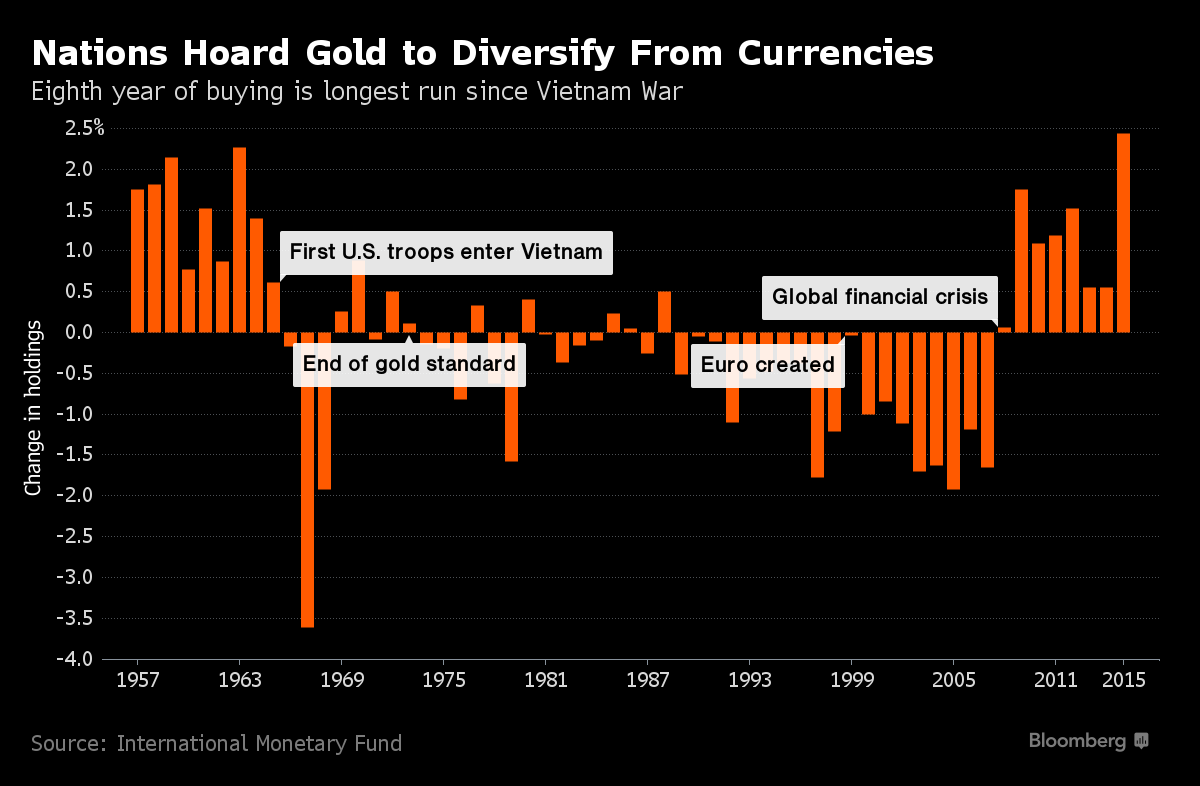

Central Banks Buying Gold Chart

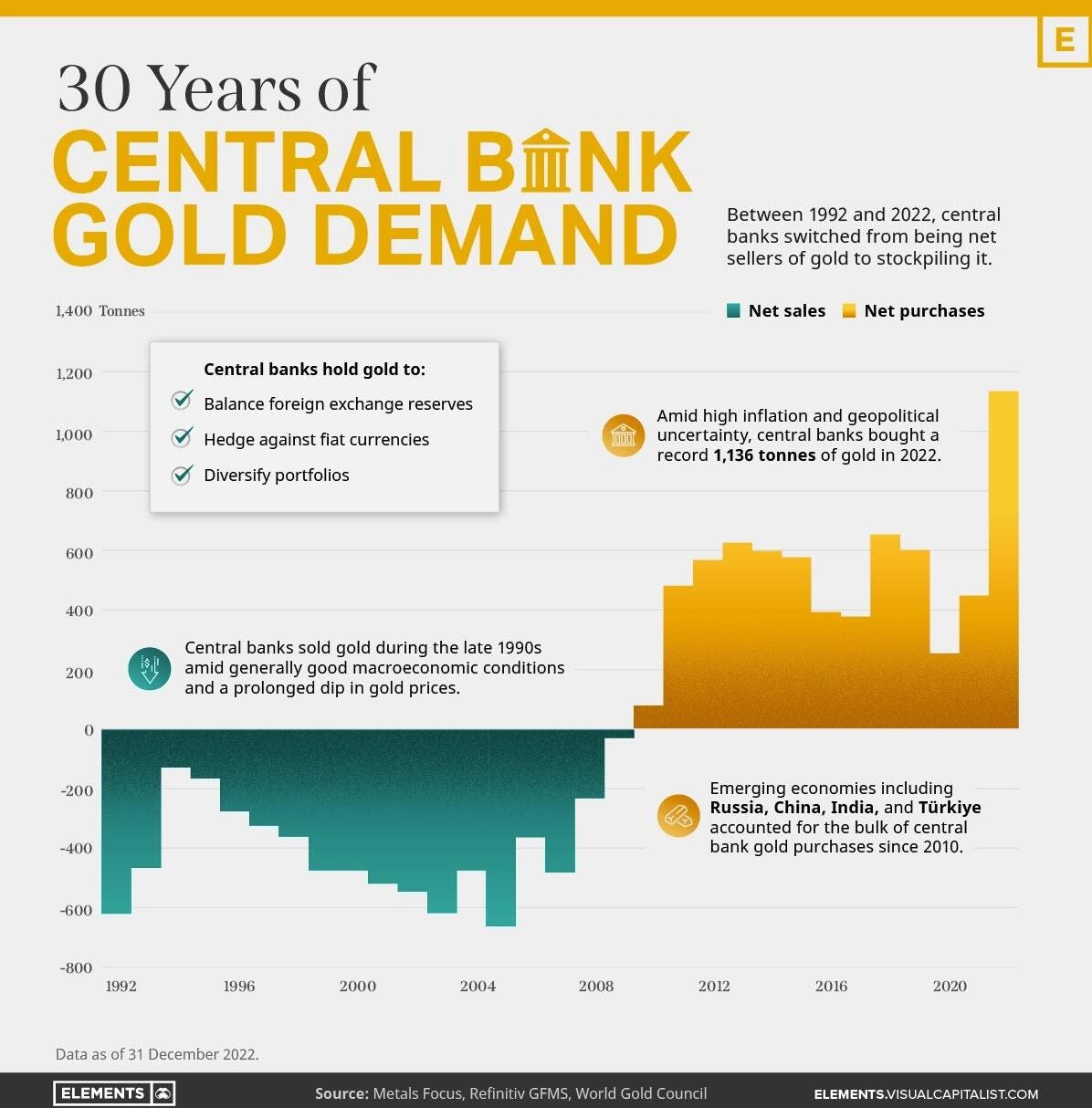

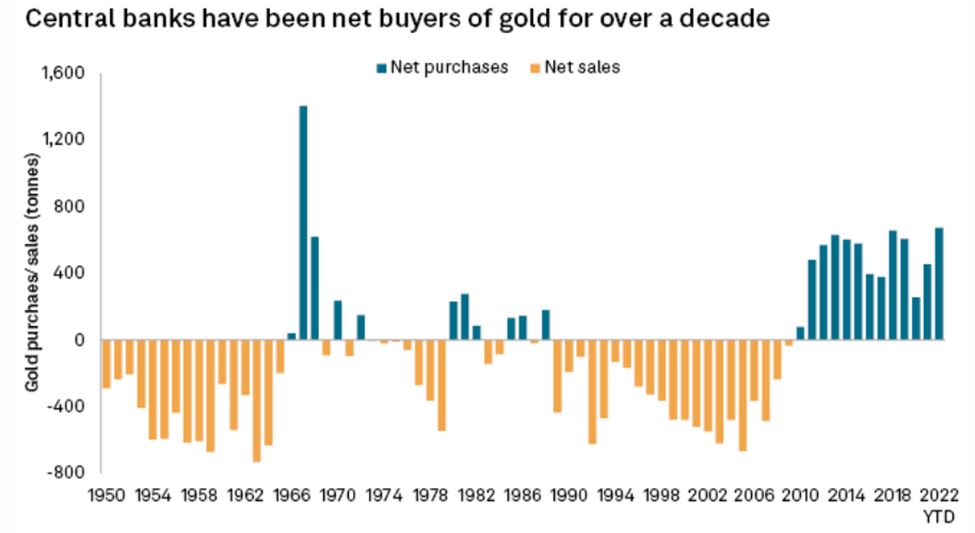

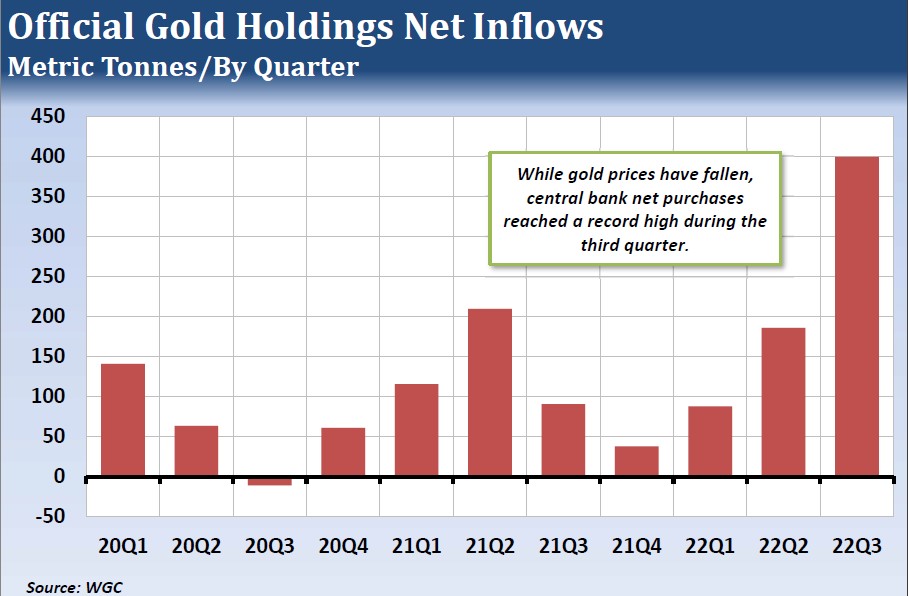

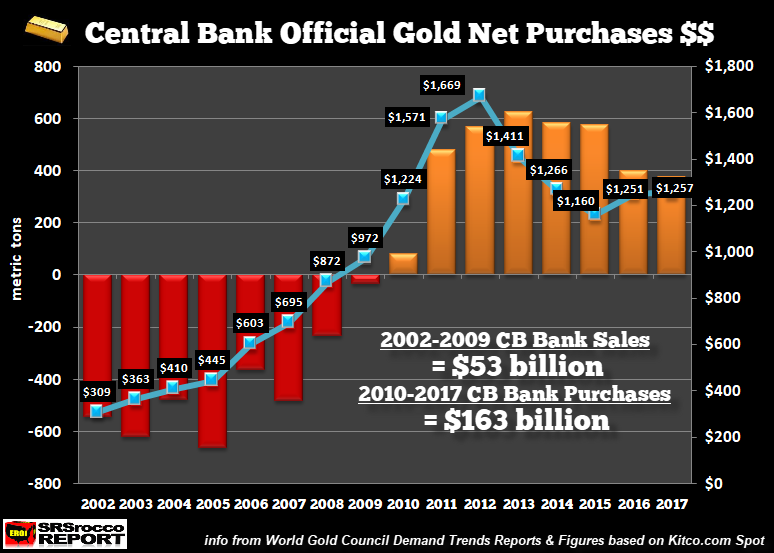

Central Banks Buying Gold Chart - Web now central banks are furiously buying gold again (see chart). The central bank of turkey was the largest buyer, increasing its official reserves. Web see how central banks have shifted from selling to buying gold over the last three decades, and which countries are the largest official buyers. Web central banks have purchased the most gold in 2022. Web central bank purchases of gold hit 417 tonnes in the final three months of the year, roughly 12 times higher than the same quarter a year ago. Central banks, federal reserve bank of st. Web analysis | 03/07/2024 15:16:00 gmt. In the third quarter alone 400 tonnes moved into their reserves. Web eight central banks increased their gold reserves by a tonne or more in april. See the chart of central bank buying by country and the factors driving their demand. That has pushed the total from. In the third quarter alone 400 tonnes moved into their reserves. Web see how central banks have shifted from selling to buying gold over the last three decades, and which countries are the largest official buyers. He explained that while central banks aren’t necessarily concerned with. This was a “combination of steady reported purchases. Central banks took up where they left off in 2023, adding more gold to their stockpiles to kick off the new year. He explained that while central banks aren’t necessarily concerned with. Web the amount of gold bought by central banks rose by 152 per cent year on year in 2022 to 1,136 tonnes, according to the world gold council,. Web eight central banks increased their gold reserves by a tonne or more in april. Web emde central banks, which have been the primary driver of gold buying since the 2008 global financial crisis, appear to more pessimistic about the us dollar’s future and more. Web central banks bought 180t of gold in q2, lifting h1 net purchases to 270t.. He explained that while central banks aren’t necessarily concerned with. See the chart of central bank buying by country and the factors driving their demand. Central banks took up where they left off in 2023, adding more gold to their stockpiles to kick off the new year. Web analysis | 03/07/2024 15:16:00 gmt. Web now central banks are furiously buying. But with its recent small correction downward,. Web central banks bought 180t of gold in q2, lifting h1 net purchases to 270t. Web central banks accumulated gold at the fastest pace on record in the first two months of 2023, according to a report by the world gold council’s (wgc) krishan. Web central bank gold reserves swell by more than. Web now central banks are furiously buying gold again (see chart). This was a “combination of steady reported purchases by central banks and a substantial. Central bank demand totalled 229t in q4, 35% lower q/q this lifted full. Web central bank purchases of gold hit 417 tonnes in the final three months of the year, roughly 12 times higher than. China, turkey and the middle east were the. And the buying spree has continued, with 387. World gold council citing metals focus,. Web the amount of gold bought by central banks rose by 152 per cent year on year in 2022 to 1,136 tonnes, according to the world gold council, a trade body. But with its recent small correction downward,. But with its recent small correction downward,. Web the amount of gold bought by central banks rose by 152 per cent year on year in 2022 to 1,136 tonnes, according to the world gold council, a trade body. March 7th, 2024 · comments · print. Web shah expects the gold market to form an interesting pattern in this environment. But. China, turkey and the middle east were the. Central banks have been buying gold at a record pace. But with its recent small correction downward,. This was a “combination of steady reported purchases by central banks and a substantial. In the third quarter alone 400 tonnes moved into their reserves. But with its recent small correction downward,. Web eight central banks increased their gold reserves by a tonne or more in april. This was a “combination of steady reported purchases by central banks and a substantial. Web emde central banks, which have been the primary driver of gold buying since the 2008 global financial crisis, appear to more pessimistic about. The central bank of turkey was the largest buyer, increasing its official reserves. Web central banks bought 180t of gold in q2, lifting h1 net purchases to 270t. Louis, international monetary fund, world bank, world gold council; March 7th, 2024 · comments · print. But with its recent small correction downward,. Central banks have been buying gold at a record pace. China, turkey and the middle east were the. Central banks took up where they left off in 2023, adding more gold to their stockpiles to kick off the new year. Web central bank gold reserves swell by more than 1,000t for the second successive year. See the chart of central bank buying by country and the factors driving their demand. Web analysis | 03/07/2024 15:16:00 gmt. Q3 net demand includes substantial estimate for unreported purchases. Web now central banks are furiously buying gold again (see chart). Web central banks’ gold purchases rose dramatically in the third quarter of 2022, according to data from the world gold council. Central bank demand totalled 229t in q4, 35% lower q/q this lifted full. Web central bank purchases of gold hit 417 tonnes in the final three months of the year, roughly 12 times higher than the same quarter a year ago.

Chart Showing Central Bank Gold Purchases Over Last Three Decades Will

Central Bank Gold BullionBuzz Chart of the Week BMG

12.12.19 central bank gold purchases graph CMI Gold & Silver

Gold Revaluation and the Hidden Motive Behind Central Banks’ Gold

Central Banks Buying Gold Traders' Insight

Gold purchases by central banks are increasing here's why World

CENTRAL BANK GOLD PURCHASES Stunning Impact On The Gold Price Gold Eagle

Then There Was None Canada Sells its Gold BMG

Central Banks Extend Longest GoldBuying Spree Since 1965 Chart

Eastern And Western Central Banks Support Gold Price GoldEagle News

Central Bank Demand Hit 228T In Q1, 34% Higher Than The Previous Q1 Record, Set In 2013 This Follows.

Central Banks, Federal Reserve Bank Of St.

In The Third Quarter Alone 400 Tonnes Moved Into Their Reserves.

This Was A “Combination Of Steady Reported Purchases By Central Banks And A Substantial.

Related Post: