Expanding Chart Pattern

Expanding Chart Pattern - Web the first is rising wedges where price is contained by 2 ascending trend lines that converge because the lower trend line is steeper than the upper trend line. Triangles are similar to wedges and pennants and can be either a continuation pattern,. Cvx) remains a leading player in the oil and gas industry. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. Web the number of deaths shot up. It is represented by two lines, one ascending and one descending, that diverge from each other. We cover the characteristics, entry and exit points, and risk management strategies for this chart pattern. It is created by price moves that allow for a horizontal line to be drawn along the swing highs and a rising trendline to. Web there are basically 3 types of triangles and they all point to price being in consolidation: The expanding triangle is another broadening formation with diverging trend lines that may take longer to form than other triangles. Broadening formations indicate increasing price volatility. Web the expanding triangle pattern is a unique chart formation commonly found in technical analysis. We cover the characteristics, entry and exit points, and risk management strategies for this chart pattern. It is created by price moves that allow for a horizontal line to be drawn along the swing highs and a rising trendline. Web a pattern is identified by a line connecting common price points, such as closing prices or highs or lows, during a specific period. Web detecting a triangular pattern in a chart is pretty straightforward: It is created by price moves that allow for a horizontal line to be drawn along the swing highs and a rising trendline to. Web. Web a broadening triangle is a relatively rare triangle pattern which occurs when there is a lot of volatility in a security. Web the megaphone pattern, also known as the broadening formation, is a chart pattern that occurs in trading during periods of high volatility. Web the expanding triangle pattern is a popular technical analysis tool used by traders from. Web the expanding triangle pattern is a popular technical analysis tool used by traders from decades to identify potential trend reversals in the financial markets. We will explain how to identify the pattern, its characteristics, and how traders can use it to make trading decisions. Web the rising wedge is a chart pattern used in technical analysis to predict a. Web what is an ascending broadening wedge? This pattern is formed when the price of an asset creates higher highs and lower lows, creating a triangle shape that expands over time. Web the first is rising wedges where price is contained by 2 ascending trend lines that converge because the lower trend line is steeper than the upper trend line.. Part of its strength comes from its trapping traders on each new breakout. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. An ascending broadening wedge is a bearish chart pattern (said to be a reversal pattern). Web an expanding triangle can be either a reversal or. These wedges tend to break downwards. Web a symmetrical triangle also known as a coil is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. This pattern exhibits a broadening formation, indicating increasing price volatility as the trading range expands over time. Web a broadening top is a unique chart pattern resembling. Technical analysts and chartists seek to identify patterns. Web a broadening top is a unique chart pattern resembling a reverse triangle or megaphone that signals significant volatility and disagreement between bullish and bearish investors. Web volume, momentum oscillators, or chart pattern analysis can help determine breakout validity. Cvx) remains a leading player in the oil and gas industry. Web a. Cvx) remains a leading player in the oil and gas industry. Web patterns in revenue, volumes, dividend yields, valuation multiples, cash flows, and inventories look potentially bearish. It consists of two trendlines—one ascending and the other descending—forming a triangle as they widen. Web the expanding triangle pattern is a unique chart formation commonly found in technical analysis. Web the megaphone. Cvx) remains a leading player in the oil and gas industry. Web the number of deaths shot up. Web the first is rising wedges where price is contained by 2 ascending trend lines that converge because the lower trend line is steeper than the upper trend line. Web an ascending triangle is a chart pattern used in technical analysis. The. Web an ascending triangle is a chart pattern used in technical analysis. Web a broadening triangle is a relatively rare triangle pattern which occurs when there is a lot of volatility in a security. An ascending broadening wedge is a bearish chart pattern (said to be a reversal pattern). Web detecting a triangular pattern in a chart is pretty straightforward: Web the megaphone pattern, also known as the broadening formation, is a chart pattern that occurs in trading during periods of high volatility. It is formed by two diverging bullish lines. Web a broadening top is a unique chart pattern resembling a reverse triangle or megaphone that signals significant volatility and disagreement between bullish and bearish investors. Web what is an ascending broadening wedge? Web there are basically 3 types of triangles and they all point to price being in consolidation: Web expanding triangle chart pattern. Nifty intraday 15 mins chart. It consists of two trendlines—one ascending and the other descending—forming a triangle as they widen. You just have to look for the sequence of three consecutive highs and lows; Web the first is rising wedges where price is contained by 2 ascending trend lines that converge because the lower trend line is steeper than the upper trend line. We cover the characteristics, entry and exit points, and risk management strategies for this chart pattern. Broadening formations indicate increasing price volatility.

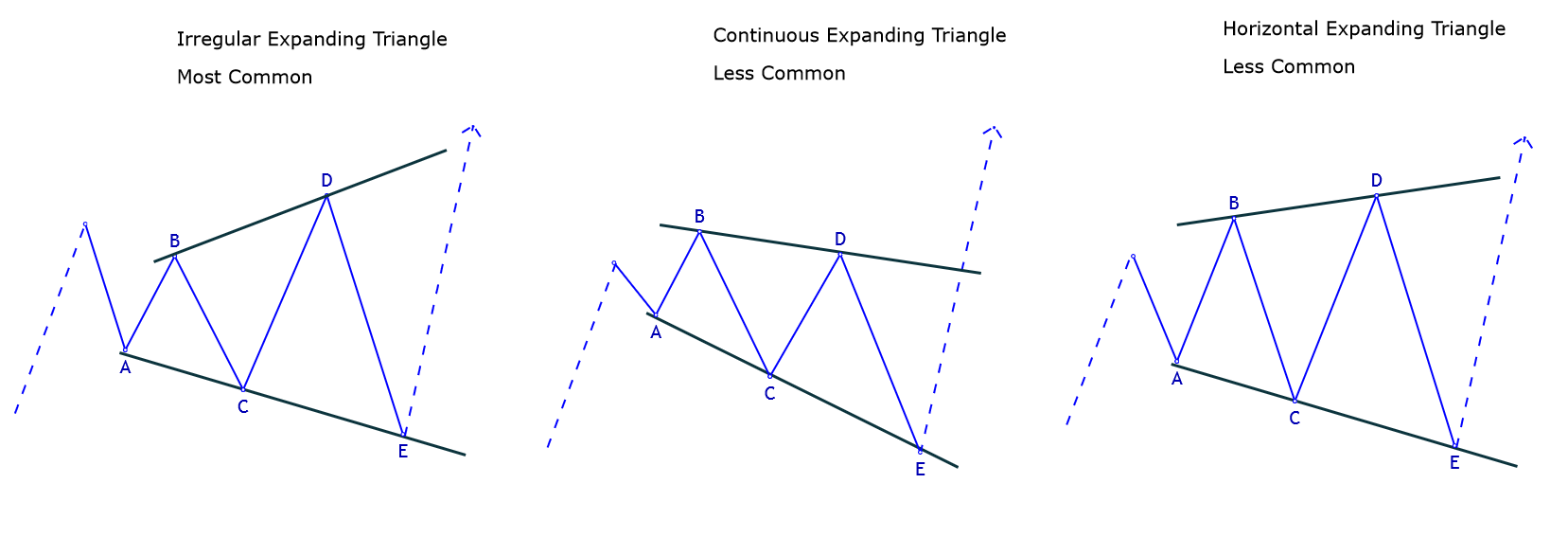

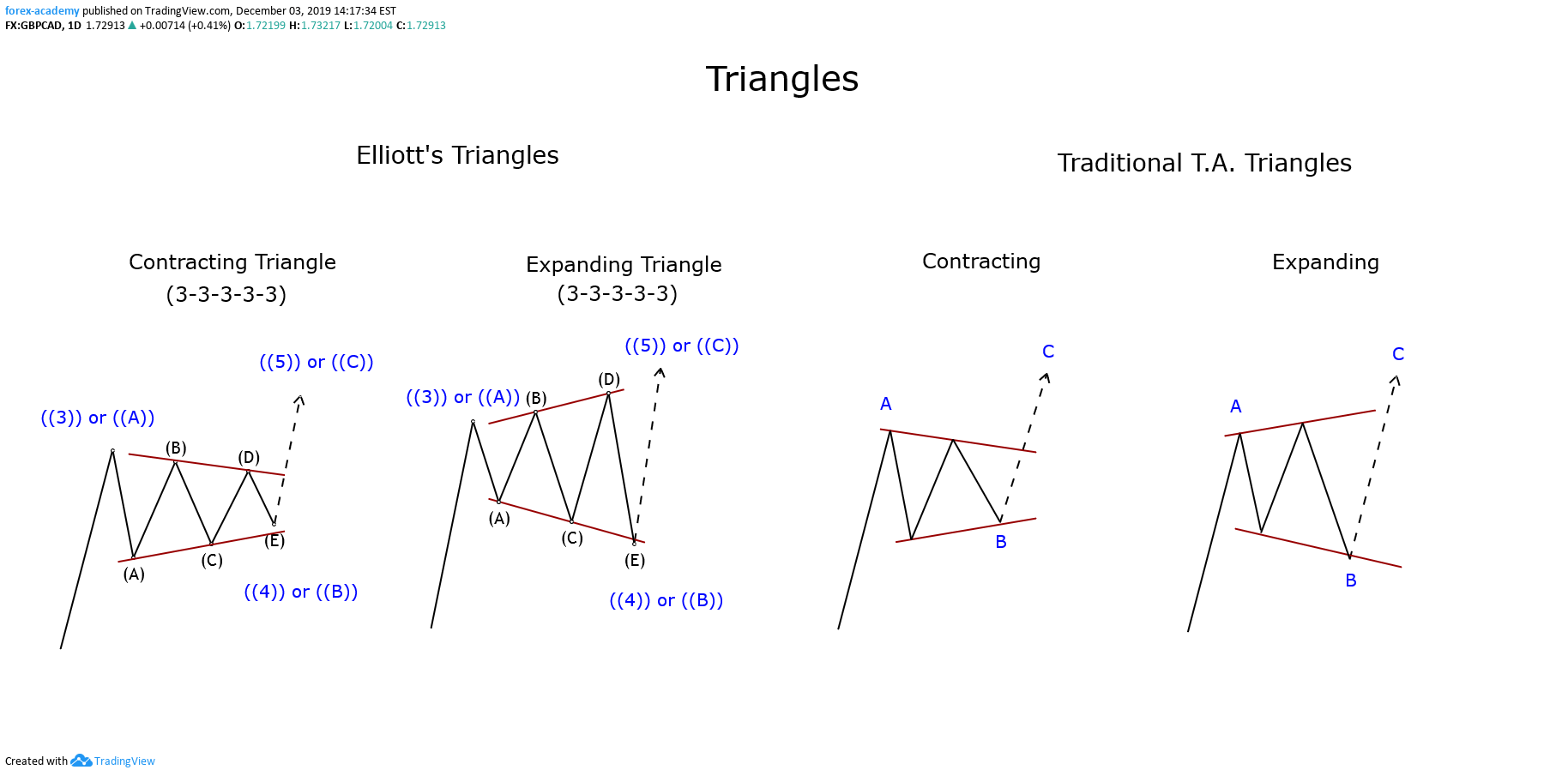

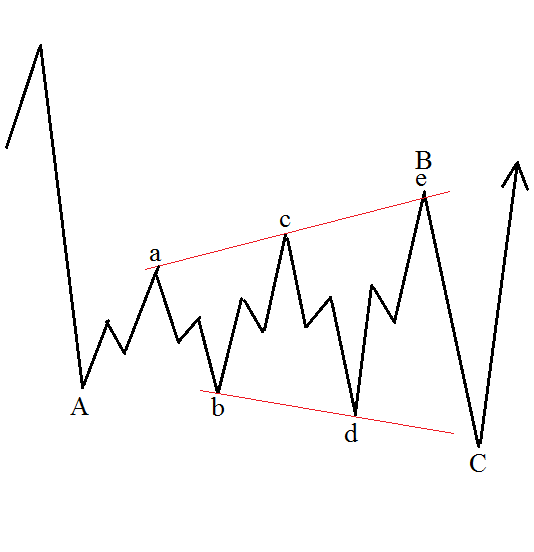

Your detailed guide to the Elliott Wave expanding triangle pattern

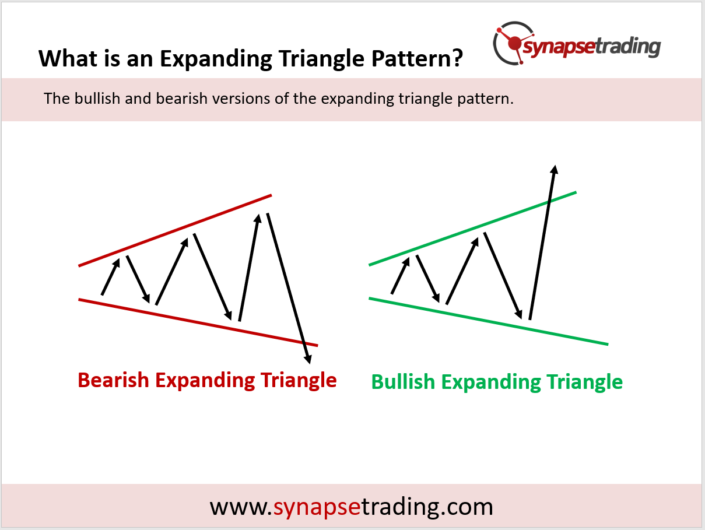

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

Expanding Triangle Forex Trading Technical Analysis Stock

Expanding Triangle Chart Pattern

Ascending & Descending Triangle Pattern Strategy Guide

Bear Expanding Triangle — ToTheTick™

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

Your detailed guide to the Elliott Wave expanding triangle pattern

Bull Expanding Triangle — ToTheTick™

Web There Are 6 Broadening Wedge Patterns That We Can Separately Identify On Our Charts And Each Provide A Good Risk And Reward Potential Trade Setup When Carefully Selected And Used Alongside Other Components To A Successful Trading Strategy.

It Is Considered A Continuation Pattern, Indicating That The Prevailing Trend Is Likely To Continue After A Brief Consolidation Or Pause.

It Is Characterized By A Narrowing Range Of Price With Higher Highs And Higher Lows, Both.

We Will Explain How To Identify The Pattern, Its Characteristics, And How Traders Can Use It To Make Trading Decisions.

Related Post: