Iowa Sales Tax Chart

Iowa Sales Tax Chart - Find your iowa combined state and local tax rate. Iowa law imposes both a sales tax and a use tax. Web iowa 6% sales tax chart. Groceries and prescription drugs are exempt from the iowa sales tax. Click on any county for detailed sales tax rates, or see a full list of iowa counties here. Iowa sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache. $ state & local sales tax rates, as of january 1, 2023. Web the base state sales tax rate in iowa is 6%. $ iowa sales tax table at 7% prices from $1.00 to $59.50. Average sales tax (with local): Depending on the local jurisdiction, the total tax rate can be as high as 7%. Web to determine the 2024 ia sales tax rate, start with the statewide sales tax rate of 6%. $ iowa sales tax table at 7% prices from $1.00 to $59.50. Web iowa sales tax calculator. $ state & local sales tax rates, as of january. Web currently, combined sales tax rates in iowa range from 6 percent to 8 percent, depending on the location of the sale. Municipal governments in iowa are allowed to collect local sales taxes, so the total sales tax rate varies between cities, counties, and special districts. Web to determine the 2024 ia sales tax rate, start with the statewide sales. Web this interactive sales tax map map of iowa shows how local sales tax rates vary across iowa's 99 counties. List of local sales tax rates in iowa. Counties and cities can charge an additional local sales tax of up to 1%, for a maximum possible combined sales tax of 7% Iowa sales tax rates vary depending on which county. $ state & local sales tax rates, as of january 1, 2023. Iowa law imposes both a sales tax and a use tax. Product / service net sale amount ($) select location in iowa. Iowa sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache. Web iowa. Avoidance of sales tax is most likely to occur in areas where there is a significant difference between jurisdictions’ rates. Iowa sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache. Local tax rates in iowa range from 0% to 2%, making the sales tax range in. Discover and explore more sales tax resources for the state of iowa in this page. Web may 10, 2023 • updated on may 10, 2023. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Groceries and prescription drugs are exempt from the iowa sales. Web our free online iowa sales tax calculator calculates exact sales tax by state, county, city, or zip code. $ state & local sales tax rates, as of january 1, 2023. Web iowa sales tax calculator. Iowa has state sales tax of 6% ,. Add these local rates to the state rate to get the total sales tax rate for. Discover and explore more sales tax resources for the state of iowa in this page. Depending on the local jurisdiction, the total tax rate can be as high as 7%. Groceries and prescription drugs are exempt from the iowa sales tax. So, you need to know about sales tax in the hawkeye state. Web 2024 iowa sales tax table. Product / service net sale amount ($) select location in iowa. Web may 10, 2023 • updated on may 10, 2023. So, you need to know about sales tax in the hawkeye state. List of local sales tax rates in iowa. Certain business activities create physical nexus. Iowa sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache. Web our free online iowa sales tax calculator calculates exact sales tax by state, county, city, or zip code. Discover and explore more sales tax resources for the state of iowa in this page. Product /. Disaster emergency tax penalty relief. Idr releases new tax guidance: Local tax rates in iowa range from 0% to 2%, making the sales tax range in iowa 6% to 8%. Find your iowa combined state and local tax rate. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Depending on the local jurisdiction, the total tax rate can be as high as 7%. Iowa law imposes both a sales tax and a use tax. The rate for both is 6%, though an additional 1% applies to most sales subject to sales tax, as many. Web the iowa state sales tax rate is 6%, and the average ia sales tax after local surtaxes is 6.78%. Certain business activities create physical nexus. You can use our iowa sales tax calculator to look up sales tax rates in iowa by address / zip code. Web 2024 iowa sales tax table. Web our free online iowa sales tax calculator calculates exact sales tax by state, county, city, or zip code. Web currently, combined sales tax rates in iowa range from 6 percent to 8 percent, depending on the location of the sale. Do you have physical or economic nexus in iowa? Click on any county for detailed sales tax rates, or see a full list of iowa counties here.

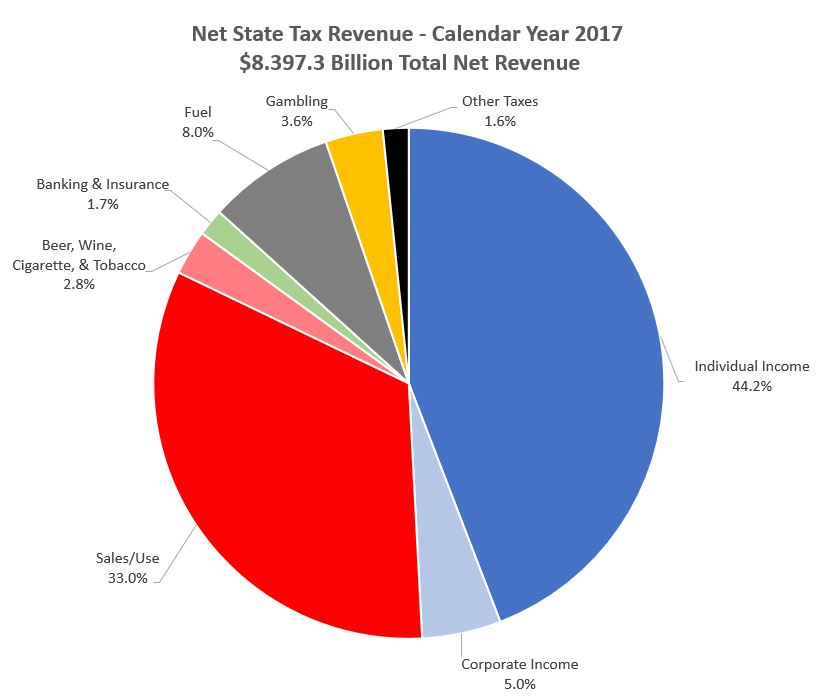

Iowa's Net Revenue Increases & DM Register Proposes Tax Hike Iowans

State Sales Tax State Sales Tax Iowa

Sales Tax Expert Consultants Sales Tax Rates by State State and Local

Payment Options for Property Taxes Black Hawk County IA

Form 31092 Iowa Sales Tax Annual Return 2002 printable pdf download

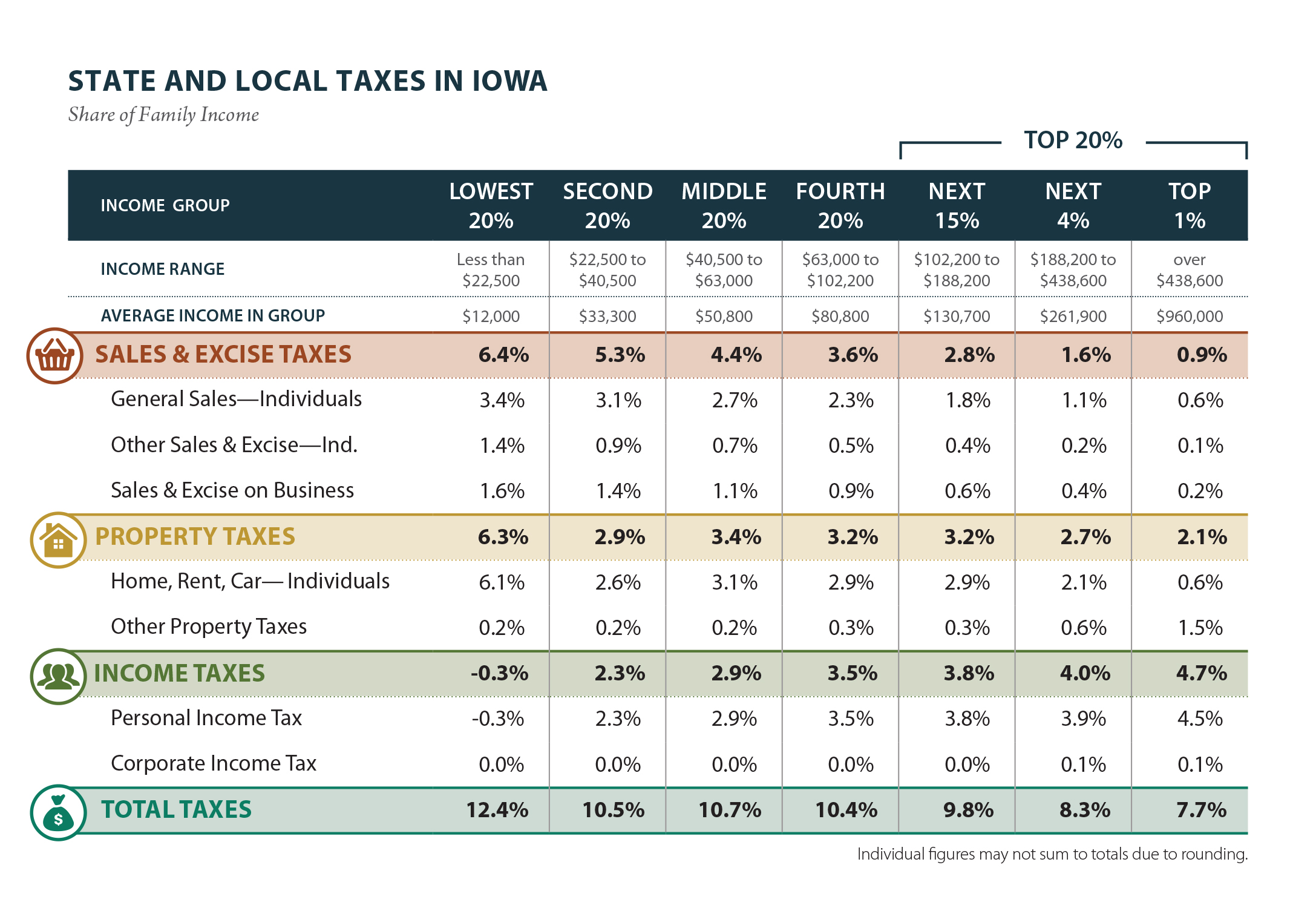

Iowa Who Pays? 6th Edition ITEP

Printable Sales Tax Chart Printable World Holiday

Iowa Sales Tax Annual Return printable pdf download

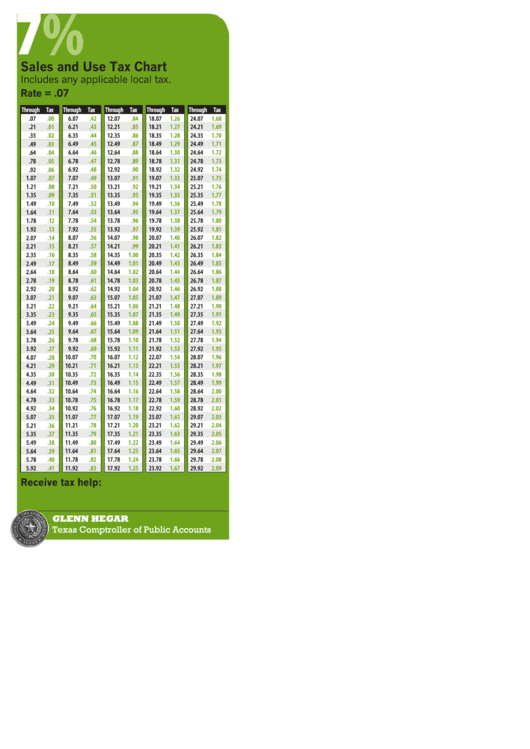

7 Sales And Use Tax Chart Texas Comptroller printable pdf download

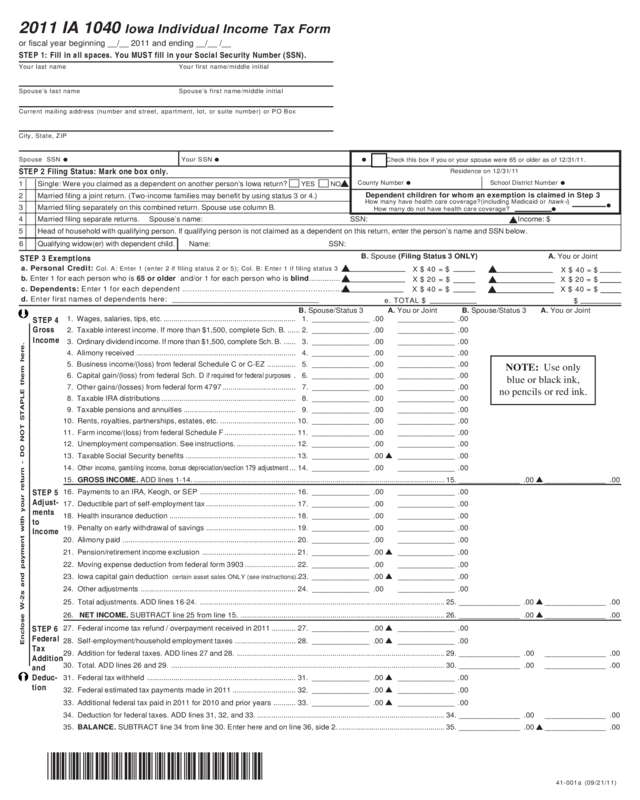

Iowa Individual Tax Form 2007 Edit, Fill, Sign Online Handypdf

Iowa Sales Tax Rates & Calculations In 2023.

Web The Base State Sales Tax Rate In Iowa Is 6%.

As A Business Owner Selling Taxable Goods Or Services, You Act As An Agent Of The State Of Iowa By Collecting Tax From Purchasers And Passing It Along To The Appropriate Tax Authority.

Web Iowa Sales Tax Calculator.

Related Post: