Chart Of Accounts Non Profit

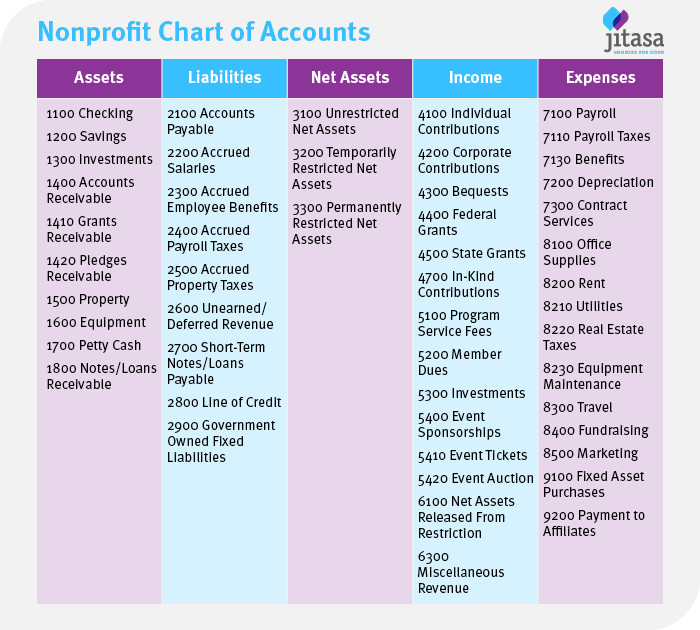

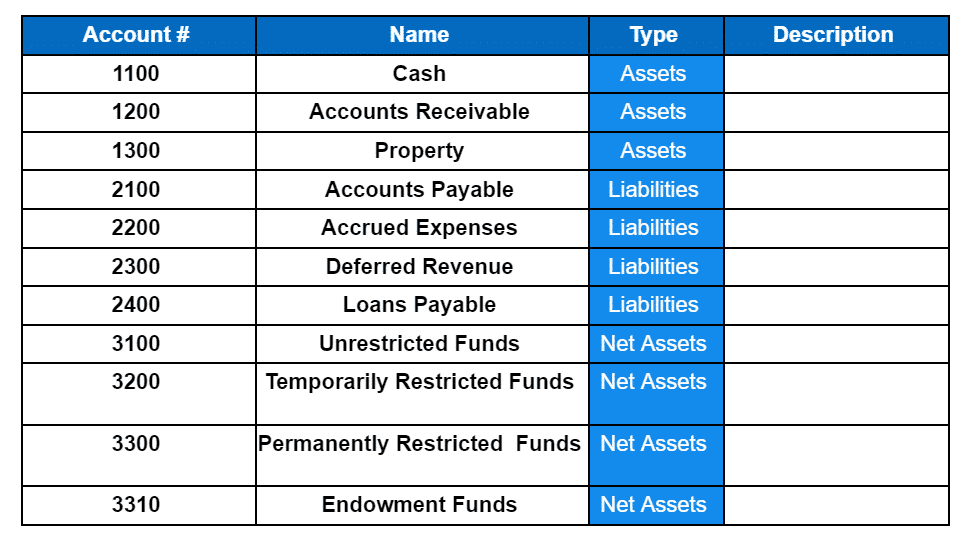

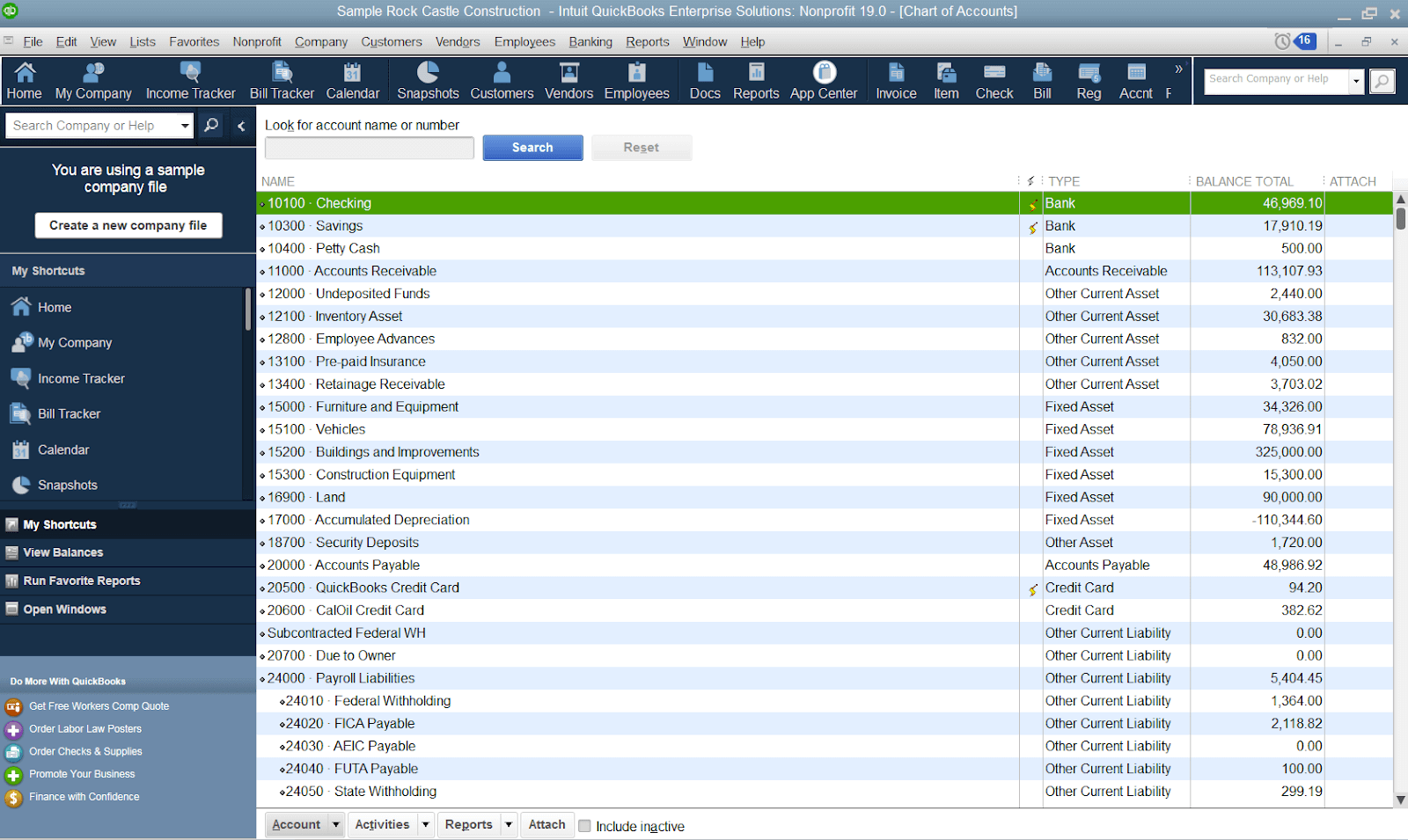

Chart Of Accounts Non Profit - Web what is a chart of accounts anyway? Each time you put money in or take money out of your group, you need to record it to the right account. Web steps for nonprofits to implement a chart of accounts. I understood that when you set the organization to nonprofit and the tax form to 990, that the chart of accounts would change to use terms like income instead of revenue for the type. Charts of accounts are like snowflakes. Let’s dive in with an overview of what your nonprofit’s coa is and how it’s. This will help you categorize and organize them effectively. Web in a nonprofit’s chart of accounts, each account is identified in four ways: The first step toward building an effective coa is to create a list of what your company will need to account for in the future. Get all the details in this blog. Web there are just four steps you need to follow when setting up your nonprofit chart of accounts, so let’s start with step one. Money league clubs reported a comparatively modest increase in. Web the chart of accounts (or coa) is a numbered list that categorizes your financial activity into different accounts and subaccounts. Compare fees, investment options, services, and. But why should it matter to your nonprofit, and how will you create and maintain one? The word chart just makes it sound fancy. The chart of accounts does not track specific transactions. Your chart of accounts reflects your unique organization. Let’s dive in with an overview of what your nonprofit’s coa is and how it’s. No two are exactly alike because no two organizations are exactly alike. Web the nonprofit chart of accounts should be split into statement of financial position and statement of activities sections, each of which is then subdivided into groups (e.g. It’s a series of line items, or accounts, that allows you to organize your accounting data. Web a nonprofit chart. Web there are just four steps you need to follow when setting up your nonprofit chart of accounts, so let’s start with step one. Web discover how to build your chart of accounts in quickbooks and take advantage of our sample chart of accounts. Your chart of accounts reflects your unique organization. The first step toward building an effective coa. Your chart of accounts should reflect what your organization has and does. Cash, accounts receivable, revenue, expenses etc). To number a chart of accounts, start by determining the types of accounts your nonprofit has. Web what is a chart of accounts anyway? The first step toward building an effective coa is to create a list of what your company will. Web in this guide, we’ll cover the basics of the nonprofit chart of accounts, including: Web a nonprofit chart of accounts (coa) is a guide that helps nonprofits classify and track expenses and revenue. Create a list of accounts. Web what is a nonprofit chart of accounts? Because the coa compiles so much information, this important resource can be daunting. Web now, the company is venturing into the generative ai space with “fit hub,” a new tool that aims to improve the way online shoppers find clothing that fits their body type. Web a nonprofit chart of accounts (coa) is a guide that helps nonprofits classify and track expenses and revenue. Web what is a chart of accounts anyway? Web. Web a nonprofit chart of accounts (coa) is a guide that helps nonprofits classify and track expenses and revenue. Your coa should align with the specific needs of the organization and reflect its unique financial activities. Compare fees, investment options, services, and features to find the top brokerage account. Web a chart of accounts (coa) is a list of general. I am new to qb and have a question about the chart of accounts. Web a chart of accounts (coa) is a list of financial accounts that helps nonprofits keep track of their transactions. Web discover how to build your chart of accounts in quickbooks and take advantage of our sample chart of accounts. The first step toward building an. Purpose of the nonprofit chart of accounts; It provides a structure for organizing financial information, ensuring accurate allocation of transactions, and facilitating compliance with financial reporting standards. I am new to qb and have a question about the chart of accounts. Web the chart of accounts (coa) tracks your various ledgers and everything your nonprofit does financially. Web discover the. Web a chart of accounts is a systematic way to organize and track financial transactions using different “accounts”. Purpose of the nonprofit chart of accounts; A nonprofit chart of accounts for your organization is the list of each account that money comes into, or out of, in your organization. Generally the most used accounts should be kept near the top of each group. Web there are just four steps you need to follow when setting up your nonprofit chart of accounts, so let’s start with step one. But the first two, number and name, determine the overall structure and organization of accounts and subaccounts. The word chart just makes it sound fancy. Web 3 steps for numbering a chart of accounts. Nonprofit chart of accounts example; Charts of accounts are like snowflakes. These line items pertain to your financial position (or statement of financial position) and to your financial activities (or statement of activities). But why should it matter to your nonprofit, and how will you create and maintain one? What is a nonprofit chart of accounts? Web what is a chart of accounts anyway? This will help you categorize and organize them effectively. A coa categorizes an expense or revenue as either “revenue” or “expense.” it is a financial document used by organizations with 501 (c) (3) status to account for the money they receive and spend.

sample nonprofit chart of accounts

Nonprofit Chart Of Accounts Example Excel

Chart Of Accounts For Non Profit Accounting

Nonprofit Chart of Accounts How to Get Started + Example

Chart Of Accounts For Nonprofit Sample

sample nonprofit chart of accounts

The Beginner’s Guide to Nonprofit Chart of Accounts

Nonprofit Chart of Accounts Template Double Entry Bookkeeping

Grow Your Nonprofit Organization With A Good Chart of Accounts Help

Quickbooks Nonprofit Chart Of Accounts

Web The Chart Of Accounts (Coa) Tracks Your Various Ledgers And Everything Your Nonprofit Does Financially.

This List Is Created By Your Organization And Will Vary Depending On Your Nonprofit’s Needs.

Analyze Your Organization’s Needs And Objectives.

Each Time You Put Money In Or Take Money Out Of Your Group, You Need To Record It To The Right Account.

Related Post: