Bond Stock Correlation Chart

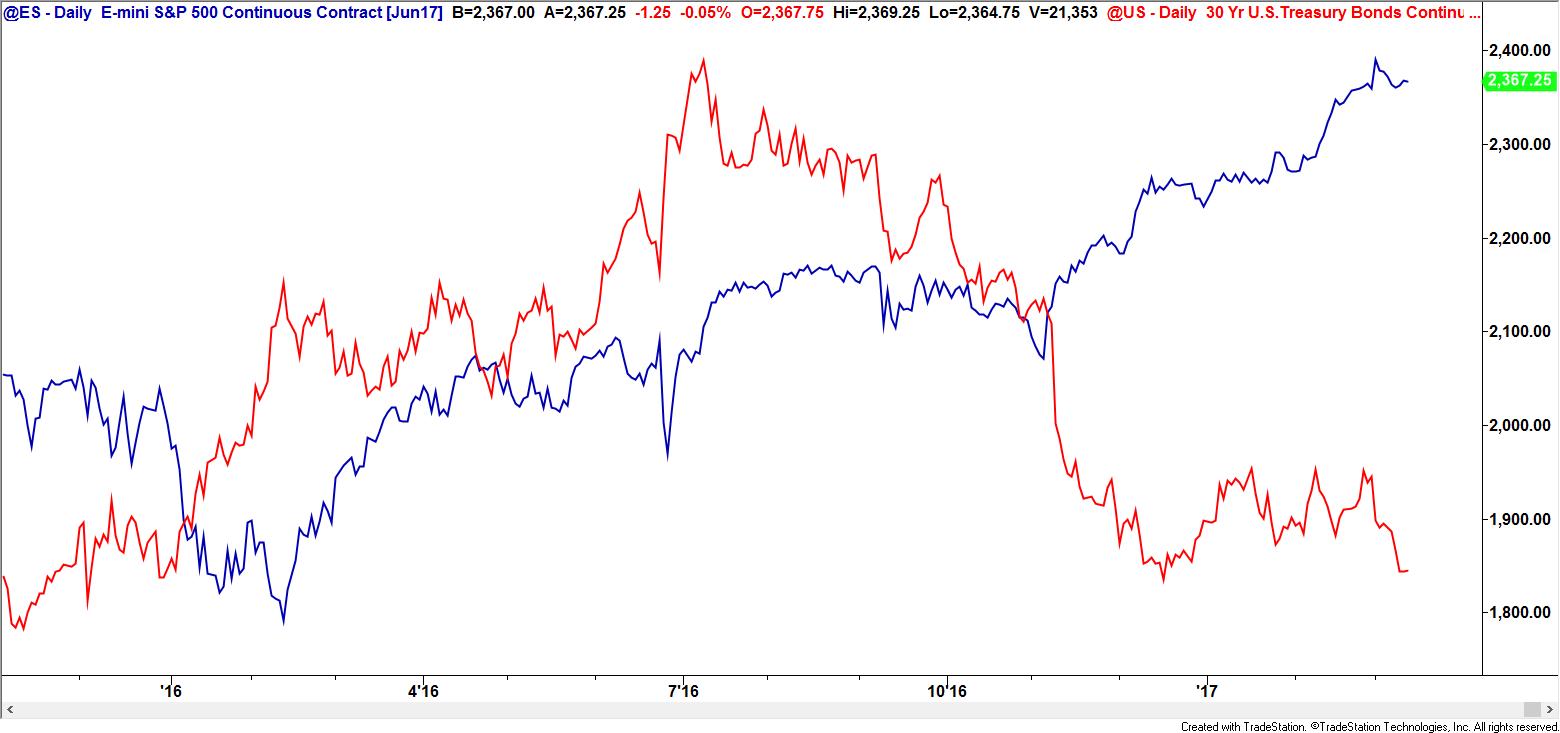

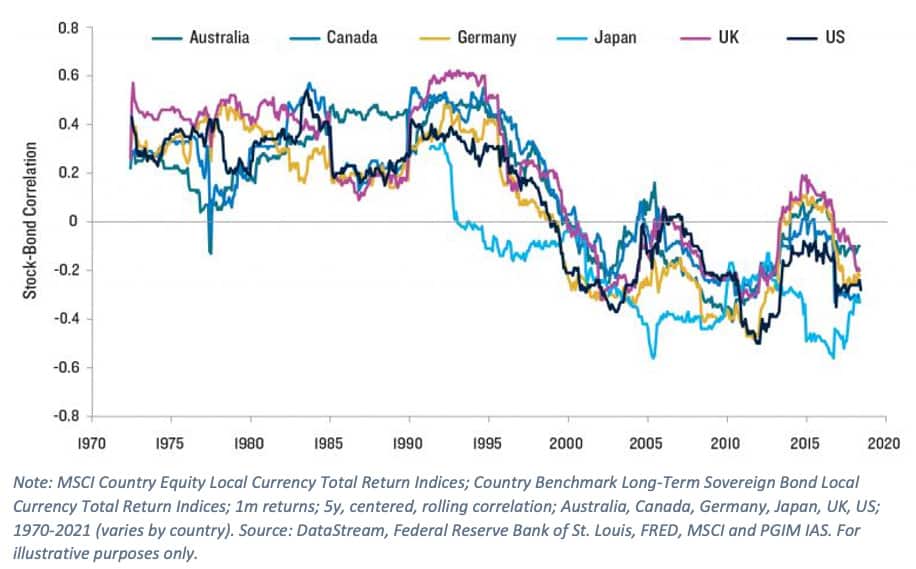

Bond Stock Correlation Chart - Morningstar direct, ubs asset management. Web inflation will increase stock/bond correlation by raising the discount factor (y t) common to stocks and bonds. S&p 500 with sbbi long government bonds. An increase in uncertainty about the outlook for growth, on the other hand, will decrease the correlation as the equity risk premium increases, depressing stock prices, while the bond term premium declines, increasing bond prices. This week’s chart looks at the trend and how it has exacerbated the diversification challenge. Web for each calendar quarter from 1989 through the first three quarters of 2021, the chart below shows (in orange) the correlation of the daily returns on the s&p 500® index and the bloomberg barclays u.s. Bloomberg finance, lp, fs investments. June 17, 2022 | 2 minute read. This infographic is available as a poster. Web as prices spike, this week’s chart looks at rising inflation’s impact on the correlation between stocks and bonds. August 18, 2023 | 2 minute read. Correlation of stock/bond performance vs. One thing it clearly shows is the volatile nature of equity market returns, which stands in contrast against global bonds, which have historically delivered smoother, more predictable returns. How can you minimize the impact of a market crash on your portfolio? Bloomberg finance, l.p., as of aug. It also shows (in blue) the annualized volatility of the daily equity returns and (in gray) the daily bond market returns. This week’s chart looks at how it exacerbates the diversification challenge. Web the below chart exemplifies this point: And fs investments, as of april 30, 2022. Morningstar direct, ubs asset management. Correlation of stock/bond performance vs. Data as of 30 september 2019. Core inflation has averaged 4.5% for the past three years and is currently 4.7%. A correlation coefficient of +1 indicates a perfect positive correlation, meaning that stocks and bonds moved in the same direction during. Web for each calendar quarter from 1989 through the first three quarters of 2021,. Asset class correlation over 25 years. How can you minimize the impact of a market crash on your portfolio? Bonds are an obvious casualty from rising inflation. This week’s chart looks at the trend and how it has exacerbated the diversification challenge. A correlation coefficient of +1 indicates a perfect positive correlation, meaning that stocks and bonds moved in the. An earlier version of this article was published as the q2 2022 alternative thinking. Morningstar direct, ubs asset management. Bureau of economic analysis, bloomberg finance, l.p. The relationship between stock and bond returns is a fundamental determinant of risk in traditional portfolios. This week’s chart looks at how it exacerbates the diversification challenge. How can you minimize the impact of a market crash on your portfolio? Morningstar direct, ubs asset management. It also shows (in blue) the annualized volatility of the daily equity returns and (in gray) the daily bond market returns. This infographic is available as a poster. Web for each calendar quarter from 1989 through the first three quarters of 2021,. January 5, 2024 | 3 minute read. Web the chart below illustrates that us equities and government fixed income are diverging ever so slightly in performance. It also shows (in blue) the annualized volatility of the daily equity returns and (in gray) the daily bond market returns. Bureau of economic analysis, bloomberg finance, l.p. Morningstar direct, ubs asset management. Morningstar direct, ubs asset management. An increase in uncertainty about the outlook for growth, on the other hand, will decrease the correlation as the equity risk premium increases, depressing stock prices, while the bond term premium declines, increasing bond prices. And fs investments, as of april 30, 2022. Web inflation will increase stock/bond correlation by raising the discount factor (y. Bloomberg finance, lp, fs investments. Web the chart below illustrates that us equities and government fixed income are diverging ever so slightly in performance. Bonds are an obvious casualty from rising inflation. One thing it clearly shows is the volatile nature of equity market returns, which stands in contrast against global bonds, which have historically delivered smoother, more predictable returns.. The relationship between stock and bond returns is a fundamental determinant of risk in traditional portfolios. How strong is this relationship when we look at individual months? January 5, 2024 | 3 minute read. An earlier version of this article was published as the q2 2022 alternative thinking. Web for each calendar quarter from 1989 through the first three quarters. Bloomberg finance, lp, fs investments. The relationship between stock and bond returns is a fundamental determinant of risk in traditional portfolios. It also shows (in blue) the annualized volatility of the daily equity returns and (in gray) the daily bond market returns. Core inflation has averaged 4.5% for the past three years and is currently 4.7%. This week’s chart looks at how it exacerbates the diversification challenge. Web as prices spike, this week’s chart looks at rising inflation’s impact on the correlation between stocks and bonds. Correlation of stock/bond performance vs. January 5, 2024 | 3 minute read. This week’s chart looks at the trend and how it has exacerbated the diversification challenge. Web the chart below illustrates that us equities and government fixed income are diverging ever so slightly in performance. Bonds are an obvious casualty from rising inflation. Web for each calendar quarter from 1989 through the first three quarters of 2021, the chart below shows (in orange) the correlation of the daily returns on the s&p 500® index and the bloomberg barclays u.s. How can you minimize the impact of a market crash on your portfolio? An increase in uncertainty about the outlook for growth, on the other hand, will decrease the correlation as the equity risk premium increases, depressing stock prices, while the bond term premium declines, increasing bond prices. A recent paper analyzing the correlation between stock and bond returns going back to 1875 suggests the relationship of the past quarter century is shifting in an uncertain inflationary. Bureau of economic analysis, bloomberg finance, l.p.

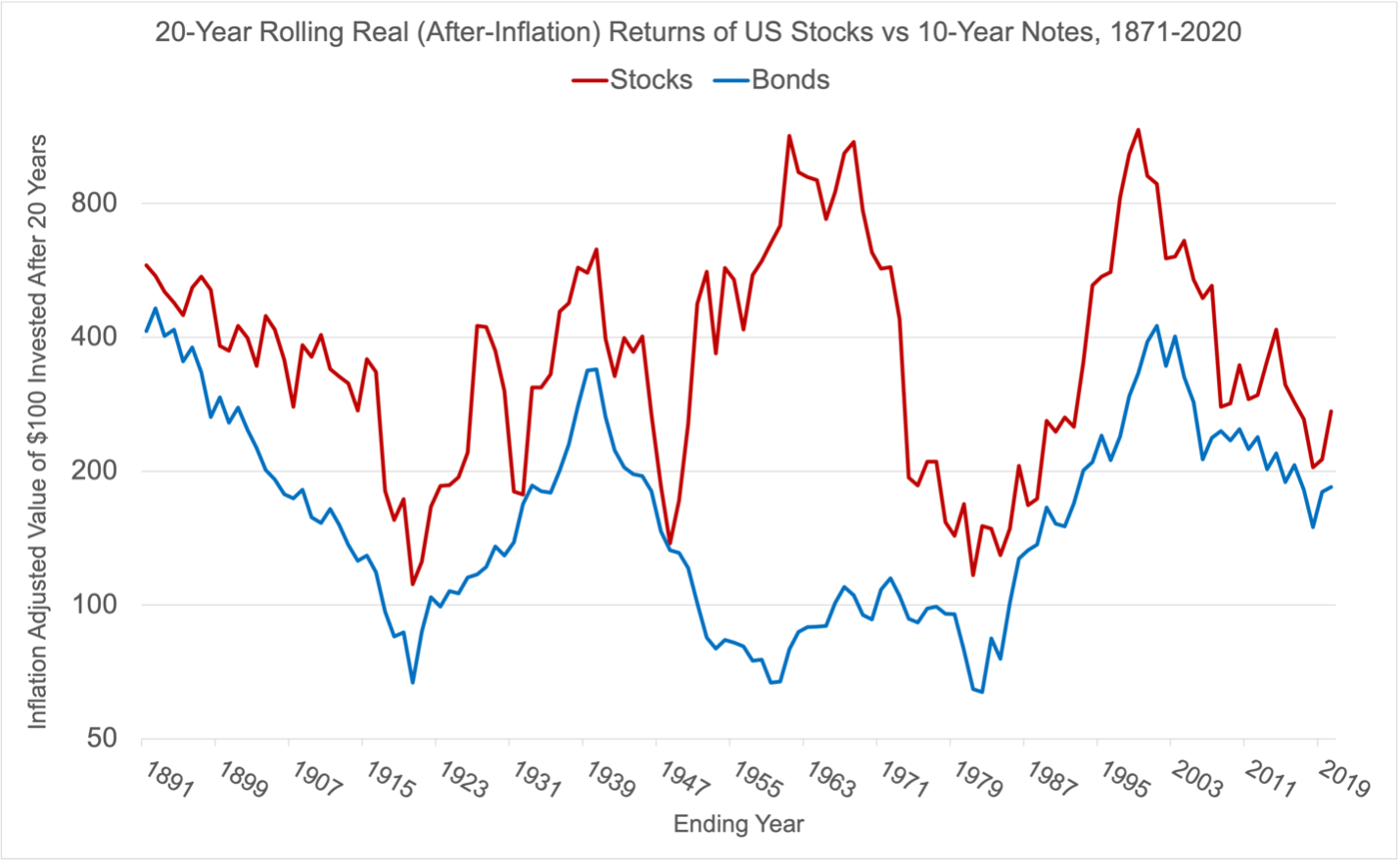

Quick Chart 20Year Rolling Returns of Stocks vs Bonds GFM Asset

A Century of StockBond Correlations Bulletin September 2014 RBA

Stock and Bond Correlation Explained

Is The StockBond Correlation Positive Or Negative Russell Investments

Stock Bond Correlation A Global Perspective Fixed News Australia

With inflation, stockbond correlation jumps FS Investments

A Century of StockBond Correlations Bulletin September 2014 RBA

StockBond Correlation, an InDepth Look QuantPedia

Stock & Bond Correlation

Historical Asset Class Correlations Which Have Been the Best Portfolio

Web The Below Chart Exemplifies This Point:

This Infographic Is Available As A Poster.

August 18, 2023 | 2 Minute Read.

June 17, 2022 | 2 Minute Read.

Related Post: