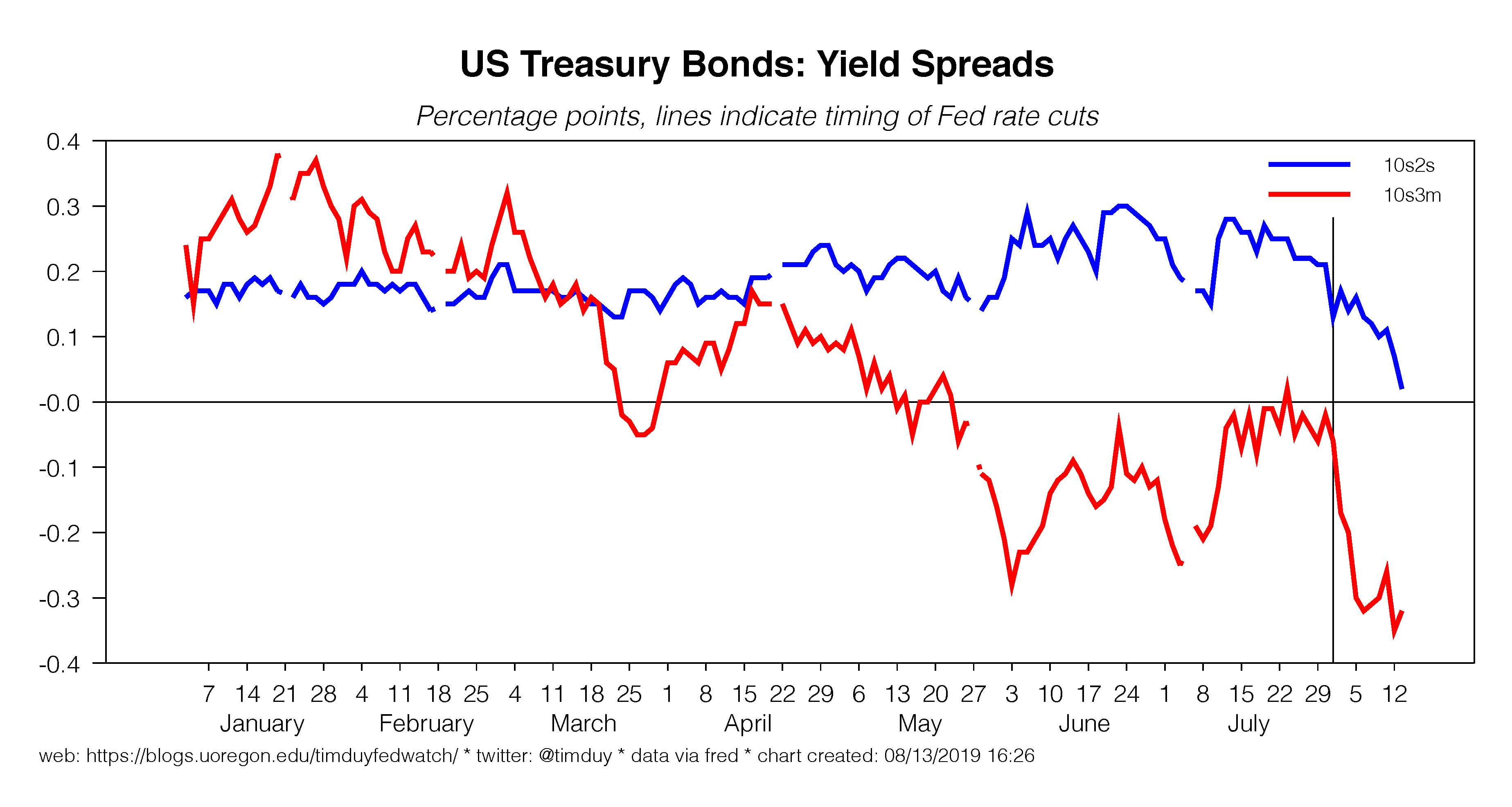

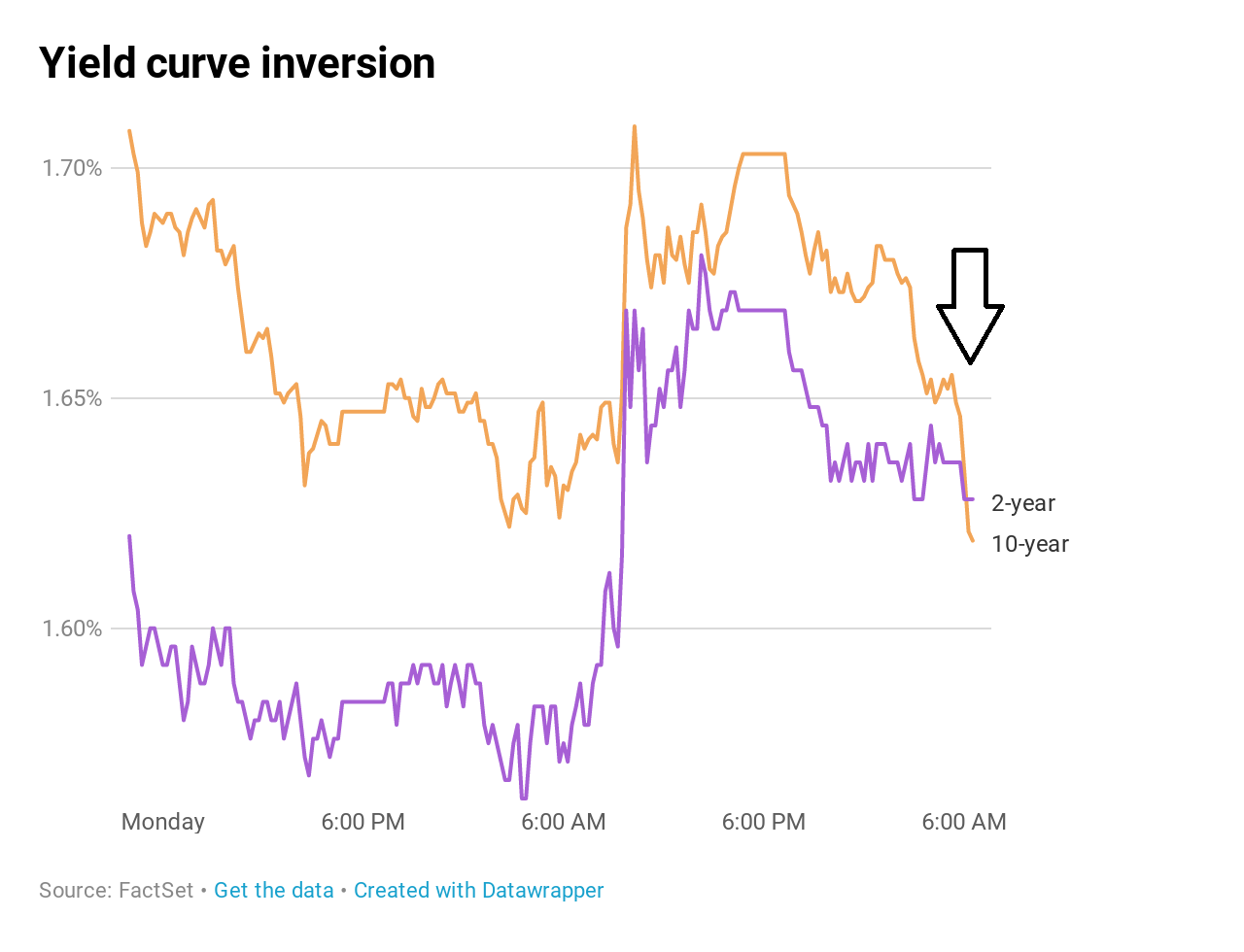

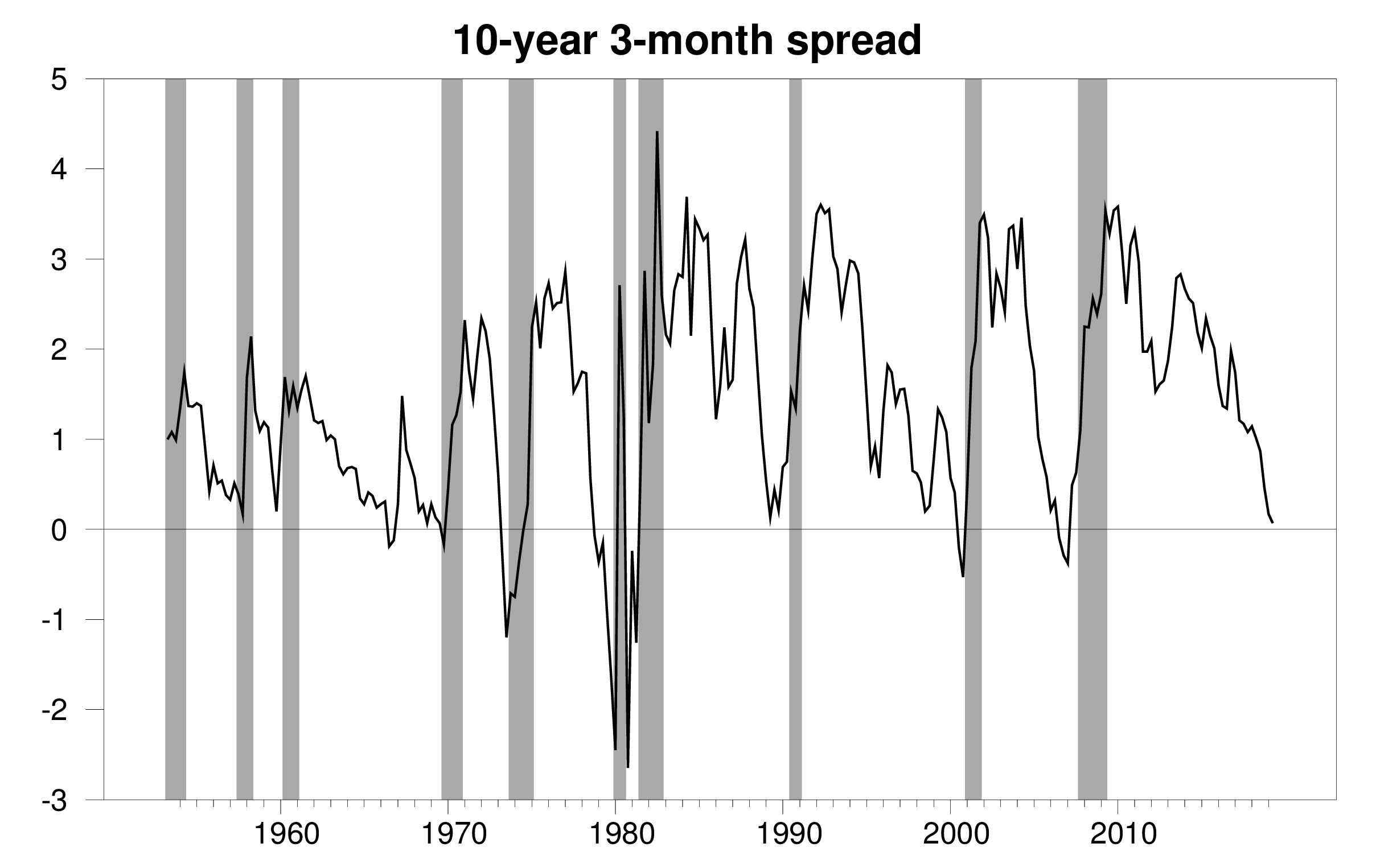

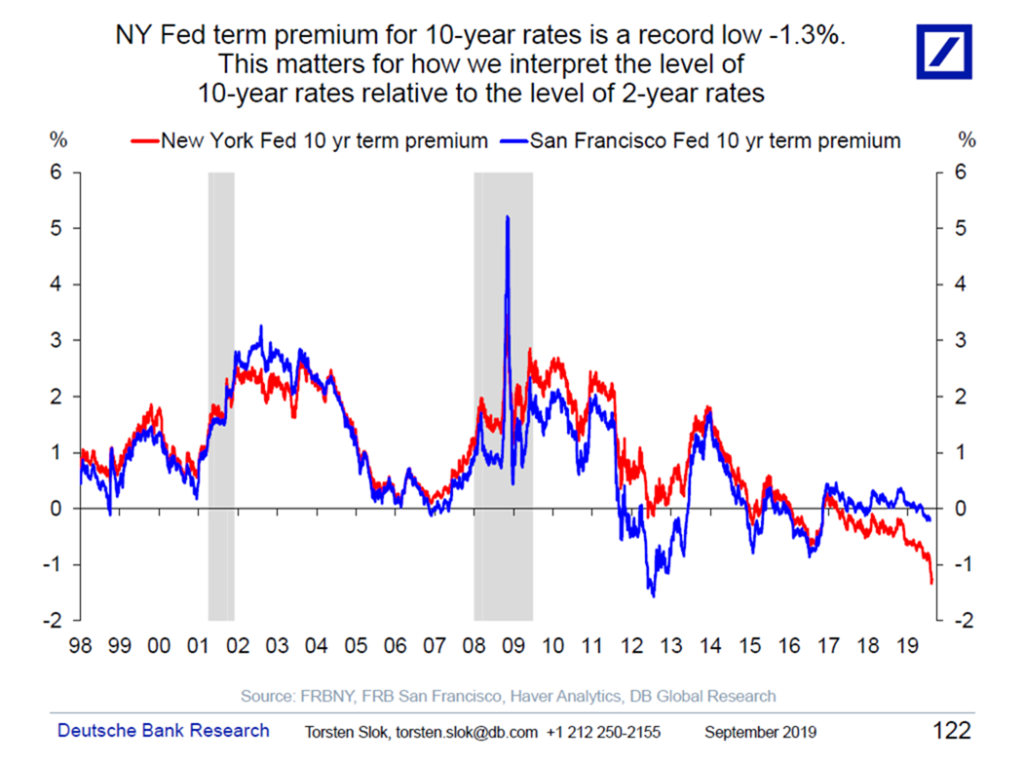

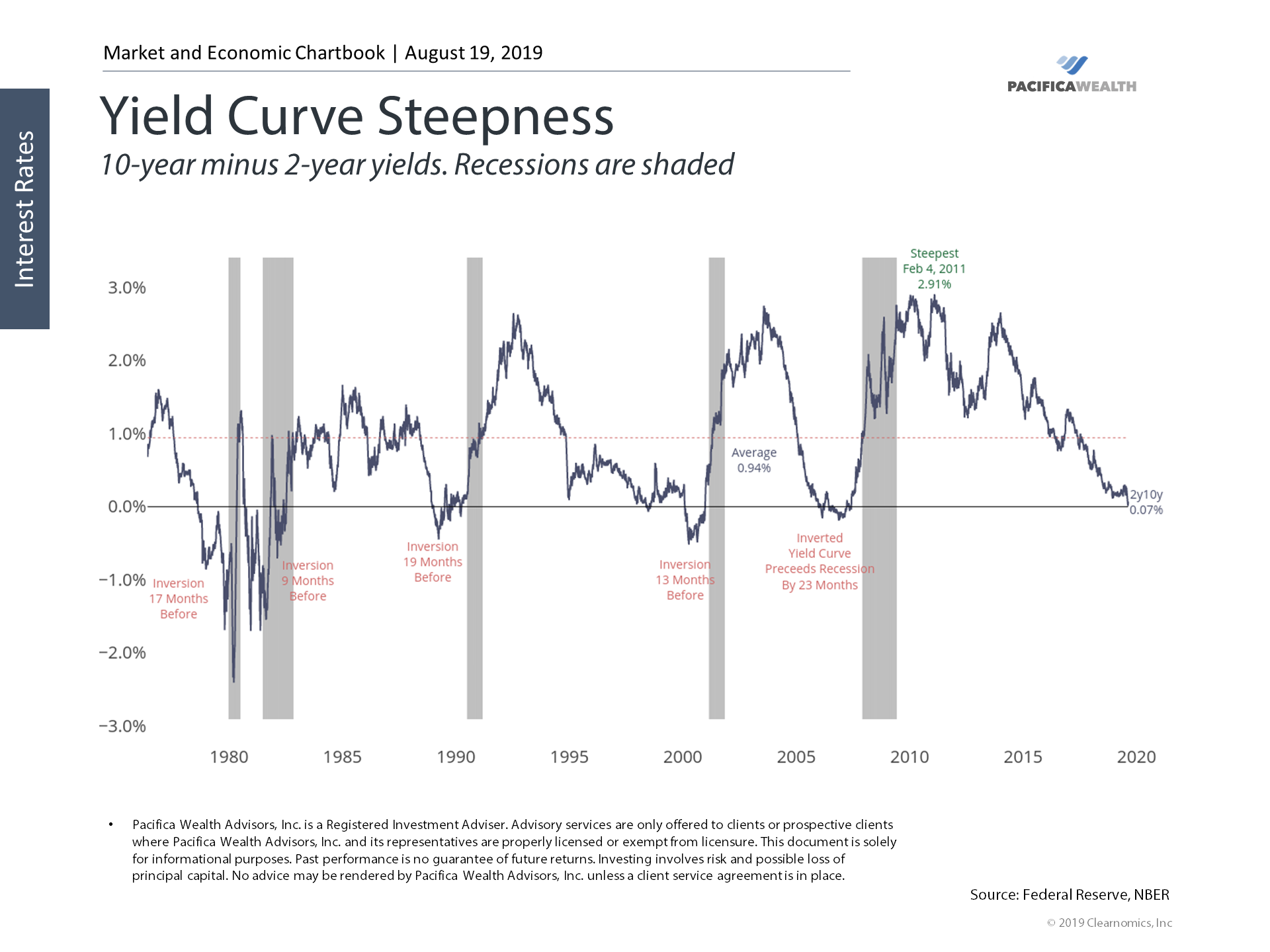

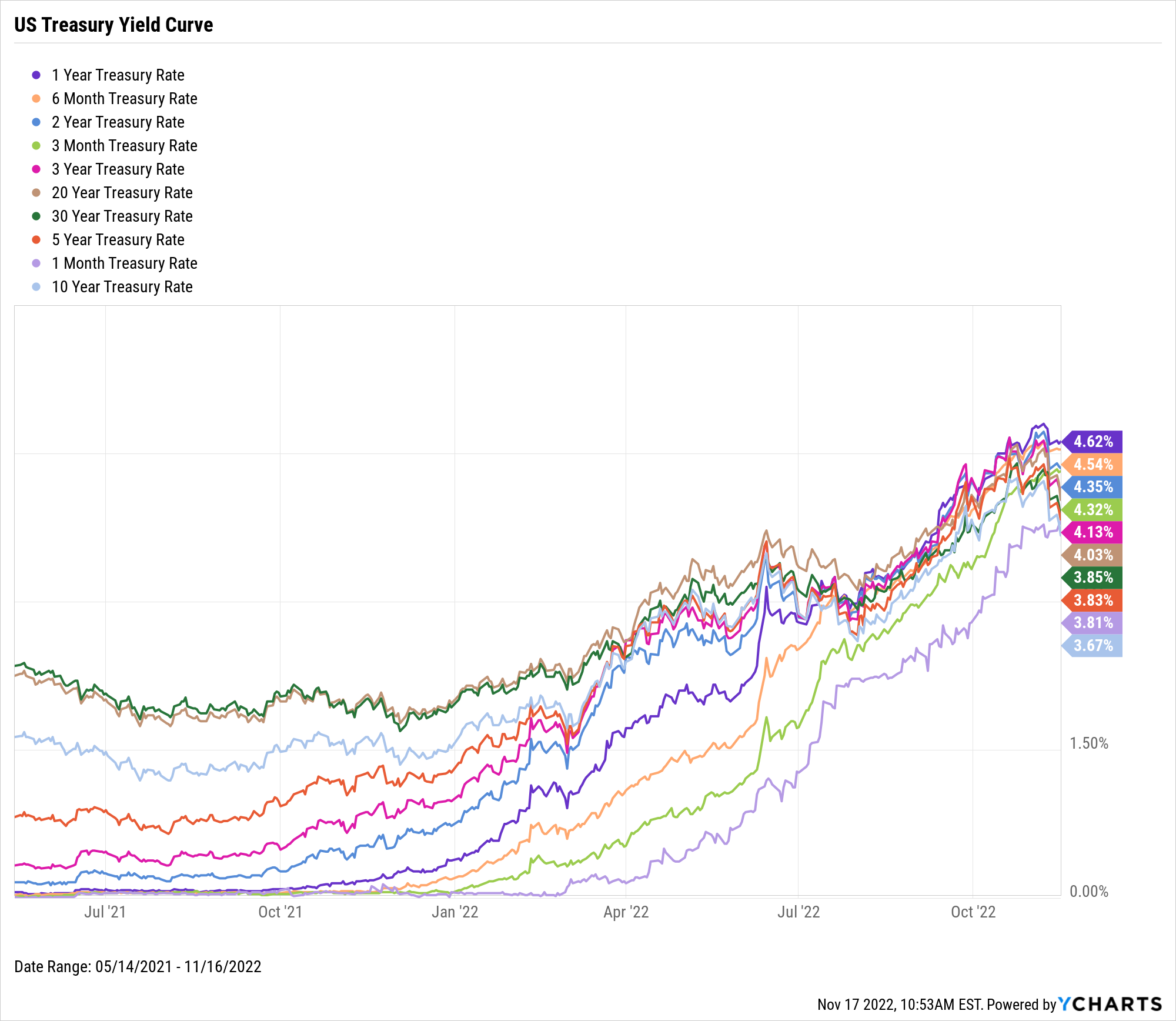

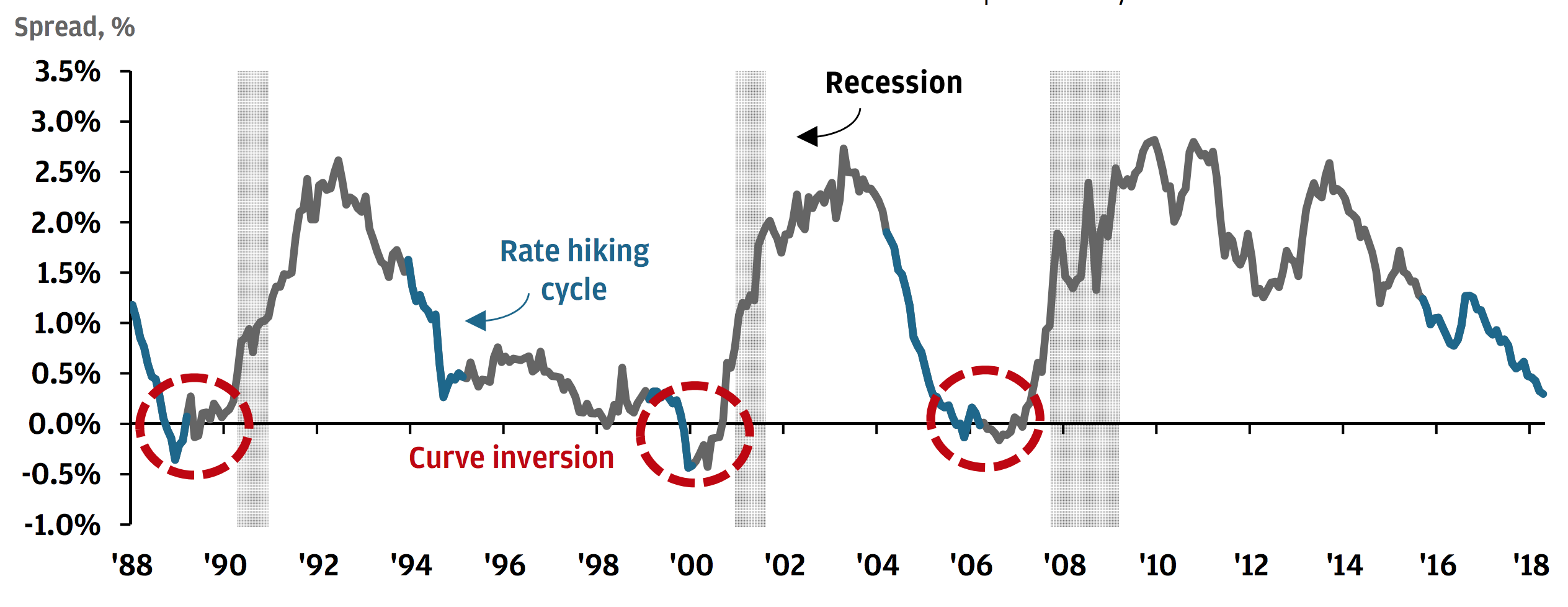

Look At The Below Yield Curve Inversion Chart - We look specifically at the difference in yield between treasuries maturing in. Treasury debt at different maturities at a given. Web generally speaking, the yield curve is a line chart that plots interest rates for bonds that have equal credit quality, but different maturity dates. Web the yield curve inversion suggests potential economic concern. It often precedes economic downturn,. Gdp will rise gdp will dip term premium will rise. Web treasury rates can be plotted based on maturity, and normally, that’s an upward sloping line with more risk (time) compensated by greater return (yield). In normal economic conditions, investors are rewarded with higher interest rates for holding bonds over longer time periods, resulting in an upward sloping yield curve. Here is a quick primer on what an inverted yield curve means, how it has predicted recession, and what it might be. Web market yield on u.s. It's the stock market that worries me. Web 2022 inverted yield curve. Web i would not go long equities until the yield curve inversion ends. An invested yield curve is viewed as an important. Not sure why, everyone keeps hoping for no returns. Web 2022 inverted yield curve. Gdp will rise gdp will dip term premium will rise. On net, i am bearish. Treasury debt at different maturities at a given. What is most likely to happen as a result of the most recent yield curve inversion shown? Not sure why, everyone keeps hoping for no returns. Here is a quick primer on what an inverted yield curve means, how it has predicted recession, and what it might be. Web the yield curve inversion suggests potential economic concern. Web generally speaking, the yield curve is a line chart that plots interest rates for bonds that have equal credit. Web what is most likely to happen as a result of the most recent yield curve inversion shown? Term premium will remain constant. Web the yield curve inversion suggests potential economic concern. Web the yield curve is a visual representation of how much it costs to borrow money for different periods of time; Web 2022 inverted yield curve. Gdp will rise gdp will dip term premium will rise. An invested yield curve is viewed as an important. Web despite a slight upturn in 2021 and 2022, the spread between long term and short term euro area bond yields, known as the “slope of the yield curve”, has fallen into negative territory, and to its lowest level since the. It often precedes economic downturn,. Not sure why, everyone keeps hoping for no returns. Web look at the below yield curve inversion chart. Web despite a slight upturn in 2021 and 2022, the spread between long term and short term euro area bond yields, known as the “slope of the yield curve”, has fallen into negative territory, and to its. Web a yield curve illustrates the interest rates on bonds of increasing maturities. Web the yield curve inversion suggests potential economic concern. It's the stock market that worries me. When they flip, or invert, it’s widely regarded as a bad. This can take place at differing maturities and in different ways. But for rate hopes, nearly all news is bearish. Term premium will remain constant. It's the stock market that worries me. What is most likely to happen as a result of the most recent yield curve inversion shown? This can take place at differing maturities and in different ways. Web the yield curve is a visual representation of how much it costs to borrow money for different periods of time; Web look at the below yield curve inversion chart. It shows interest rates on u.s. On net, i am bearish. What is most likely to happen as a result of the most recent yield curve inversion shown? Web generally speaking, the yield curve is a line chart that plots interest rates for bonds that have equal credit quality, but different maturity dates. The gray bars throughout the charts indicate the past u.s. This can take place at differing maturities and in different ways. It shows interest rates on u.s. The history of inversions and recessions. Web the yield curve inversion suggests potential economic concern. Web despite a slight upturn in 2021 and 2022, the spread between long term and short term euro area bond yields, known as the “slope of the yield curve”, has fallen into negative territory, and to its lowest level since the recession of 1992 (see chart 1). On net, i am bearish. Web treasury rates can be plotted based on maturity, and normally, that’s an upward sloping line with more risk (time) compensated by greater return (yield). The slope of the yield curve can predict future interest rate. In normal economic conditions, investors are rewarded with higher interest rates for holding bonds over longer time periods, resulting in an upward sloping yield curve. The gray bars throughout the charts indicate the past u.s. When they flip, or invert, it’s widely regarded as a bad. Web market yield on u.s. Treasury debt at different maturities at a given. The history of inversions and recessions. Web the yield curve is a visual representation of how much it costs to borrow money for different periods of time; This can take place at differing maturities and in different ways. We look specifically at the difference in yield between treasuries maturing in. Here is a quick primer on what an inverted yield curve means, how it has predicted recession, and what it might be. Web the yield curve shows the interest rates that buyers of government debt demand in order to lend their money over various periods of time — whether overnight, for one month, 10 years or even 100.

Yield Curve Inversion Chart

OneClass Look at the below yield curve inversion chart. What is most

2020 Recession Watch & Yield Curve 101 w Heidi Moore & Josh Brown

Yield curve inversion Econbrowser

Interpreting the Yield Curve Inversion The Big Picture

How an Inverted Yield Curve Impacts Investors

Inverted Yield Curve What It Means and How to Navigate It YCharts

Yield Curve Inversion J.P. Asset Management

:max_bytes(150000):strip_icc()/InvertedYieldCurve2-d9c2792ee73047e0980f238d065630b8.png)

Inverted Yield Curve Definition, What It Can Tell Investors, and Examples

Yield curve inversion recession 260309Us yield curve inversion recession

Web A Yield Curve Illustrates The Interest Rates On Bonds Of Increasing Maturities.

It's The Stock Market That Worries Me.

It Shows Interest Rates On U.s.

It Often Precedes Economic Downturn,.

Related Post: