Chart Of Accounts For Churches

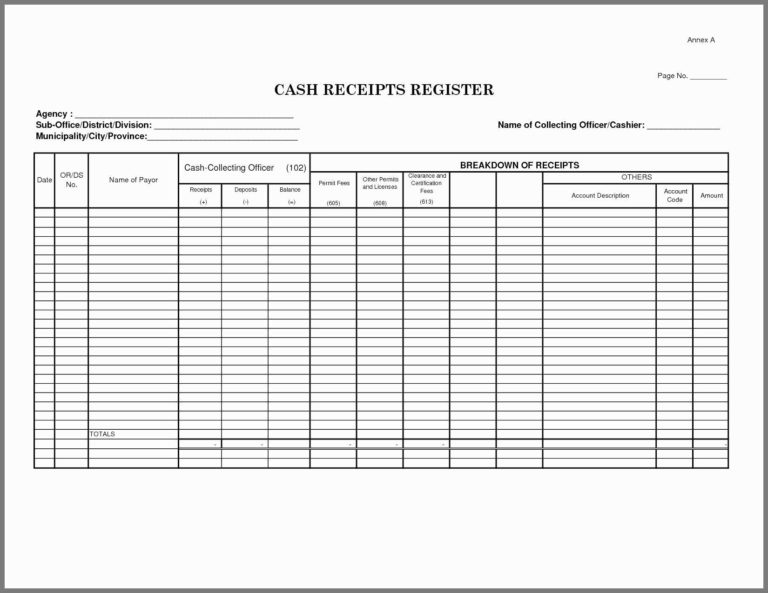

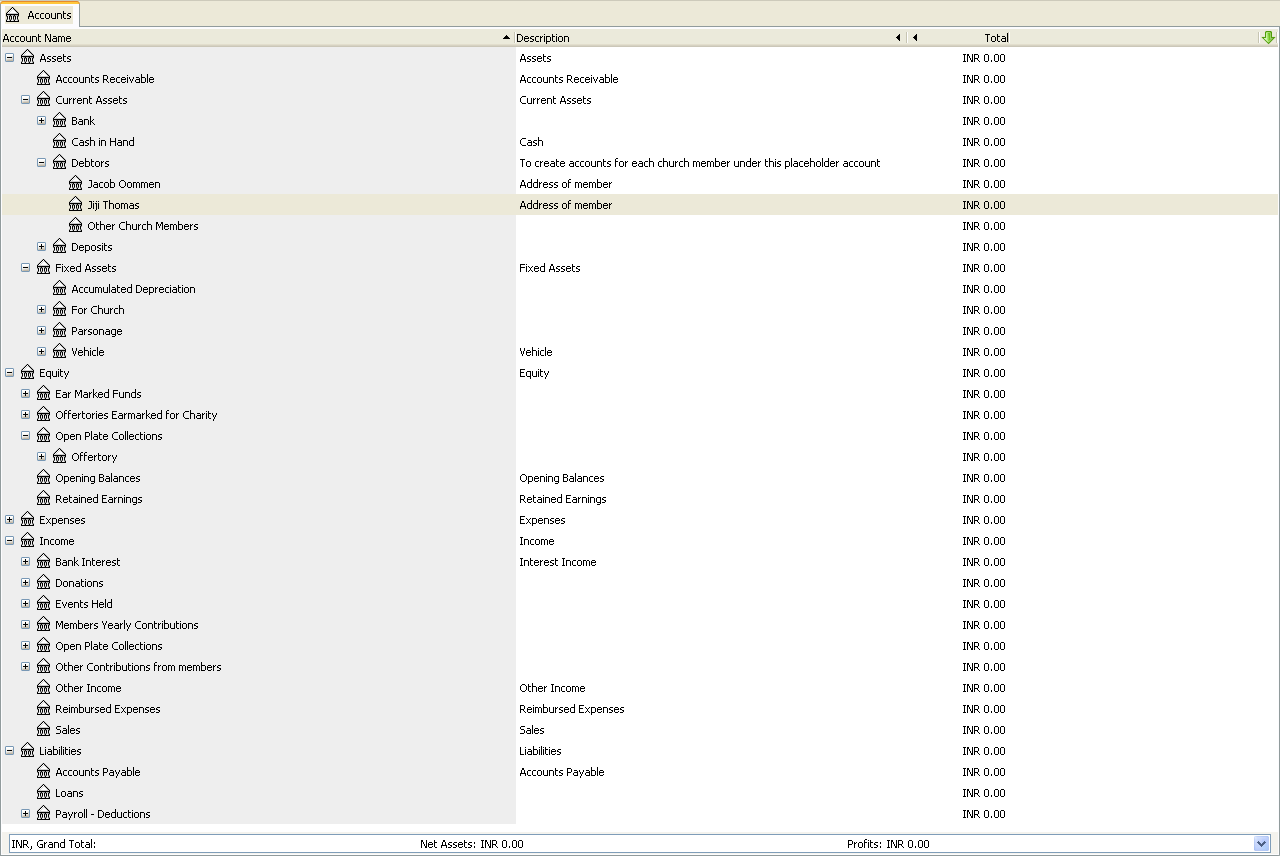

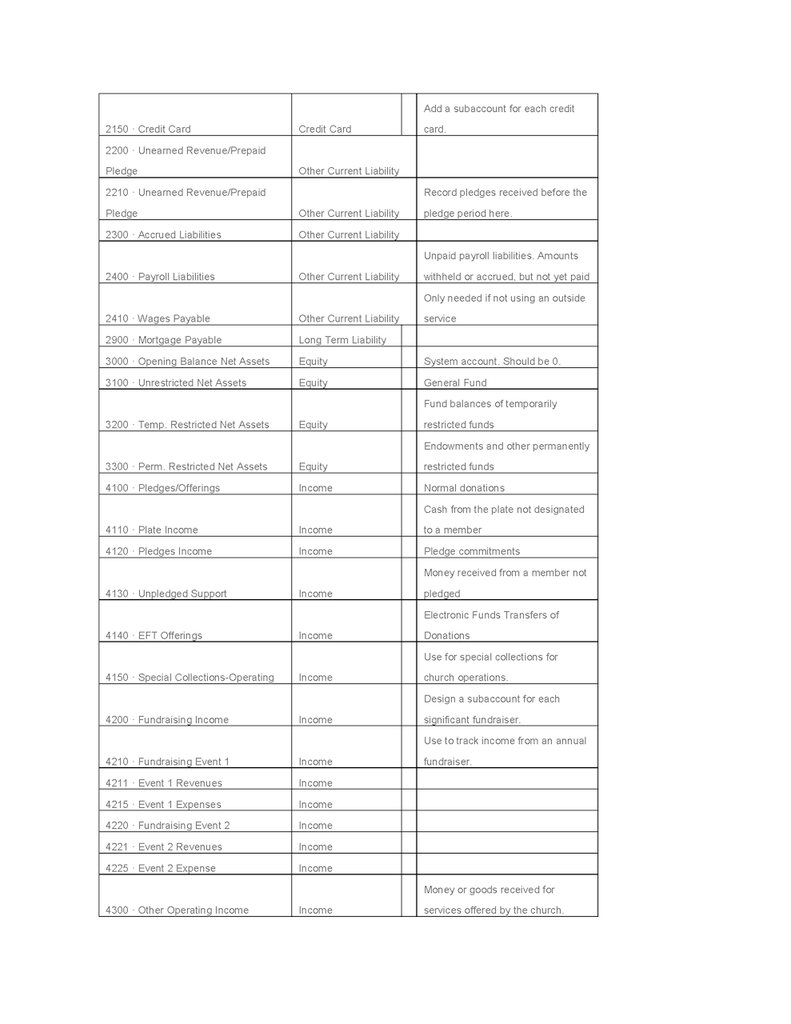

Chart Of Accounts For Churches - Fund accounting helps churches show accountability because bookkeepers can break down revenue and expenses into separate funds. An ideal structure will be based on your vision, plans, and organizational chart. Full spreadsheet template for church accounting. Web setting up and reviewing your chart of accounts. Web the church’s chart of accounts (coa) is the building block for your entire church accounting system. It is one of the most important things you’ll need to set up to correctly record transactions and contributions, and to generate financial reports. Churches, like any other organization, need to keep a close eye on their finances to ensure a stable future and continued growth. Web a chart of accounts is a helpful and pivotal tool in tracking a church’s financial activity, from tithes and offerings to payroll and other costs. Churches should use fund accounting. Web the chart of accounts is a list of accounts that you set up to organize and keep track of the money your church spends and receives. Web what is a chart of accounts? Locations, funds, and departments are the common building. Web what is a chart of accounts and how should you number your chart of accounts for a church or nonprofit? This comprehensive tool allows you to categorize financial activity by class, location, and project, giving you a clear and detailed view of your congregation’s. Web written by aplos success team. If you’re using quickbooks®, there may not be an easy way to set up your church’s chart of. They make it easy for you to access accounting spreadsheets on a computer or mobile device, as well as print them out. Web the chart of accounts is a list of accounts that you set up. Web the chart of accounts is a list of accounts that you set up to organize and keep track of the money your church spends and receives. Web sample church chart of accounts church name statement assets current assets. Web a church chart of accounts should track assets, liabilities, and equities, income and expense accounts as a fundamental financial task. Full spreadsheet template for church accounting. An ideal structure will be based on your vision, plans, and organizational chart. Web your church chart of accounts. It can trace your income and expenses as well as your equity, assets, and liability. Web north texas conference suggested chart of accounts for churches. Bookkeepers can start with smaller ledgers for different revenue sources, and accountants can combine them into a greater chart of accounts. Web a church chart of accounts should track assets, liabilities, and equities, income and expense accounts as a fundamental financial task because it plays a crucial role in tracking and managing the financial resources of a church or any. You don’t record any financial data in the chart itself. To get started with church accounting, you’ll need to understand a few notable financial resources and reports. If you’re using quickbooks®, there may not be an easy way to set up your church’s chart of. Churches should use fund accounting. In a proper church accounting system, the coa works in. Fund accounting helps churches show accountability because bookkeepers can break down revenue and expenses into separate funds. In a proper church accounting system, the coa works in conjunction with funds, to create a robust church fund accounting system that answers the question of accountability. Web a church chart of accounts should track assets, liabilities, and equities, income and expense accounts. Locations, funds, and departments are the common building. 1100 cash and marketable securities. Fund accounting helps churches show accountability because bookkeepers can break down revenue and expenses into separate funds. Web discover how to effectively set up a chart of accounts for a church. Web setting up and reviewing your chart of accounts. Web north texas conference suggested chart of accounts for churches. Church windows accounting provides your church with a chart of accounts structure that allows for assets, liabilities, funds, income, and expense accounts to be separated into their own distinct categories. Web an elegant chart of accounts can bring clarity, simplicity, and efficiency to an organization’s financial reporting. Churches should use. If you’re using quickbooks®, there may not be an easy way to set up your church’s chart of. Web north texas conference suggested chart of accounts for churches. Web our church chart of accounts template is here to help! Web the accounting templates are designed to assist you in the process of maintaining your financial records and organizing church money.. Web our church chart of accounts template is here to help! Churches should use fund accounting. This comprehensive tool allows you to categorize financial activity by class, location, and project, giving you a clear and detailed view of your congregation’s financial performance. Web the chart of accounts is a list of accounts that you set up to organize and keep track of the money your church spends and receives. Here is a breakdown of four of the most important document types. Church windows accounting provides your church with a chart of accounts structure that allows for assets, liabilities, funds, income, and expense accounts to be separated into their own distinct categories. Learn the essentials of church financial management in this guide. 5200 x 5210 bank charges x 5220 payroll charges x 5230 office expenses x 5240 general conference expense x 5250 core giving x 5300 x 5310 equipment maintenance x 5320 repairs and maintenance x 5330 telephone, internet x 5340 heat x 5350. Web key church accounting documents. 1100 cash and marketable securities. Web there are four basic principles of effective chart of accounts design and they are most prominently applied to reporting elements like travel, supplies, and meals. To get started with church accounting, you’ll need to understand a few notable financial resources and reports. Your church’s chart of accounts is essentially its financial directory. It’s a list of the accounts you use in your organization to track your financial transactions. Funds received from special appeals for capital projects over $100,000 which have been approved by the bishop for church building. Web a church chart of accounts should track assets, liabilities, and equities, income and expense accounts as a fundamental financial task because it plays a crucial role in tracking and managing the financial resources of a church or any nonprofit organization.

SOLUTION Accounting sample chart of accounts church windows Studypool

Quickbooks For Churches Chart Of Accounts Beautiful Free Church with

Chart Of Accounts Examples For Churches

Chart Of Accounts List For Church

Church Accounting Using Gnucash 4 Sample chart of accounts Finance

QuickBooks® For Churches Chart Of Accounts Aplos Academy

Chart Of Accounts List For Church

QuickBooks® Online Chart of Accounts Template for Churches

Sample Church Chart Of Accounts

Church Chart of Accounts File for QuickBooks Online or QuickBooks 2020

Setting Up Your Church Chart Of Accounts Correctly Is The Mandatory First Step Toward Accurate Fund Accounting.

Web The Church’s Chart Of Accounts (Coa) Is The Building Block For Your Entire Church Accounting System.

Locations, Funds, And Departments Are The Common Building.

A Church Chart Of Accounts.

Related Post: