Libor Ois Spread Chart

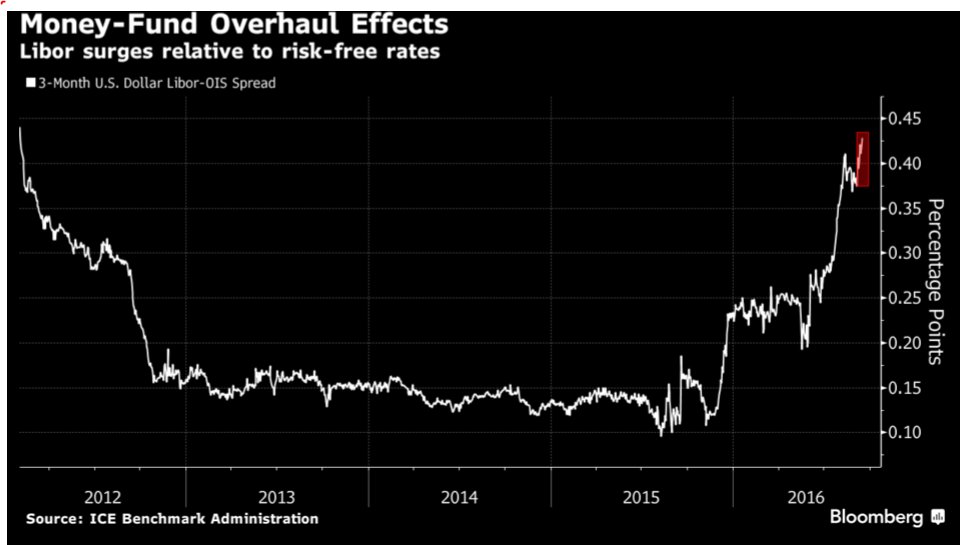

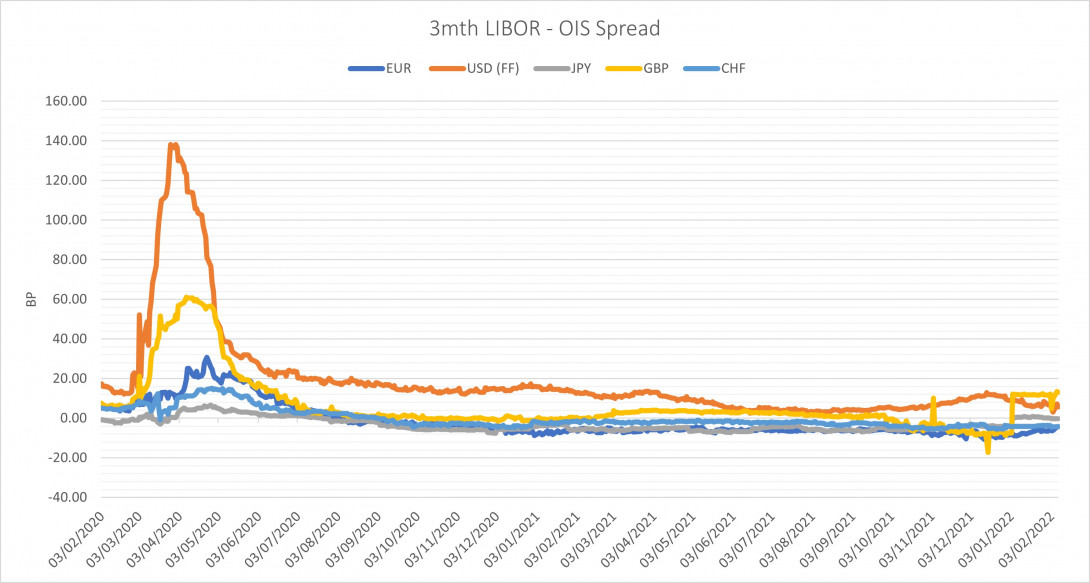

Libor Ois Spread Chart - Web the current 1 month libor rate as of september 2020 is 0.16. Consistent with recent studies, we find that systemic credit and counterparty risks, market liquidity, and volatility are spread determinants. This interactive chart compares 1 month, 3 month, 6 month and 12 month historical dollar libor rates back to 1986. The interest rate spread mainly reflects the counterparty risk indicator in the interbank lending market. The spread between fra and ois represents the trends of borrowing costs. When the interest rate spread widens, it means that the bank believes that the risk of another transaction bank defaulting is increasing, and the lending bank will demand higher interest to compensate for this risk. Many books have been and will be written about these seminal events, but the story can also be told graphically, as the charts and graphs below aim to do. Download, graph, and track economic data. Ois is the overnight index swap rate. According to the british bankers' association, the libor reflects the rate at which panel banks can raise unsecured cash in the interbank lending markets. Many books have been and will be written about these seminal events, but the story can also be told graphically, as the charts and graphs below aim to do. The interest rate spread mainly reflects the counterparty risk indicator in the interbank lending market. Web this interactive chart tracks the daily ted spread (3 month libor / 3 month treasury. Web overnight index swaps (ois) are contracts where overnight interest rates swap for fixed interest rate, referring to us federal funds rates. Download, graph, and track economic data. Web this interactive chart tracks the daily ted spread (3 month libor / 3 month treasury bill) as a measure of the perceived credit risk in the u.s. The interest rate spread. Web this interactive chart tracks the daily ted spread (3 month libor / 3 month treasury bill) as a measure of the perceived credit risk in the u.s. Here's a couple of interesting charts which are behaving in a boring fashion. Web london interbank offered rate. The spread between fra and ois represents the trends of borrowing costs. According to. Ois is the overnight index swap rate. The interest rate spread mainly reflects the counterparty risk indicator in the interbank lending market. This interactive chart compares 1 month, 3 month, 6 month and 12 month historical dollar libor rates back to 1986. Web a measure of stress in u.s. Consistent with recent studies, we find that systemic credit and counterparty. Download, graph, and track economic data. The spread between fra and ois represents the trends of borrowing costs. Here's a couple of interesting charts which are behaving in a boring fashion. Web 1 economic data series with tags: Consistent with recent studies, we find that systemic credit and counterparty risks, market liquidity, and volatility are spread determinants. This interactive chart compares 1 month, 3 month, 6 month and 12 month historical dollar libor rates back to 1986. The spread between fra and ois represents the trends of borrowing costs. Download, graph, and track economic data. Consistent with recent studies, we find that systemic credit and counterparty risks, market liquidity, and volatility are spread determinants. Ois is the. Ois is the overnight index swap rate. Web 1 min read. Web overnight index swaps (ois) are contracts where overnight interest rates swap for fixed interest rate, referring to us federal funds rates. Web london interbank offered rate. This interactive chart compares 1 month, 3 month, 6 month and 12 month historical dollar libor rates back to 1986. Web a measure of stress in u.s. Web the current 1 month libor rate as of september 2020 is 0.16. Many books have been and will be written about these seminal events, but the story can also be told graphically, as the charts and graphs below aim to do. Ois is the overnight index swap rate. Interest rate spreads, 36. The spread between fra and ois represents the trends of borrowing costs. Many books have been and will be written about these seminal events, but the story can also be told graphically, as the charts and graphs below aim to do. Web the current 1 month libor rate as of september 2020 is 0.16. Download, graph, and track economic data.. According to the british bankers' association, the libor reflects the rate at which panel banks can raise unsecured cash in the interbank lending markets. Download, graph, and track economic data. Web *libor is the london interbank offer rate. Consistent with recent studies, we find that systemic credit and counterparty risks, market liquidity, and volatility are spread determinants. Web 1 economic. Ois is the overnight index swap rate. Web overnight index swaps (ois) are contracts where overnight interest rates swap for fixed interest rate, referring to us federal funds rates. Web 1 min read. Web a measure of stress in u.s. Download, graph, and track economic data. When the interest rate spread widens, it means that the bank believes that the risk of another transaction bank defaulting is increasing, and the lending bank will demand higher interest to compensate for this risk. The spread between fra and ois represents the trends of borrowing costs. According to the british bankers' association, the libor reflects the rate at which panel banks can raise unsecured cash in the interbank lending markets. Interest rates > libor rates, fred: Interest rate spreads, 36 economic data series, fred: Web london interbank offered rate. Here's a couple of interesting charts which are behaving in a boring fashion. Web 1 economic data series with tags: Download, graph, and track economic data. Consistent with recent studies, we find that systemic credit and counterparty risks, market liquidity, and volatility are spread determinants. Many books have been and will be written about these seminal events, but the story can also be told graphically, as the charts and graphs below aim to do.

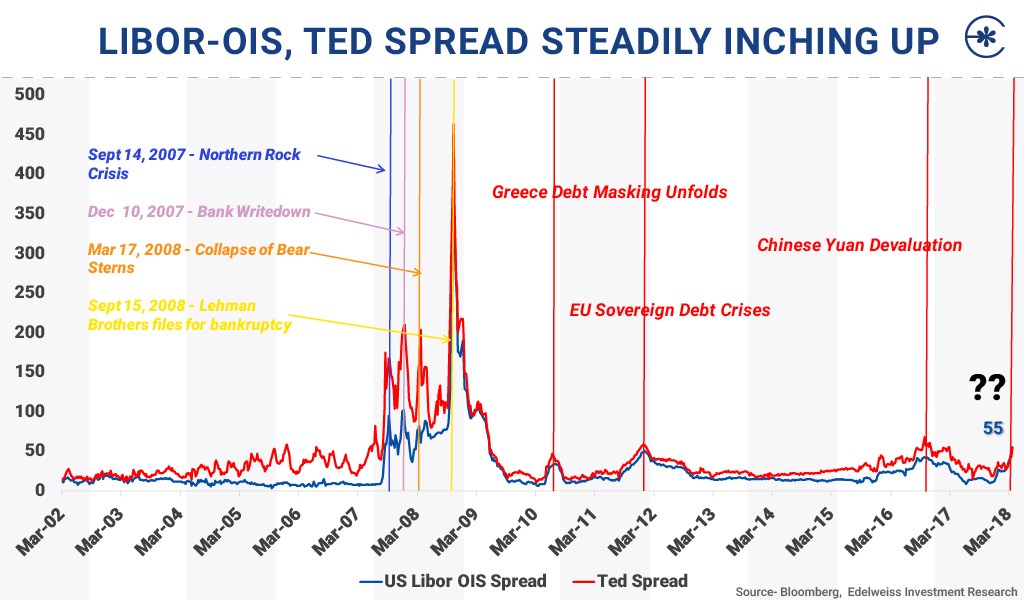

libor ois and ted spread reached 55 highest since the

Actual and fitted spread from a regression of threemonth LiborOIS

LIBOR OIS spread (Bloomberg) Download Scientific Diagram

Ois Libor Spread Chart

U.S. dollar LIBOROIS spreads () and major events Download

ACEMAXXANALYTICS Was macht eigentlich der LiborOIS Spread inzwischen?

Ois Libor Spread Chart

Chart TED Spread and LIBOROIS

Chart us liborois spread

a. 3Month LIBOR Spreads To OIS (Overnight Index Swap, bps) Download

The Interest Rate Spread Mainly Reflects The Counterparty Risk Indicator In The Interbank Lending Market.

This Interactive Chart Compares 1 Month, 3 Month, 6 Month And 12 Month Historical Dollar Libor Rates Back To 1986.

Web This Interactive Chart Tracks The Daily Ted Spread (3 Month Libor / 3 Month Treasury Bill) As A Measure Of The Perceived Credit Risk In The U.s.

Web *Libor Is The London Interbank Offer Rate.

Related Post: