Calstrs 2 At 60 Chart

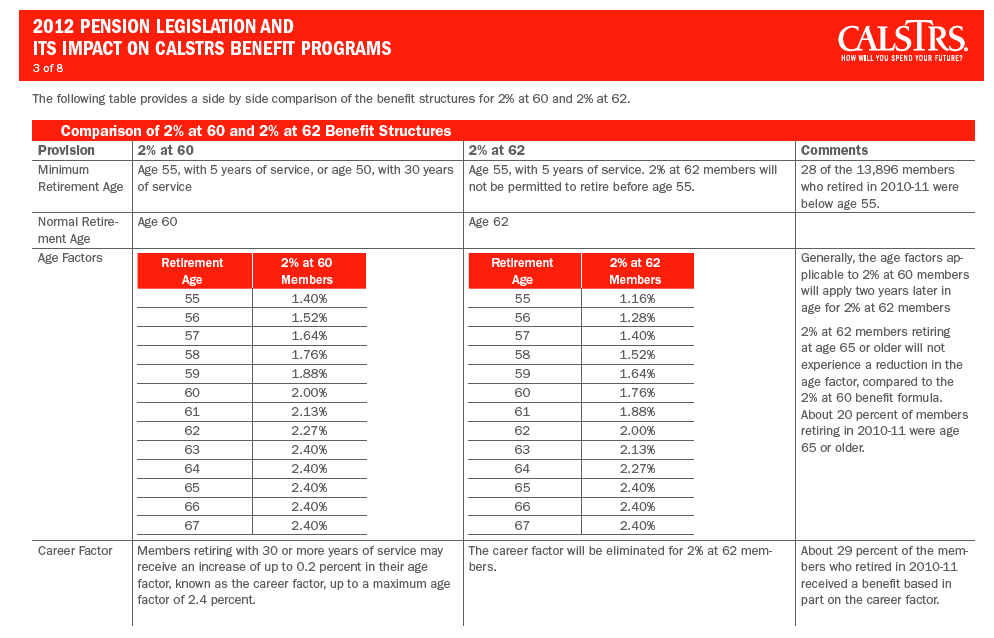

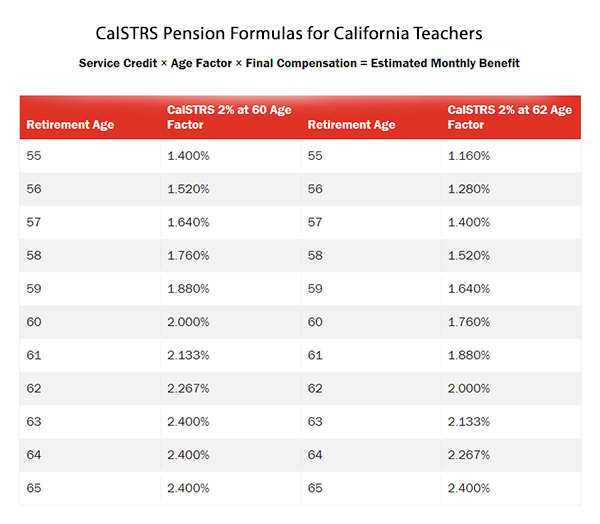

Calstrs 2 At 60 Chart - Web the california state teachers’ retirement system ( calstrs) and the california public employees’ retirement system ( calpers) manage pensions for california public school educators and other public employees. Web if only the fourth condition is not met, the payment is not creditable for db 2% at 62 members but may still be creditable for db 2% at 60 members. The standard age factor is 2% at age 60. Web if you became a calstrs member before january 1, 2013, you're under the calstrs 2% at 60 benefit structure.your benefit structure determines how your calstrs. Set at 2% at age 62. Web we have included two charts related to the state miscellaneous and industrial retirement formula 2% at 62. The second chart shows the percentage of final compensation you will receive. You were first hired before 01/01/2013 or were a member of a concurrent retirement system before 01/01/2013 and you performed service under that system within six months of becoming a calstrs member. For members under the calstrs 2% at 62 benefit structure, your age factor is: *estimate based on calstrs 2% at 60 benefit structure. Web calstrs 2% at 60 members. Years of credited service you expect to have at. Web for members under the calstrs 2% at 60 benefit structure, your age factor is: Based on your years of service credit and highest earnings. The chart on the next page shows the percentage of final compensation you will receive. The age factor gradually decreases to 1.1% at age 50 if you retire before age 60 and gradually increases to 2.4% at age 63 if you retire after age 60. For members under the calstrs 2% at 62 benefit structure, your age factor is: The chart below shows how the benefit factor increases for each quarter year of age from. Web 2percent 60 @ retirement formulas and benefit factors. Web to see your benefit factor for each quarter year of age, choose your retirement formula below. You can retire at age 55 with at least five years of service credit. The standard age factor is 2% at age 60. Web we have included two charts related to the state miscellaneous. Percentage based on your age at the time you retire. *estimate based on calstrs 2% at 60 benefit structure. Calstrs 2% at 60 (expressed as percentages) note: Web retirement benefits calculator. Years of credited service you expect to have at. • is the payment associated with the performance of creditable service? The second chart shows the percentage of final compensation you will receive. Web to see your benefit factor for each quarter year of age, choose your retirement formula below. Web we have included two charts related to the state miscellaneous and industrial retirement formula 2% at 60. The chart. The standard age factor is 2% at age 60. Percentage based on your age at the time you retire. You can retire at age 55 with at least five years of service credit. Estimate your retirement benefits* read the disclaimer before using this calculator. Web we have included two charts related to the state miscellaneous and industrial retirement formula 2%. This is the percent of final compensation to which you are entitled for each year of service credit, determined by your age on the last day of the month in which your retirement is effective. Web in the current system, benefit structures are referred to as retirement formulas and are displayed as 2% at 60 or 2% at 62 on. For members under the calstrs 2% at 62 benefit structure, your age factor is: Increased to a maximum of 2.4% if you retire at age 63 or later. As a calstrs 2% at 60 member, if you have 30 or more years of service credit, add 0.2% to the age factor on the chart above. Web retirement benefits calculator. Depending. Web we have included two charts related to the state miscellaneous and industrial retirement formula 2% at 60. The chart below shows how the benefit factor increases for each quarter year of age from 50 to 67. Calstrs 2% at 60 (expressed as percentages) note: Members under calstrs 2% at 60 also have the option to retire at age 50. Percentage based on your age at the time you retire. For members under the calstrs 2% at 62 benefit structure, your age factor is: Calstrs 2% at 60 (expressed as percentages) note: Web retirement benefits calculator. Your benefit structure determines how your calstrs lifetime monthly retirement benefit is calculated. Web we have included two charts related to the state miscellaneous and industrial retirement formula 2% at 60. This is done using your initial hire date: Set at 2% at age 60. Each pdf includes two charts. The standard age factor is 2% at age 60. Web if you became a calstrs member on or after january 1, 2013, you're under the calstrs 2% at 62 benefit structure. Set at 2% at age 62. \爀屲suggested interaction:\爠ᰀ吀栀攀 猀攀挀漀渀搀 挀漀洀瀀漀渀攀渀琀 椀渀 礀漀甀爀. Depending upon your career, work history, employer, and position, you may be able to participate in both plans. You can retire at age 55 with at least five years of service credit. The age factor gradually decreases to 1.1% at age 50 if you retire before age 60 and gradually increases to 2.4% at age 63 if you retire after age 60. Web deciding when to retire. Percentage based on your age at the time you retire. Web retirement benefits calculator. Increased to a maximum of 2.4% if you retire at age 63 or later. Decreased if you retire before age 62.

Topic Retirement Security CFT A Union of Educators and Classified

Calpers 2 At 55 Chart

Calstrs 2 At 60 Chart

Calstrs 2 At 60 Chart

Multiplication Table To 60

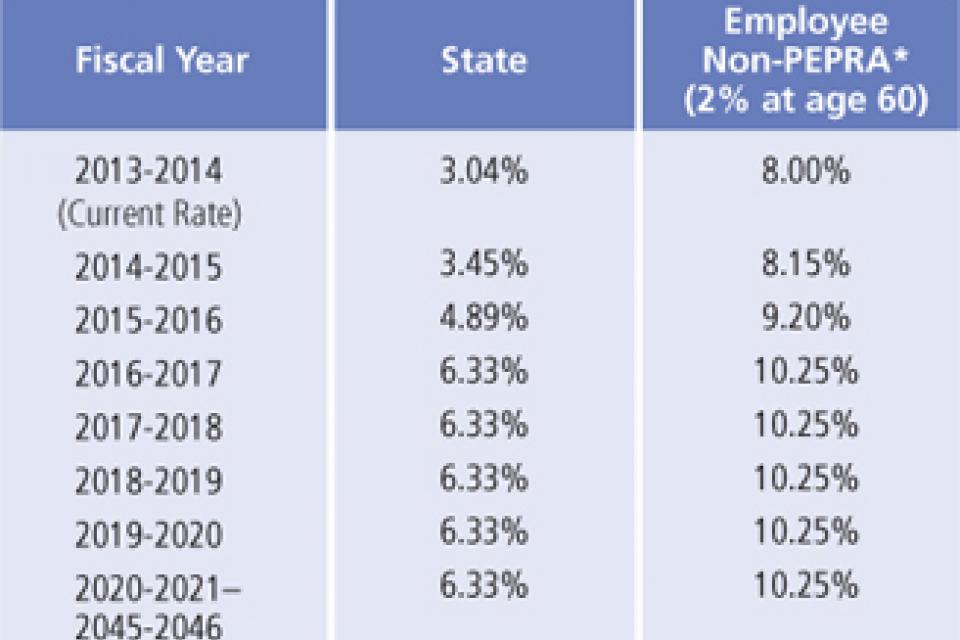

More Info. on STRS Rates The AFT Guild

CALPRO Network Calculate Your CalSTRS Pension

Reform by the ounce, unfunded pension debt by the pound EdSource

Understanding the formula CalSTRS 2 at 60 on Vimeo

A for the California Teachers Association Civic Finance

The Chart Below Shows How The Benefit Factor Increases For Each Quarter Year Of Age From 50 To 67.

Identifying Benefit Structures In The New System.

Web The California State Teachers’ Retirement System ( Calstrs) And The California Public Employees’ Retirement System ( Calpers) Manage Pensions For California Public School Educators And Other Public Employees.

This Is The Percent Of Final Compensation To Which You Are Entitled For Each Year Of Service Credit, Determined By Your Age On The Last Day Of The Month In Which Your Retirement Is Effective.

Related Post: