Free Bollinger Band Charts

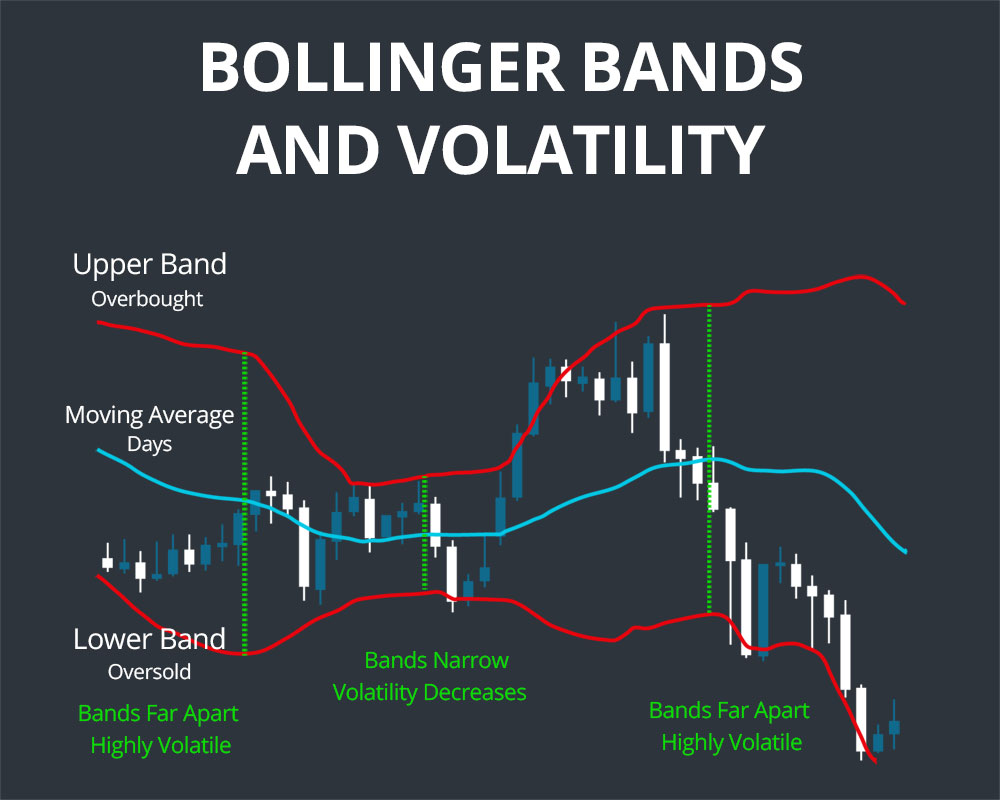

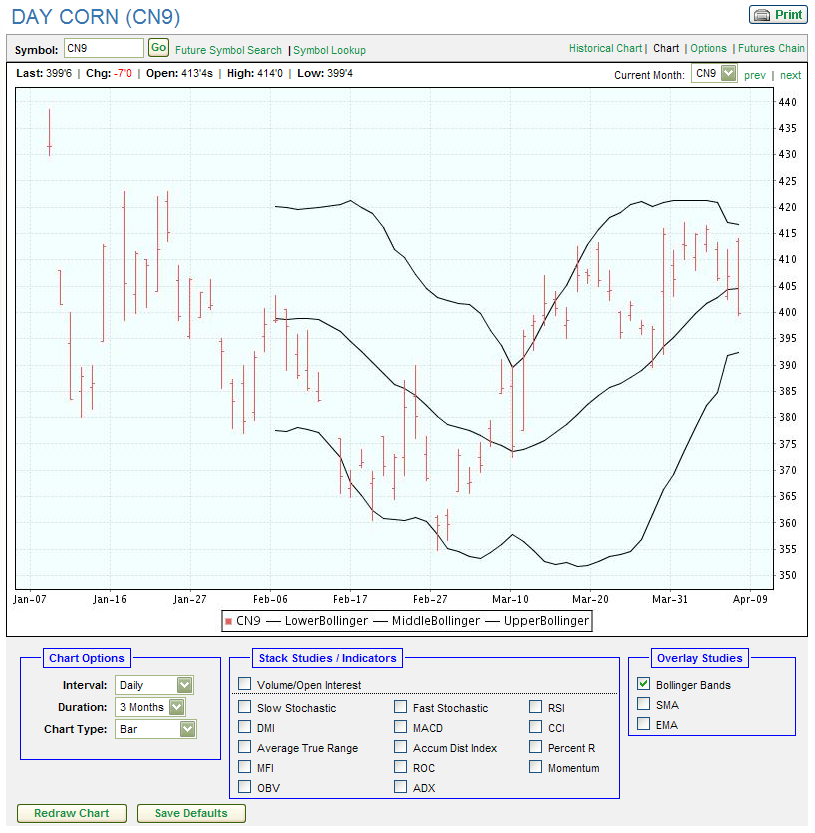

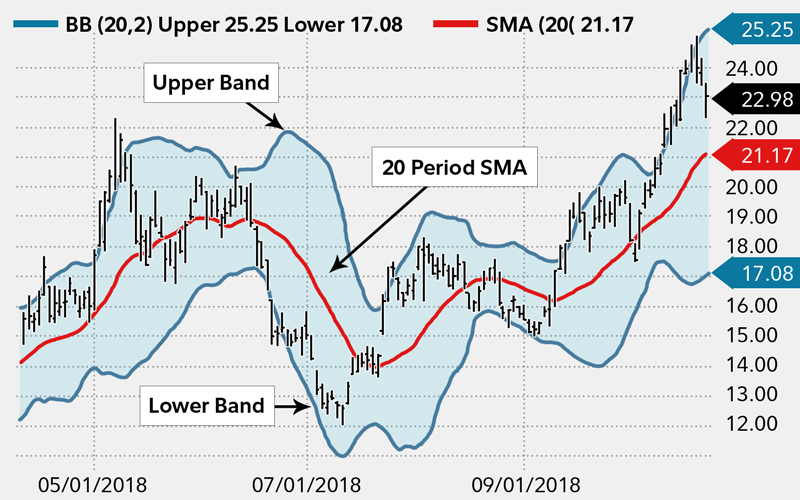

Free Bollinger Band Charts - Web stock chart with bollinger bands indicator. Web this spreadsheet shows the calculations for the bollinger bands in the spy chart above. Web bollinger bands are used to detect small shifts in a process. Web bollinger bands explained with free pdf download. Scanner guide scan examples feedback. You can customize your charts with bollinger bands and over 50 indicators, trendlines and systems/stops. Bollinger bands are used in technical analysis to help calculate and measure volatility. The bands widen when volatility increases and narrow when. Web what is the free bollinger bands ea? They consist of a simple moving average. Bollinger band filters are calculated using exponential moving averages. Values are compared to bollinger bands at 1.0 standard deviation above and below the. Web developed by john bollinger, bollinger bands® are volatility bands placed above and below a moving average. Web this spreadsheet shows the calculations for the bollinger bands in the spy chart above. Web bollinger bands is a. Bollinger bandwidth is best known for identifying the squeeze. Web bollinger bands show the volatility of a stock based on standard deviation around a simple moving average. Web bollinger bands is a widely used technical analysis tool in trading, developed by john bollinger in the 1980s. Click below to download this spreadsheet example. Bollinger bands were created by john bollinger. If you are a fan of the bollinger bands indicator and don’t want to constantly be sifting through multiple charts and. If you are not sure what an indicator does, just. Bollinger bandwidth is best known for identifying the squeeze. They consist of a simple moving average. Bollinger bands were created by john bollinger in the 1980s and are one. This script is an upgrade to the classic bollinger bands. Web what is the free bollinger bands ea? There are three bands that are included in chart: Learn how to create a cusum chart and compare them to ewma and xmr charts. Web what are bollinger bands? Web bollinger bands are used to detect small shifts in a process. How to use bollingers and the history of the bollinger band. If you are not sure what an indicator does, just. This occurs when volatility falls to a very low level, as evidenced by the narrowing bands. Values are compared to bollinger bands at 1.0 standard deviation above. Learn how to create a cusum chart and compare them to ewma and xmr charts. Bollinger band is a technical analysis indicator designed to provide investors with insights to discover oversold and undersold. Web developed by john bollinger, bollinger bands® are volatility bands placed above and below a moving average. Bollinger band filters are calculated using exponential moving averages. There. They consist of a simple moving average. This script is an upgrade to the classic bollinger bands. Web bollinger bands show the volatility of a stock based on standard deviation around a simple moving average. If you are a fan of the bollinger bands indicator and don’t want to constantly be sifting through multiple charts and. Volatility is based on. Web bollinger bands are used to detect small shifts in a process. Web developed by john bollinger, bollinger bands® are volatility bands placed above and below a moving average. Web bollinger bands is a widely used technical analysis tool in trading, developed by john bollinger in the 1980s. This occurs when volatility falls to a very low level, as evidenced. If you are not sure what an indicator does, just. Bollinger bands were created by john bollinger in the 1980s and are one of the most popular and widely used technical. You can customize your charts with bollinger bands and over 50 indicators, trendlines and systems/stops. Bollinger band filters are calculated using exponential moving averages. Scanner guide scan examples feedback. How to use bollingers and the history of the bollinger band. The idea behind bollinger bands is the. Web bollinger bands explained with free pdf download. Bollinger band filters are calculated using exponential moving averages. Web bollinger bands show the volatility of a stock based on standard deviation around a simple moving average. How to use bollingers and the history of the bollinger band. Bollinger bandwidth is best known for identifying the squeeze. Bollinger band is a technical analysis indicator designed to provide investors with insights to discover oversold and undersold. Web bollinger bands are used to detect small shifts in a process. Values are compared to bollinger bands at 1.0 standard deviation above and below the. Web this spreadsheet shows the calculations for the bollinger bands in the spy chart above. Web developed by john bollinger, bollinger bands® are volatility bands placed above and below a moving average. This occurs when volatility falls to a very low level, as evidenced by the narrowing bands. Bollinger bands are used in technical analysis to help calculate and measure volatility. Bollinger band filters are calculated using exponential moving averages. If you are not sure what an indicator does, just. They consist of a simple moving average. Web bollinger bands is a widely used technical analysis tool in trading, developed by john bollinger in the 1980s. Web what is the free bollinger bands ea? Web what are bollinger bands? Web bollinger bands explained with free pdf download.

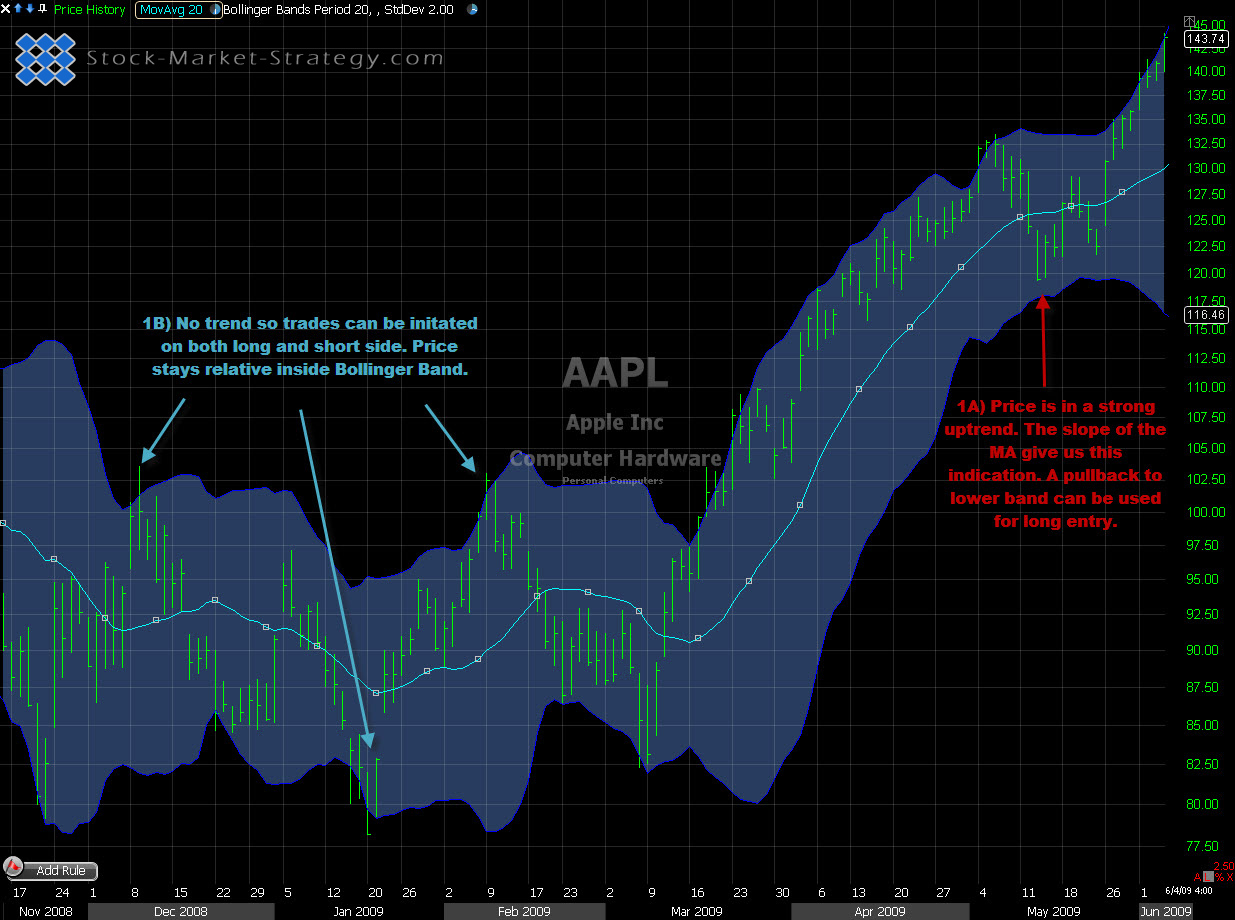

Bollinger Bands What You Need To Know To Change Your Trading

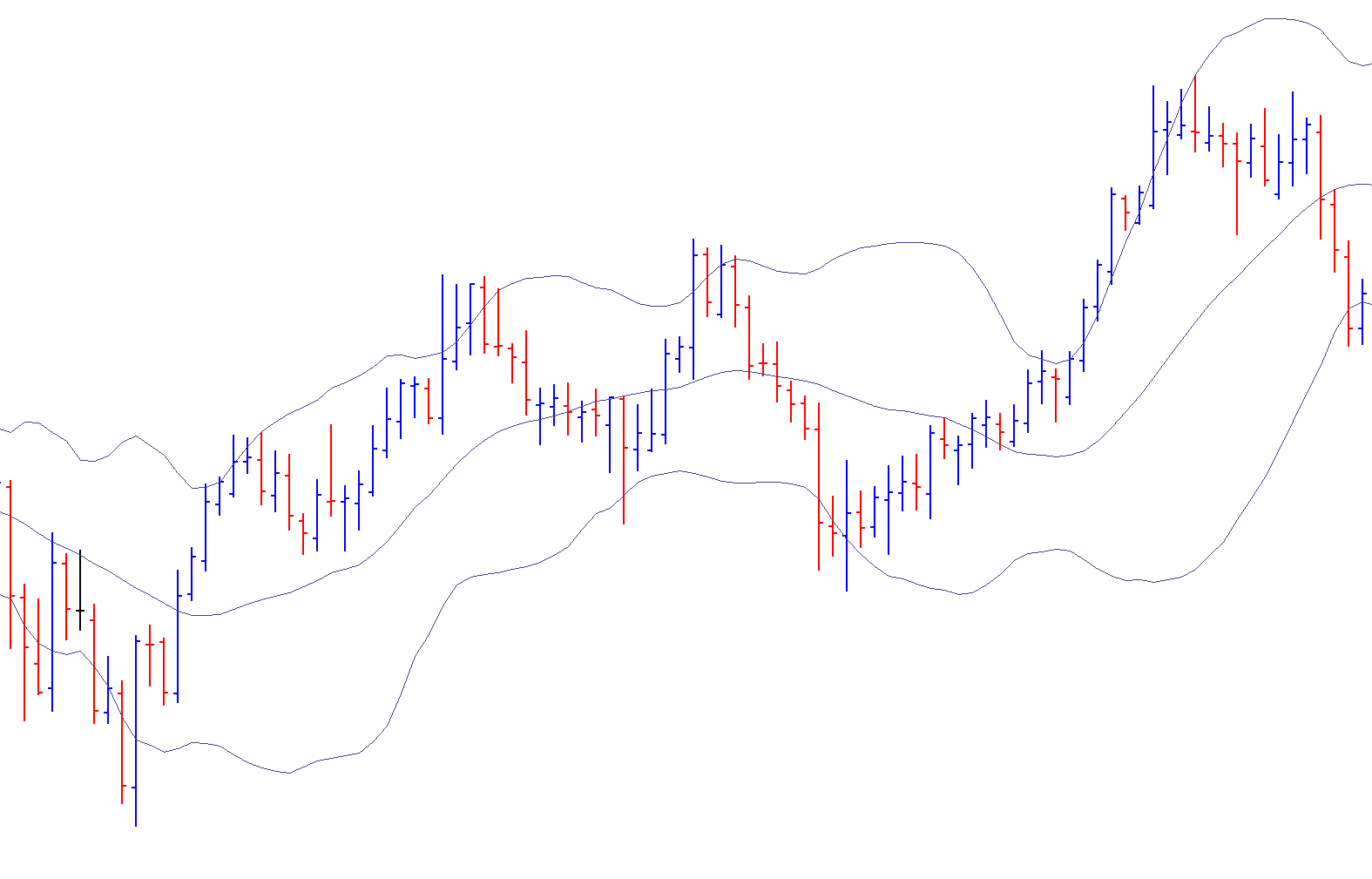

Trade Using Bollinger Bands Technical Analysis. Learn for Free

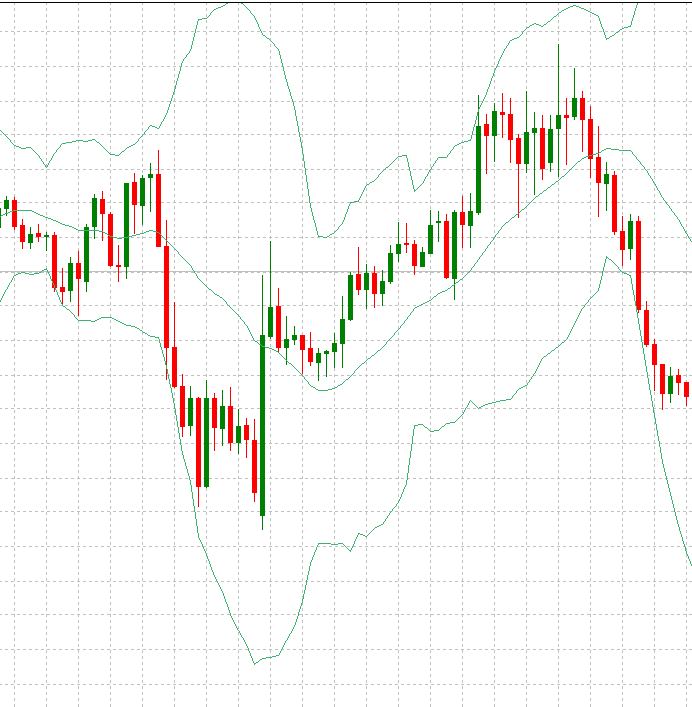

Bollinger Bands Study (Static Charts pic)

Read more about bollinger band trading TechnicalAnalysisCharts in

How to use Bollinger Bands Fidelity

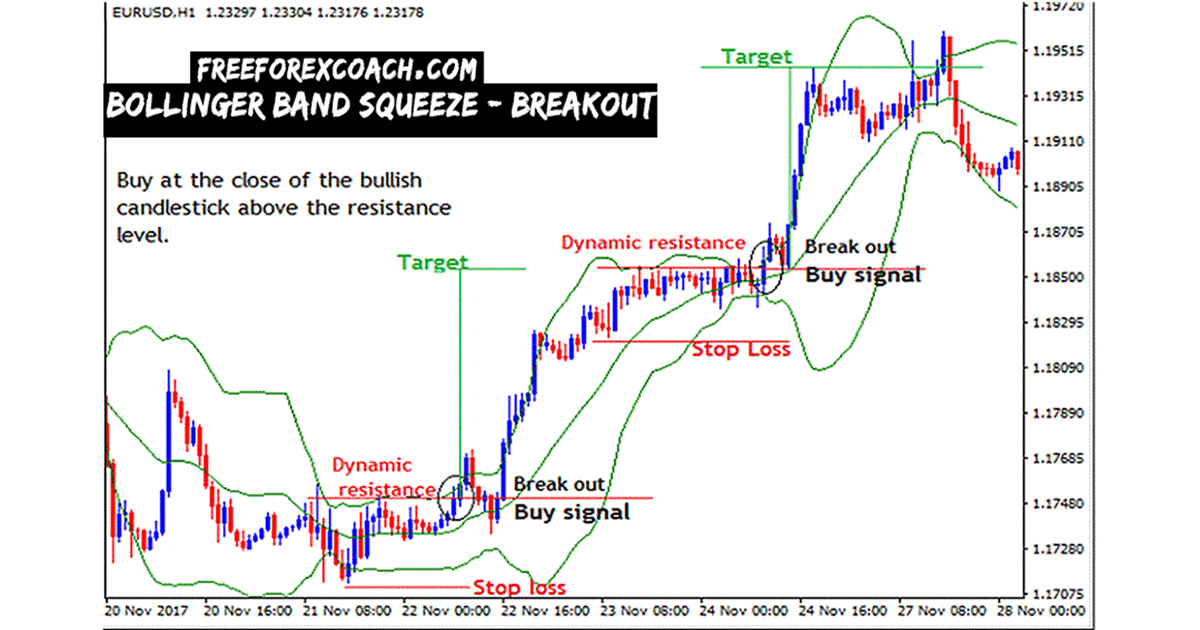

Bollinger Bands Breakout EA FREE Forex Trading EA The Forex Bots

Bollinger Bands Explained With Free PDF Download

Bollinger bands free charts

![Bollinger Bands [ChartSchool]](https://school.stockcharts.com/lib/exe/fetch.php?media=technical_indicators:bollinger_bands:bb-acp.png)

Bollinger Bands [ChartSchool]

Bollinger Bands Strategy in Forex Trading Free Forex Coach

You Can Customize Your Charts With Bollinger Bands And Over 50 Indicators, Trendlines And Systems/Stops.

Bollinger Bands Were Created By John Bollinger In The 1980S And Are One Of The Most Popular And Widely Used Technical.

The Idea Behind Bollinger Bands Is The.

Volatility Is Based On The Standard Deviation, Which Changes As.

Related Post: