Investment Pie Chart

Investment Pie Chart - Web the pie chart on the left shows, at a glance, in which asset classes you are invested and what share they make up in your portfolio. Get the information you need to help keep your portfolio on track. Create a pie chart where each slice represents an investment, labeled with its name and percentage. Web asset allocation simply refers to the specific mix or distribution of different asset types in one's investment portfolio based on personal goals, risk tolerance, and time horizon. Web portfolio charts shares interactive investing charts that illustrate everything from accumulation ranges to withdrawal rates for any asset allocation. To find the asset allocation that's right for your investment portfolio, it's important to have a clear understanding of your goals, time frame, and risk tolerance. Web an m1 pie is a compelling visual representation of your investment pies. Track our top geopolitical risks and their potential impact on markets. Synthetics to build positions with a seat belt. Enter the price at which you bought the investment. And in pie chart living color. Merely being invested in different types of stocks and bonds isn’t good enough anymore. Why bonds’ past performance can’t equal future results. We use a monte carlo simulation model to calculate the expected returns of 10,000 portfolios for each risk profile. Web portfolio charts shares interactive investing charts that illustrate everything from accumulation ranges. Get the information you need to help keep your portfolio on track. Track the current market price of your investment. Build a solid investment strategy to help realize your goals—no matter what the market does. Select the right type of chart that aligns with your strategy and time horizon. Track our top geopolitical risks and their potential impact on markets. Build a solid investment strategy to help realize your goals—no matter what the market does. Create a pie chart where each slice represents an investment, labeled with its name and percentage. Enter the name or symbol of your investment. Web portfolio charts shares interactive investing charts that illustrate everything from accumulation ranges to withdrawal rates for any asset allocation. Most. Our interactive charts enable investors to go deep on markets, geopolitics and economics, and quickly zero in on the information they need. It is hard not to be confident. Goals refer to things you want to do or buy, such as a downpayment on a house and/or retiring at age 55. Web an asset allocation model helps investors understand the. Easy to understand and visualize. Partners on this page provide us earnings. This allows you to make educated decisions on where you are strong and need to invest additional funds, or where you are weak and perhaps need to reallocate. Goals refer to things you want to do or buy, such as a downpayment on a house and/or retiring at. Pie charts can help show percentages and sizes of different categories, but they can be ambiguous when representing data when there are many categories and many varying data points. M1 is a brokerage with no regular investment fees and a delectable twist. Specify the number of units or shares purchased. Each type of security offers contrasting. Diversification can help manage. Web asset allocation simply refers to the specific mix or distribution of different asset types in one's investment portfolio based on personal goals, risk tolerance, and time horizon. Our interactive charts enable investors to go deep on markets, geopolitics and economics, and quickly zero in on the information they need. Get the information you need to help keep your portfolio. It is hard not to be confident. Web asset allocation simply refers to the specific mix or distribution of different asset types in one's investment portfolio based on personal goals, risk tolerance, and time horizon. Why sequence of returns matter. Web portfolio charts shares interactive investing charts that illustrate everything from accumulation ranges to withdrawal rates for any asset allocation.. And in pie chart living color. M1 is a brokerage with no regular investment fees and a delectable twist. Web the pie chart shows you how your company retirement plan account is currently invested in a mixture of stocks, bonds, and money market funds. Get the information you need to help keep your portfolio on track. Enter the price at. Select the right type of chart that aligns with your strategy and time horizon. M1 is a brokerage with no regular investment fees and a delectable twist. Web what’s in your pie chart? Web the guide to diversification. Web the pie chart displays the relationship between a category of data. Our interactive charts enable investors to go deep on markets, geopolitics and economics, and quickly zero in on the information they need. Web an m1 pie is a compelling visual representation of your investment pies. Learn how your portfolio’s returns compare to market benchmarks over time. Each type of security offers contrasting. Track our top geopolitical risks and their potential impact on markets. What if we go sideways or down? We use a monte carlo simulation model to calculate the expected returns of 10,000 portfolios for each risk profile. Volatility is an emerging asset class. Synthetics to build positions with a seat belt. Diversification can help manage risk. Web the pie chart displays the relationship between a category of data. Web the pie chart shows you how your company retirement plan account is currently invested in a mixture of stocks, bonds, and money market funds. Select the right type of chart that aligns with your strategy and time horizon. M1 is a brokerage with no regular investment fees and a delectable twist. How do i interpret the new composition bar chart? Select a benchmark that can help put the investment under analysis into context.

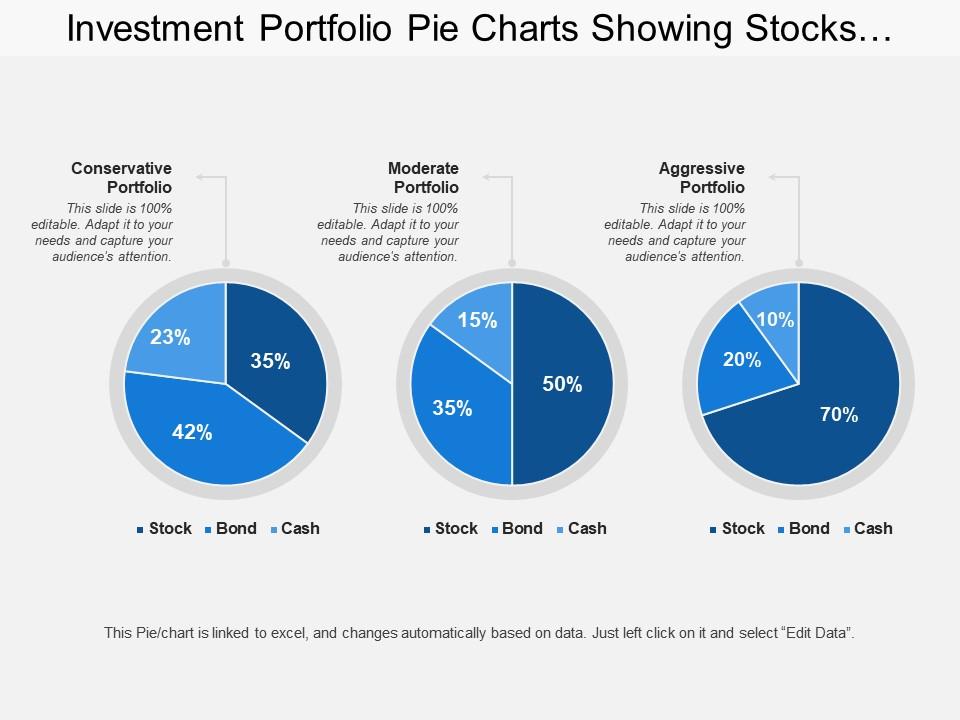

Investment Portfolio Pie Charts Showing Stocks Bonds Cash With

Investment Pie Charts CAF AmericaCAF America

Investment Pie Chart. stock vector. Illustration of success 127900568

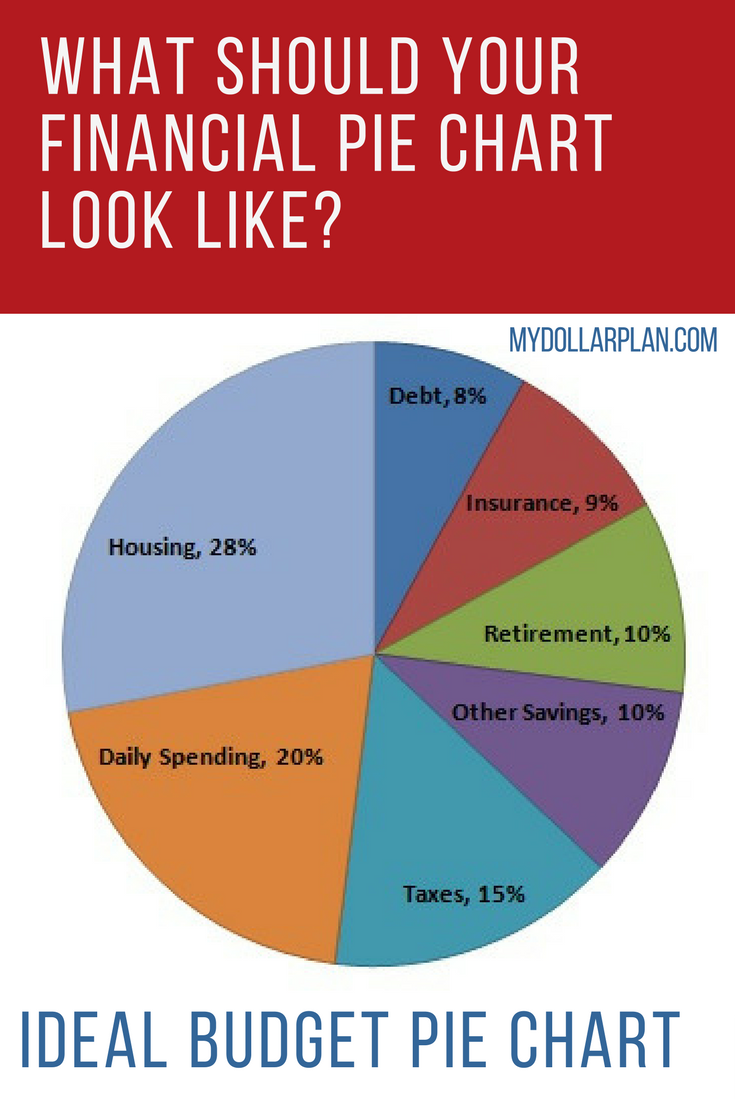

Financial Pie Chart What Should Your Ideal Budget Pie Chart Look Like?

45 Free Pie Chart Templates (Word, Excel & PDF) ᐅ TemplateLab

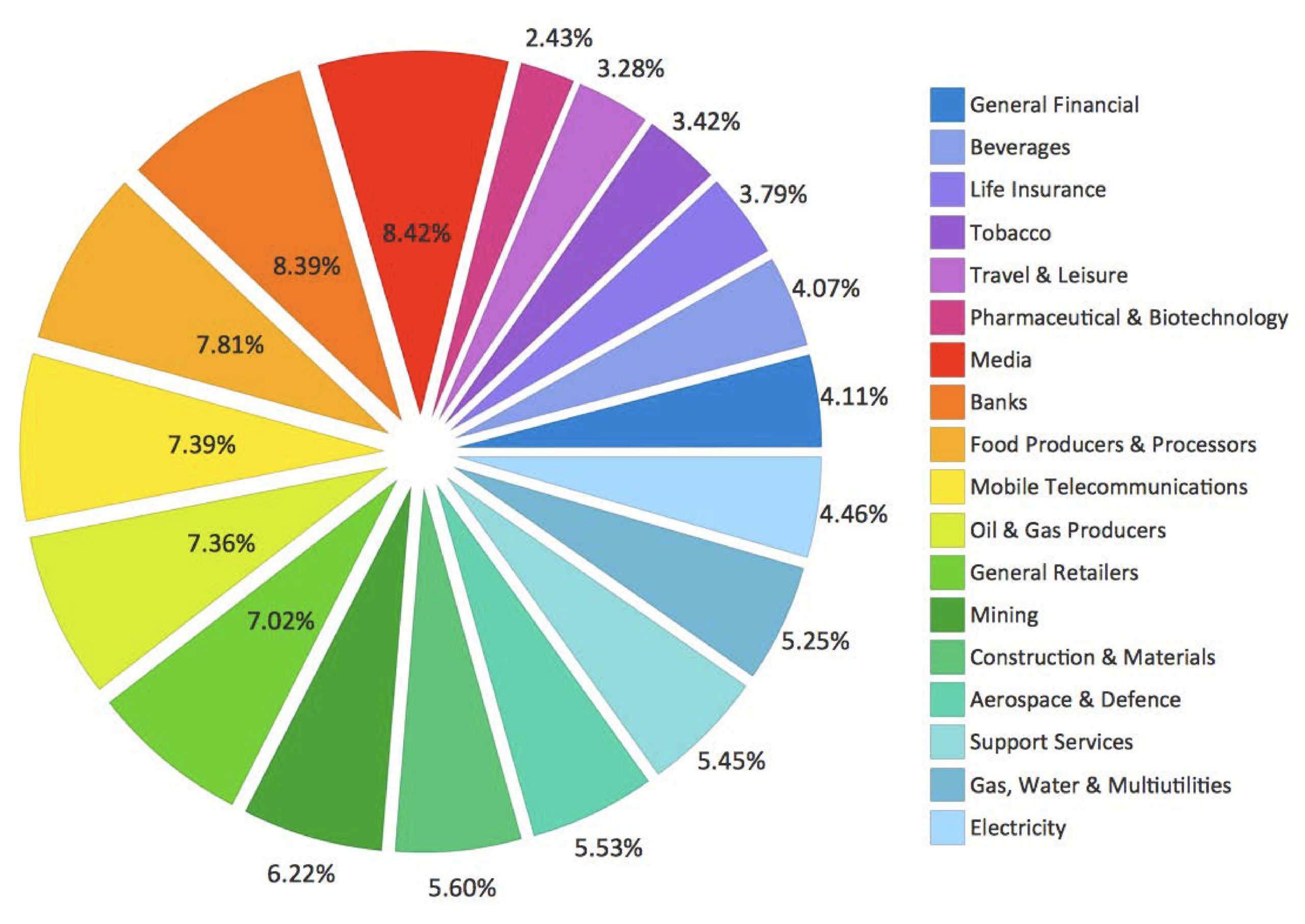

How To Invest Your 200,000,000 Portfolio

How To Invest Your Money. Investing Pie Chart. Stock Vector

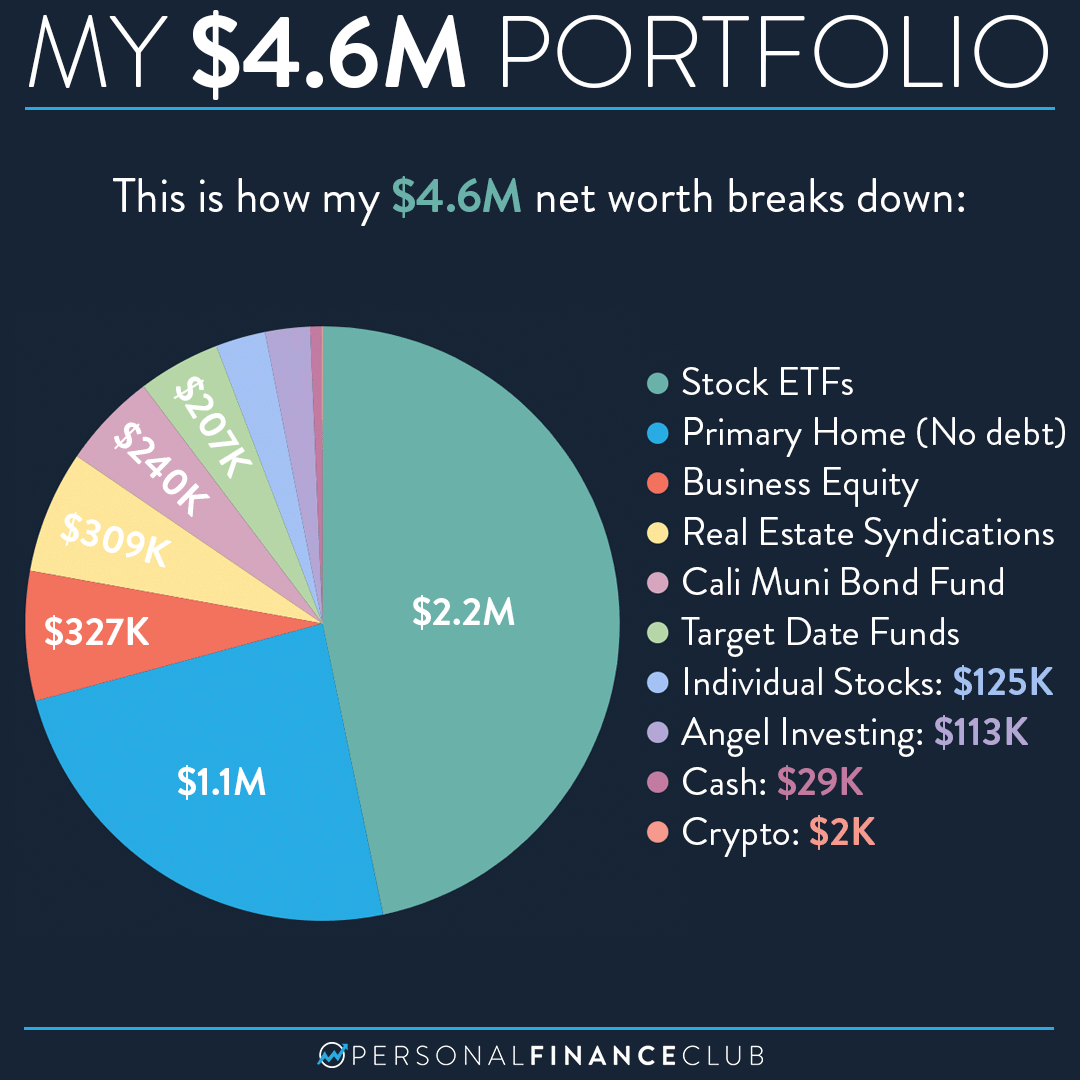

My 4.6M Net Worth Portfolio Breakdown Pie Chart Personal Finance Club

Asset allocation pie chart graph financial Vector Image

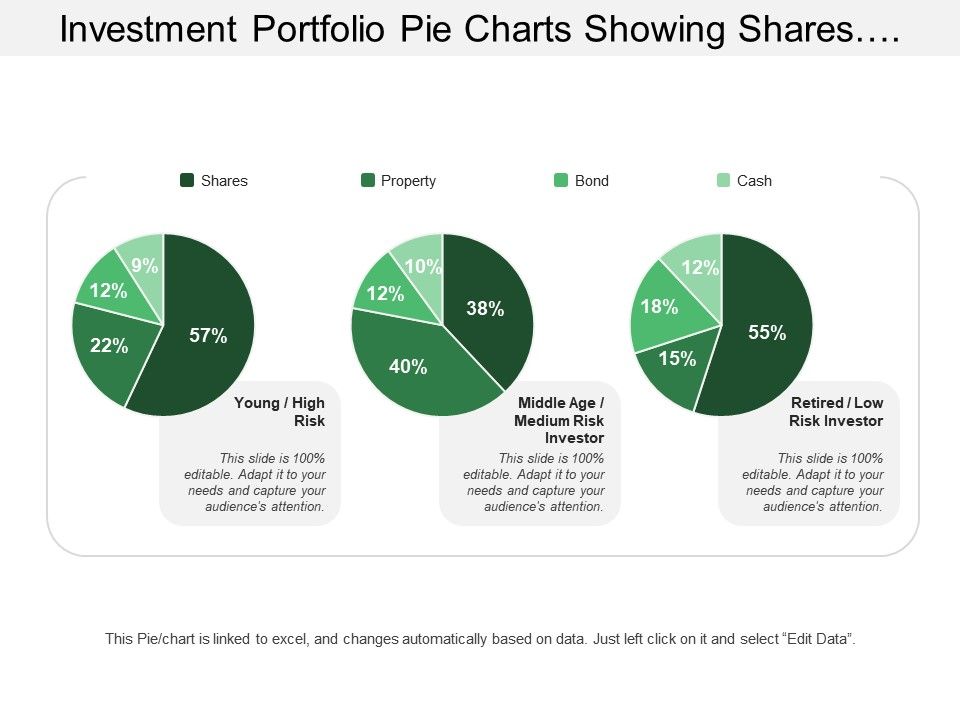

Investment Portfolio Pie Charts Showing Shares Property Bond Cash Risk

The Graph On The Right Shows How Your Asset Allocation Has Changed Over Time.

Many Investors Split Their Portfolios Between Stocks, Bonds, And Cash Because It's One Way To Balance Growth And Risk Versus Income And Safety.

List All Your Investments And Their Respective Values.

Web We Use Historical Returns And Standard Deviations Of Stocks, Bonds And Cash To Simulate What Your Return May Be Over Time.

Related Post: