Dark Cloud Cover Candlestick Chart

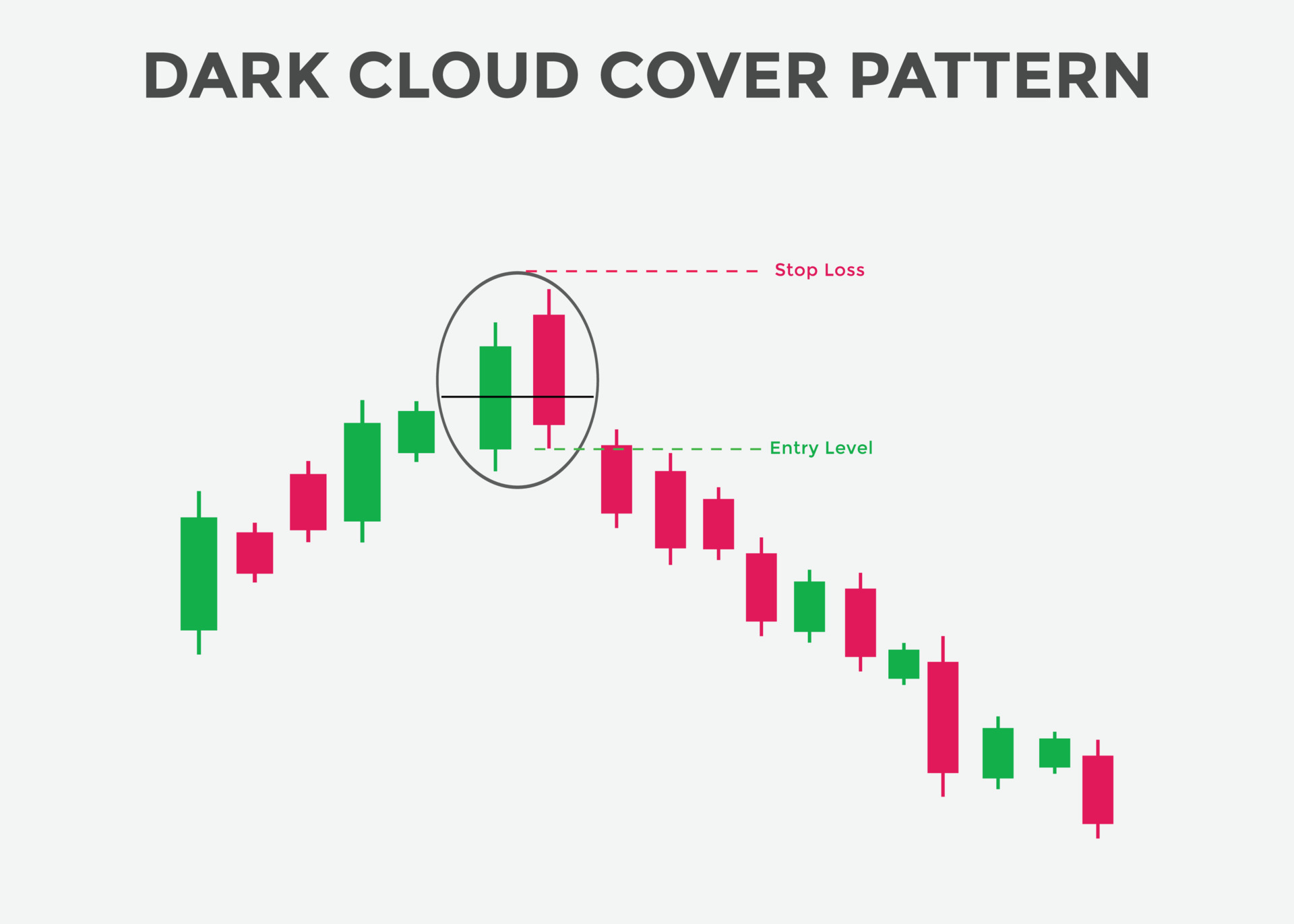

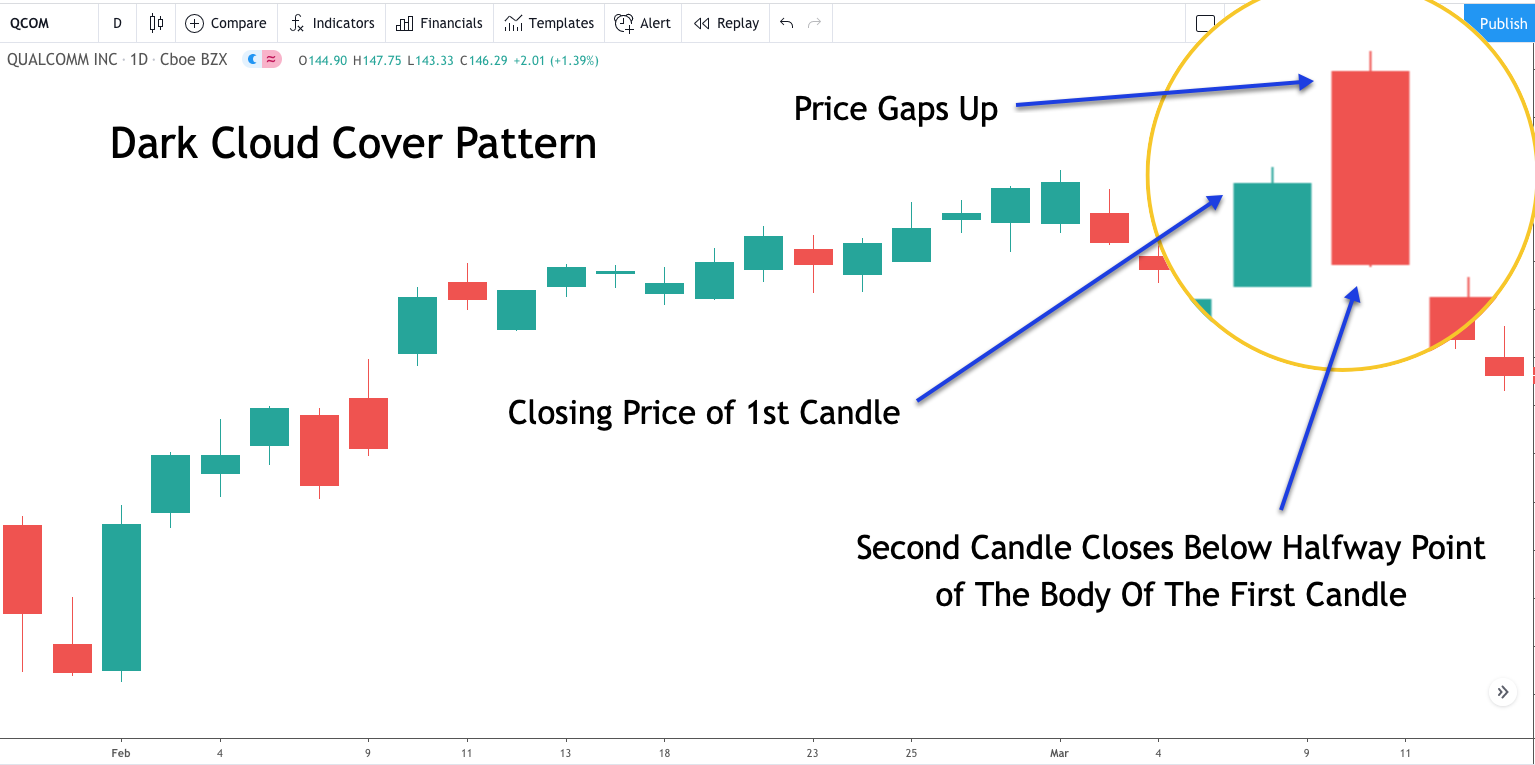

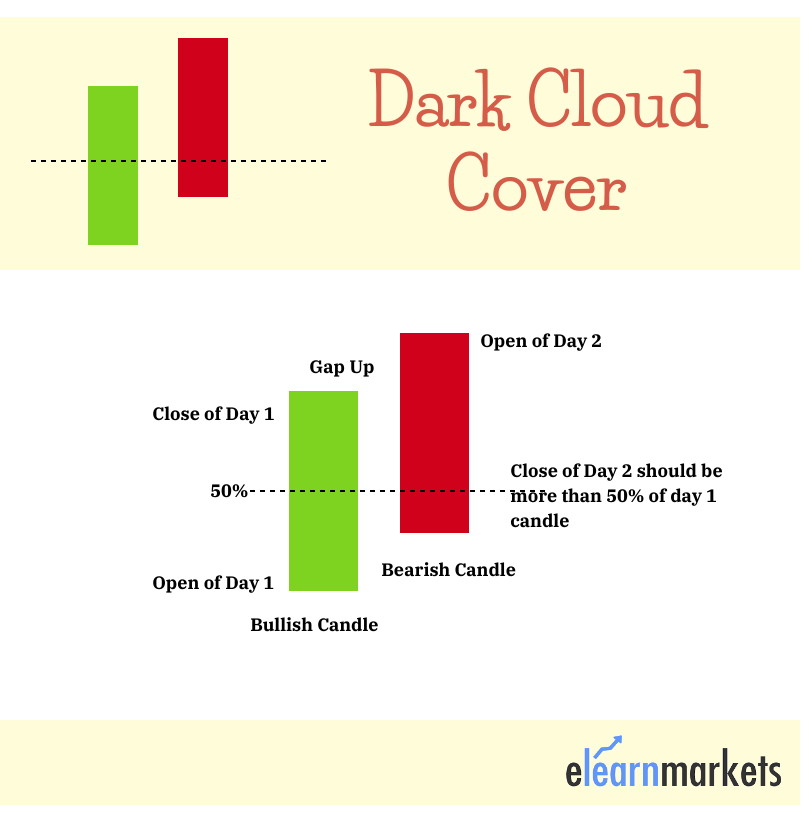

Dark Cloud Cover Candlestick Chart - Web a dark cloud cover is a bearish candlestick pattern visible at the end of an uptrend. The hammer or the inverted hammer. Web what is a dark cloud cover? Web the dark cloud cover is a candlestick pattern that signals a momentum shift to bearish. Web we will focus on five bullish candlestick patterns that give the strongest reversal signal. Web the dark cloud cover forms as follows: However, as we’ll soon see, this candlestick isn’t so scary. Web the dark cloud cover is a bearish reversal candlestick pattern that occurs after an uptrend. Web the dark cloud cover gets its name from the ominous second black candlestick. It forms when a bearish candlestick follows a bullish candlestick, where the bearish candlestick opens above the previous bullish candlestick’s closing price but closes below its midpoint. Web the dark cloud cover is a type of forex candlestick, and before continuing, readers should ensure they have a good grasp on how to read a candlestick chart. Stock passes all of the below filters in cash segment: Web the dark cloud cover forms as follows: Web the dark cloud cover is a candlestick pattern that signals a momentum. Usually, a down candle follows an up candle,. The hammer or the inverted hammer. Web the dark cloud cover gets its name from the ominous second black candlestick. The topic for this article is the dark cloud cover, which is one of the most widely known and used candlestick patterns. The hammer is a bullish reversal pattern, which signals that. This pattern is significant as it indicates a shift in momentum from upward to downward. The second candle opens higher than the previous close. Web this article describes the dark cloud cover candlestick, including performance statistics and rankings, written by internationally known author and trader thomas bulkowski. Trading the dark cloud cover with moving averages. There are two notable characteristics. This pattern is significant as it indicates a shift in momentum from upward to downward. Web the dark cloud cover is a bearish reversal candlestick pattern where a down candle (black or red) opens above the close of the preceding up candle (white or green) and closes below the midpoint of the up candle. Web what is a dark cloud. The hammer is a bullish reversal pattern, which signals that a. A piercing line is a bullish reversal pattern that forms at the end of a downtrend. Trading the dark cloud cover with moving averages. Trading the dark cloud cover with resistance levels. What is the dark cloud cover candlestick pattern? Usually, a down candle follows an up candle,. Web originating from japanese candlestick charting, the dark cloud cover candlestick pattern is easily recognizable by its distinct formation. Trading the dark cloud cover with pivot. Web this article describes the dark cloud cover candlestick, including performance statistics and rankings, written by internationally known author and trader thomas bulkowski. Greater than 1. The next candle gaps higher, but then turns black/red and closes in the lower half. Usually, a down candle follows an up candle,. However, as we’ll soon see, this candlestick isn’t so scary. A prior uptrend followed by a dark cloud cover pattern indicates a trend reversal towards a. This pattern is significant as it indicates a shift in momentum. However, as we’ll soon see, this candlestick isn’t so scary. The dark cloud cover candlestick pattern involves just two candles and acts as the opposite of the piercing pattern. It helps the investors predict if the prices will decline. This pattern is significant as it indicates a shift in momentum from upward to downward. In the case of the piercing. The pattern is significant as it shows a shift in the momentum from the upside to the downside. A piercing line is a bullish reversal pattern that forms at the end of a downtrend. Web a dark cloud cover is a bearish candlestick pattern visible at the end of an uptrend. Beide formationen bestehen aus zwei aufeinanderfolgenden kerzen. Its ominous. Trading the dark cloud cover with resistance levels. Greater than 1 day ago. It appears in an uptrend and is characterized by a long white (or green) candle followed by a black (or red) candle. Web the dark cloud cover is a type of forex candlestick, and before continuing, readers should ensure they have a good grasp on how to. It forms when a bearish candlestick follows a bullish candlestick, where the bearish candlestick opens above the previous bullish candlestick’s closing price but closes below its midpoint. Web the dark cloud cover gets its name from the ominous second black candlestick. This pattern is significant as it indicates a shift in momentum from upward to downward. What is the dark cloud cover candlestick pattern? Trading the dark cloud cover with rsi divergences. Web in this guide to understanding the dark cloud cover candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it, and provide examples. The topic for this article is the dark cloud cover, which is one of the most widely known and used candlestick patterns. The hammer or the inverted hammer. Trading the dark cloud cover with moving averages. Web a dark cloud cover is a bearish candlestick pattern visible at the end of an uptrend. Web the dark cloud cover is a bearish reversal candlestick pattern that occurs after an uptrend. A prior uptrend followed by a dark cloud cover pattern indicates a trend reversal towards a. Web the dark cloud cover forms as follows: Scanner guide scan examples feedback. The second candle opens higher than the previous close. The first candlestick is a white/green candle with a long real body.

Dark Cloud Cover Candle Stick Pattern

How To Trade Blog What Is Dark Cloud Cover Candlestick Pattern

Dark cloud cover candlestick forex, call option interest rate cap

Dark cloud candlestick chart pattern. Japanese candlesticks pattern

Overview Of The Dark Cloud Cover Candlestick Pattern Forex Training Group

Dark Cloud Cover How to trade with this powerful candlestick Pattern2022

How To Trade Blog What Is A Dark Cloud Cover Candlestick? Meaning And

What is Dark Cloud Cover in candlestick chart with example.

What Is Dark Cloud Cover Candlestick Pattern? How To Trade Blog

Tutorial on Dark Cloud Cover Candlestick Pattern YouTube

Web Dark Cloud Cover Is A Bearish Reversal Candlestick Pattern Where A Down Candle (Typically Black Or Red) Opens Above The Close Of The Prior Up Candle (Typically White Or Green), And Then Closes Below The Midpoint Of The Up Candle.

The Hammer Is A Bullish Reversal Pattern, Which Signals That A.

Web The Dark Cloud Cover Is A Candlestick Pattern That Signals A Momentum Shift To Bearish.

It Appears In An Uptrend And Is Characterized By A Long White (Or Green) Candle Followed By A Black (Or Red) Candle.

Related Post: