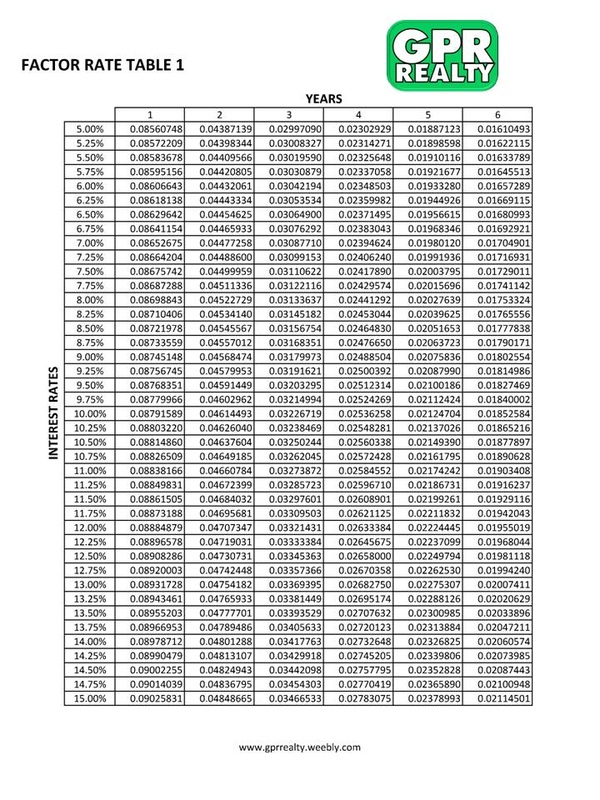

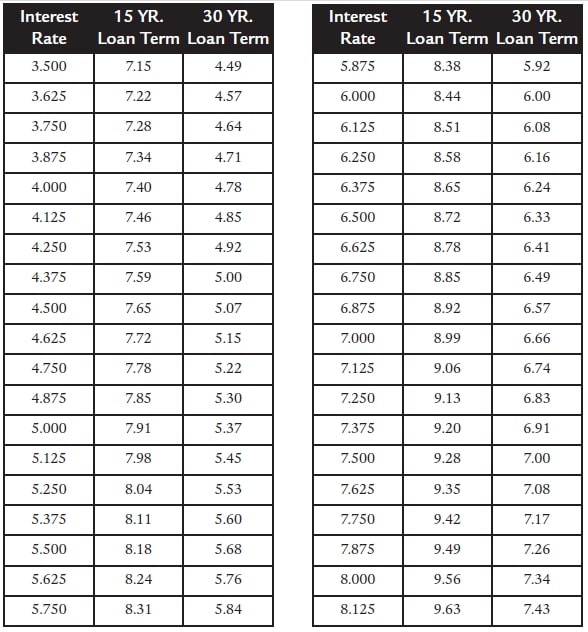

Interest Rate Factor Chart

Interest Rate Factor Chart - See an example and a printable table for different interest. Web view current mortgage rates from multiple lenders at realtor.com®. Web current mortgage interest rates chart. The interest rate is the amount a lender charges a borrower and is. Web compute the interest rate. The first step is determining the interest rate you wish to convert into a money factor. Web updated february 23, 2024. Web compound interest tables 277 table c.2 0.50% compound interest factors 0.50% single payment uniform payment series compound present sinking capital. Factor rate vs interest rate. In this example, we will take 20% as the interest. Web find the factor for the interest rate and number of years of your loan to calculate a fully amortized monthly payment. How does a factor rate work for small businesses? Web compound interest tables 277 table c.2 0.50% compound interest factors 0.50% single payment uniform payment series compound present sinking capital. The interest rate calculator determines real interest rates. Web 58 rows this chart covers interest rates from 1% to 7.875%, and loan terms of 15 and. Web interest principal ending balance; Web an interest rate factor chart, also called rate factor sheet, lists precalculated factors that help you figure monthly payments of principal and interest as. Web factor rates, like interest rates, represent the cost of your funding.. (f p, i, ∞) =∞ (a f, i, ∞) = 0 (p f, i, ∞). Web compute the interest rate. See an example and a printable table for different interest. Web factor rates, like interest rates, represent the cost of your funding. Factor rate vs interest rate. Web easily compute for monthly amortization payments with these factor rates, for annual interest rates from 1% to 20% per year, for 1 to 30 year payment terms. Web current mortgage interest rates chart. (f p, i, ∞) =∞ (a f, i, ∞) = 0 (p f, i, ∞). The loan factor formula is x=y*f, where y is the principal. Web amortization chart monthly payment per $1,000 of mortgage rate interest only 10 year 15 year 20 year 25 year 30 year 40 year 2.000 0.16667 9.20135 6.43509 5.05883. (f p, i, ∞) =∞ (a f, i, ∞) = 0 (p f, i, ∞). Web view current mortgage rates from multiple lenders at realtor.com®. For example, it can calculate interest.. Web most factor rates are between 1.1 and 1.5. In this example, we will take 20% as the interest. The loan factor formula is x=y*f, where y is the principal of the loan, f is the factor, and x is the final principal. For example, it can calculate interest. The interest rate is the amount a lender charges a borrower. The interest rate calculator determines real interest rates on loans with fixed terms and monthly payments. Web a chart to calculate monthly principal and interest payment for a 15 or 30 year loan based on interest rate and loan amount. Web current mortgage interest rates chart. Web compound interest tables appendix b 559 values of interest factors when n equals. Web find out what factor rates are and how they’re different from interest, and use our factor rate calculators to estimate the cost of your next business loan. In this example, we will take 20% as the interest. Web 58 rows this chart covers interest rates from 1% to 7.875%, and loan terms of 15 and. Web factor rates, like. The first step is determining the interest rate you wish to convert into a money factor. Web an interest rate factor chart, also called rate factor sheet, lists precalculated factors that help you figure monthly payments of principal and interest as. However, instead of being expressed as a percentage, factor rates are expressed as a decimal. The interest rate calculator. The interest rate is the amount a lender charges a borrower and is. The first step is determining the interest rate you wish to convert into a money factor. Web most factor rates are between 1.1 and 1.5. Web an interest rate factor chart, also called rate factor sheet, lists precalculated factors that help you figure monthly payments of principal. Web find the factor for the interest rate and number of years of your loan to calculate a fully amortized monthly payment. Web updated february 23, 2024. See how to use the chart with. The first step is determining the interest rate you wish to convert into a money factor. Web most factor rates are between 1.1 and 1.5. Web factor rates, like interest rates, represent the cost of your funding. The interest rate is the amount a lender charges a borrower and is. Web find out what factor rates are and how they’re different from interest, and use our factor rate calculators to estimate the cost of your next business loan. See an example and a printable table for different interest. Web interest principal ending balance; Web 58 rows this chart covers interest rates from 1% to 7.875%, and loan terms of 15 and. However, instead of being expressed as a percentage, factor rates are expressed as a decimal. (f p, i, ∞) =∞ (a f, i, ∞) = 0 (p f, i, ∞). The loan factor formula is x=y*f, where y is the principal of the loan, f is the factor, and x is the final principal. Web factor rates — which typically range from 1.1 to 1.5 — are multiplied by your loan amount to calculate the total amount you’ll need to pay back to the lender. How does a factor rate work for small businesses?

Factor Rate Table

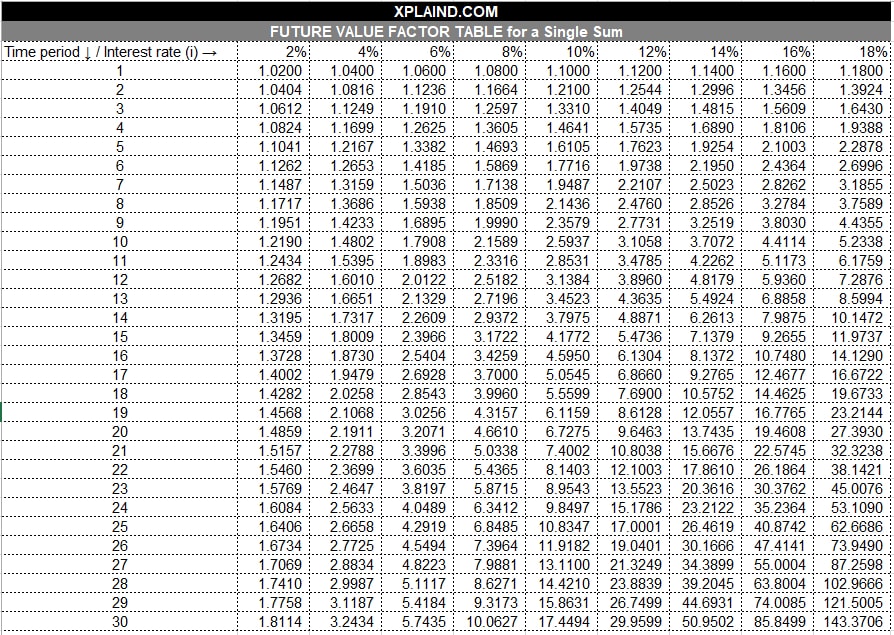

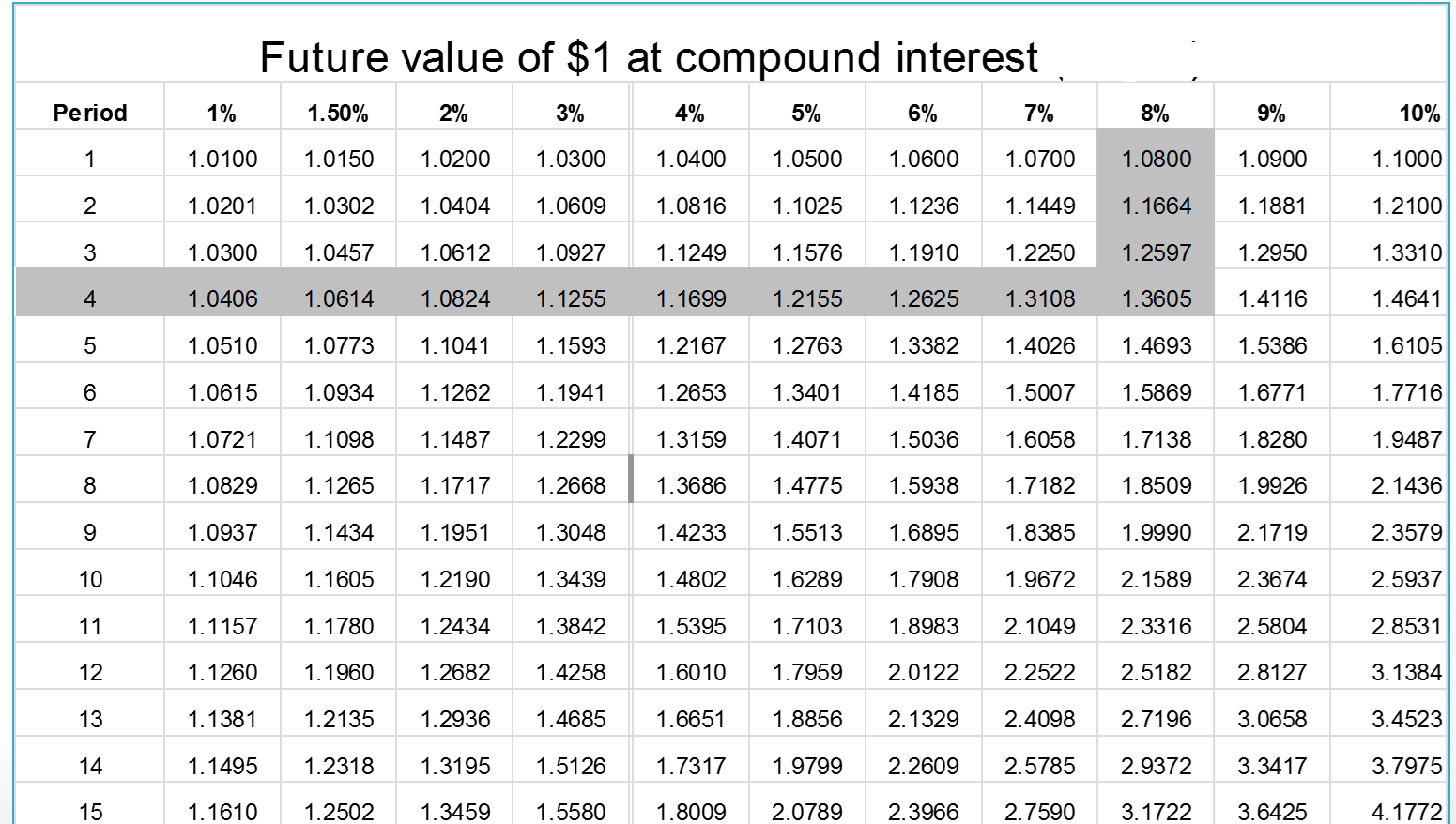

Present and Future Value Factors Tables Online Technical Discussion

Present Value Interest Factor Annuity Table Pdf Bruin Blog

Principal And Interest Factor Chart

Future Value (Interest) Factor Tables What are they and how to use

Compound interest factor table ahyaksarwono

Present Value Interest Factor Annuity Table Pdf Bruin Blog

Compound Interest Factor Table.pdf

Present Value Interest Factor Annuity Table Pdf Bruin Blog

How to figure a monthly mortgage payment

In This Example, We Will Take 20% As The Interest.

Web Compound Interest Tables Appendix B 559 Values Of Interest Factors When N Equals Infinity Single Payment:

Web Amortization Chart Monthly Payment Per $1,000 Of Mortgage Rate Interest Only 10 Year 15 Year 20 Year 25 Year 30 Year 40 Year 2.000 0.16667 9.20135 6.43509 5.05883.

Web View Current Mortgage Rates From Multiple Lenders At Realtor.com®.

Related Post: