Alabama Standard Deduction Chart

Alabama Standard Deduction Chart - Please refer to the chart below to determine the standard. The federal federal allowance for over 65 years of age single filer in 2020 is $ 1,650.00. Web we last updated the standard deduction chart 40nr in february 2024, so this is the latest version of standard deduction chart 40nr, fully updated for tax year 2023. We last updated alabama standard deduction chart form 40 in january 2024 from the alabama department of. Web alabama provides a standard personal exemption tax deduction of $ 1,500.00 in 2024 per qualifying filer and $ 1,000.00 per qualifying dependent (s), this is used to reduce the. Web more about the alabama standard deduction chart form 40. Married filing jointly tax brackets. The standard deduction in alabama is adjusted for single filers based on gross income in 2023, see. First, we calculate your adjusted gross income (agi) by taking your total household income and reducing it by certain items. Web the standard deduction for a single filer in alabama for 2021 is $ 2,500.00. Web the standard deduction for a single filer in alabama for 2022 is $ 3,000.00. Web we last updated the individual income tax return (short form) in january 2024, so this is the latest version of form 40a, fully updated for tax year 2023. The standard deduction in alabama is adjusted for single filers based on gross income in 2022,. Web how income taxes are calculated. We last updated alabama standard deduction chart form 40 in january 2024 from the alabama department of. 2021)), there is still much ongoing research into finding efficient rewriting and simplification techniques to expedite or better inform the solving. Web more about the alabama standard deduction chart form 40. Web the standard deduction for a. Web the standard deduction for a single filer in alabama for 2022 is $ 3,000.00. For earnings between $0.00 and $500.00,. Web the chart below breaks down the alabama tax brackets using this model: First, we calculate your adjusted gross income (agi) by taking your total household income and reducing it by certain items. H&r block ® is a registered. The standard deduction in alabama is adjusted for single filers based on gross income in 2023, see. Web the standard deduction for a single filer in alabama for 2023 is $ 3,000.00. Web we last updated the individual income tax return (short form) in january 2024, so this is the latest version of form 40a, fully updated for tax year. Web the standard deduction for a single filer in alabama for 2023 is $ 3,000.00. Web the chart below breaks down the alabama tax brackets using this model: Web ability (biere et al. Web we last updated the standard deduction chart for form 40 in january 2024, so this is the latest version of standard deduction chart form 40, fully. Web alabama has made the following changes to their tax code for the 2023 tax year: Web ability (biere et al. Web alabama provides a standard personal exemption tax deduction of $ 1,500.00 in 2024 per qualifying filer and $ 1,000.00 per qualifying dependent (s), this is used to reduce the. Web we last updated the standard deduction chart 40nr. The standard deduction in alabama is adjusted for single filers based on gross income in 2023, see. 2021)), there is still much ongoing research into finding efficient rewriting and simplification techniques to expedite or better inform the solving. Web alabama provides a standard personal exemption tax deduction of $ 1,500.00 in 2024 per qualifying filer and $ 1,000.00 per qualifying. Web the standard deduction for a single filer in alabama for 2023 is $ 3,000.00. Web ability (biere et al. Web alabama has made the following changes to their tax code for the 2023 tax year: Standard deduction chart for form 40. Web we last updated the standard deduction chart 40nr in february 2024, so this is the latest version. Standard deduction chart (form 40) previous. The federal federal allowance for over 65 years of age single filer in 2020 is $ 1,650.00. The standard deduction in alabama is adjusted for single filers based on gross income in 2022, see. Web more about the alabama standard deduction chart form 40. Web income tax deductions for alabama standard deduction. Web alabama provides a standard personal exemption tax deduction of $ 1,500.00 in 2024 per qualifying filer and $ 1,000.00 per qualifying dependent (s), this is used to reduce the. Standard deduction chart (form 40) previous. Web ability (biere et al. Web the standard deduction for a single filer in alabama for 2022 is $ 3,000.00. The federal federal allowance. H&r block ® is a registered trademark of hrb innovations, inc. Please refer to the chart below to determine the standard. Standard deduction chart (form 40) previous. We last updated alabama standard deduction chart form 40 in january 2024 from the alabama department of. Web the federal standard deduction for a single filer in 2020 is $ 12,400.00. The standard deduction in alabama is adjusted for single filers based on gross income in 2023, see. Standard deduction chart for form 40. Web we last updated the standard deduction chart 40nr in february 2024, so this is the latest version of standard deduction chart 40nr, fully updated for tax year 2023. Web in late april, the alabama department of revenue issued revised withholding tax tables and instructions for employers and withholding agents to reflect changes to the. Web the standard deduction for a single filer in alabama for 2022 is $ 3,000.00. First, we calculate your adjusted gross income (agi) by taking your total household income and reducing it by certain items. Web more about the alabama standard deduction chart form 40. The standard deduction in alabama is adjusted for single filers based on gross income in 2021, see. The federal federal allowance for over 65 years of age single filer in 2020 is $ 1,650.00. Web the standard deduction for a single filer in alabama for 2021 is $ 2,500.00. Web how income taxes are calculated.

Potentially Bigger tax breaks in 2023

Standard Deduction Chart for Form 40A Alabama Department of Revenue

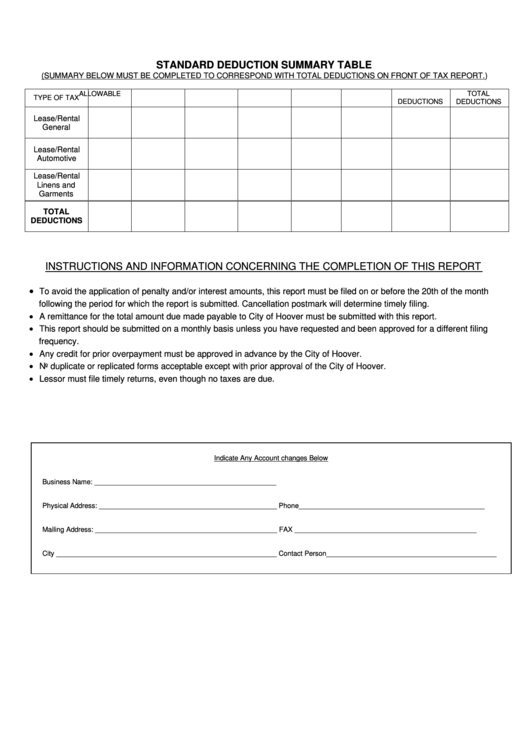

Standard Deduction Summary Table State Of Alabama printable pdf download

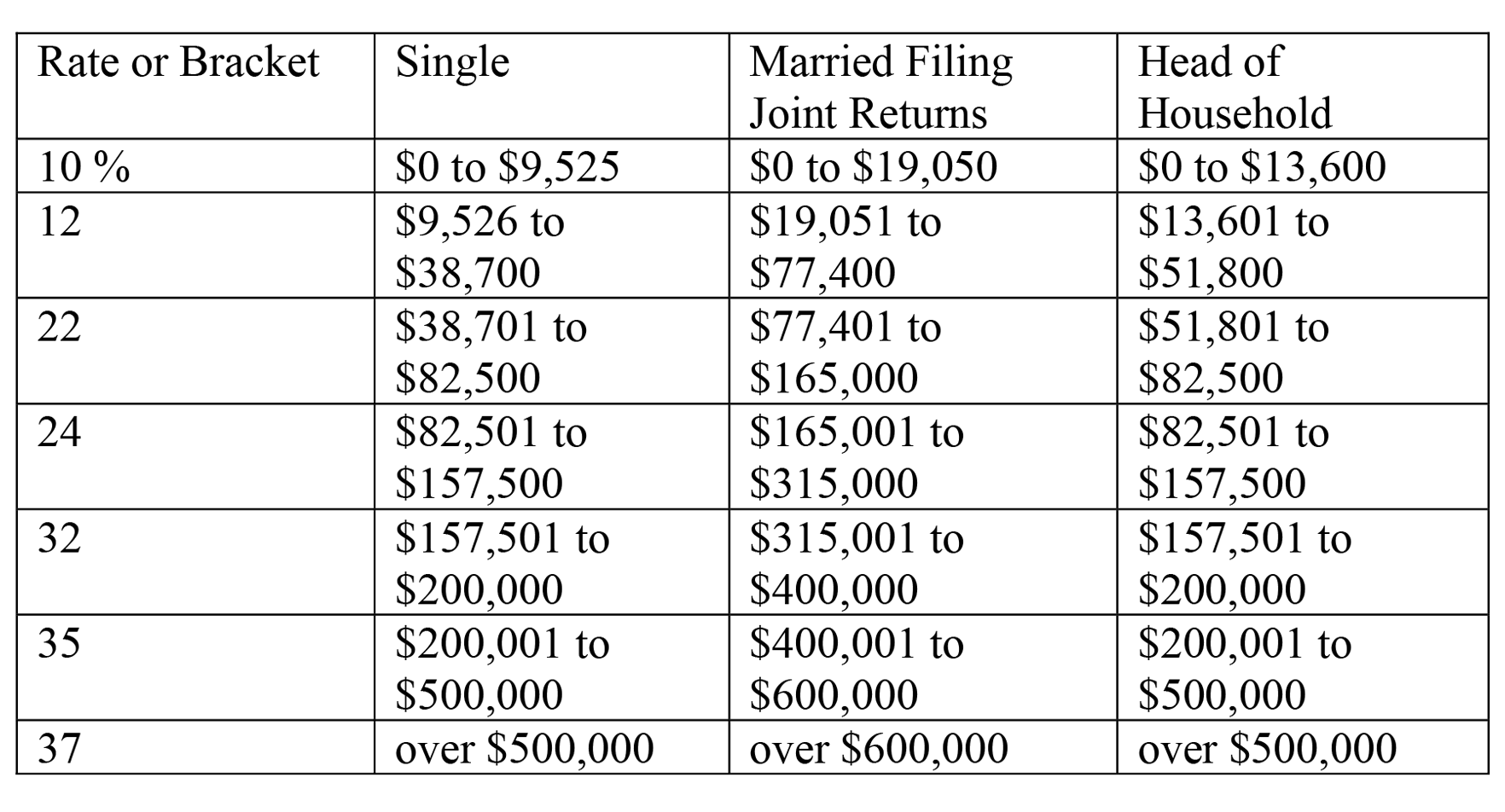

New Tax Brackets in 2018 Joel E. Berman Accountant

Standard Deduction For Fy 2023 24 In New Tax Regime Printable Forms

Alabama Standard Deduction Chart

2024 Tax Rates And Brackets Pdf Printable Arly Marcia

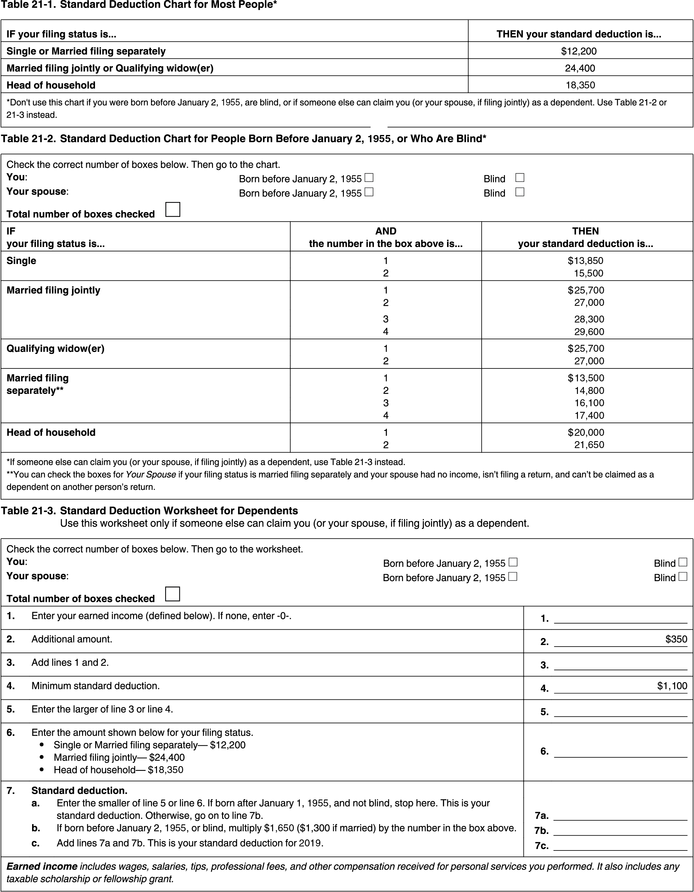

Publication 501 Exemptions, Standard Deduction, and Filing Information

Alabama Standard Deduction Chart

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC

For Earnings Between $0.00 And $500.00,.

Married Filing Jointly Tax Brackets.

Web Alabama Has Made The Following Changes To Their Tax Code For The 2023 Tax Year:

Web The Chart Below Breaks Down The Alabama Tax Brackets Using This Model:

Related Post: