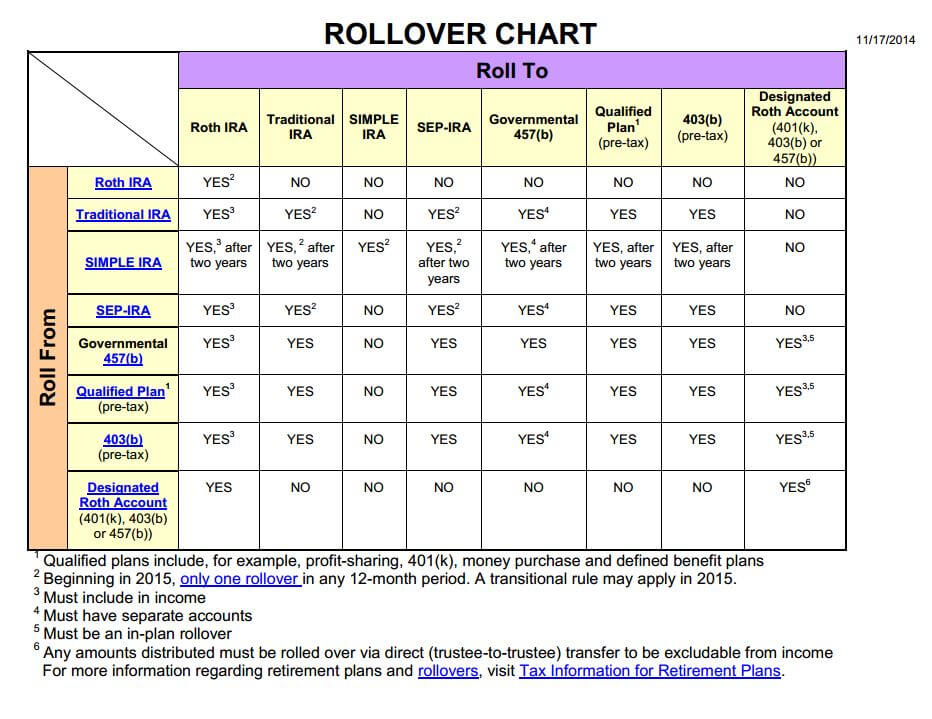

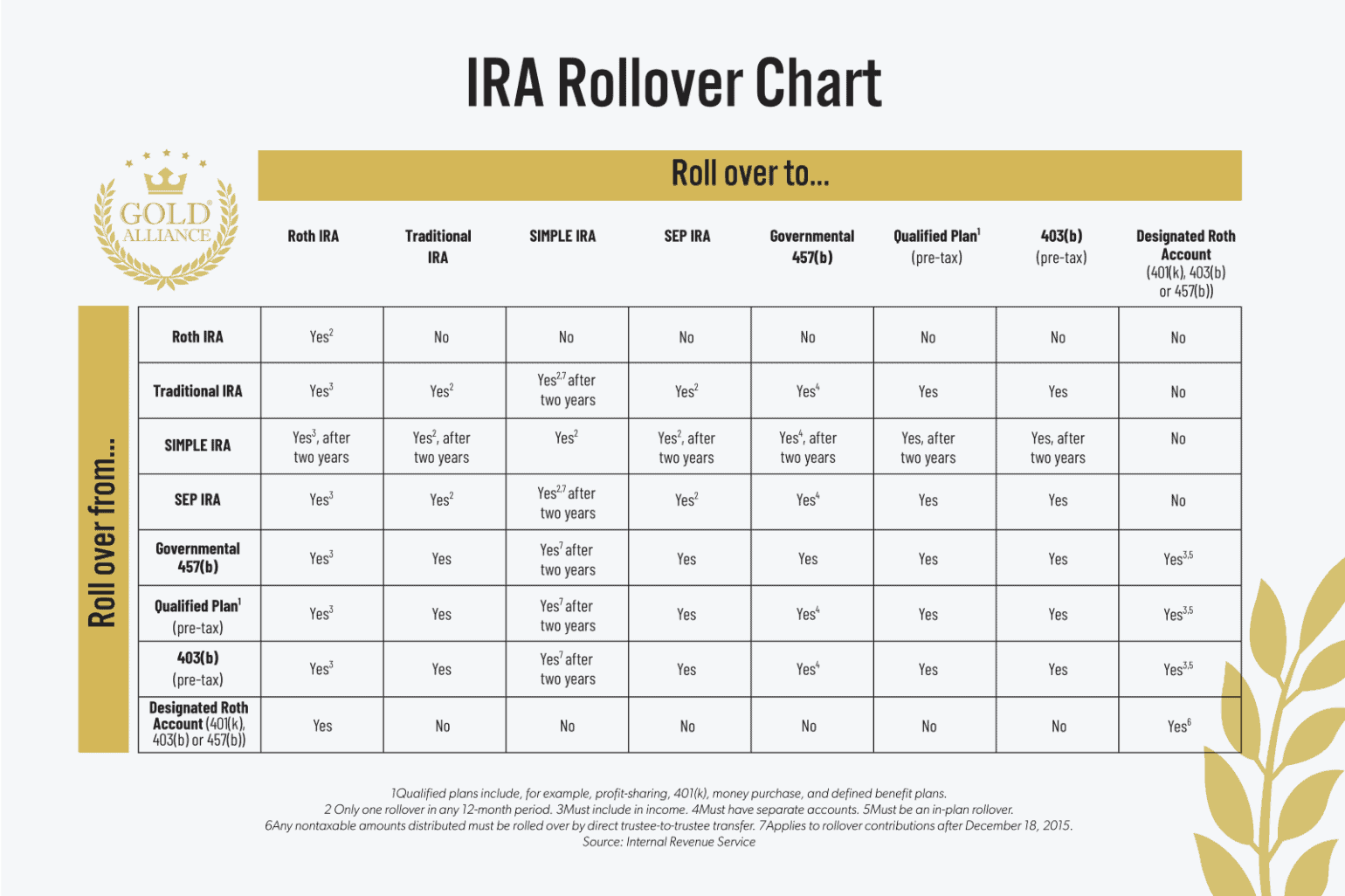

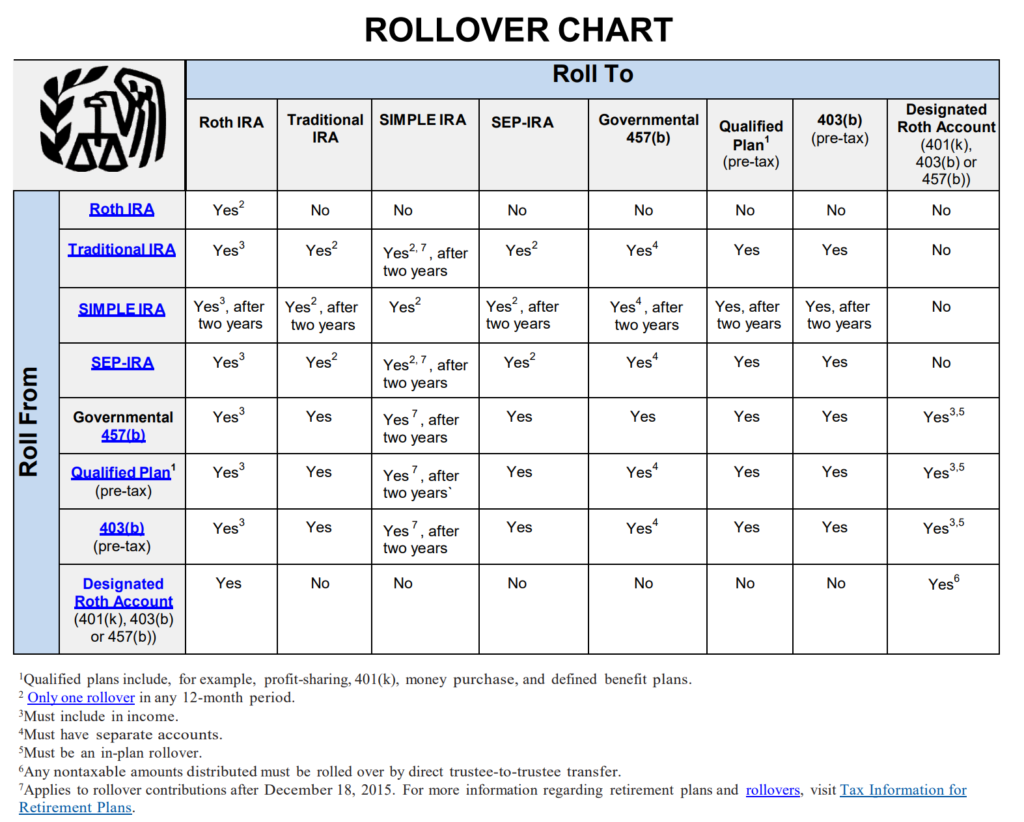

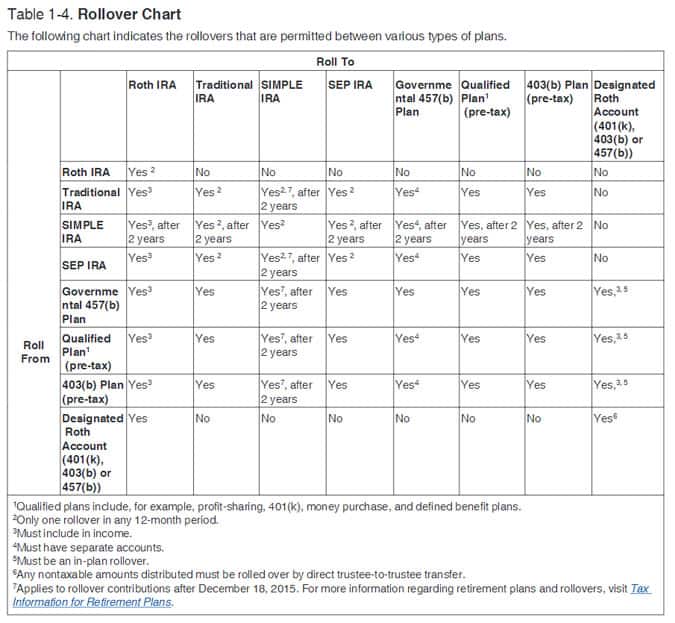

Ira Rollover Chart

Ira Rollover Chart - The chart below shows how the spot price of gold is trending over the year. Web roll over an ira to a 401 (k): See the chart for eligibility, limits, and exceptions for each option. Find out how to roll over funds from a section 529 account to a roth ira and the age requirements for. See a handy chart of the different account types and their rollover options. There are three types of 401 (k) rollovers. If an investor is considering moving assets from one retirement account to another, it is important to understand the rollover process and the rules associated with it. Web learn how to roll over funds from a workplace retirement account into an ira and the benefits and drawbacks of doing so. Web learn how to transfer funds from a retirement account to an ira, and the differences between direct and indirect rollovers. Web learn the benefits and rules of rolling over your retirement account from one plan to another. As always, getting taxes wrong can be costly. Web learn how to transfer funds from a retirement account to an ira, and the differences between direct and indirect rollovers. This article will discuss rollover basics as well as rules associated with rollovers. If an investor is considering moving assets from one retirement account to another, it is important to understand. Web learn how to transfer funds from a retirement account to an ira, and the differences between direct and indirect rollovers. There are three types of 401 (k) rollovers. A rollover ira is a form of funding mechanism. Web learn about the rules and limits for contributing to and deducting traditional and roth iras, as well as the new developments. A rollover ira is a form of funding mechanism. Web 100% free ira rollover. Compare the investment choices, fees, taxes, and withdrawal rules for different types of retirement accounts. Compare different types of ira accounts, see pricing details and find answers to frequently asked questions. Choose between a roth and a traditional ira. Rules regarding rollovers and conversions. 401 (k) rollover to an ira. Web a rollover occurs when you withdraw cash or other assets from one eligible retirement plan and contribute all or part of it, within 60 days, to another eligible retirement plan. Both plans have the same annual contribution. Web three important ira rollover rules to remember. Free storage, maintenance and insurance for up to 3 years. If the income exceeds that amount, you would pay 32% in taxes on the. Web learn about the features, benefits and options of rolling over your retirement assets to a merrill ira. Compare different types of ira accounts, see pricing details and find answers to frequently asked questions. 3 must. Web rollovers (see our rollover chart pdf) the why, what, how, when and where about moving your retirement savings. If an investor is considering moving assets from one retirement account to another, it is important to understand the rollover process and the rules associated with it. Web a couple filing a married joint can stay within the 24% tax rate. Web learn how to transfer money from an old 401 (k) to a roth or traditional ira without paying taxes or penalties. If the income exceeds that amount, you would pay 32% in taxes on the. Web here’s a recent and handy rollover chart by the internal revenue service updated for new rules that may be helpful. The chart below. If an investor is considering moving assets from one retirement account to another, it is important to understand the rollover process and the rules associated with it. Free storage, maintenance and insurance for up to 3 years. Web learn how to roll over your 401 (k) to an ira or a roth ira, and the pros and cons of each. 3 must include in income. Both plans have the same annual contribution. The chart below shows how the spot price of gold is trending over the year. If an investor is considering moving assets from one retirement account to another, it is important to understand the rollover process and the rules associated with it. Web learn how to roll over. Web learn the benefits and rules of rolling over your retirement account from one plan to another. Web learn how to roll over your 401 (k) to an ira or a roth ira, and the pros and cons of each option. Both plans have the same annual contribution. See the irs chart of eligible accounts and the steps to perform. Web learn how to roll over funds from a workplace retirement account into an ira and the benefits and drawbacks of doing so. Web a couple filing a married joint can stay within the 24% tax rate as long as their combined income doesn’t exceed $364,200. There are three types of 401 (k) rollovers. Web 100% free ira rollover. The chart below shows how the spot price of gold is trending over the year. Web learn how to roll over your old 401 (k) or other retirement plan into a schwab ira and avoid taxes and penalties. Web three important ira rollover rules to remember. Rules regarding rollovers and conversions. Web learn about the rules and limits for contributing to and deducting traditional and roth iras, as well as the new developments for 2023 and 2024. Web roll over an ira to a 401 (k): Free storage, maintenance and insurance for up to 3 years. Choose between a roth and a traditional ira. Web learn how to roll over your retirement plan or ira distributions within 60 days to avoid taxable income and additional tax. Find out the differences between direct and indirect rollovers, and the tax implications of each option. If an investor is considering moving assets from one retirement account to another, it is important to understand the rollover process and the rules associated with it. Web learn how to transfer funds from a retirement account to an ira, and the differences between direct and indirect rollovers.

IRA Rollover Chart Where Can You Roll Over Your Retirement Account

Learn the Rules of IRA Rollover & Transfer of Funds

Rollover Rules Chart A Visual Reference of Charts Chart Master

IRA Rollover Chart Where Can You Roll Over Your Retirement Account

IRA Rollover Chart Rules Regarding Rollovers and Conversions AAII

Learn the Rules of IRA Rollover & Transfer of Funds

Follow the Rules When Rolling Over Your EmployerSponsored Retirement

The Ultimate Guide To Easily Roll Over Your Retirement Plan Into An IRA

IRA Rollover Chart

Individual Retirement Accounts (IRAs) Prosperity Financial Group

You Can Roll Your 401 (K) Into Either A Roth Or A Traditional Individual Retirement Account (Ira).

Compare Different Types Of Ira Accounts, See Pricing Details And Find Answers To Frequently Asked Questions.

Both Plans Have The Same Annual Contribution.

Web A Rollover Occurs When You Withdraw Cash Or Other Assets From One Eligible Retirement Plan And Contribute All Or Part Of It, Within 60 Days, To Another Eligible Retirement Plan.

Related Post: