7 Sales Tax Chart

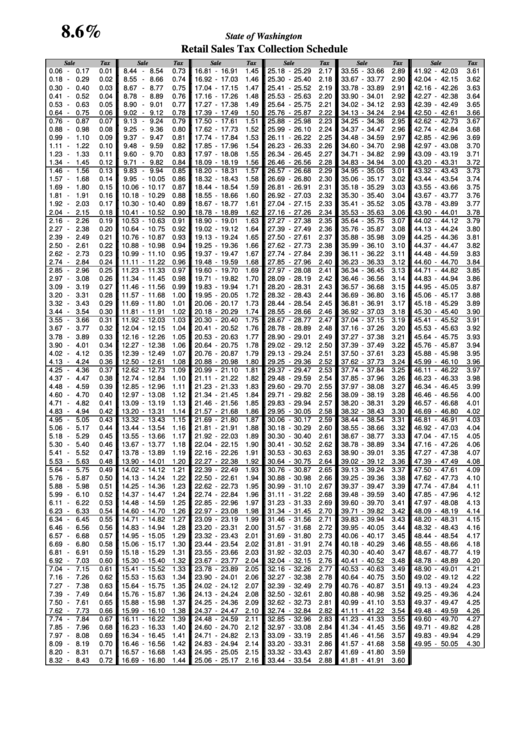

7 Sales Tax Chart - Also, check the sales tax rates in different states of the u.s. Collect tax amount between collect tax amount between collect tax amount between collect. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; What is the total amount including sales tax on. Our sales tax table generator can be used to make a custom sales tax tax. The sales tax on a $50 purchase is $3.63. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). The sales tax rate is 7.25%. Web a sales tax chart can be used to quickly determine how much tax is owed for a purchase of a given price. Web this table of sales tax rates by state is updated on a monthly basis from various state department of revenue materials and commercial tax rate providers. Web this chart lists the standard state level sales and use tax rates. 2024 us sales tax by state, updated frequently. Web 51 rows this sales tax table (also known as a sales tax chart or sales. If you are looking for additional detail, you may wish to utilize the sales tax rate databases, which are provided in a comma. The range of local taxes is also included as a quick reference. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Web this table of sales tax rates by state is updated on a monthly basis from various state department of revenue materials and commercial tax rate providers. Web sales. State of california 7.75% sales tax reimbursement — california department of tax and fee administration civil code. Web printable 7% sales tax table. Web this chart lists the standard state level sales and use tax rates. Price up to tax total price up to tax total price up to tax total price up to tax total price up to tax. Web printable 7% sales tax table. How much is the sales tax on a $50 purchase? Web printable 7.5% north carolina sales tax table a sales tax chart can be used to quickly determine how much tax is owed for a purchase of a given price. The sales tax on a $50 purchase is $3.63. Collect tax amount between collect. Web a sales tax chart can be used to quickly determine how much tax is owed for a purchase of a given price. If you are looking for additional detail, you may wish to utilize the sales tax rate databases, which are provided in a comma separated value (csv). Web printable 7% sales tax table. State of california 7.75% sales. This is a printable 7% sales tax table, by sale amount, which can be customized by sales tax rate. Web 51 rows this sales tax table (also known as a sales tax chart or sales. Web each state has a different sales tax amount, and many cities and counties charge an additional sales tax. Web a sales tax chart can. The sales tax on a $50 purchase is $3.63. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Web this chart lists the standard state level sales and use tax rates. What is the total amount including sales tax on. Price up to tax price up to tax price up. 2024 us sales tax by state, updated frequently. How much is the sales tax on a $50 purchase? Web each state has a different sales tax amount, and many cities and counties charge an additional sales tax. Web printable 7% sales tax table. The range of local taxes is also included as a quick reference. 2024 us sales tax by state, updated frequently. Web 51 rows this sales tax table (also known as a sales tax chart or sales. Web printable 7.5% north carolina sales tax table a sales tax chart can be used to quickly determine how much tax is owed for a purchase of a given price. The sales tax rate is 7.25%.. Collect tax amount between collect tax amount between collect tax amount between collect. Web printable 7.5% north carolina sales tax table a sales tax chart can be used to quickly determine how much tax is owed for a purchase of a given price. Web tax rates & charts. The sales tax on a $50 purchase is $3.63. Web rates are. The sales tax rate is 7.25%. Web tax rates & charts. Also, check the sales tax rates in different states of the u.s. Collect tax amount between collect tax amount between collect tax amount between collect. Web a sales tax chart can be used to quickly determine how much tax is owed for a purchase of a given price. State of california 7.75% sales tax reimbursement — california department of tax and fee administration civil code. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Here's how much sales tax you can expect to pay in each. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Price up to tax total price up to tax total price up to tax total price up to tax total price up to tax total;. Web this chart lists the standard state level sales and use tax rates. If you are looking for additional detail, you may wish to utilize the sales tax rate databases, which are provided in a comma separated value (csv). Our sales tax table generator can be used to make a custom sales tax tax. The range of local taxes is also included as a quick reference. Web 51 rows this sales tax table (also known as a sales tax chart or sales. This chart can be used to easily calculate 7% sales taxes.

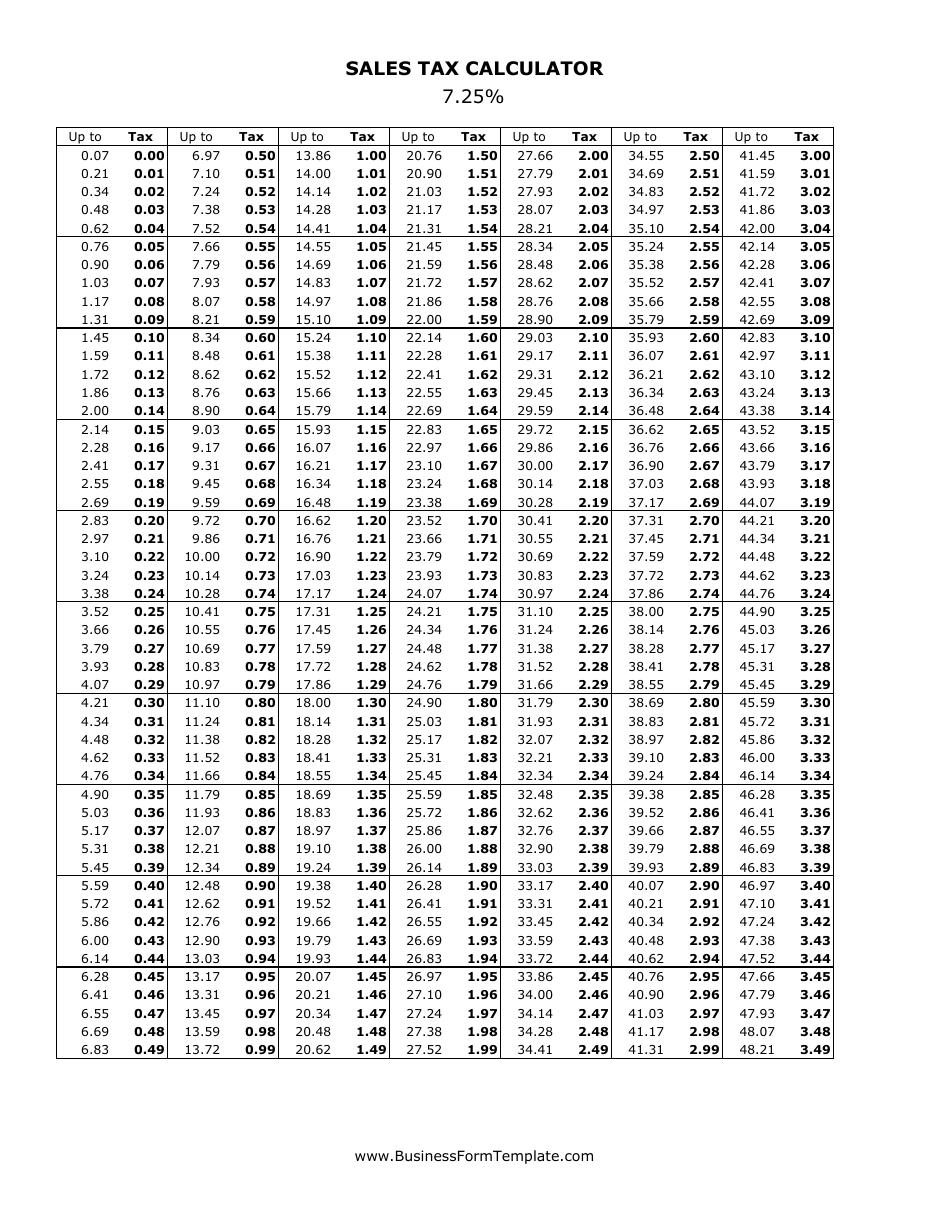

7.25 Sales Tax Chart Printable Printable Word Searches

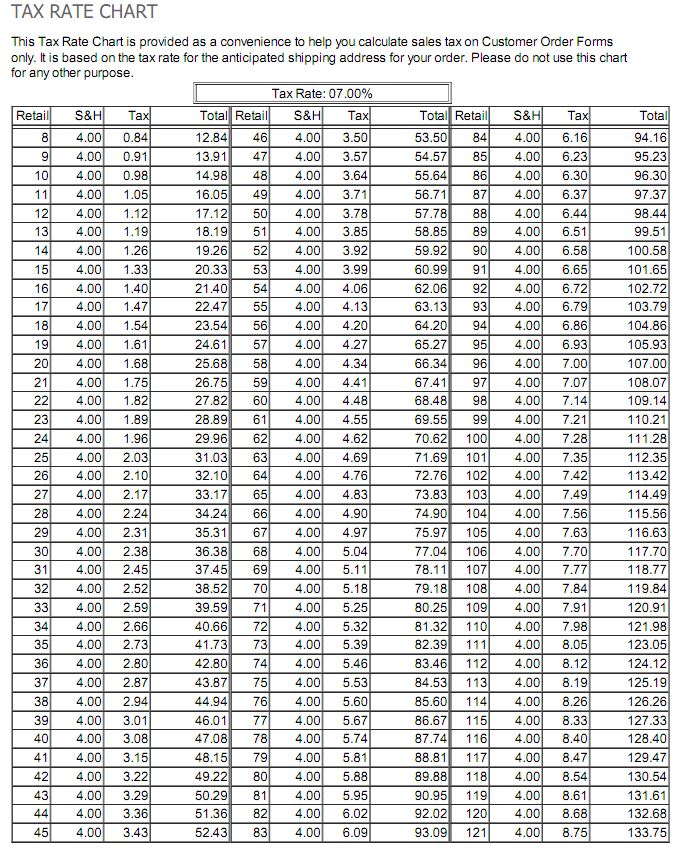

Printable Sales Tax Chart Konaka

Sales Tax By State Chart

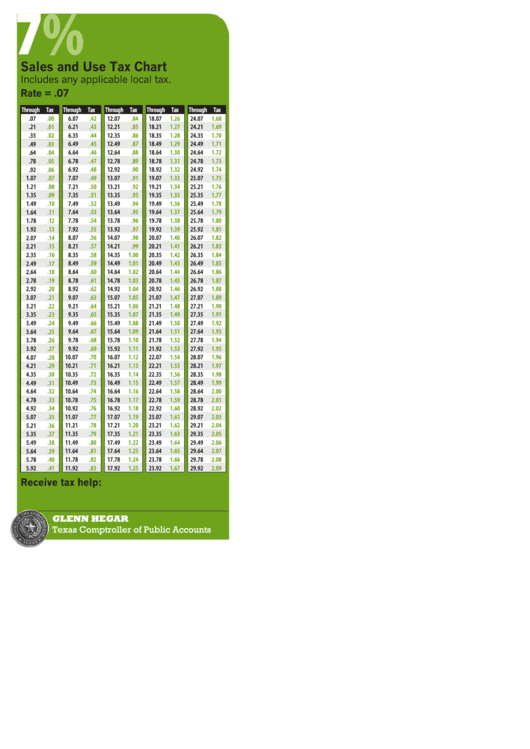

7 Sales And Use Tax Chart Texas Comptroller printable pdf download

7 25 Sales Tax Chart Printable Printable Word Searches

7.25 Sales Tax Chart Printable Printable Word Searches

Printable Sales Tax Chart Printable World Holiday

Printable Sales Tax Chart

7 Sales Tax Chart Printable A Visual Reference of Charts Chart Master

Free Printable Sales Tax Chart Printable World Holiday

What Is The Total Amount Including Sales Tax On.

This Is A Printable 7.75% Sales Tax Table, By Sale Amount, Which Can Be Customized By Sales Tax Rate.

How Much Is The Sales Tax On A $50 Purchase?

Web This Table Of Sales Tax Rates By State Is Updated On A Monthly Basis From Various State Department Of Revenue Materials And Commercial Tax Rate Providers.

Related Post: