Credit Suisse Default Swaps Chart

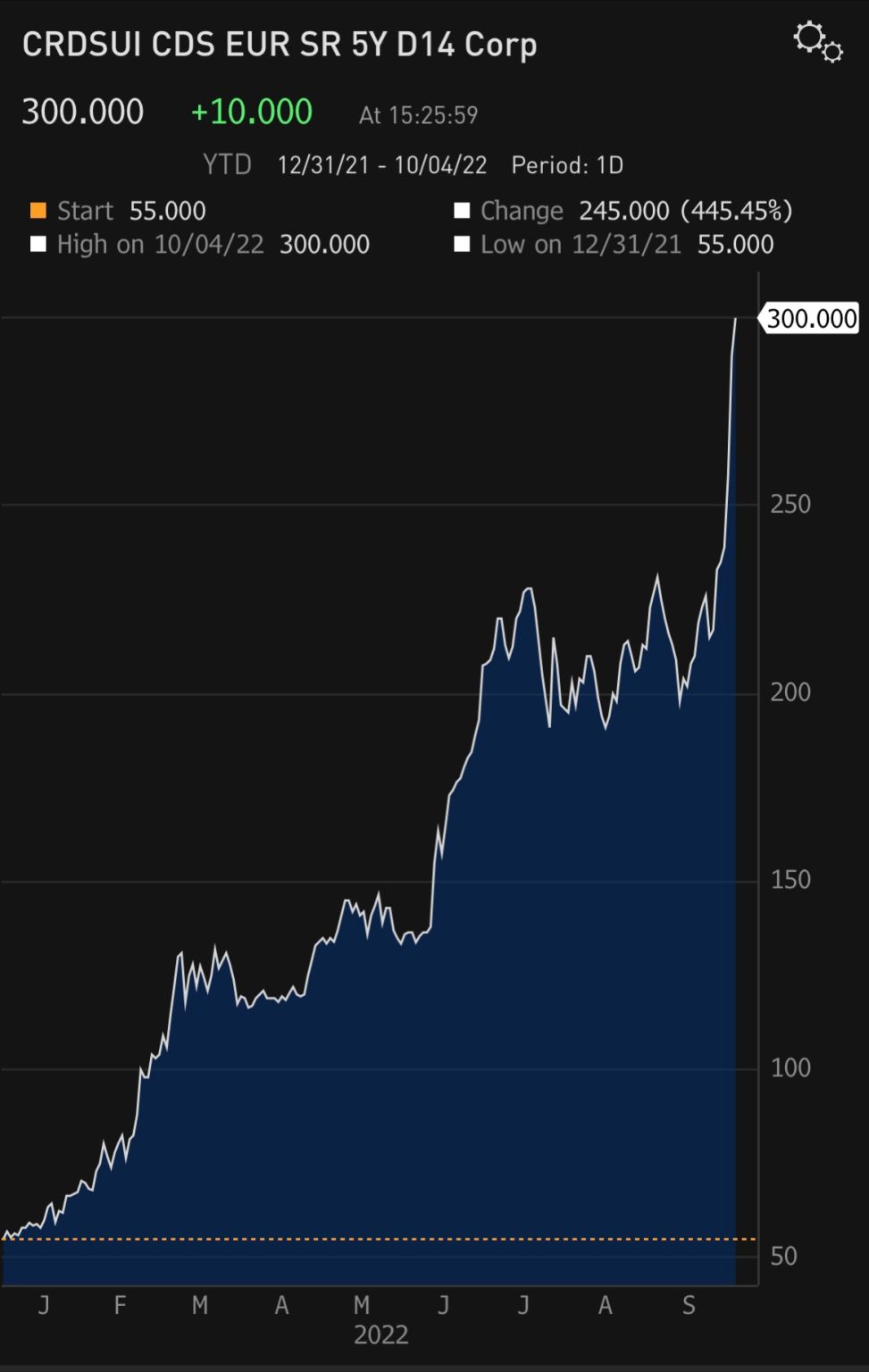

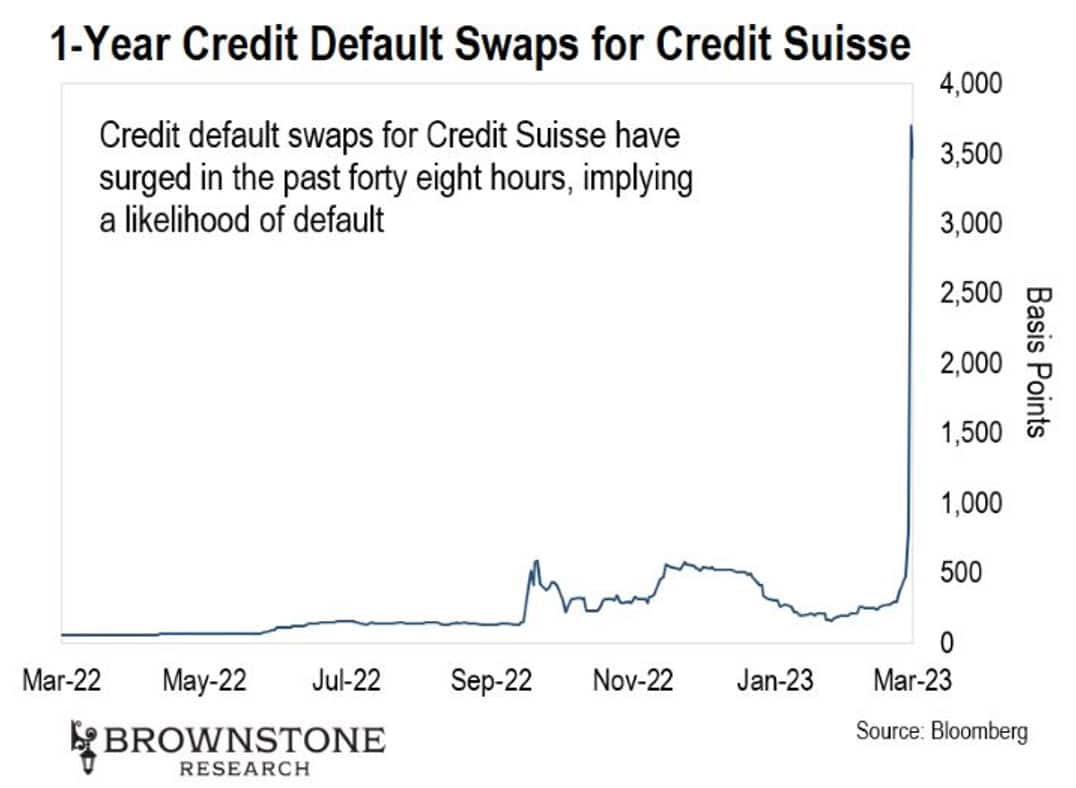

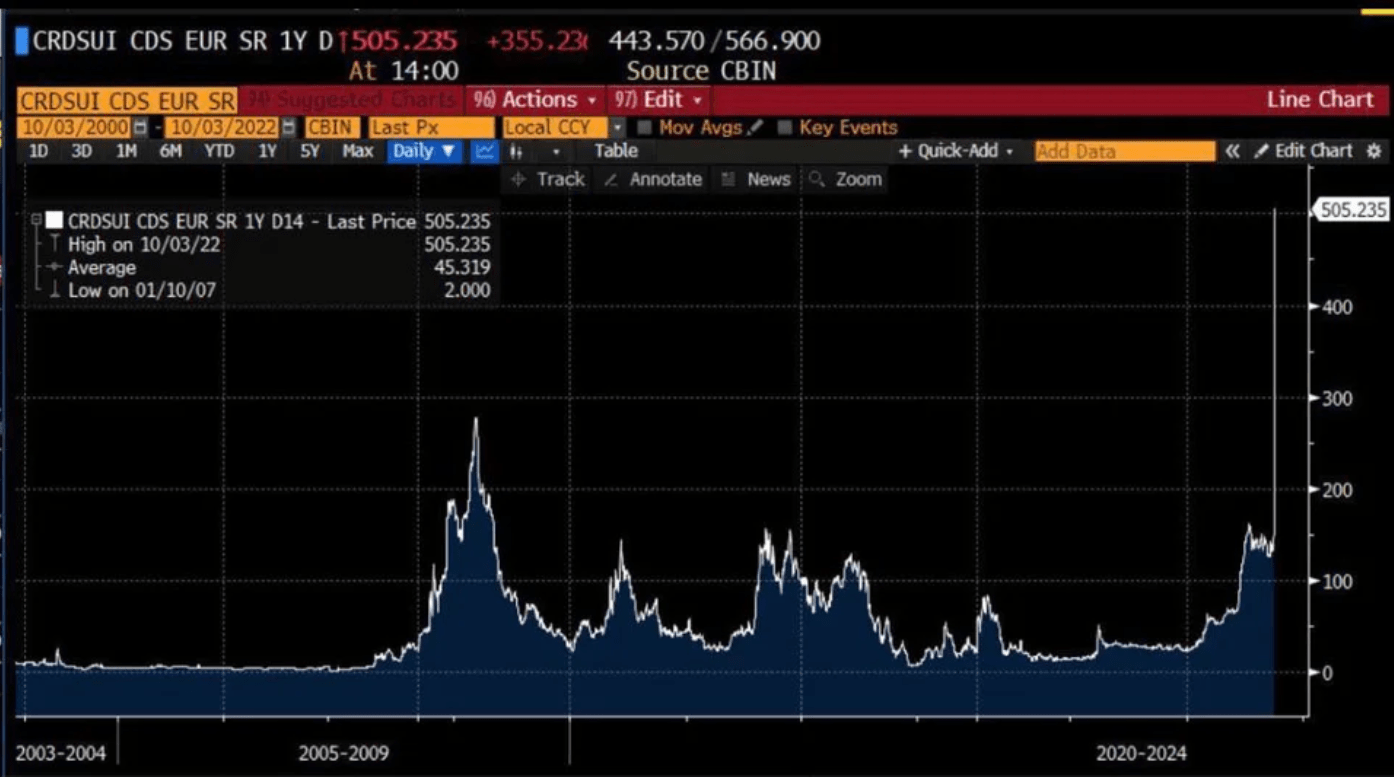

Credit Suisse Default Swaps Chart - Web the cost of insuring exposure to debt issued by swiss lender ubs rose to a decade high on monday after peer credit suisse was caught in the market spotlight amid concerns about its ability to. This article is for subscribers only. Web credit default swaps (cds) helfen dem anleger, die bonität eines unternehmens einzuschätzen. Credit suisse group ag ’s wretched day in the capital markets resulted in huge distortions in the price of. In the following table you can. Web october 3, 2022 at 9:51 am pdt. They widened the most in a. Das bedeutet, dass anleger 574.000 euro. Web credit suisse default swaps are 18 times ubs, 9 times deutsche bank. 2) die citigroup global markets deutschland. Web credit suisse is out in front in the ib default sweepstakes, with peers trending higher as a pack. They widened the most in a. In the following table you can. Sign in / free sign up now to save your chart settings. Cost of protection is closing in on level signaling concern. 2) die citigroup global markets deutschland. They widened the most in a. This article is for subscribers only. In london, while ubs’ equivalent swaps were indicated at 92.7 basis points, according to ice. Cost of protection is closing in on level signaling concern. Credit suisse cds 5 years eur discussions. Web credit suisse is out in front in the ib default sweepstakes, with peers trending higher as a pack. Web traders and investors rushed to sell credit suisse’s shares and bonds while buying credit default swaps (cds), derivatives that act like insurance contracts that pay out if a company. Cost of protection is. In london, while ubs’ equivalent swaps were indicated at 92.7 basis points, according to ice. Cost of protection is closing in on level signaling concern. Web credit default swaps (cds) helfen dem anleger, die bonität eines unternehmens einzuschätzen. Get instant access to a free live advanced. Sign in / free sign up now to save your chart settings. Get instant access to a free live advanced. Das bedeutet, dass anleger 574.000 euro. Cost of protection is closing in on level signaling concern. Credit suisse cds 5 years eur discussions. Sign in / free sign up now to save your chart settings. Web as credit suisse’s stock and bond prices have whipsawed in recent days, the price of credit default swaps (cds) tied to the bank — derivatives that act like insurance and pay out if a company. Cost of protection is closing in on level signaling concern. 2) die citigroup global markets deutschland. Das bedeutet, dass anleger 574.000 euro. Credit suisse. This article is for subscribers only. Sign in / free sign up now to save your chart settings. Credit suisse group ag ’s wretched day in the capital markets resulted in huge distortions in the price of. Credit suisse cds 5 years eur discussions. Web credit suisse default swaps are 18 times ubs, 9 times deutsche bank. Credit suisse cds 5 years eur discussions. In london, while ubs’ equivalent swaps were indicated at 92.7 basis points, according to ice. Web as credit suisse’s stock and bond prices have whipsawed in recent days, the price of credit default swaps (cds) tied to the bank — derivatives that act like insurance and pay out if a company. Das bedeutet,. Web traders and investors rushed to sell credit suisse’s shares and bonds while buying credit default swaps (cds), derivatives that act like insurance contracts that pay out if a company. Credit suisse group ag ’s wretched day in the capital markets resulted in huge distortions in the price of. Web credit suisse is out in front in the ib default. They widened the most in a. Credit suisse cds 5 years eur discussions. Sign in / free sign up now to save your chart settings. Web credit suisse is out in front in the ib default sweepstakes, with peers trending higher as a pack. Web credit suisse default swaps are 18 times ubs, 9 times deutsche bank. They widened the most in a. Web october 3, 2022 at 9:51 am pdt. Web credit suisse default swaps are 18 times ubs, 9 times deutsche bank. Get instant access to a free live advanced. In the following table you can. Sign in / free sign up now to save your chart settings. In london, while ubs’ equivalent swaps were indicated at 92.7 basis points, according to ice. The bunching is because cds isn’t an objective barometer of default risk. Web the cost of insuring exposure to debt issued by swiss lender ubs rose to a decade high on monday after peer credit suisse was caught in the market spotlight amid concerns about its ability to. 2) die citigroup global markets deutschland. Web as credit suisse’s stock and bond prices have whipsawed in recent days, the price of credit default swaps (cds) tied to the bank — derivatives that act like insurance and pay out if a company. Web credit default swaps (cds) helfen dem anleger, die bonität eines unternehmens einzuschätzen. Credit suisse cds 5 years eur discussions. Web credit default swaps (cds) are a type of insurance against default risk by a particular country. Credit suisse group ag ’s wretched day in the capital markets resulted in huge distortions in the price of. Cost of protection is closing in on level signaling concern.James W. sur LinkedIn Credit Suisse’s Default Swaps Rise to a Record

Credit Default Swaps and Credit Suisse Fixed News Australia

Credit Suisse Credit Default Swap What is it and how did it happen

Steve Burns on Twitter "What are the 5 year Credit Default Swaps for

Credit Suisse — Credit Default Swaps a Flashing Caution Sign?

![[긴급/로이터] 스위스 중앙은행, 크레디트 스위스 사태 개입발표. 540억 달러지원. 클리앙](https://graphics.reuters.com/CREDITSUISSEGP-STOCKS/akveqegdgvr/chart.png)

[긴급/로이터] 스위스 중앙은행, 크레디트 스위스 사태 개입발표. 540억 달러지원. 클리앙

What is a Credit Default Swap (CDS)? Meaning and How They Work IG UK

Credit Suisse Credit Default Swaps Chart

Credit default swap definition and meaning Market Business News

Can you purchase credit default swaps? Leia aqui Can anyone buy credit

Web Credit Suisse Is Out In Front In The Ib Default Sweepstakes, With Peers Trending Higher As A Pack.

This Article Is For Subscribers Only.

Web Traders And Investors Rushed To Sell Credit Suisse’s Shares And Bonds While Buying Credit Default Swaps (Cds), Derivatives That Act Like Insurance Contracts That Pay Out If A Company.

Das Bedeutet, Dass Anleger 574.000 Euro.

Related Post: