2290 Fee Chart

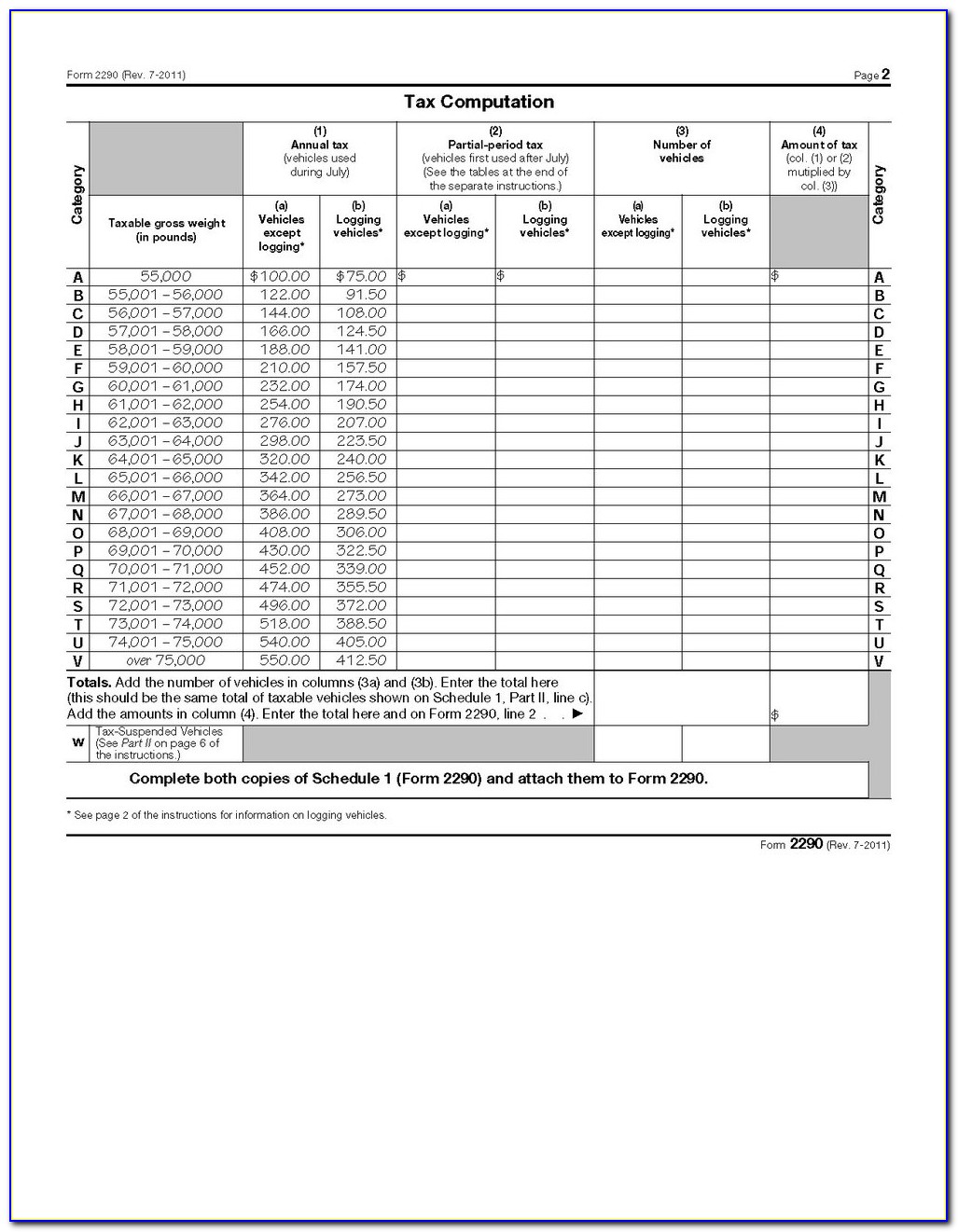

2290 Fee Chart - Gvw, the fee for a 2290 is $550 a. The federal heavy vehicle use tax (hvut) is required and administered by the internal revenue service (irs). Web for vehicles purchased from a seller who has paid the tax for the current period: If you are reporting 25 or more taxable heavy highway motor vehicles for any taxable period, you. What is the usual form 2290 tax period? · business name, address, and employer identification number (ein) · the vehicle identification number. Free form 2290 tax calculator from expresstrucktax, an irs. Web this july 2022 revision is for the tax period beginning on july 1, 2022, and ending on june 30, 2023. If a vehicle is purchased on or after july 1, 2023, but before june 1, 2024, and the buyer's first use. $99.99* unlimited form 2290 filings (file an unlimited number of form. At the legal maximum of 80,000 lbs. A vehicle having a registered gross vehicle weight of 55,000 lbs pays $100 using form 2290. · business name, address, and employer identification number (ein) · the vehicle identification number. The irs requires a form 2290 (heavy highway vehicle use tax return) for all heavy vehicles operating on us public highways. Web this. $99.99* unlimited form 2290 filings (file an unlimited number of form. A vehicle having a registered gross vehicle weight of 55,000 lbs pays $100 using form 2290. Web this july 2022 revision is for the tax period beginning on july 1, 2022, and ending on june 30, 2023. Web for vehicles purchased from a seller who has paid the tax. The irs requires a form 2290 (heavy highway vehicle use tax return) for all heavy vehicles operating on us public highways. Heavy highway vehicle use tax. The current period begins july 1, 2023, and ends june 30,. Web the fee you pay for the 2290 depends on the gvw of the registered vehicles that are required to file. If you. Web discover all the essential information about the irs heavy vehicle use tax (hvut) form 2290, including filing requirements, deadlines, penalties, and faqs. If you are reporting 25 or more taxable heavy highway motor vehicles for any taxable period, you. Web calculating fees (fees are based on gross taxable weight per vehicle): If you own a heavy vehicle weighing. It. Web calculating fees (fees are based on gross taxable weight per vehicle): It is a fee assessed annually on heavy vehicles. Web this july 2022 revision is for the tax period beginning on july 1, 2022, and ending on june 30, 2023. Web what is the cost to file form 2290? Don’t use this revision if you need to file. If you own a heavy vehicle weighing. Free form 2290 tax calculator from expresstrucktax, an irs. Web simply enter your vehicle weight and use type, and our app will immediately calculate your 2290 tax amount. · business name, address, and employer identification number (ein) · the vehicle identification number. Web yes, eform2290’s hvut tax calculator lets you calculate your 2290. If you own a heavy vehicle weighing. Web discover all the essential information about the irs heavy vehicle use tax (hvut) form 2290, including filing requirements, deadlines, penalties, and faqs. Irs form 2290 highway use tax period starts from july 1st of each year and lasts till june 30th of the following year. Web to file a form 2290, you. The current period begins july 1, 2023, and ends june 30,. $99.99* unlimited form 2290 filings (file an unlimited number of form. If a vehicle is purchased on or after july 1, 2023, but before june 1, 2024, and the buyer's first use. Web discover all the essential information about the irs heavy vehicle use tax (hvut) form 2290, including. · business name, address, and employer identification number (ein) · the vehicle identification number. Attach both copies of schedule 1 to this return. If a vehicle is purchased on or after july 1, 2023, but before june 1, 2024, and the buyer's first use. $99.99* unlimited form 2290 filings (file an unlimited number of form. Web for vehicles purchased from. Web for vehicles purchased from a seller who has paid the tax for the current period: Keller, it could cost you more. Web discover all the essential information about the irs heavy vehicle use tax (hvut) form 2290, including filing requirements, deadlines, penalties, and faqs. Free form 2290 tax calculator from expresstrucktax, an irs. Web this july 2023 revision is. · business name, address, and employer identification number (ein) · the vehicle identification number. Web this july 2023 revision is for the tax period beginning on july 1, 2023, and ending on june 30, 2024. It calculates your 2290, considering factors such as taxable gross weight, first used. If you are reporting 25 or more taxable heavy highway motor vehicles for any taxable period, you. Gvw, the fee for a 2290 is $550 a. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. It is a fee assessed annually on heavy vehicles. Prepay, postpaid, and pay as you go models available for tax professionals. A vehicle having a registered gross vehicle weight of 55,000 lbs pays $100 using form 2290. Web heavy highway vehicle use tax return. Heavy highway vehicle use tax. For the period july 1, 2023, through june 30, 2024. What is the usual form 2290 tax period? Web this july 2022 revision is for the tax period beginning on july 1, 2022, and ending on june 30, 2023. Don’t use this revision if you need to file a return for a tax period that began on. Keller, it could cost you more.

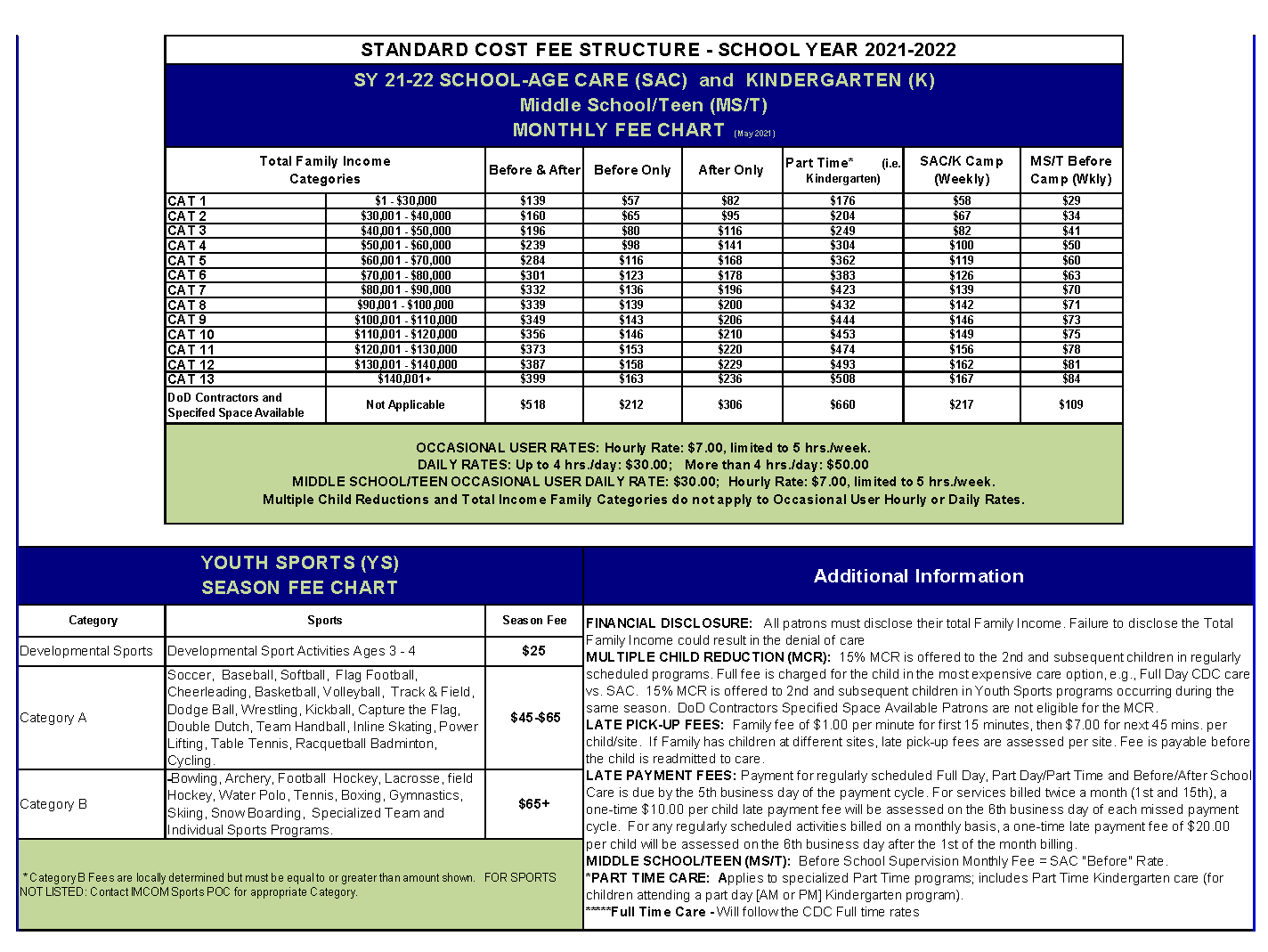

Army Cys Fee Chart 2021 Army Military

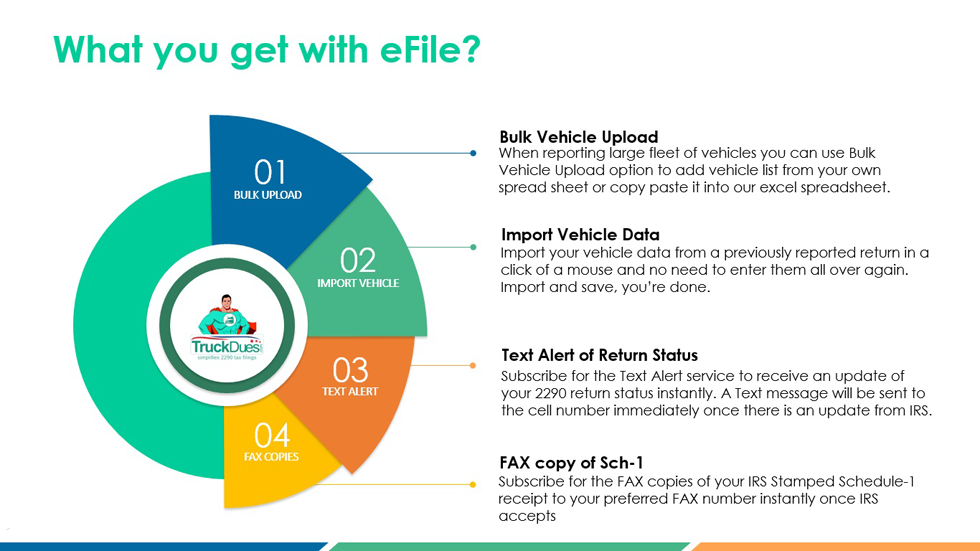

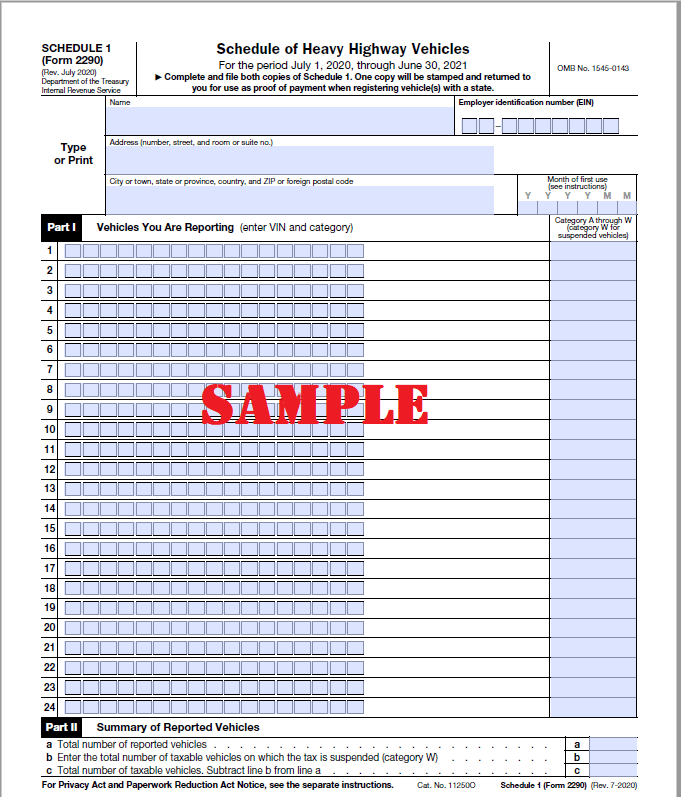

How to Get Form 2290 Schedule 1, proof of HVUT Payment in Minutes

Why E File Form 2290 Tax Easy as 123!

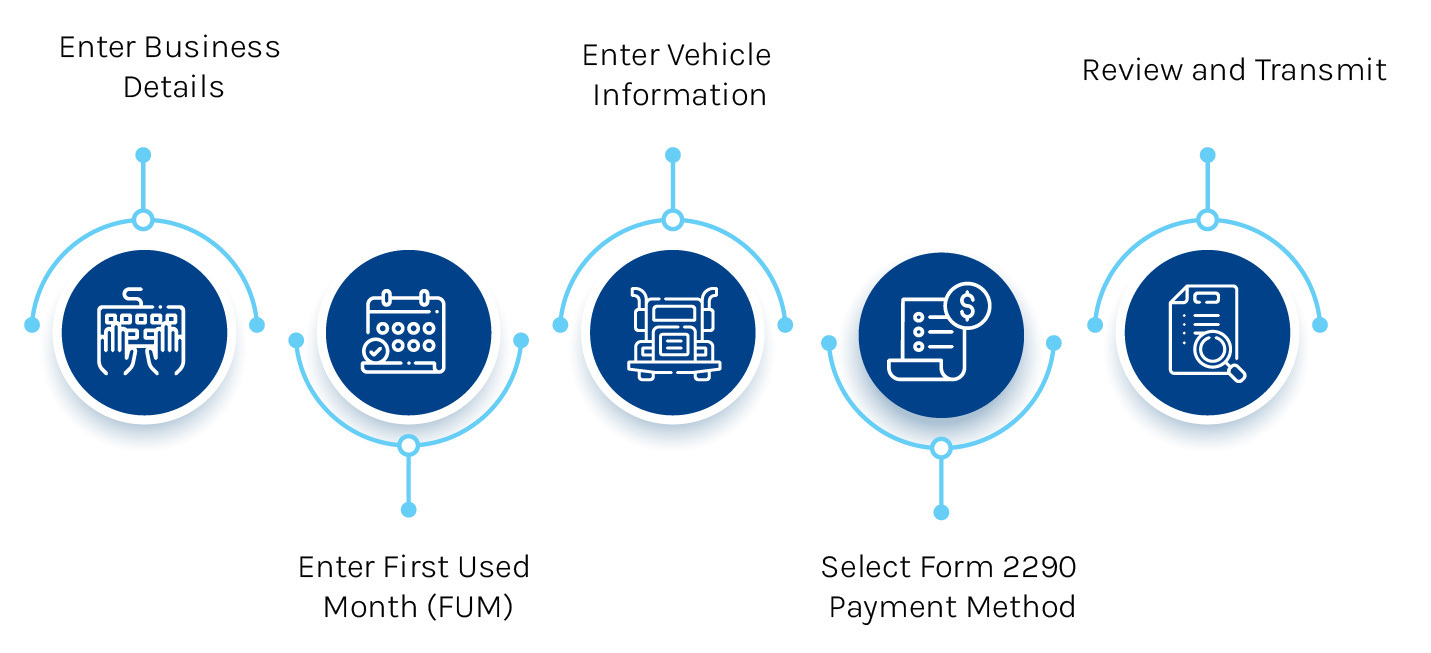

Form 2290 Instructions In Normal People Language

Form 2290 Instructions In Normal People Language

IRS Form 2290 Due Date For 20232024 Tax Period

Printable 2290 Form

Figuring the IRS Tax for Form 2290 for Tax Year 20112012

IRS Form 2290 Fill it Without Stress

Schedule 1 IRS Form 2290 Proof of Payment

Irs Form 2290 Highway Use Tax Period Starts From July 1St Of Each Year And Lasts Till June 30Th Of The Following Year.

If You Own A Heavy Vehicle Weighing.

If A Vehicle Is Purchased On Or After July 1, 2023, But Before June 1, 2024, And The Buyer's First Use.

Web Yes, Eform2290’S Hvut Tax Calculator Lets You Calculate Your 2290 Online Without Any Cost.

Related Post: