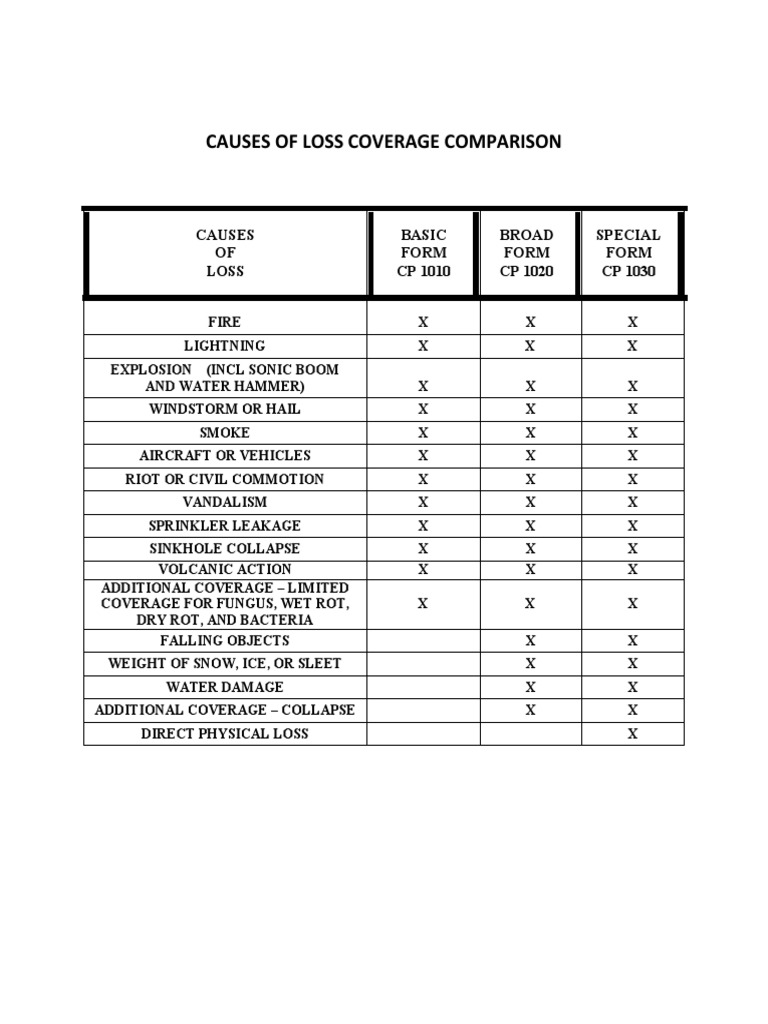

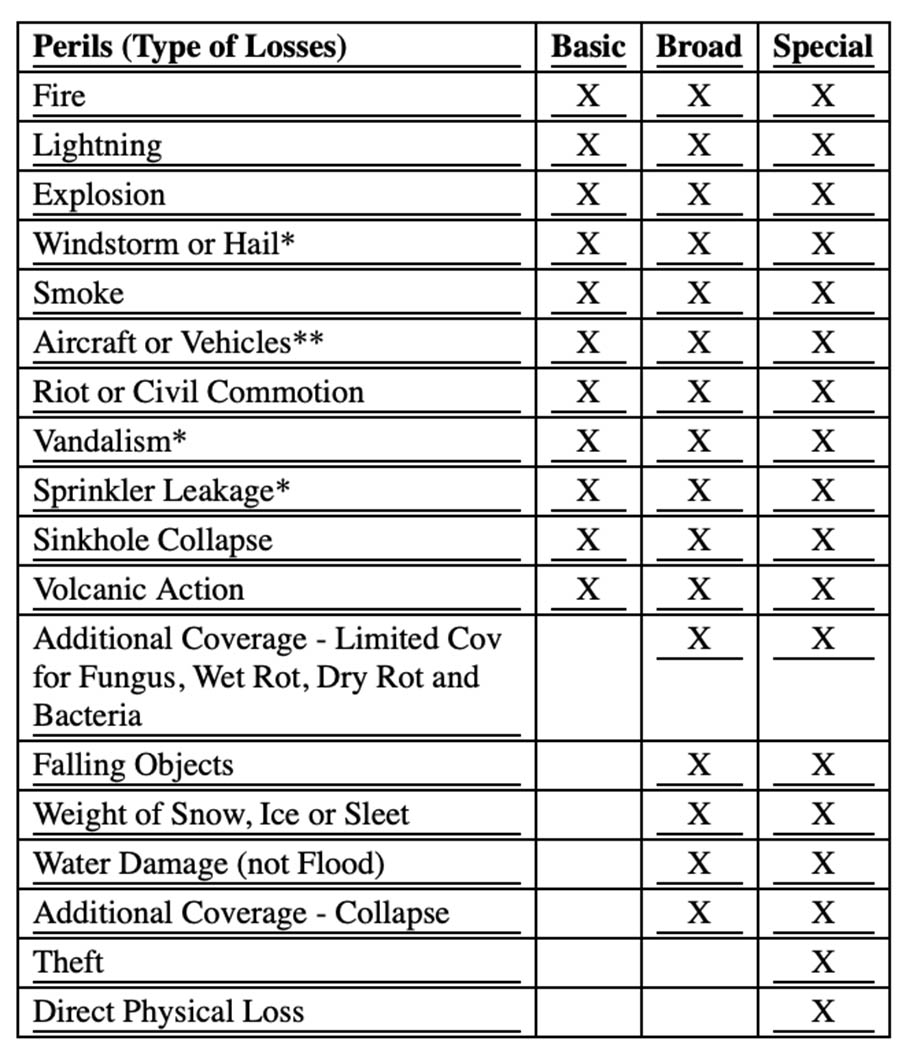

Basic Broad Special Causes Of Loss Chart

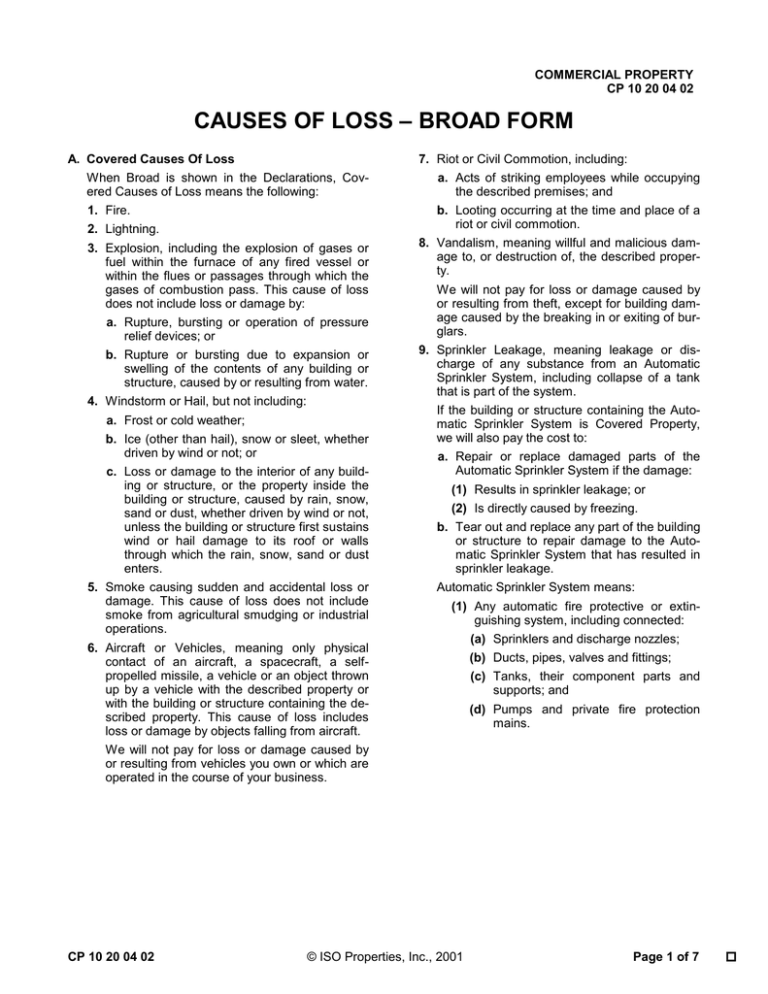

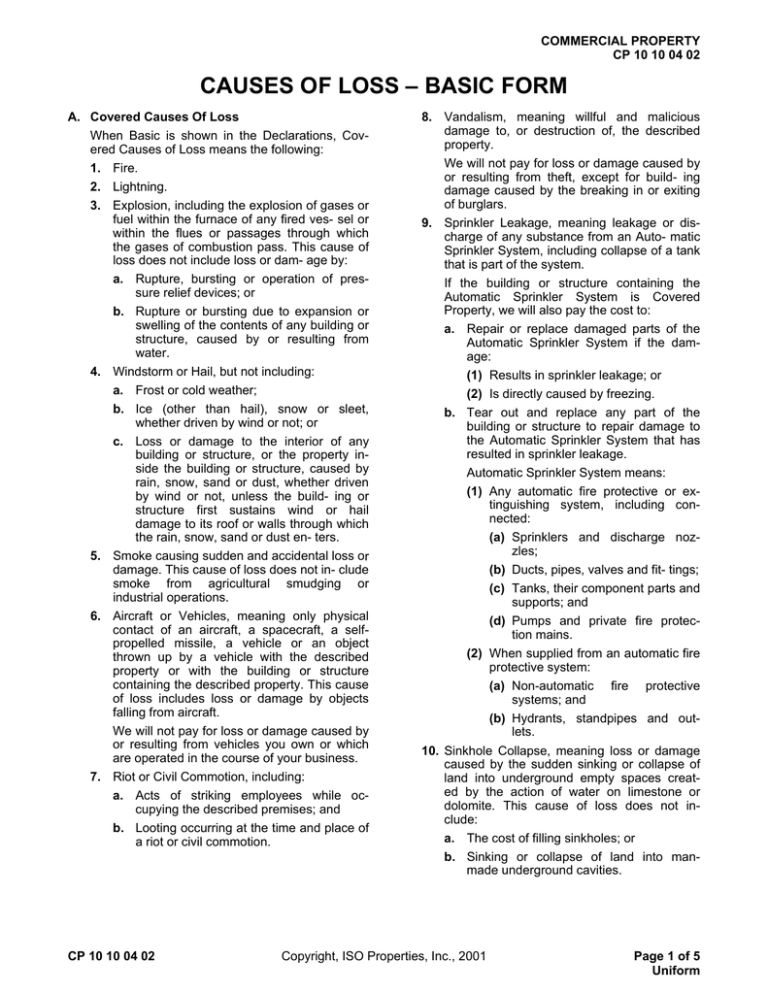

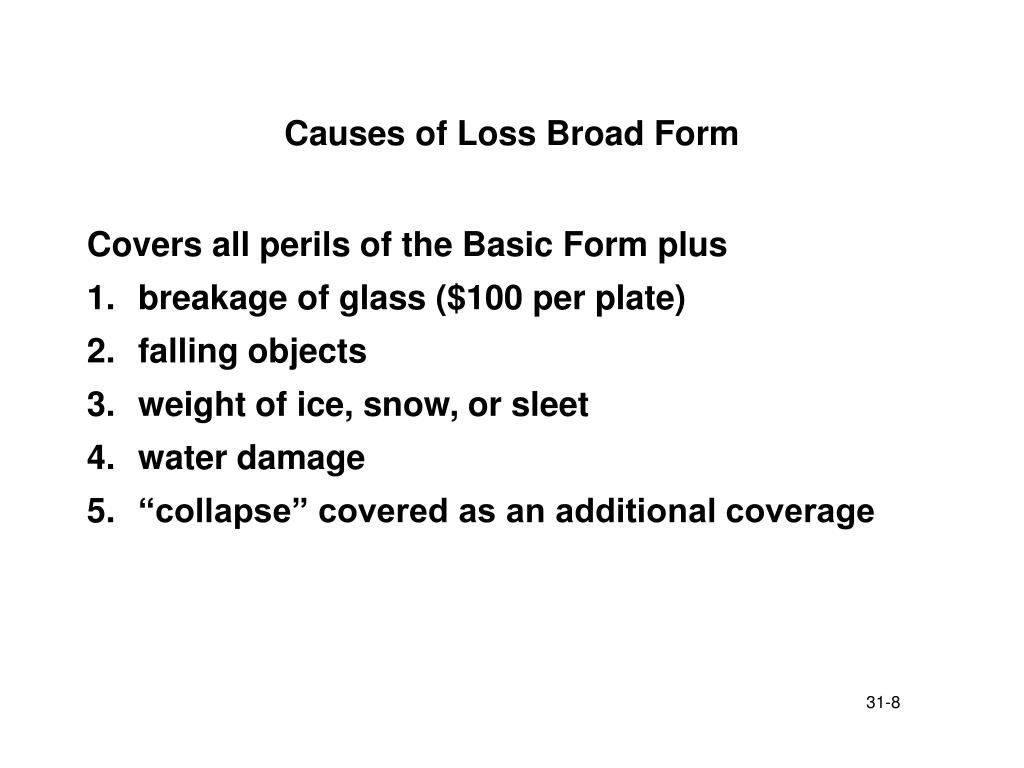

Basic Broad Special Causes Of Loss Chart - Web if you’ve shopped for property insurance before, you may have noticed that some policies list covered losses as basic, while others specify broad or special. It’s important to note that both basic and broad form coverage policies only cover a specific set of named perils. They provide coverage for loss from only the particular causes that are listed in the policy as covered. Basic, broad, and special (or open). Web in terms of property coverage, there are three causes of loss forms available for landlord insurance policies: Web basic is the least inclusive of the three coverage forms because it covers only named perils. The basic causes of loss form (cp 10 10) provides coverage for the. Web when property insurance is written on a broad form, you receive coverage for the 11 causes of loss mentioned in the description of the basic form, with the addition. These forms can apply to various forms of property insurance, including homeowners, commercial. The differences in the perils. Web as stated in the commercial lines manual (clm), rule 70.d.2., when rating a basic form policy, the amount of insurance and the coinsurance percentage must be the same for. The broad causes of loss form (cp 10 20) provides named perils coverage. Web if you’ve shopped for property insurance before, you may have noticed that some policies list covered. Web koverage insurance group was formed through the merger and acquisition of seven insurance agencies located throughout connecticut, south carolina, and florida who. Web there are three causes of loss forms: Web when property insurance is written on a broad form, you receive coverage for the 11 causes of loss mentioned in the description of the basic form, with the. It’s important to note that both basic and broad form coverage policies only cover a specific set of named perils. Each form provides coverage for different sets of perils, offering varying levels of protection to the. In other words, if it’s not. Web causes of loss forms establish and define the causes of loss (or perils) for which coverage is. The differences in the perils. Web as stated in the commercial lines manual (clm), rule 70.d.2., when rating a basic form policy, the amount of insurance and the coinsurance percentage must be the same for. Fire or lightning, smoke, windstorm or hail, explosion, riot or civil commotion, aircraft (striking the property),. Selecting the “basic” form of insurance coverage will only. Web basic cause of loss form covers fire lightning explosion windstorm and hail smoke aircraft or vehicles riot and civil commotion vandalism sprinkler leakage sinkhole. Web to make it easy to see the coverage differences, we’ve included the below chart: Web causes of loss forms establish and define the causes of loss (or perils) for which coverage is provided. Web. Basic, broad, special and earthquake. Web in terms of property coverage, there are three causes of loss forms available for landlord insurance policies: It’s important to note that both basic and broad form coverage policies only cover a specific set of named perils. Web there are three causes of loss forms: Basic form covers these 11 “perils” or causes of. Web causes of loss forms establish and define the causes of loss (or perils) for which coverage is provided. Selecting the “basic” form of insurance coverage will only cover your property from named perils. The special causes of loss form (cp 10 30) provides what is referred to as all risks coverage: Web basic form is the most restrictive, while. The basic causes of loss form (cp 10 10) provides coverage for the. Web basic form insurance coverage. Basic form covers these 11 “perils” or causes of loss: This simply means your property will only. Web as stated in the commercial lines manual (clm), rule 70.d.2., when rating a basic form policy, the amount of insurance and the coinsurance percentage. Web as stated in the commercial lines manual (clm), rule 70.d.2., when rating a basic form policy, the amount of insurance and the coinsurance percentage must be the same for. These forms can apply to various forms of property insurance, including homeowners, commercial. Web basic is the least inclusive of the three coverage forms because it covers only named perils.. Web basic form insurance coverage. Each form provides coverage for different sets of perils, offering varying levels of protection to the. Differentiate between the covered causes of loss forms: Web there are three causes of loss forms: They provide coverage for loss from only the particular causes that are listed in the policy as covered. They provide coverage for loss from only the particular causes that are listed in the policy as covered. It’s important to note that both basic and broad form coverage policies only cover a specific set of named perils. Each form provides coverage for different sets of perils, offering varying levels of protection to the. Web if you’ve shopped for property insurance before, you may have noticed that some policies list covered losses as basic, while others specify broad or special. Web basic form is the most restrictive, while special offers the greater level of protection. Web causes of loss forms establish and define the causes of loss (or perils) for which coverage is provided. Basic, broad, and special (or open). Web to make it easy to see the coverage differences, we’ve included the below chart: Basic, broad, special and earthquake. It is the silver package of the three forms and gives you the bare minimum for the. Web basic cause of loss form covers fire lightning explosion windstorm and hail smoke aircraft or vehicles riot and civil commotion vandalism sprinkler leakage sinkhole. Selecting the “basic” form of insurance coverage will only cover your property from named perils. Web there are three main types of cause of loss forms: The broad causes of loss form (cp 10 20) provides named perils coverage. Web there are three causes of loss forms: The differences in the perils.

Causes Of Loss Basic Form

Basic vs Special Form Insurance Coverage Resources Commercial

Commercial Property Different Coverage Forms (Basic vs. Broad vs

Basic Broad And Special Perils Chart

Basic vs Special Form Coverage Insurance Resources

causes of loss broad form Midwest Security Insurance Services

causes of loss basic form

Causes Of Loss Forms Comparison Chart

Causes Of Loss Forms Comparison Chart

Comparing Coverage Options A Breakdown of Causes of Loss Coverages

Differentiate Between The Covered Causes Of Loss Forms:

Web Koverage Insurance Group Was Formed Through The Merger And Acquisition Of Seven Insurance Agencies Located Throughout Connecticut, South Carolina, And Florida Who.

This Simply Means Your Property Will Only.

These Forms Can Apply To Various Forms Of Property Insurance, Including Homeowners, Commercial.

Related Post: