High Yield Spread Chart

High Yield Spread Chart - Interactive chart for spdr bloomberg. All bonds in this comparison have long durations, making the main differentiator the underlying credit risk. Web earnings and spread reflects which asset class is more expensive, while dividend and bond yield spread can help investors identify optimal timing to increase/reduce their exposure to stocks or bonds. Web 26 rows 9.03% for may 24 2024. Web our dynamic yield curve tool shows the rates for 3 months, 2 years, 5 years, 7 years, 10 years, 20 years, and 30 years. May 30, 2024 9:00 am cdt. This is lower than the long term average of 5.88%. This data represents the ice bofa us high yield index value, which tracks the performance of us dollar denominated below investment grade rated corporate debt publicly issued in the us domestic market. 1y | 5y | 10y | max. Web 94.28 +0.33 (+0.35%) at close: Data in this graph are copyrighted. View and export this data back to 1996. View and export this data back to 1997. Closing index values, return on investment and yields paid to. Web the below chart shows the recent history of junk bond rates compared to the 10 year us treasury bond. Web market yield on u.s. This is lower than the long term average of 5.34%. Web the 2s10s is the most quoted yield curve spread, but many other spreads are used to measure the shape and slope of the yield curve. Interactive chart for spdr bloomberg. 2s10s 3m10y 2s30s 2s5s 1s5s 10s30s May 24 at 7:22 pm edt. All bonds in this comparison have long durations, making the main differentiator the underlying credit risk. Web the 2s10s is the most quoted yield curve spread, but many other spreads are used to measure the shape and slope of the yield curve. The chart shows the spread between the yield of the j.p. Web. This is lower than the long term average of 5.34%. Web 3.11% for may 24 2024. This data represents the ice bofa us high yield index value, which tracks the performance of us dollar denominated below investment grade rated corporate debt publicly issued in the us domestic market. The credit spreads tend to widen in economic recessions and indicate an. Web 26 rows 9.03% for may 24 2024. May 24, 2024 9:38 am cdt. Closing index values, return on investment and yields paid to. Web the 2s10s is the most quoted yield curve spread, but many other spreads are used to measure the shape and slope of the yield curve. This page looks at high yield bonds. The vertical axis of a yield curve chart shows the yield, while the horizontal axis shows the maturity of the bonds (often converted into months in order to get a proper scaling on the chart). Web earnings and spread reflects which asset class is more expensive, while dividend and bond yield spread can help investors identify optimal timing to increase/reduce. 1y | 5y | 10y | max. Closing index values, return on investment and yields paid to. Web 94.28 +0.33 (+0.35%) at close: The credit spreads tend to widen in economic recessions and indicate an increased risk of default as well as reduced liquidity in the market. Web the 2s10s is the most quoted yield curve spread, but many other. Web 3.11% for may 24 2024. Web market yield on u.s. Below are charts of several common yield curve spreads: This is lower than the long term average of 5.34%. 1y | 5y | 10y | max. Web the 2s10s is the most quoted yield curve spread, but many other spreads are used to measure the shape and slope of the yield curve. Web earnings and spread reflects which asset class is more expensive, while dividend and bond yield spread can help investors identify optimal timing to increase/reduce their exposure to stocks or bonds. Closing index values,. May 24, 2024 9:38 am cdt. Closing index values, return on investment and yields paid to. Web market yield on u.s. 1y | 5y | 10y | max. Web the below chart shows the recent history of junk bond rates compared to the 10 year us treasury bond. Federal reserve bank of st. Web the ice bofa high yield master ii oas uses an index of bonds that are below investment grade (those rated bb or below). 1y | 5y | 10y | max. Data in this graph are copyrighted. 1y | 5y | 10y | max. Web 3.11% for may 24 2024. Below are charts of several common yield curve spreads: Bank of america merrill lynch. View and export this data back to 1997. This data represents the ice bofa us high yield index value, which tracks the performance of us dollar denominated below investment grade rated corporate debt publicly issued in the us domestic market. 2s10s 3m10y 2s30s 2s5s 1s5s 10s30s Web as an example, the us ccc credit spread is calculated as follows: This is lower than the long term average of 5.88%. Web earnings and spread reflects which asset class is more expensive, while dividend and bond yield spread can help investors identify optimal timing to increase/reduce their exposure to stocks or bonds. Interactive chart for spdr bloomberg. View and export this data back to 1996.

What HighYield Spreads Signal About U.S. Equities Bloomberg

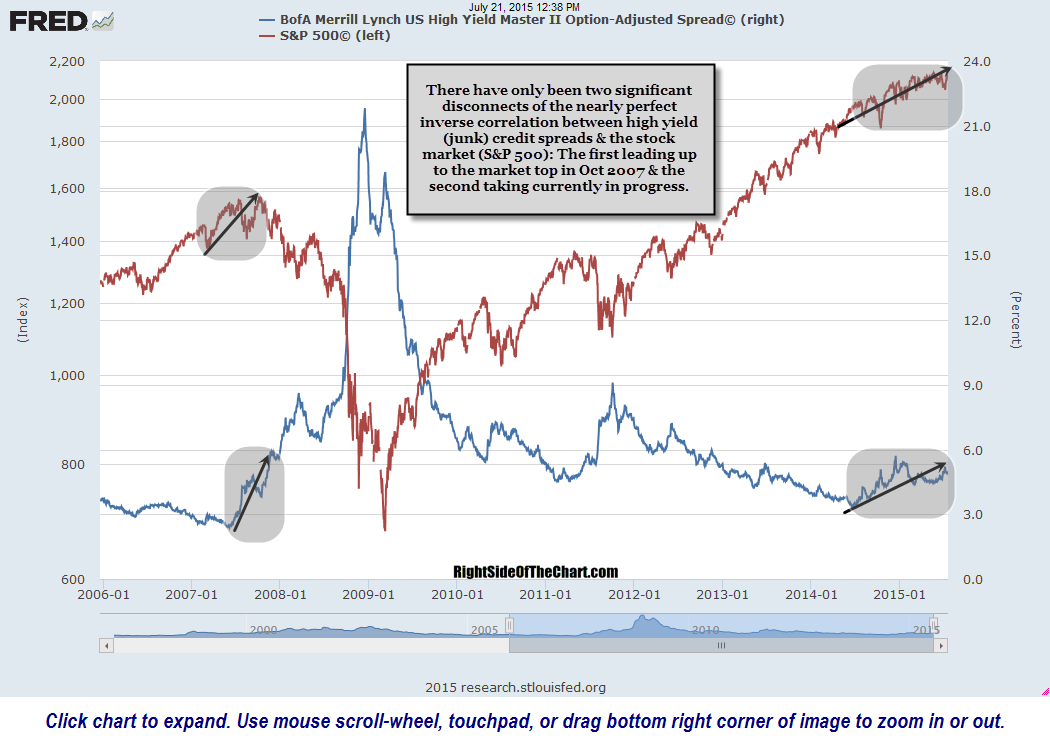

US Equity Market Overview (video + static charts) Right Side Of The Chart

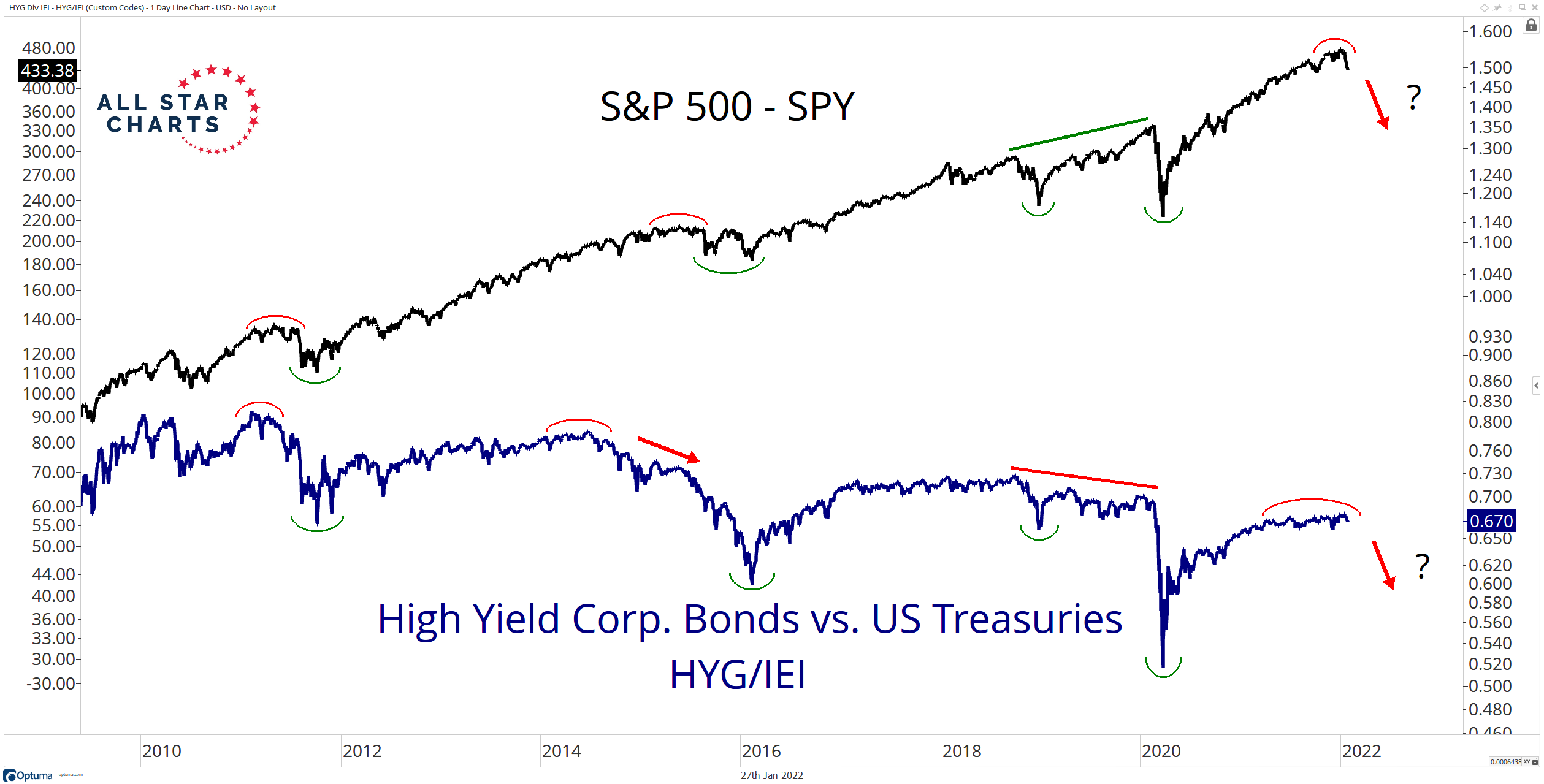

Breaking Down Credit Spreads All Star Charts

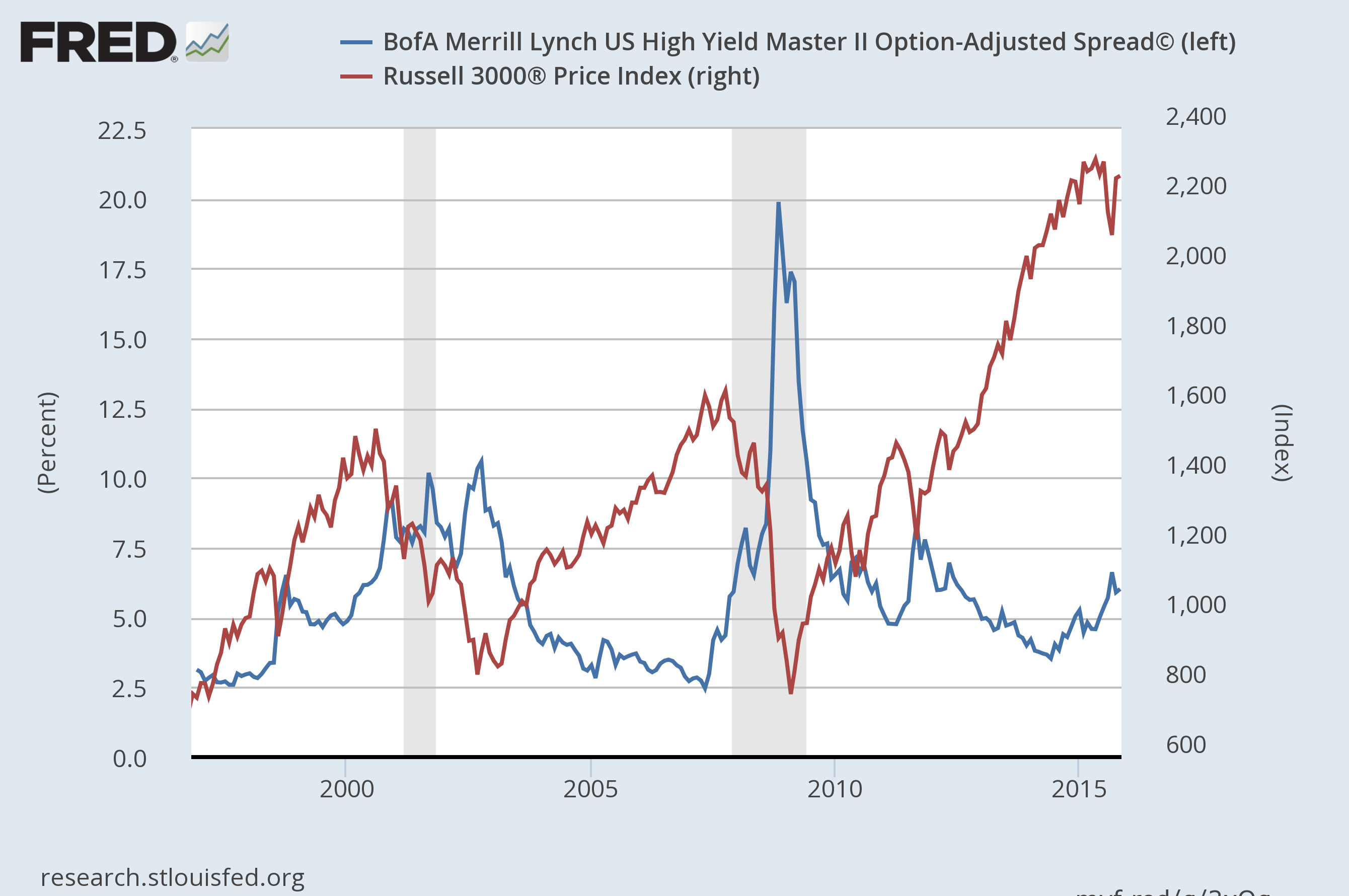

ICE BofA US High Yield Index OptionAdjusted Spread (FREDBAMLH0A0HYM2

What will be the Impact of increasing yields and Inflation? The

Stock Market Warning Credit Spreads Are Widening Again Seeking Alpha

High Yield Spreads Chart

CHART OF THE DAY High Yield Spreads (Widest Since July 2016)

U.S. High Yield What Does History Tell Us about Elevated Spreads

Highyield bond spreads by sector Business Insider

Web These Charts Display The Yield Spreads Between Corporate Bonds, Treasury Bonds, And Mortgages.

The Chart Is Intuitive Yet Powerful, Customize The Chart Type To View Candlestick Patterns,.

The Vertical Axis Of A Yield Curve Chart Shows The Yield, While The Horizontal Axis Shows The Maturity Of The Bonds (Often Converted Into Months In Order To Get A Proper Scaling On The Chart).

Data In This Graph Are Copyrighted.

Related Post: