Credit Suisse Credit Default Swaps Chart

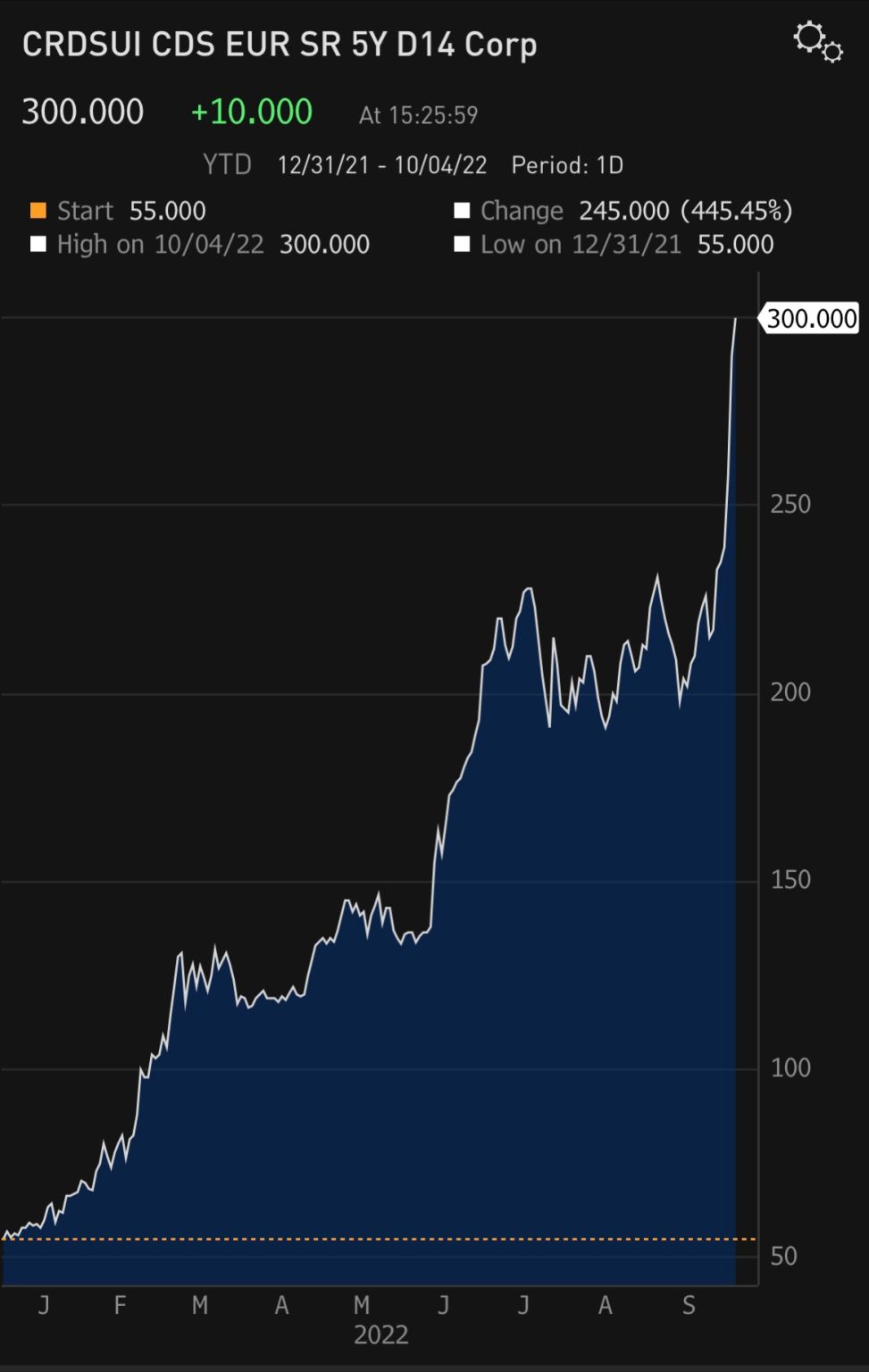

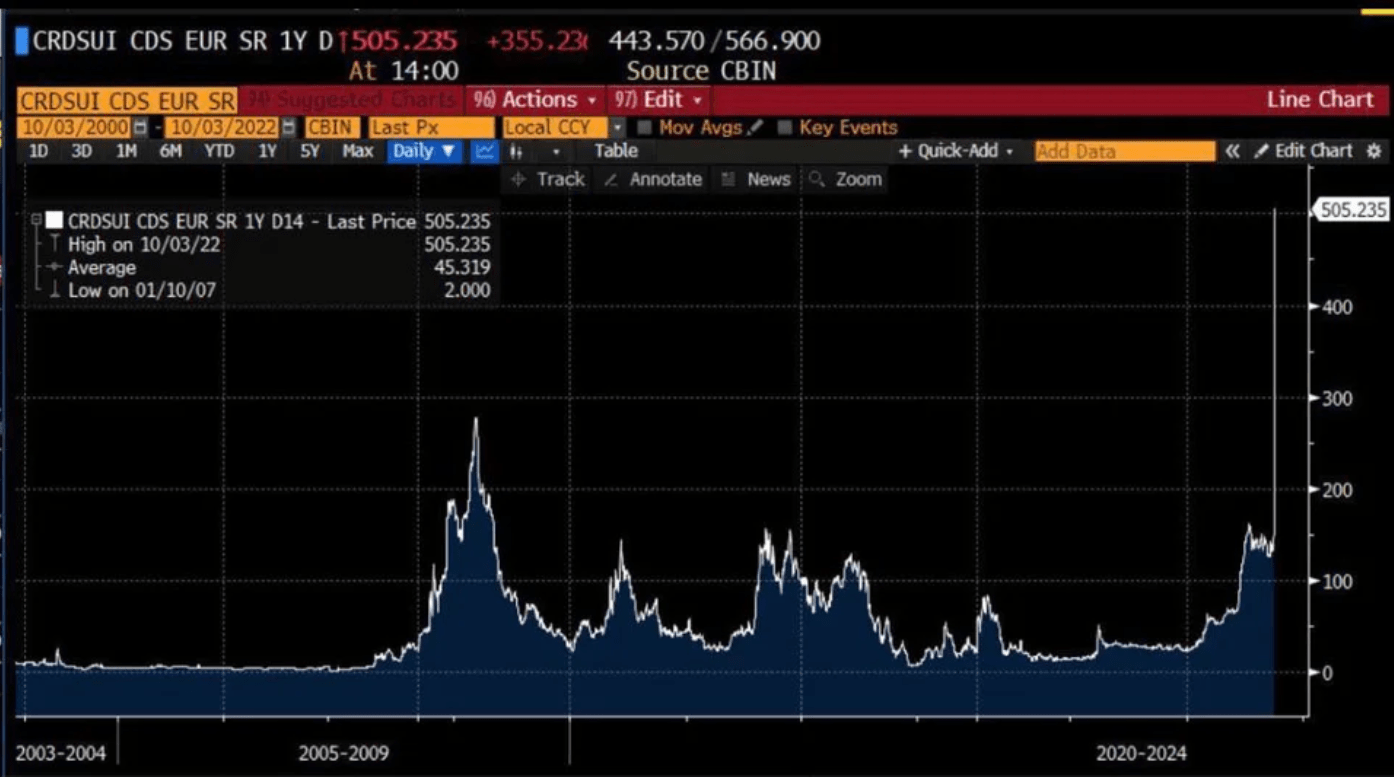

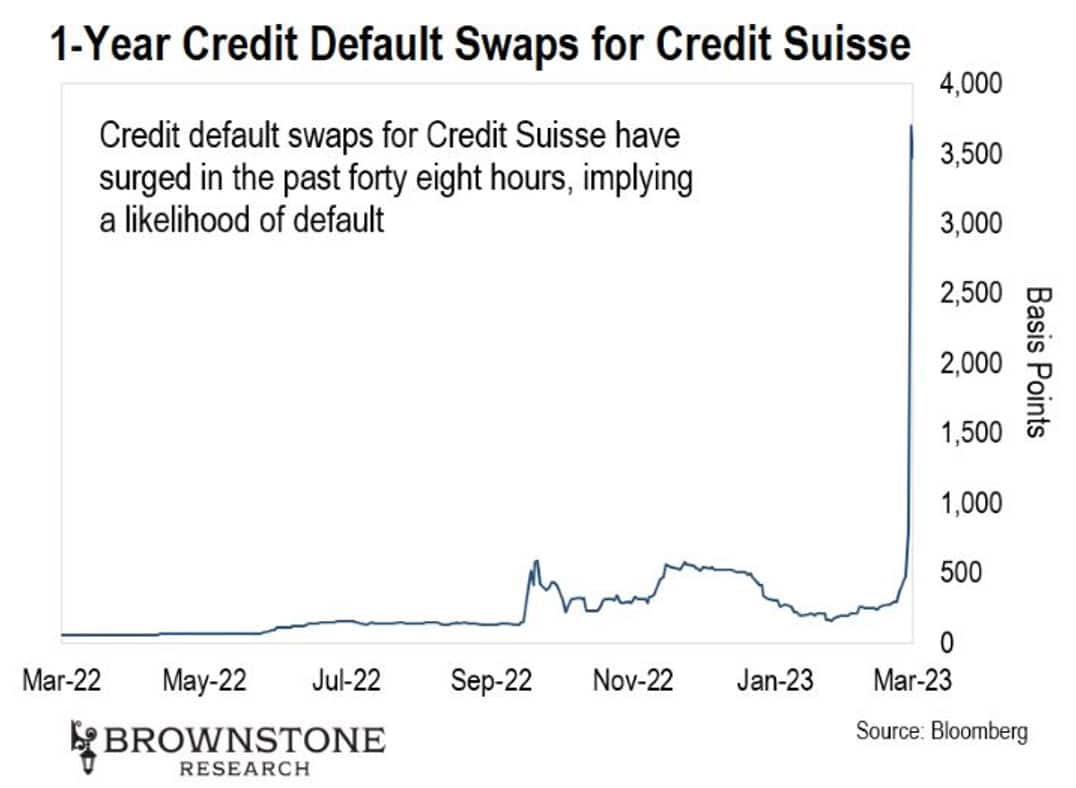

Credit Suisse Credit Default Swaps Chart - The cost of insuring exposure to credit suisse debt rose on friday by 24 basis points from thursday's close to 320 bps, data from s&p global market intelligence showed. Web credit default swaps spike: 2) die citigroup global markets deutschland. Cost of protection is closing in on level signaling concern. In london, while ubs’ equivalent swaps were indicated at 92.7 basis points, according. Web traders and investors rushed to sell credit suisse’s shares and bonds while buying credit default swaps (cds), derivatives that act like insurance contracts that pay out if a company. Web as credit suisse’s stock and bond prices have whipsawed in recent days, the price of credit default swaps (cds) tied to the bank — derivatives that act like insurance and pay out if a company. Anleiheinvestoren hoffen, die zinsen für ihre anleihen und ihr geld bei fälligkeit der anleihe zurückzuerhalten. Cds increases with interest rates. There are the charts you want starting 2006. Web credit suisse default swaps plunge as panel rules against payout. Web henesys12 • 10 mo. The mkt value of those contracts is going parabolic over the last 45 days. Das bedeutet, dass anleger 574.000 euro. Web as credit suisse’s stock and bond prices have whipsawed in recent days, the price of credit default swaps (cds) tied to the bank. Web as credit suisse’s stock and bond prices have whipsawed in recent days, the price of credit default swaps (cds) tied to the bank — derivatives that act like insurance and pay out if a company. In london, while ubs’ equivalent swaps were indicated at 92.7 basis points, according. Web henesys12 • 10 mo. Panel said at1 bonds are junior. About 1000 cds are covered. Web wallst is buying up bets on credit suisse defaulting on credit obligations. Shares in the bank rose by 3% on. Web as credit suisse’s stock and bond prices have whipsawed in recent days, the price of credit default swaps (cds) tied to the bank — derivatives that act like insurance and pay out if. The crisis at credit suisse ( cs) is deepening, with credit default swaps at the bank nearing distressed levels, on the heels of the silicon valley bank fallout. Shares in the bank rose by 3% on. Anleiheinvestoren hoffen, die zinsen für ihre anleihen und ihr geld bei fälligkeit der anleihe zurückzuerhalten. Web traders and investors rushed to sell credit suisse’s. Panel said at1 bonds are junior to notes underlying the. Web traders and investors rushed to sell credit suisse’s shares and bonds while buying credit default swaps (cds), derivatives that act like insurance contracts that pay out if a company. The higher interest rates go up, the more attractive bonds are going to be, and the more likely an investor. About 1000 cds are covered. Cds increases with interest rates. Anleiheinvestoren hoffen, die zinsen für ihre anleihen und ihr geld bei fälligkeit der anleihe zurückzuerhalten. Web traders and investors rushed to sell credit suisse’s shares and bonds while buying credit default swaps (cds), derivatives that act like insurance contracts that pay out if a company. There are the charts you. Cds increases with interest rates. They widened the most in a. Web credit suisse default swaps are 18 times ubs, 9 times deutsche bank. The higher interest rates go up, the more attractive bonds are going to be, and the more likely an investor would purchase them, and hence more demand for hedges against those bonds defaulting, causing cds. Panel. Shares in the bank rose by 3% on. I do not believe based on screenshot that. About 1000 cds are covered. Credit suisse’s credit default swaps, or cds, a derivative instrument that allows an investor to swap their credit risk with another investor, surged. Web wallst is buying up bets on credit suisse defaulting on credit obligations. I do not believe based on screenshot that. There are the charts you want starting 2006. Shares in the bank rose by 3% on. Panel said at1 bonds are junior to notes underlying the. About 1000 cds are covered. Anleiheinvestoren hoffen, die zinsen für ihre anleihen und ihr geld bei fälligkeit der anleihe zurückzuerhalten. Web credit suisse default swaps are 18 times ubs, 9 times deutsche bank. In london, while ubs’ equivalent swaps were indicated at 92.7 basis points, according. They widened the most in a. Cost of protection is closing in on level signaling concern. The mkt value of those contracts is going parabolic over the last 45 days. Web henesys12 • 10 mo. There are the charts you want starting 2006. Shares in the bank rose by 3% on. The cost of insuring exposure to credit suisse debt rose on friday by 24 basis points from thursday's close to 320 bps, data from s&p global market intelligence showed. The crisis at credit suisse ( cs) is deepening, with credit default swaps at the bank nearing distressed levels, on the heels of the silicon valley bank fallout. Web credit suisse default swaps are 18 times ubs, 9 times deutsche bank. They widened the most in a. Panel said at1 bonds are junior to notes underlying the. I do not believe based on screenshot that. The higher interest rates go up, the more attractive bonds are going to be, and the more likely an investor would purchase them, and hence more demand for hedges against those bonds defaulting, causing cds. Credit suisse’s credit default swaps, or cds, a derivative instrument that allows an investor to swap their credit risk with another investor, surged. Cost of protection is closing in on level signaling concern. Web as credit suisse’s stock and bond prices have whipsawed in recent days, the price of credit default swaps (cds) tied to the bank — derivatives that act like insurance and pay out if a company. Web credit default swaps spike: 2) die citigroup global markets deutschland.

Credit Suisse ( CDS ) Credit Default Swap r/Wallstreetbetsnew

Credit Suisse — Credit Default Swaps a Flashing Caution Sign?

Steve Burns on Twitter "What are the 5 year Credit Default Swaps for

Credit default swap definition and meaning Market Business News

![[긴급/로이터] 스위스 중앙은행, 크레디트 스위스 사태 개입발표. 540억 달러지원. 클리앙](https://graphics.reuters.com/CREDITSUISSEGP-STOCKS/akveqegdgvr/chart.png)

[긴급/로이터] 스위스 중앙은행, 크레디트 스위스 사태 개입발표. 540억 달러지원. 클리앙

James W. sur LinkedIn Credit Suisse’s Default Swaps Rise to a Record

Credit Suisse Credit Default Swap What is it and how did it happen

Credit Suisse Credit Default Swaps Chart

Credit Default Swaps and Credit Suisse Fixed News Australia

Explainer What are credit default swaps and why are they causing

In London, While Ubs’ Equivalent Swaps Were Indicated At 92.7 Basis Points, According.

About 1000 Cds Are Covered.

Web Wallst Is Buying Up Bets On Credit Suisse Defaulting On Credit Obligations.

Anleiheinvestoren Hoffen, Die Zinsen Für Ihre Anleihen Und Ihr Geld Bei Fälligkeit Der Anleihe Zurückzuerhalten.

Related Post: