Fed Pivot Chart

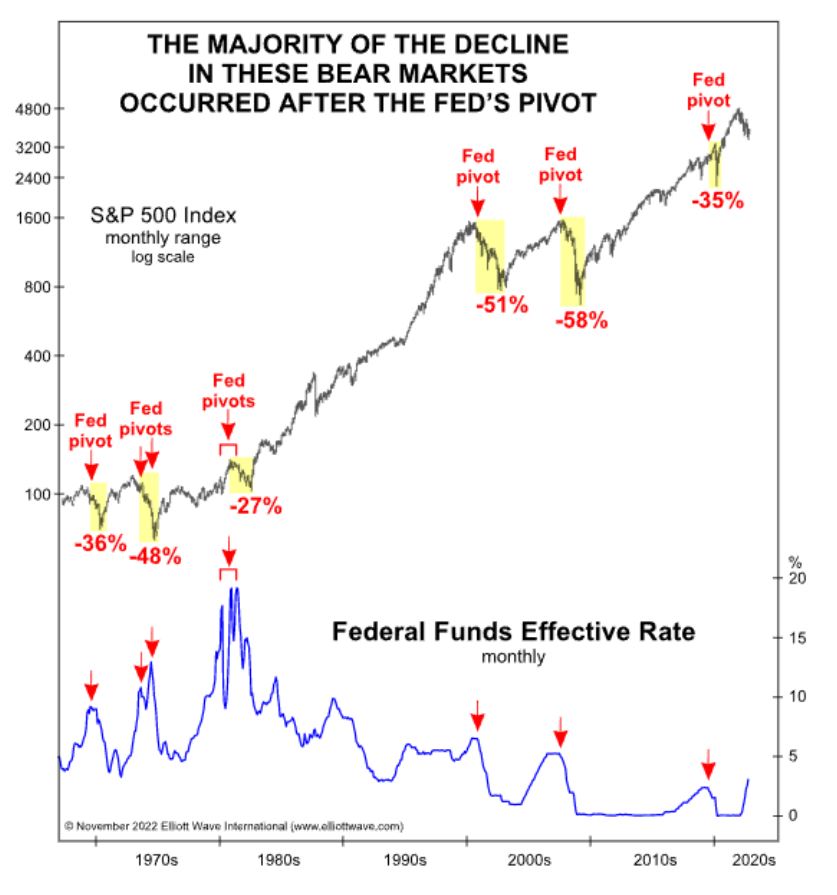

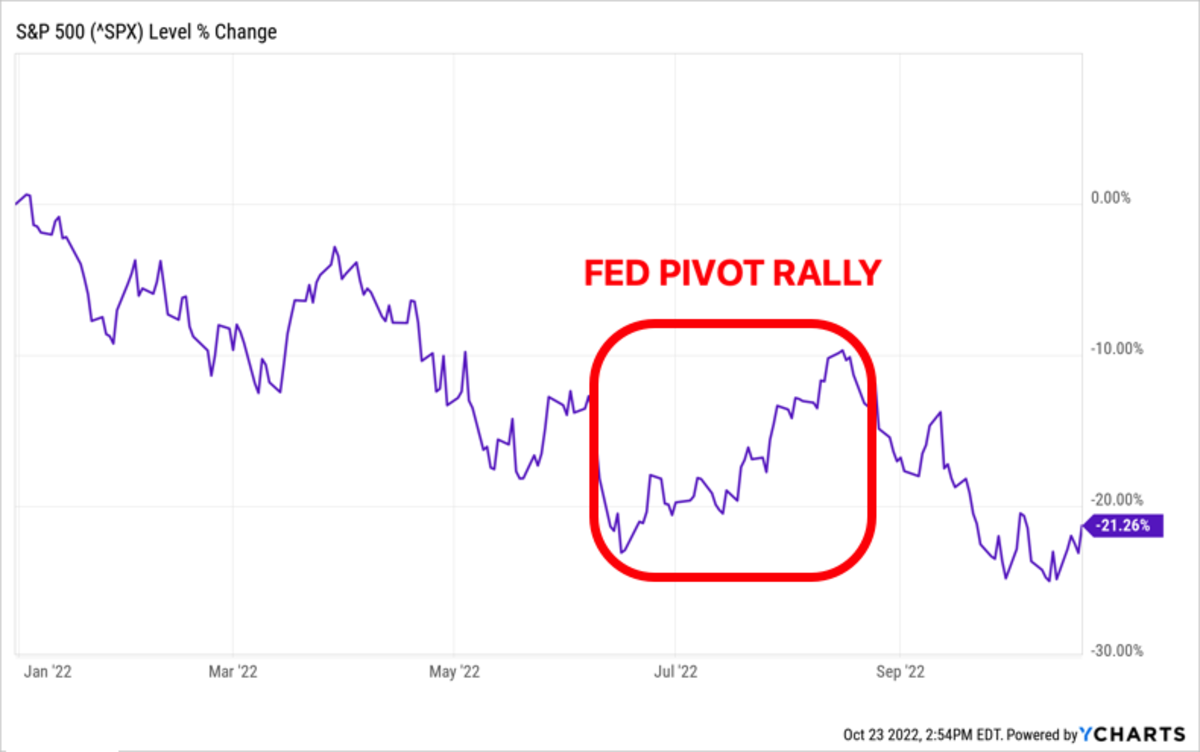

Fed Pivot Chart - Web what is a fed pivot? Chart #2 shows how the surge in m2 growth was almost entirely driven by massive federal deficit spending from 2020 through late 2021. Wage growth, the primary fuel for demand. Keep prices stable and maximum employment. What is the likelihood that the fed will change the federal target rate at upcoming fomc meetings, according to interest rate traders? The fed has two jobs: In effect, the government sent out many trillions. Web fed chair jerome powell reinforced four key points: Web the “fed pivot” underscores the rapidly shifting outlook for both growth and inflation. (3) the fed is focused on not keeping rates too high for too long; Inflation data sparked one of the biggest rallies in u.s. Central bank, reverses its policy outlook and changes course from expansionary (loose) to contractionary (tight) monetary. Dollar as inflation stabilizes, according to strategists at jpmorgan. (3) the fed is focused on not keeping rates too high for too long; (1) we are likely near the peak rate of the current. Given the fed changes direction once it realizes it has. Us central bank crystallises stimulus withdrawal plans as prices rise and job market recovers. The fed has two jobs: The federal reserve has talked financial markets into creating an. Web fed pivots and recessions. Web while it may seem logical to buy stocks when the fed makes its initial pivot, history suggests such a call is often an early event. Central bank, reverses its policy outlook and changes course from expansionary (loose) to contractionary (tight) monetary. Web june 1, 2024, 2:55 pm pdt. Chart #2 shows how the surge in m2 growth was almost. Keep prices stable and maximum employment. Chart #2 shows how the surge in m2 growth was almost entirely driven by massive federal deficit spending from 2020 through late 2021. Wage growth, the primary fuel for demand. Web the “fed pivot” underscores the rapidly shifting outlook for both growth and inflation. The votes are still being counted in south africa, but. Fed chair jay powell justified. Web june 1, 2024 at 5:05 p.m. Economy, often undergoing significant policy shifts, or pivots, to navigate the changing economic environment. Inflation data sparked one of the biggest rallies in u.s. Web fed chair jerome powell reinforced four key points: Federal reserve announced on december 15 that it will move more quickly to end its stimulus, doubling the rate at which it winds down (or tapers) its asset purchase program. Stocks, bonds and interest rates markets in years. The s&p 500 has gained 11.8% in 2024 on optimism surrounding a potential fed pivot to rate cuts, but a policy misstep. (2) discussion of rate cuts had begun; Inflation data sparked one of the biggest rallies in u.s. The votes are still being counted in south africa, but. Web the “fed pivot” underscores the rapidly shifting outlook for both growth and inflation. The fed has two jobs: Inflation data sparked one of the biggest rallies in u.s. Last week, the fed released minutes from its most recent meeting and the minutes gave an indication the fed was near pausing and/or slowing the pace of interest rate increases. Web no june rate cut expected. With a banking crisis unfolding, the fed must curb its aggressive interest rate policy. The fed has two jobs: Web the data set from the daily shot below shows how several indicators, particularly related to employment, have not yet demonstrated recessionary signs, other than wholesale retail sales which. Web 8.16k follower s. Central bank, reverses its policy outlook and changes course from expansionary (loose) to contractionary (tight) monetary. Given the fed changes direction once. The uniformity of market internals is a key gauge of speculative. Web slowing economic growth and a softer job market could allow the federal reserve to pivot, marking a peak for the u.s. Fed chair jay powell justified. Dollar as inflation stabilizes, according to strategists at jpmorgan. Monetary policy adjustments are how the fed achieves both goals, moves like adjusting. Web fed chair jerome powell reinforced four key points: Web 8.16k follower s. (3) the fed is focused on not keeping rates too high for too long; Last week, the fed released minutes from its most recent meeting and the minutes gave an indication the fed was near pausing and/or slowing the pace of interest rate increases. Web fed’s ‘pivot is complete’ in the face of inflationary pressures. Web while it may seem logical to buy stocks when the fed makes its initial pivot, history suggests such a call is often an early event. Wage growth, the primary fuel for demand. (2) discussion of rate cuts had begun; Fed chair jay powell justified. Federal reserve announced on december 15 that it will move more quickly to end its stimulus, doubling the rate at which it winds down (or tapers) its asset purchase program. Stocks, bonds and interest rates markets in years. Web the data set from the daily shot below shows how several indicators, particularly related to employment, have not yet demonstrated recessionary signs, other than wholesale retail sales which. Web june 1, 2024 at 5:05 p.m. Web a fed pivot occurs when the federal reserve, which is the u.s. Federal reserve chair jerome powell testifies on capitol hill may 10. And (4) economic growth is slowing.

US Fed Funds Target Rate vs. Wage Growth

Chartpoint » Fed policy pivot 2H 2023

„Fed pivot” rynkowy motyw przewodni na 2023 rok Qnews Edukacyjny

Effective Federal Funds Rate (FREDFEDFUNDS) — Historical Data and

When Will the Fed Pivot?

![]()

Jim Cramer Says Fed Pivot Means Buy Stocks? RIA

The Fed’s Pivot

Fed Pivot? Be Careful What You Wish for The Sounding Line

Our View on the Fed Pivot Blue Chip Daily Trend Report

The Fed Pivot Is A Myth, But The Markets Might Rally Anyway

The Uniformity Of Market Internals Is A Key Gauge Of Speculative.

(1) We Are Likely Near The Peak Rate Of The Current Policy Cycle;

Dollar As Inflation Stabilizes, According To Strategists At Jpmorgan.

Chart #2 Shows How The Surge In M2 Growth Was Almost Entirely Driven By Massive Federal Deficit Spending From 2020 Through Late 2021.

Related Post: