Best Rsi Settings For 1 Minute Chart

Best Rsi Settings For 1 Minute Chart - The stochastic rsi indicator is a powerful tool that combines the strength of the stochastic oscillator and the rsi indicator. Web jasper lawler ・ 8 march 2021 ・ technical analysis. The rsi trading strategy identifies overbought and oversold conditions in markets, measuring momentum on a scale. I think 1m is still too low for rsi to be useful but those settings are. Rsi can help traders identify trend, momentum,. Web on a 5 minute chart, rsi 14 signals are based on the last 70 minutes. It is designed to measure the strength of a currency pair by comparing the average gains to the average. To calculate the rsi indicator, follow. Web we can get the best rsi settings for 15 min chart by lowering the periods. Buy signals when rsi (period = 2) is in an. Rsi indicator calculation & formula. Web on a 5 minute chart, rsi 14 signals are based on the last 70 minutes. I basically just use the rsi to look for a divergence to predict a pullback or consolidation. Web top 3 rsi indicator strategies for day trading: Web 1 minute scalping with rsi and stochastic is a best trend momentum. However, the setting yields wider swings that. Using rsi combined with the 30 and 70 levels to buy and sell signals. Here is the rationale behind it. Using the right rsi setting is crucial for successful technical analysis and trading strategy on a 5 min chart. The stochastic rsi indicator is a powerful tool that combines the strength of the. The stochastic rsi indicator is a powerful tool that combines the strength of the stochastic oscillator and the rsi indicator. An rsi trading strategy using the relative strength indicator is a great place to start when day trading and forex trading. Web on a 5 minute chart, rsi 14 signals are based on the last 70 minutes. Web rsi pullback,. Using the right rsi setting is crucial for successful technical analysis and trading strategy on a 5 min chart. I basically just use the rsi to look for a divergence to predict a pullback or consolidation. I like indicators that tell me the flow of the trend/volume profile, like rsi, ema's vwap, bbands. Web we can get the best rsi. It is designed to measure the strength of a currency pair by comparing the average gains to the average. The stochastic rsi indicator is a powerful tool that combines the strength of the stochastic oscillator and the rsi indicator. An rsi trading strategy using the relative strength indicator is a great place to start when day trading and forex trading.. On a 15 minute chart, rsi 14 signals are based on the last 210 minutes (3.5 hours). Web rsi pullback, trendline break, and divergence strategies can be implemented for trading opportunities. Using the right rsi setting is crucial for successful technical analysis and trading strategy on a 5 min chart. Relative strength index (rsi) is one of the most popular.. It is designed to measure the strength of a currency pair by comparing the average gains to the average. Web that said, if you want to use rsi on a 1m chart, go check out how to change the settings to a 2 period 90/10 rsi. Web we can get the best rsi settings for 15 min chart by lowering. Here is the rationale behind it. Rsi, or the relative strength index, is a technical indicator used in forex trading. To calculate the rsi indicator, follow. The stochastic rsi indicator is a powerful tool that combines the strength of the stochastic oscillator and the rsi indicator. Web jasper lawler ・ 8 march 2021 ・ technical analysis. I like indicators that tell me the flow of the trend/volume profile, like rsi, ema's vwap, bbands. The rsi trading strategy identifies overbought and oversold conditions in markets, measuring momentum on a scale. I think 1m is still too low for rsi to be useful but those settings are. Buy signals when rsi (period = 2) is in an. Web. On a 15 minute chart, rsi 14 signals are based on the last 210 minutes (3.5 hours). Using rsi combined with the 30 and 70 levels to buy and sell signals. Web that said, if you want to use rsi on a 1m chart, go check out how to change the settings to a 2 period 90/10 rsi. Buy signals. The rsi trading strategy identifies overbought and oversold conditions in markets, measuring momentum on a scale. Web top 3 rsi indicator strategies for day trading: Web jasper lawler ・ 8 march 2021 ・ technical analysis. Web that said, if you want to use rsi on a 1m chart, go check out how to change the settings to a 2 period 90/10 rsi. An rsi trading strategy using the relative strength indicator is a great place to start when day trading and forex trading. However, the setting yields wider swings that. Web we can get the best rsi settings for 15 min chart by lowering the periods. I basically just use the rsi to look for a divergence to predict a pullback or consolidation. Rsi can help traders identify trend, momentum,. To calculate the rsi indicator, follow. The stochastic rsi indicator is a powerful tool that combines the strength of the stochastic oscillator and the rsi indicator. Here is the rationale behind it. I think 1m is still too low for rsi to be useful but those settings are. Relative strength index (rsi) is one of the most popular. On a 15 minute chart, rsi 14 signals are based on the last 210 minutes (3.5 hours). Using the right rsi setting is crucial for successful technical analysis and trading strategy on a 5 min chart.

Best Rsi Settings For 1 Minute Chart (2022 Review Updated

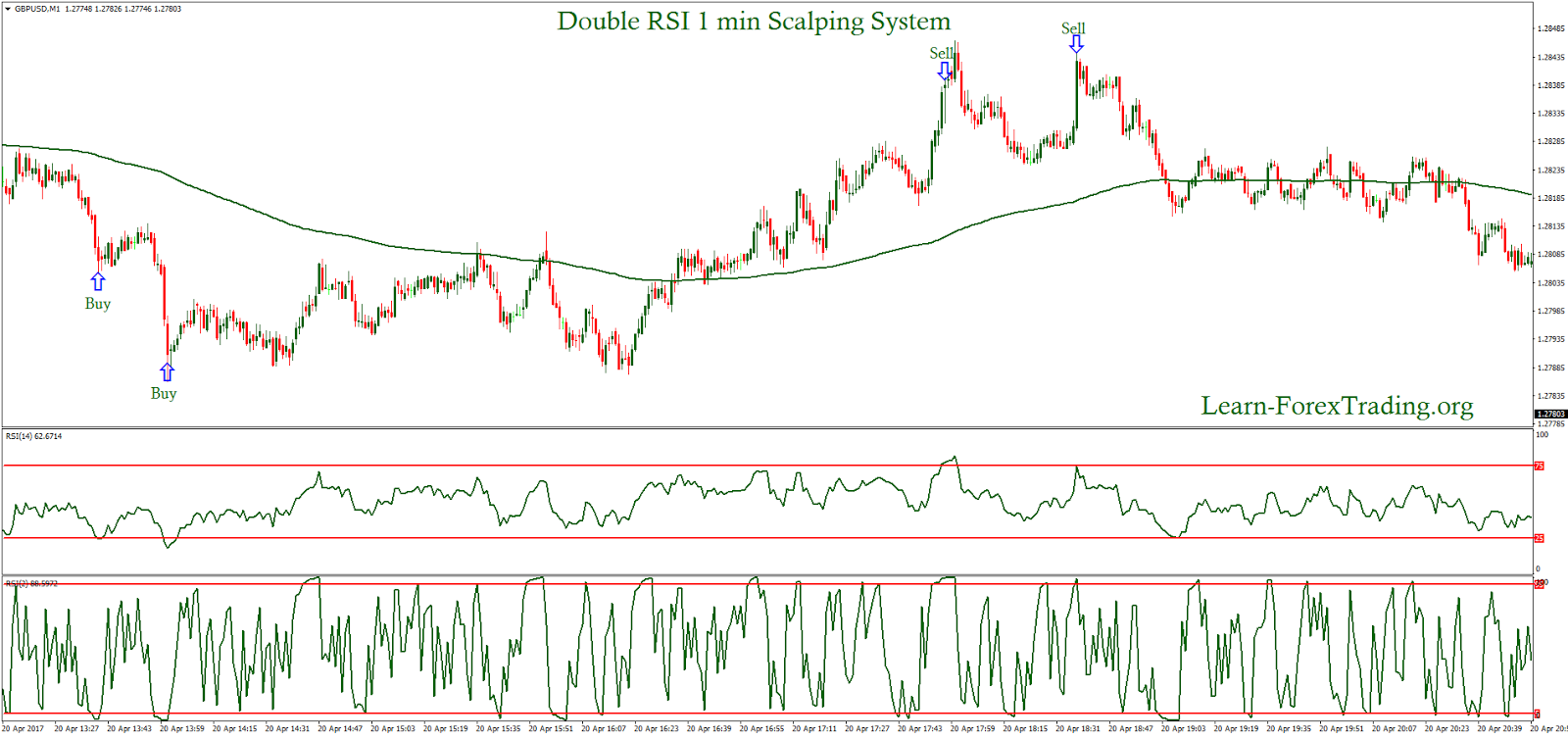

Double RSI 1 min Scalping System Learn Forex Trading

Best RSI Settings for 1 Minute Chart The Forex Geek

Best RSI settings for 1 minute chart RSI relative strength index best

Best RSI Settings📚 in 2021 Trading quotes, Trading charts, Stock

Best RSI Settings for 1 Minute Chart The Forex Geek

Beginner Guide to the RSI Indicator 24/7 Charts

best macd settings for 1 minute chart

Best setting RSI indicator god of trend readers iq option strategy

SPECIAL Settings For Best RSI 1 Minute Scalping Trading Strategy RSI

Web On A 5 Minute Chart, Rsi 14 Signals Are Based On The Last 70 Minutes.

Web Rsi Pullback, Trendline Break, And Divergence Strategies Can Be Implemented For Trading Opportunities.

Rsi, Or The Relative Strength Index, Is A Technical Indicator Used In Forex Trading.

It Is Designed To Measure The Strength Of A Currency Pair By Comparing The Average Gains To The Average.

Related Post: