Delta Footprint Chart

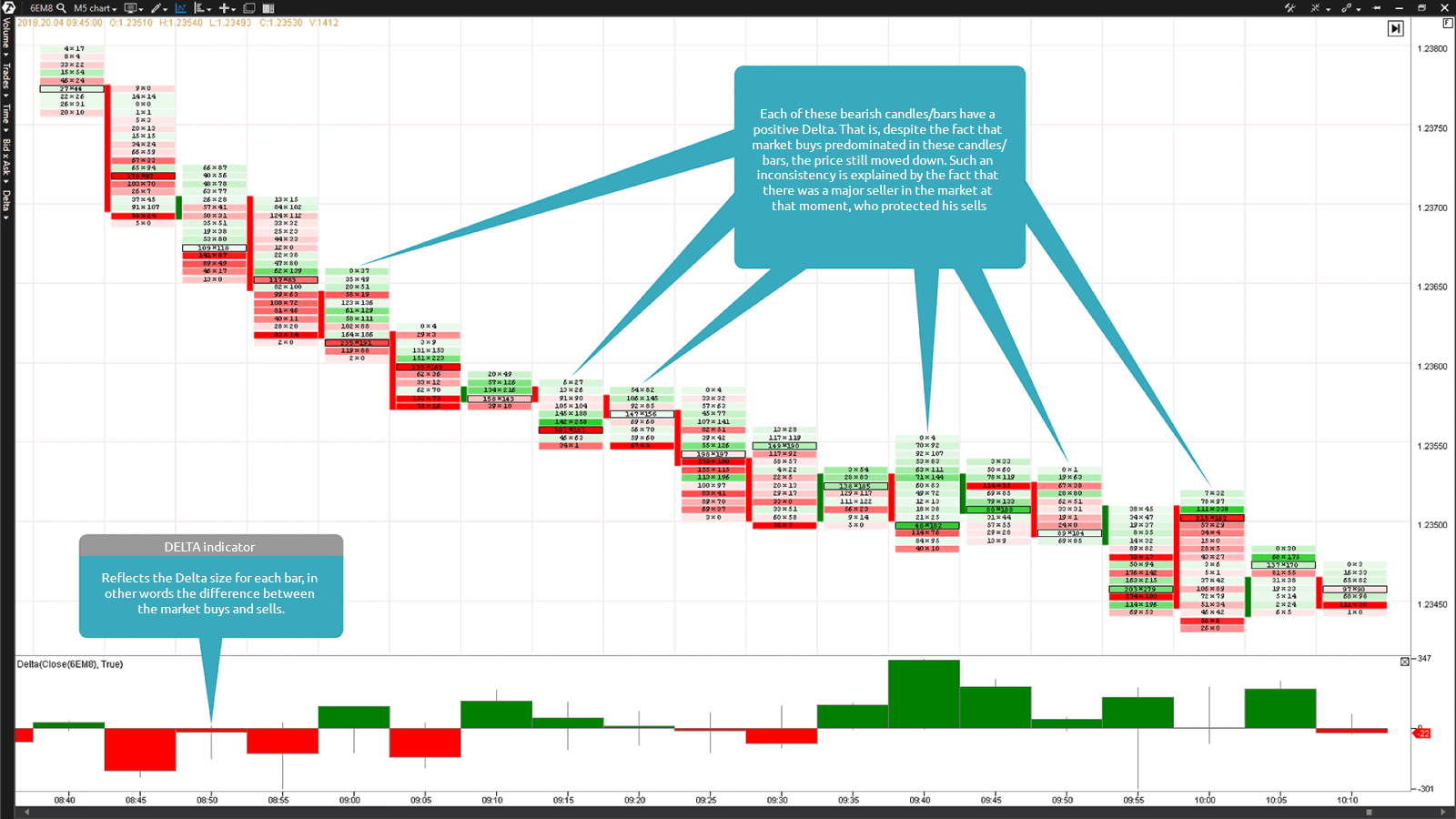

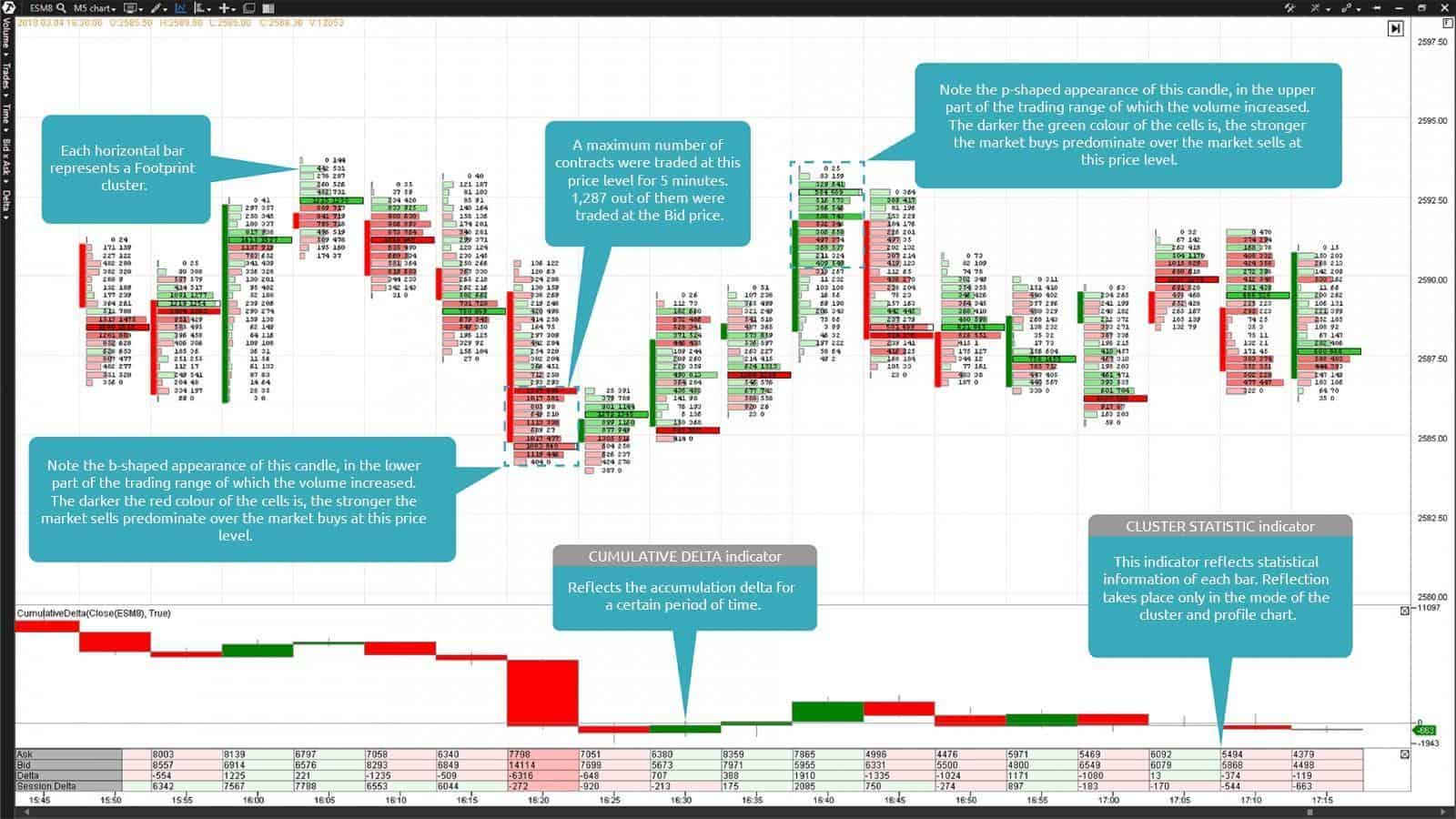

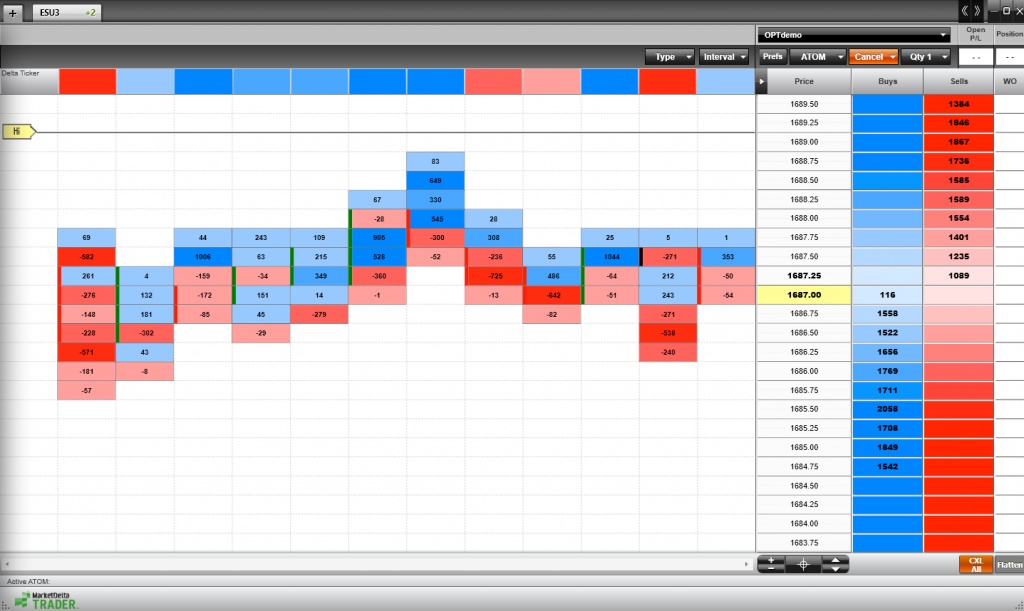

Delta Footprint Chart - A footprint cell with a positive delta is coloured green and characterises a positive order flow, in the result of which buyers were more aggressive at a specific price level. The footprint chart provides increased market transparency for active traders and delivers a discrete advantage over other charting methods. The result is more precise trade execution and a better understanding of where you should be trading. This analysis is similar to how volume profile evaluates volume data from a portion of the chart. It’s calculated by taking the difference of the volume that traded at the offer price and the volume that traded at the bid price. Single, multiple, stacked, reverse, inverse, overzized, big consecutive and more. Shows all the different imbalances. Web this article serves as an introduction to two ways of interpreting delta when daytrading futures instrukments: Web these patterns suggest a potential reversal in the current trend. Commonly the footprint term is used with the term order flow. Web delta footprint charts are a great way to see absorption taking place in the order flow. And if a buyer initiates a buy. All 4 of tradinglite's footprint styles, offer the ability to toggle ' delta mode '. Web volume footprint is a powerful charting tool that visualizes the distribution of trading volume across several price levels for each. Web the footprint chart reflects the positive and negative delta values inside each candle as it can be seen in chart 1. All 4 of tradinglite's footprint styles, offer the ability to toggle ' delta mode '. Single, multiple, stacked, reverse, inverse, overzized, big consecutive and more. Displays the net difference at each price between volume initiated by buyers and. The delta is calculated as follows: Web the footprint chart display modes in the form of delta. Commonly the footprint term is used with the term order flow. A footprint cell with a positive delta is coloured green and characterises a positive order flow, in the result of which buyers were more aggressive at a specific price level. They often. A footprint cell with a positive delta is coloured green and characterises a positive order flow, in the result of which buyers were more aggressive at a specific price level. Web the tool has 3 modes, which display different volume data for the traded prices of each bar: Web footprint charts provide volume information to candlestick charts. You can see. Rather than displaying market sells and market buys within each candlestick, the delta of the two is instead displayed. 5.1k views 5 months ago. The delta is calculated as follows: Web the footprint chart display modes in the form of delta. Footprint is a type of the chart where you can see sum of the traded volumes at a specified. If the delta is positive, it’s a sign of more aggressive behavior by buyers, who purchased at the ask. The footprint chart provides increased market transparency for active traders and delivers a discrete advantage over other charting methods. Use this guide to learn more about the various ways to use the footprint® chart, market profile® and other tools included in. If the delta is positive, it’s a sign of more aggressive behavior by buyers, who purchased at the ask. The result is more precise trade execution and a better understanding of where you should be trading. The delta footprint displays positive or negative values. A negative delta indicates aggressive selling and a larger number of sales at the bid. Web. Delta profile and the delta footprint. It’s calculated by taking the difference of the volume that traded at the offer price and the volume that traded at the bid price. The #footprint indicator allows us to see accumulation and distribution of market volumes. Volume delta is the difference between buying and selling pressure. A footprint cell with a positive delta. Total volume transacted at each price; Volume delta measure the difference between buying and selling power. They often reveal large hidden orders of bid versus ask imbalances, enabling traders to gain a more. The result is more precise trade execution and a better understanding of where you should be trading. The delta footprint displays positive or negative values. A footprint cell with a positive delta is coloured green and characterises a positive order flow, in the result of which buyers were more aggressive at a specific price level. Commonly the footprint term is used with the term order flow. Web data, charting, & trading in a single platform. Traders will see the delta data at every price level. Web marketdelta® offers unique tools and analytics to empower the trader to see more, do more, and make more. If the delta is positive, it’s a sign of more aggressive behavior by buyers, who purchased at the ask. Total volume transacted at each price; Our footprint indicator has all the features orderflow traders need. The footprint chart provides increased market transparency for active traders and delivers a discrete advantage over other charting methods. The delta is calculated as follows: Web data, charting, & trading in a single platform. Shows all the different imbalances. Web the footprint chart reflects the positive and negative delta values inside each candle as it can be seen in chart 1. A footprint cell with a positive delta is coloured green and characterises a positive order flow, in the result of which buyers were more aggressive at a specific price level. And, (3) delta volume footprint: The #footprint indicator allows us to see accumulation and distribution of market volumes. The result is more precise trade execution and a better understanding of where you should be trading. Footprint is a type of the chart where you can see sum of the traded volumes at a specified price for a certaing period. The next style of footprint chart is the delta footprint. Web this article serves as an introduction to two ways of interpreting delta when daytrading futures instrukments:

Strategy of using the footprint through the example of a currency futures

Webinar 2 Why Some Traders That Use The Market Delta Footprint Chart

The Ultimate Guide To Profiting From Footprint Charts

Footprint Charts The Complete Trading Guide

Footprint charts in XTick software

Stock Market Analysis Delta Footprint Charts

How to View Cumulative Delta on a Footprint Chart YouTube

Delta and Cumulative Delta how could they help a day trader?

Absorption of demand and supply in the footprint chart

FootPrint® Charting Introduction Market Delta Optimus Futures

And If A Buyer Initiates A Buy.

Web The Tool Has 3 Modes, Which Display Different Volume Data For The Traded Prices Of Each Bar:

Commonly The Footprint Term Is Used With The Term Order Flow.

5.1K Views 5 Months Ago.

Related Post: